Hi there, welcome to another post by Cedar Grove Capital Management and our first post sharing our thoughts on a recent earnings release.

Posts like this will generally go to paid subs but this one will be completely free and the following earnings recap will be partially free with all others after being paywalled.

If you enjoyed today’s post, please hit the heart button and if you have any feedback, comment below.

Earnings Recap

Last week, RH RH 0.00%↑ released its Q4’22 and FY’22 earnings and they weren’t the most spectacular.

Looking at GAAP figures, net revenue, operating margin, and net income were all down y/y.

Bright spot was on gross margin which was up 110bps from last year. Cash was down a massive ~$660M from a year ago while leverage remained mostly elevated (more on this later).

I could keep going down the list but that’s boring but the takeaway is that hey, things were down.

Looking at their outlook, however, RH sees $2.9B - $3.1B in sales with an operating margin of 15%-17% which includes 150 bps of drag due to international expansion.

On the earnings call, the company also foresees elevated capital expenditures from its historical range hitting anywhere from $275M to $325M.

But was everything so bad? Well, RH is faced with what I believe to be an inflection point and you as an investor need to understand what’s going on if you plan to stick around or jump ship.

Background Context

Back in late 2021, I first posted my take on RH and believed that it could hit $750/share. Just a few months after making that call, the price came within a stone’s throw away from it before shit ended up hitting the fan at the end of November.

In early 2022, I reiterated that I thought RH was cheap and that there was plenty of higher-income spenders out there that would somewhat isolate the company from a slowdown in the economy and RH still had plenty going for it.

It was, and is to this day, one of our most read, heard, and shared articles. You can read it below if you’d like.

With that though, macro took over and things really started to deteriorate for basically everything consumer discretionary as the spending shift really went towards experiences.

Even with our enthusiasm for RH, and the complete beat-down the stock got in 2022, that doesn’t mean that the future isn’t bright despite what the recent earnings were.

This is basically how I interpreted the most recent earnings.

Are You Going For The Ride?

Nothing new was really said in terms of how the business was expected to do. If any of you remember correctly, Gary has been calling for the shitstorm of the year to take place in 2022 (which for the most part has) and hasn’t downplayed any of it.

The market front ran all the macro and the constant commentary he was giving about the business, the economy, the housing market, and its ability to navigate.

Again, nothing new, which is why the stock has been whipped sawed left and right in the hopes of a rebound in discretionary spending.

Throughout the earnings call, Gary kept reiterating the long-term vision of what he wanted RH to be when analysts were asking him questions.

“Our strategy to elevate the design and quality of our products is central to our strategy of positioning RH as the first fully integrated luxury home brand in the world.”

RH was a traditional showroom furniture and housewares company a long time ago and then slowly transitioned from its legacy galleries into bigger, more modern galleries that made the overall experience better. This included having restaurants in the space so customers/clients can make it a destination while they shop and splurge.

This has proven fruitful over the last decade as EBITDA margins have grown >2,000 bps since the Great Financial Crisis.

But this was not the end of the vision for Gary. He wants to not just be domestic but also an international one. We are bullish on this plan since the European market is highly fragmented and its wealthy demo appreciates fine quality.

This was part of our initial thesis considering that RoW was basically a large amount of untapped whitespace for the company. The first is the RH England estate which sits on 73 acres and will have 3 full-service restaurants. Later openings in Brussels, Madrid, and Munich over the next 18 months and Paris, London, and Sydney in 2024/2025.

International expansion is not where investors need to get wary. No. The real part, which is why I labeled it the inflection point for investors, is what else Gary wants to expand to in order to complete this ultra-high-end luxury experience for the very wealthy.

In the past 12 months, the company launched RH Contemporary, new galleries (stores) such as RH San Francisco, fine-dining restaurants in multiple galleries, the first RH Guesthouse hotel venture, and charter jet, and yacht services. RH also purchased 857 acres of Napa Valley land to build a resort and winery.

But the company also wants to get in on creating where its customers live. In the works is RH Residences, which would build fully furnished luxury homes, condominiums, and apartments with “integrated services” for “time-starved consumers.”

All this obviously isn’t cheap and can be a really slow investment before anyone actually sees a return from this. Hence, why RH’s capex guidance for 2023 was a ~71% increase from FY’22 at the midpoint and historically above trend ($275M - $325M).

You really have to believe that his vision, one for catering to the very wealthy, will pan out not in the next year, but in the next 5 years as not only the economy gets better but that customers actually want to be catered to in this type of way.

Personally, I do believe there is a market to be made if RH is able to act on it fast enough but also strategically to not burn through capital before cash flow completely shits the bed.

I mean, there are reasons why getaways can cost upwards of $13,000/night and have people book and trends support that as well.

HNW individuals will also be spending more. A survey of Virtuoso travellers revealed that 74 per cent agree that “creating a travel experience that best fits my expectations is more important than price,” with plans to increase the average spend of US$20,700 per person in 2021 by 34 per cent, to US$27,800 per person in 2023.1

This is why even though there’s execution risk, the underlying RH business can still thrive while supporting the next evolution of RH in the decade.

What Keeps The Price Up

So if you are a macro bear (I am) then what’s to keep this stock from taking a nose dive harder than a rock off a cliff? There are a few things that I believe can help keep the price within range without it totally capitulating. All else being equal.

1) Expectations

Gary was one of the first CEOs to come out in 2022 to sound the alarm. Making comparisons to Bear Stearns and referencing the movie “The Big Short”. He has not sugar-coated anything or led investors to believe anything other than his thoughts on housing taking a crap, the economy slowing, and that everyone needs to brace themselves or succumb to a reality check real quick.

If we connect this to price action, the price of RH stock has reflected the negative sentiment from Gary and also the broader market since the start of 2022. Trading within range once it bottomed out.

2) Share Repurchases

In October 2021, the company took out over $2B in debt at LIBOR +250 maturing in October of 2028. This debt was raised to fund future aforementioned growth plans as well as fuel buybacks.

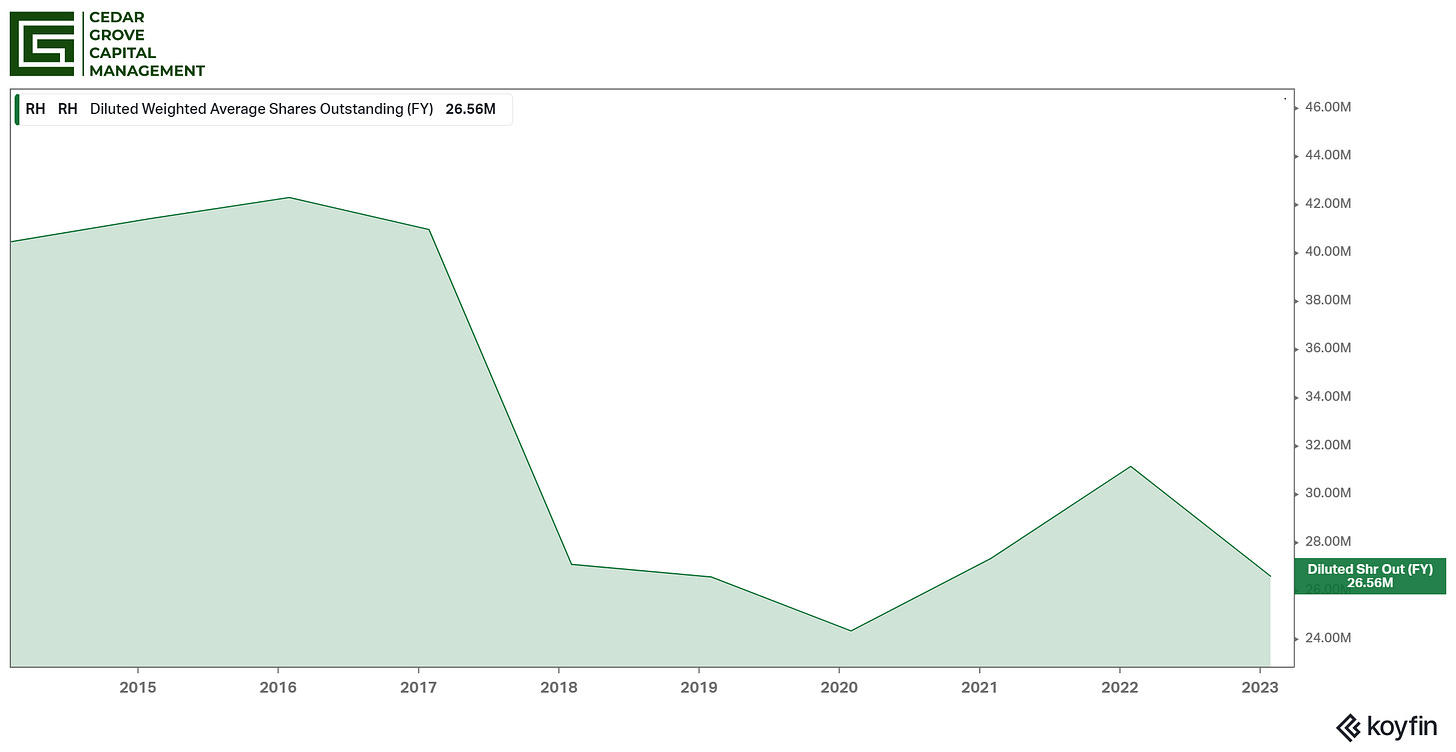

Since peaking in 2016, DSO has decreased by ~37% and the current program still has plenty of authorization left.

During fiscal 2022, the Board of Directors authorized an additional $2.0 billion for the purchase of shares of our outstanding common stock, increasing the total authorized size of the share repurchase program to $2.45 billion. We repurchased approximately 3.7 million shares of our common stock during fiscal 2022 pursuant to our share repurchase program at an average price of approximately $269 per share, for an aggregate repurchase amount of approximately $1.0 billion leaving a remaining amount of $1.45 billion outstanding and available under our share repurchase program at the end of fiscal 2022.

To remind you, the current market cap of RH at the time of writing this was $5.37B. Having an authorization of $1.45B, even spread out over the next ~2 years could still mean the company buys back ~27% of the company. Not an insignificant amount.

While I don’t hold management share guides in stone, it’s interesting to see what they think when they do publish.

3) Real Recognizes Real

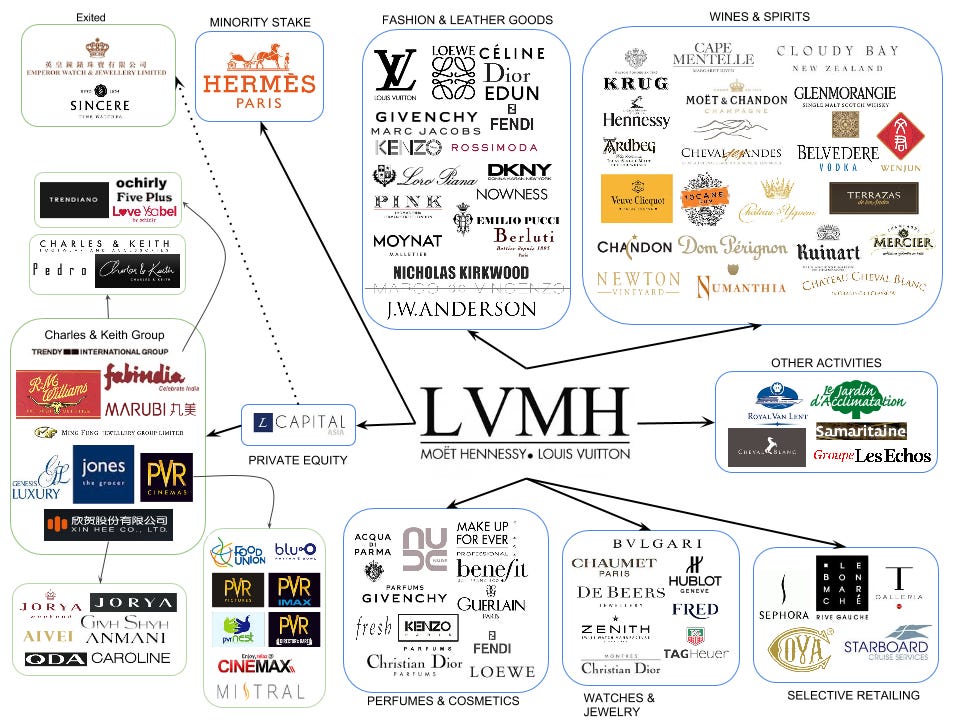

Lastly, luxury is here to stay. It has for centuries and it will not be going anywhere anytime soon. With that though, if RH does get hammered if the economy goes to shit, it could make for a VERY interesting acquisition target.

Similar to how LVMH bought Tiffany’s right before the pandemic (they contested but it went through), a marriage between LVMH (or another major fashion house) could see some massive synergies with what Gary is trying to build.

Take a look at their portfolio below to see what I mean.

Takeaways

The road ahead is going to be a bumpy one. No one is suggesting otherwise nor should anyone think otherwise. It will get worse before it gets better but the vision makes sense, and if executed well, can really pay off for a long-term investment.

The question is, are you willing to go for that ride?

As of right now, I know I am.

Lastly, for those of you that don’t know, I do run another newsletter for our private side of the business through Cedar Grove Capital Holdings. This newsletter is all SMB-related topics that I’ve gone through or wanted to share in case you're interested. See the example below.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech