As my first paid research post, I’m going to be going over the FTC complaint in detail and address all of their concerns, and provide rebuttals and counterpoints to each argument.

Those of you reading this for the first time can read my prior two posts below from December of 2023 and March of this year.

In each of those posts, I addressed the deal overall, and why before the FTC suit, it should not be blocked under anti-trust concerns.

However, as we all know by this point, the FTC sued to block the merger between Tapestry (TPR) and Capri (CPRI) on April 23rd. You can find a PDF copy below.

I will caveat that a lot is redacted to the point where you’d think you’re trying to read some CIA documents in certain places, but no matter, the points still got across.

This suit finally confirmed what the market was preparing for and as of May 7th, depending on your break price, the deal probability of going through sits anywhere from ~30 - 43%.

Before diving in though, I need to clarify a few things.

Based on Tapestry’s response to the suit, it seems that Joanne (CEO of TPR) wants the Capri assets and will fight in court to get them. Quoting her directly

“There is no question that this is a pro-competitive, pro-consumer deal and that the FTC fundamentally misunderstands both the marketplace and the way in which consumers shop. We have strong legal arguments in defense of this transaction and look forward to presenting them in court and working expeditiously to close the transaction in calendar year 2024.”

Prior to graduating college, I worked many retail jobs in the clothing industry here in NYC. Most notably, for Thomas Pink at Bloomingdale’s flagship on 59th street where I was very familiar with all the brands in question.

I was interning at Merrill Lynch in the C&R group when the Michael Kors/Jimmy Choo deal took place. I was a part of the acquisition financing.

The court date is set for September 9th.

I do hold a long position in Capri (CPRI) at the time of writing this post.

So with that, let’s get into it and go point by point on each of the FTC’s complaints on the deal and then my odds on their case at the end.

First and foremost, I think we need to tackle low-hanging fruit here that I believe is just thrown in to provide some type of ammo in a suit but doesn’t hold much water.

In the FTC’s own words

“With Tapestry’s acquisition of Michael Kors, the closest competitor of Coach and Kate Spade, consumers will lose the benefit of head-to-head competition on price, discounts and promotions, innovation, design, marketing, and employee wages and workplace benefits.”

Let’s first address the employee wages and benefits argument.

1) Employee Wages & Benefits

The FTC claims that the combined company (“NewCo”) of Tapestry (TPR) and Capri (CPRI) will hurt employee’s ability to get better wages and benefits because there’s no more competition between the two.

They cite that in 2021, Tapestry publicly committed to a $15/hr minimum wage1 in the U.S. for hourly employees, and less than two months later, Capri also decided to raise the minimum wage to $15/hr. Good stuff!

The problem here is that this is not a competition issue. Salaried employees might be harder to retain or convince to join, thus keeping top talent — think Google, Amazon, Meta, etc — but retail has never been. It’s no secret that retailers always want to try and help the margins out in their stores and workers’ wages are usually only met to meet the requirements.

However, this claim that NewCo will lead to lower wages is completely false. Retail wage issues are nothing new. Take for example the tit-for-tat exchange with Target and Walmart.

In April of 2019, before the pandemic, Target raised its minimum wage to $13/hr2 from $12/hr with the plans of increasing it to $15/hr by the end of 2020. At the time, Amazon had raised its minimum wage to $15/hr in October of 2018 and Costco also raised its minimum hourly wage to $15/hr.

Pulling from the same Reuters article,

“Retailers have been finding it tougher to attract workers, with U.S. unemployment at its lowest level in nearly 50 years, while there has been growing political pressure on companies to pay workers a fair living wage.”

Given that unemployment is right on par with where we were pre-pandemic, I’d say not much has changed.

Additionally, the pandemic just made things worse for retailers as fears of contracting COVID and receiving enhanced jobless benefits, including a government-funded $300/week, paid more than most minimum wage positions. Tack on the lack of affordable child care, retail theft on the rise, and of course the big one being working retail just sucks in general, it’s no wonder workers didn’t want to come back.

This is why Tapestry felt it necessary to raise the minimum wage and according to Reuters, was the latest company to push incentives to lure people back into the workforce.

Also, just look at the GlassDoor reviews when it comes to employee satisfaction:

Tapestry - Retail Associate - 3.8 / 75% would recommend

Michael Kors - Retail Associate - 4.1 / 56% would recommend

Jimmy Choo - Retail Associate - 4.5

Kate Spade - Retail Associate - 4.1 / 74% would recommend

Stuart Weitzman - Retail Associate - 4.4

Versace - Retail Associate - 2.8 / 99% would recommend

So here’s the first dent to the FTC’s argument.

Given the low skills needed to perform these jobs, whether you work retail for Tapestry, Target, Costco, or wherever, retail is competing with retail, not the other retailers within the same sector.

This is a fact and Vox did a piece3 on the industry back in June of 2021 highlighting why retail workers are quitting to go elsewhere.

“Even before the pandemic, a lot of retail jobs weren’t good jobs. Jobs in the industry were largely ‘considered stopgap jobs’ with low status and low pay.”

This is just the mechanics of retail jobs that the FTC has completely missed the ball on. As long as labor is tight, and retail still sucks as a job, it’s going to take companies paying more and offering more benefits in order to retain talent.

Market dynamics are self-fulfilling here.

Also, the FTC complaint highlights that the company employs 33,000 in total who would supposedly be affected by the merger. Given that many workers are abroad and are making the physical goods to sell in the U.S. it makes little sense for the FTC to blindly loop in international employees into that calculation. It just doesn’t make sense. International employees are out of the scope of the FTC.

Takeaway: The facts speak for themselves. Tight market + shitty job type in general = employers needing to pay up or not have enough workers. Slim chance to none this works.

Odds: 0-5%

2) Market Definition

The main FTC complaint is that NewCo will command too much of the “accessible handbag” market share in the U.S., thus hurting consumers.

“Accessible” being the term coined by Tapestry 20 years ago to bridge the gap between mass-market and true luxury. Mass-market is addressed in her complaint as typically being anything that is below $100 and luxury being priced to be out of reach to the masses (relative and also subjective).

That’s the core argument, albeit a very vague one. Because of this, Tapestry filed a motion over the weekend arguing that it is the FTC's burden to define the relevant markets in any of its merger challenges, something that the regulatory agency has "continuously refused" to do since it moved to block the megadeal last month.4

The FTC,

"fails to answer the basic question of what the FTC defines as a ‘handbag’ or ‘accessible luxury.’ For example, the complaint gives no guidance as to whether "handbags" include some or all of women's and men's handbags, backpacks, duffel bags, cross-body bags, business bags or other small bags. The complaint's definition of ‘accessible luxury’ relies on ‘vague, hedged and sometimes contradictory language’ to differentiate it from ‘mass market’ and ‘luxury.’

The FTC provides no clarity as to what products fall within which categories. Simply put, defendants do not know if the FTC's 'accessible luxury handbag' market is defined around certain brands, is bounded by price points, or is defined by the consumer's household income.’ ‘All of these factors are splayed throughout the rambling complaint — and yet there is no simple definition. What is in the market and what is out?’"

You can find the formal TPR response via the PDF below.

In my personal opinion, I think TPR really ripped the face off the FTC and made them look bad. Based on the rebuttals, it made the FTC look like they had no idea what they were talking about, especially when it came to defining the market.

“The FTC mistakenly believes there are only three options for a consumer seeking a high-quality handbag in whatever price range the FTC ultimately settles on for its untenable “accessible luxury” handbag market: Tapestry’s Coach and Kate Spade, and Capri’s Michael Kors. Indeed, the FTC’s Complaint incredibly goes so far as to decry that these three brands constitute a “duopoly” in that market.”

Hard to say you don’t control 100% of the market when the market you’re defining is literally just 3 companies.

To further reinforce this market definition point, using Euromonitor data (below), the market definition between “luxury” and “affordable luxury” can very well mean the difference between having a 45% market share in North America or 22%.

The issue with this definition is that depending on who you ask, it could overlap between the two. Emphasis on “could,” which is why TPR filed the motion over the weekend.

Before I dive deeper into this, we first need to address what constitutes “luxury.”

My friends

and Leandro () recently did a podcast on about the State of the Luxury Industry. You can listen to it below and the full transcript here.It’s a great discussion on what makes a luxury brand truly luxury but I’ll sum up the 3 main points from the episode so you don’t have to.

Obsession with high quality and craftsmanship that extends into the intangibles.

Exclusivity and scarcity.

These products have to evoke a certain status when you own them.

Those are the 3 characteristics of what they highlight as a luxury brand. Now while the perceived “value” of the brand extends beyond price, price is still important when defining where these brands sit.

A WSJ opinion piece put it into context very well.5

“The agency describes handbags that retail for several hundred dollars as “affordable,” which they may be for antitrust attorneys in Washington. Most middle-class Americans would consider them a genuine luxury.”

This is true which is why I mentioned earlier that the price is very relative and subjective to whom you ask. I always made fun of my mom because whenever I asked her what she wanted for Christmas she would quite literally say,

“I want a really nice handbag. Like Michael Kors or Coach.”

My mom literally thinks Coach is couture. Little does she know that I don’t personally consider them to be luxury but in her mind they are, mainly because I make multiples of what she makes so she and I don’t see eye to eye on that. Which applies to millions of other Americans.

A Ferrari will be pretty expensive and out of reach for 99.9999% of Americans but even a $30k car could be a luxury as well. It’s all relative. The FTC redefining the market to best fit their suit is incorrect and very misleading.

2.1) Discounts and Pricing

Based on the FTC’s market definition, there are also problems with their claim that luxury brands don’t discount. Pulling from their complaint

“This is in stark contrast to true luxury brands. Louis Vuitton, Prada, and Gucci all have a very public no-discounting policy; this is one way that true luxury brands distinguish their authentic products from counterfeits.”

This is for the most part true but I want to expand on this because it’s not entirely accurate. Yes, true luxury does not rely on promotions or discounts in the traditional sense that many other retailers rely on. They don’t do Black Friday sales, Memorial Day, 4th of July, etcetera. Fact.

However, just like any company out there, you still need to move unsold inventory just like anyone else. In the core retail stores, they will almost always have some products that are on sale that need to be moved. These are typically older or recently discontinued merchandise. Nothing wrong with that, but the fact is that there is still a level of discounting that the FTC seems to conveniently leave out.

They also make it seem that the outlets only truly benefit the accessible luxury brands and below because they need to use these channels to generate sales. This is categorically false. In their complaint, they label luxury brand examples such as Chanel and Hermes that don’t partake in outlet stores but at the same time, they also label Louis Vuitton, Prada, and Gucci as luxury too. So when defining the market, you can’t isolate luxury from affordable luxury and then define one of your definitions (luxury) even more to prove a point.

Looking at two very well-known outlet malls; Sawgrass Mills in FL and Woodbury Commons in NY, both Prada and Gucci are in those outlet malls. They’re there to move that old merchandise that couldn’t be sold in the core stores which are in fact, on sale.

While discounting is not core to luxury brands thesis, they still exist and I think it is incorrect to blatantly disregard that luxury companies do have some level of sales/discounting but just not in the traditional sense.

Additionally, discounting and pricing are key to the affordable luxury sector because of who the clientele is. For the FTC to say that this merger would harm consumers’ ability to afford affordable luxury is also disingenuous and proves that they don’t understand the marketplace.

Business Insider in 2018 wrote a piece that broadly speaking, retailers are trying to move away from discounting because they’ve trained consumers to only buy on discount.6

“Heavy discounting has been the flavor of the past decade as retailers try to appeal to price-conscious consumers scarred by the recession. But while 40% signs might be a way to entice customers through the door, discounts can hurt profit margins and brand status. Now, some of the most heavily discounted brands are looking to scale back.”

If you can’t move inventory, you need to discount. Plain and simple. Black and white. The only way around this is to make sure you only release amazing stuff (next to impossible) or you control your channels better.

The other side of all this is pricing. The FTC is correct in labeling the luxury industry as one that many consumers would love to have but most likely will not be able to afford.

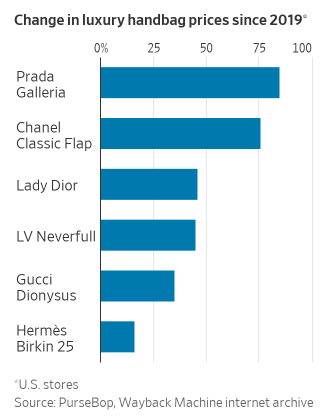

If you look at the prices of classic luxury handbags from 2019 to now, they’ve gone up considerably.7 This is by design.

While the prices are up, I don’t want to make it seem as if they’re insulated and all successful. Most of the luxury industry’s growth in 2024 will come from price increases. Sales are expected to rise by 7% this year, according to Bernstein estimates, even as brands only sell 1% to 2% more stuff.

Limiting volume growth this way only works if a brand is so popular that shoppers won’t balk at climbing prices and defect to another label. Some companies may have pushed prices beyond what consumers think they are worth. Sales of Prada’s handbags rose a meager 1% in its last quarter and the group’s cheaper sister label Miu Miu is growing faster.

The problems that would affect NewCo are the same problems that are affecting true luxury brands. It’s not an isolated incident. Just because NewCo will have overlap, they’re still technically competing against each other especially as they try to move upstream in their type of customer base.

Pricing does not exist in a vacuum. Fashion has a relatively low barrier to entry which invites new competition to the sector which can be beneficial for consumers. This is a time and true business fact over the last 100 some odd years. More on this later.

2.2) Wholesale + Outlet Channels

The image of the brand is critical to retain its value. This is exactly why as I mentioned above, true luxury limits the discounting to a minimum and leverages outlet malls to sell older merchandise.

Let me first start with wholesale channels.

Even luxury branded stores within premium retailers like Nordstrom, Saks, and Bloomingdales are all store-within-a-store concepts. They technically are being sold within those stores but for the most part, they have their autonomy.

I know this firsthand from working at Bloomingdales. These wholesale brands still had to operate under the same rules as the host retailer but did not have to participate in the sales, promotions, or deals that they would offer their customers.

Bernard Arnault of LVMH said,

“If you control your distribution, you control your image.”

It’s no secret that owned stores and channels yield higher margins than wholesale. However, it’s a very mutual relationship between the owned brand and the retailer (wholesaler). Wholesale gets your reach and volume but at a cost.

Retailers have buyers who place orders for goods that they believe will do well in their stores. All buyers have budgets and targets that they need to meet. Otherwise, the retailer believes that they have terrible taste and they aren’t a buyer for long.

As a brand, you need to supply these buyers with products that should be desired by consumers at a price that will make money for the retailer. If things don’t work out, then retailers typically place those goods on sale to move the inventory to make room for the new stuff.

Not all brands can dictate terms with wholesalers such as where things should be sold and at what price which ends up hurting the brand. This is why plenty of companies have been dialing back wholesale channel exposure to change the brand image and thus, improve perceived value.

This is nothing new too as the FTC hints at. From the same BI article referenced previously from 2018,

“Michael Kors has seen a steady decline in its same-store sales growth since 2014. This is partly because of endless promotions in its stores and at wholesalers, such as department stores, which make the brand seem less exclusive to consumers.

The chain is now trying to reposition itself a high-end retailer by reducing the number of promotions and pulling back from department stores to make the brand less available to the mass market.”

This move is a strategic one to elevate the brand, improve margins, and thus, deliver returns for shareholders. A fiduciary duty by a company. Something that John Idol called out as well on an earnings call back in 2016.

"We think that this is critical for us to really do three things; number one, to protect our brand image. As you know, that channel has become very promotional and, in fact, is causing us difficulties in our own retail channel, which is why you see our gross margins declining because we're really trying to meet certain pricing that's happening to be competitive. And we don't think that's the right thing to do for our brand going forward."

This is a business decision that won’t work unless the consumers come along for the ride. This pullback on wholesale exposure will certainly slow down brand sales as the need to retrain consumers that a new Tapestry and Capri are here to stay which they are not alone in doing.

For example, Ralph Lauren CEO Patrice Louvet pulled stock from 20% to 25% of department stores in August 2017. He claimed that discounting was damaging to the brand.

For the FTC to hint that these companies are not allowed to change their brand image because fewer people could afford them as a result, is an overreach of their governance. More on this in another section.

Now for the outlet stores, the FTC argues that they would be affected by the merger, which is also incorrect.

I believe this stems from a misunderstanding of the relationship and strategy between the two. Products at outlet stores are usually sold at reduced prices compared to regular stores due to being overstock, closeout, factory seconds, or lower-quality versions manufactured specifically for outlets.

That logic and strategy is not going to change any time soon and can affect the brand in a negative way which also aligns with why companies are dialing back wholesale exposure.

2.3) Innovation, Design, and Marketing

For this claim, I just need to come out and say it. It’s complete crap. It makes no sense. For them to say that a merger would affect innovation and design shows without a doubt they do not understand how the marketplace works.

Who is Lina Khan? Anna Wintour? Give me a break…

Down to the grassroots, design and innovation are at the forefront of fashion whether it’s for handbags or something as simple as keychains/ties. This is all critical. If they don’t do a good job, no one buys them, sales go down. Simple.

Take for example the Nikolas Bentel Penne Pasta Bag.

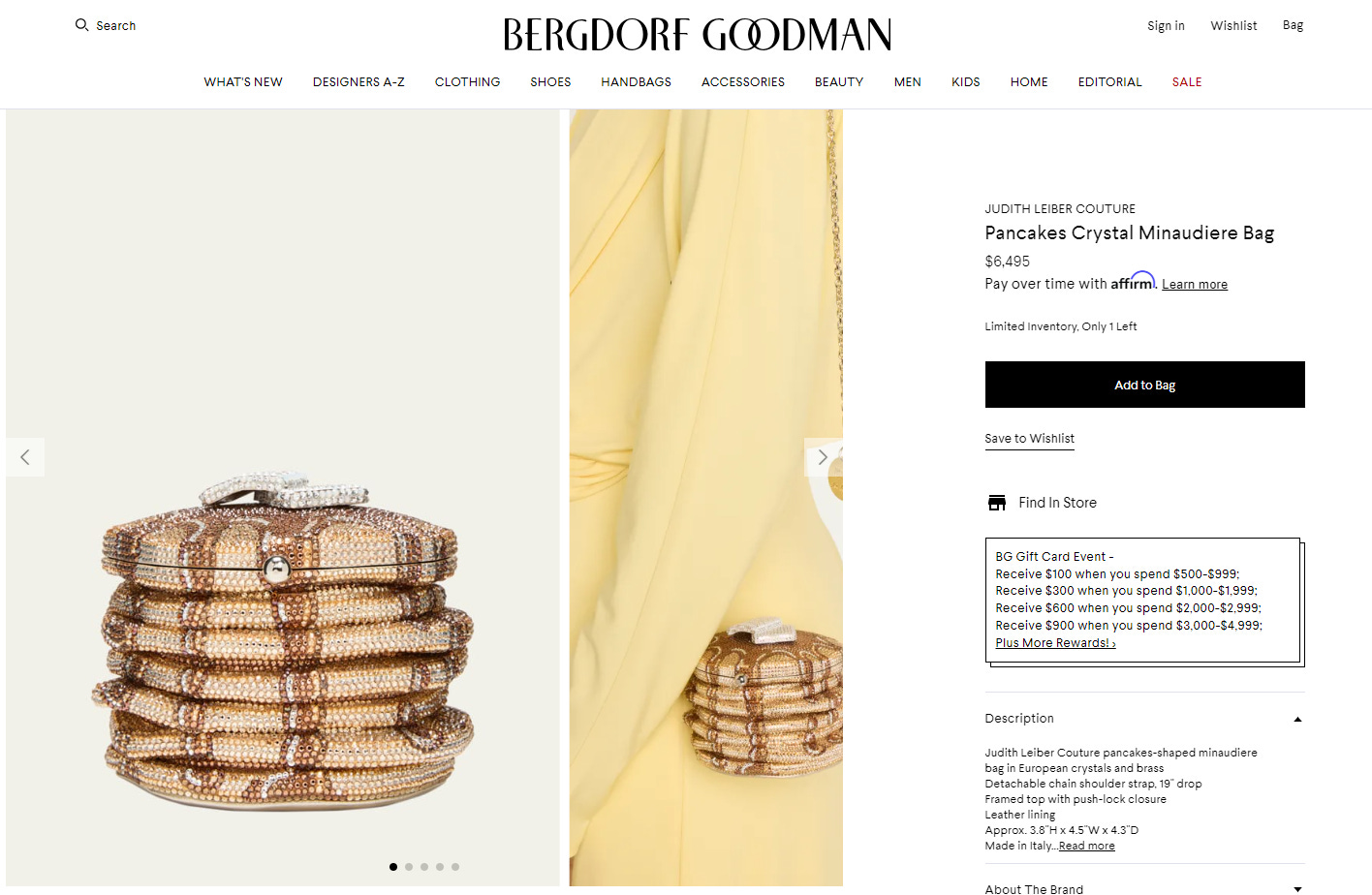

Currently on the market for $1,100 and I guarantee you that someone will buy it. Or what about the Pancake Bergdorf Goodman Bag for $6,500.

Or the Kate Spade Coffee Break bag originally listed for $279 but is now on sale at the outlet because it’s older merchandise.

Innovation is alive and kicking and if you think it’s dying or could be affected, you truly do not understand how new products enter collections on a recurring basis.

Just look at comments from Arnault about their product offering.

“We do not put the entire company at risk by introducing all new products all the time. In any given year in fact, only 15% of our business comes from the new; the rest comes from traditional, proven products – the classics.”

She praises luxury to be a differentiated product offering to consumers but neglects the fact that they themselves do not come out with nearly full inventory turnover every year. To add insult to injury, the “innovation” part of fashion is to the eye of the beholder.

This is a direct result of decades of luxury brands curating a perceived value from their product design. Something that Tapestry and Capri have been working towards over the last decade.

2.4) Competition Exists

Now it’s come to my favorite part about this post. The “limited options” discussion. As mentioned in the beginning, the FTC labels mass-market as goods under $100 and affordable luxury to be within the few hundred dollar range.

If you define the market based on the FTC’s perceived market definition, it looks like they have a large share. However, the FTC implies that there is a lack of competition in the space should they combine.

This is false.

Looking at Amazon for “women’s handbags” in the price range of $100 - $500, you get over 2,000 product offerings on the platform.

Granted it’s Amazon, so when looking on Farfetch, “women’s clutch bags” at the same price point get you over 123 brands with over 650 products.

When looking at Saks, for their handbags at the same price point, at the time of this post you have 105 brands with over 1,500 products.

This is just a taste of what is out there at least on the retailer front.

What’s funny, which is why the FTC’s market definition is incorrect, is that a lot of the “true luxury” brands have offerings within this range. In the Saks search, Prada, Givenchy, Ferragamo, Dolce & Gabbana are all in that price range too.

This is specifically the overlap that I’m talking about as NewCo moves to go upstream and true luxury still creates products in the “affordable luxury” price range as defined by the FTC.

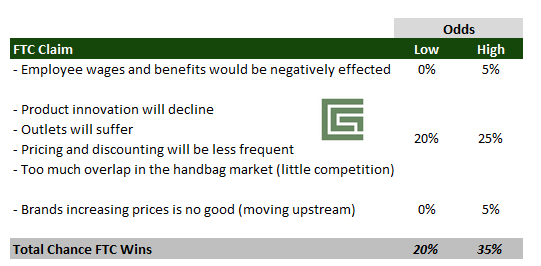

Takeaway: The FTC is fighting an uphill battle in being able to genuinely prove that this deal would hurt employees when the facts are retailer pay and benefits have only gone up; how innovation gets hurt, how pricing and discounts aren’t a double-edged sword, or even what the market they’re defining is.

Odds: 20-25%

3) Swimming Upstream

Here’s where the issue with this suit also lies and where I believe that Tapestry will lean heavily on its counter during court. It’s the ability and right to change the image of your brand.

The FTC complaints almost allege that NewCo is not allowed to do that. They cannot combine because the market share they currently have would be too much and hurt consumers. They can’t raise prices because it would hurt consumers. They can’t get rid of discounting because it would hurt consumers.

This too I believe is an overreach of the FTC. The brand’s merger strategy to elevate its image is nothing new, both for themselves and for others as well.

A few outside examples to prove this.

Gucci at multiple times in its history was a highly commercialized product and faced brand dilution by doing so. Over the last few decades, it too has raised prices in an effort to capture more of the affluent customer.

Before their successful rebrand, Burberry was for chavs (townies, hoodlums, gangsters – depending on where in the world you’re from.) Put it this way, nobody with any decency would be seen dead in anything Burberry in the late 90s / early 00s. After Harry Potter and the marketing that followed suit, the company was all the rage and sales jumped 21%.8

And here are the core changes from NewCo.

Michael Kors, back when it was just a one-branded company, was facing a declining brand image after years of explosive growth under Michael. As hinted above, SSS had been steadily declining since 2014 because of overproduction, heavy discounting, and promotions.

In an effort to elevate their brand to be taken more seriously, they acquired Jimmy Choo in 2017. As a London luxury brand, this was its first foray into the luxury market as it looked to convince consumers that it was not the cheap brand that had affected it years earlier.

A year later, they acquired Versace9 and rebranded as Capri. John Idol said at the time that,

“Buying Versace was an important milestone for the US company and that creating a ‘family of luxury brands’ would deliver shareholders “multiple years of revenue and earnings [profits] growth.”

In essence, the company was trying to move upstream and compete more with luxury companies and not mass market. Tapestry is no different in its push into great American brands like Kate Spade and Stuart Weitzman.

For this strategy to be contested is against the fundamentals of capitalism in the name of “protecting consumers.”

Takeaway: This isn’t really part of their complaint but it’s implied which I imagine the TPR legal team will use as grounds for the FTC overstepping their bounds. I would categorize this closer to the pricing and discounts part of the claim.

Odds: 0-5%

Weighted Outcome

I addressed a lot of the core arguments from the FTC complaint and echoing TPR in their recent motion asking them to define the market really makes them look bad. The industry is too nuanced, too competitive, and too fragile to have any real negative effect on the consumer.

With that, I give the FTC odds of a 20% chance of winning on the low end and a 35% chance on the high end. There’s just too much that the FTC is alleging that goes directly against what reality is.

I’ll continue to monitor it and update you all as more information comes in but despite me being long, I do truly believe that the FTC not only does not understand this market but also has overstepped its mandate.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm