Key Highlights:

Currently a few dozen restaurants with a clear path to a few hundred

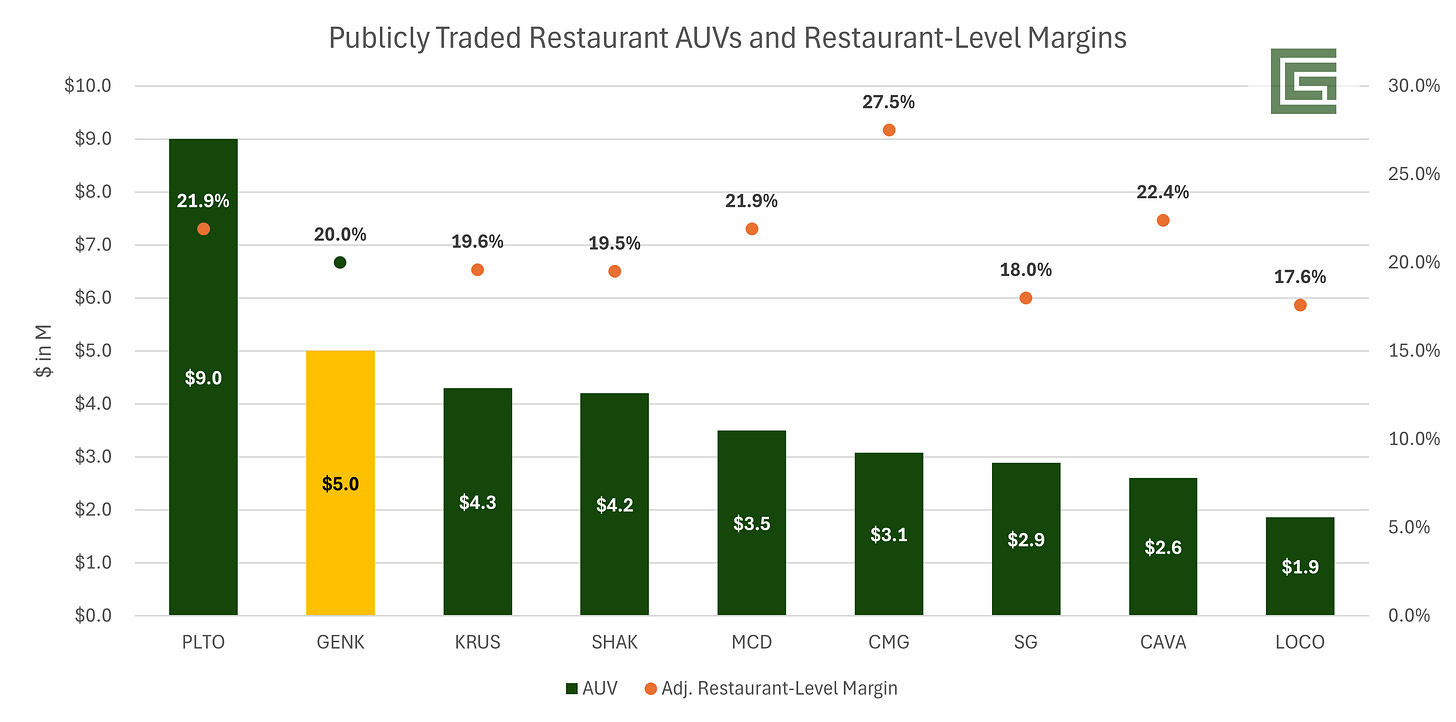

Some of the highest restaurant AUVs in the industry with an emphasis on “value”

Ability to boost restaurant-level margins through premium menu offerings, diversified unit growth, and economies of scale

New unit growth mostly paid for by FCF and virtually zero debt on the balance sheet

Based on my model, returns could be >100 - 200% in a matter of years if growth expectations are met

Funny enough, I actually came across GEN Restaurant Group (GENK) back in March when I heard it on the ValueHive podcast. The short story was compelling enough for me to investigate further and I ended up liking it so much that I eventually made it the second largest position in my portfolio.

The quick intro on GENK is that it’s currently an owner-operator of 40-unit Korean BBQ restaurants in 8 states across the U.S. For those of you who don’t know, unlike traditional American restaurants, Korean BBQ prides itself on having its patrons (mostly) be the chefs of the night. This type of experience is part of the allure and value proposition for this all-you-can-eat-style buffet.

Customers can order unlimited quantities of food for a fixed price, typically anywhere from $19.95 to $29.95 and upwards of $37.95 depending on the location, which is usually, but not always, below local competitors’ pricing.

Since its IPO in the summer of 2023, the stock has been absolutely hammered. Probably rightly so as the valuation was nearing $200M on not-stellar growth.

However, the stock bottomed in early March and the company’s most recent earnings report on 5/14 for Q1’24 gave investors the reassurance they needed that management’s growth plan was indeed working out.

But what makes this opportunity so special? There’s a lot to like so let’s begin.

1) Unit Economics

One might think that an all-you-can-eat restaurant concept isn’t a money-generating machine but you would be wrong.

Over the last 9 quarters, GENK has been able to keep AUVs above $5 million while growing its total store count from 29 in Q1’22 to 40 as of May 2024 and increasing its total store count by 37% over that time frame.

The company boasts a targeted ~2.5-year payback period on each unit built and +40% CoC returns. Not bad if you ask me.

Given that GENK is a cook-it-yourself buffet-style restaurant, the closest public comp we have is Kura Sushi (KRUS) which is up over 375% since it went public in 2019. KRUS is one of those conveyor belt sushi restaurants where diners sit down and pick up sushi as it passes by them. As you can imagine, being able to make sushi is an actual skill and people go to school to be trained to become a sushi chef. That makes staff not cheap and since more space is needed to prepare the sushi, that means fewer tables for guests.

Because of that, KRUS’s AUV as of last earnings is $4.3 million with 19.6% adjusted restaurant-level EBITDA margins.

This is in contrast to GENK’s unit economics, which as of the most recent quarter, were $5.8 million in AUV and 16.6% adjusted restaurant-level EBITDA margins. But don’t let what I just said confuse you with what you’re seeing above. As GENK is ramping up its unit growth, new units in new markets will both a) bring down AUV and, b) potentially expand margins at scale.

This is why you see the above AUV of $5 million and margins of 20% being the targets set by management in their November 2023 Investor Presentation. Despite these targets, on a per-unit basis, the company is still able to command more sales and better cash flow than other restaurant concepts in the industry.

How do they achieve this? In a few very interesting ways that immediately caught my attention.