M&A Arb Update: Tapestry Acquiring Capri

Addressing the current spread of the deal and the risks associated with closing

TL;DR

Despite the FTC’s second request, it’s hard to see what anti-trust issues will arise from these companies joining together

SAMR approval seems to be a non-issue since historically speaking, the agency has favored retail brands merging

Financing for TPR is not an issue if you believe what the combined company can achieve post-close and prioritizing deleveraging

On August 10th, Tapestry (TPR) announced that it would be buying Capri Holdings (CPRI) for $57/share, valuing the company at $8.5 billion and expecting to close in 2024. For those of you who don’t know, Tapestry (formerly Coach) owns Coach, Kate Spade, and Stuart Weitzman. Capri Holdings (formerly Michael Kors), owns Michael Kors, Jimmy Choo, and Versace.

However, despite the initial optimism of the deal, the market has thought otherwise and probability has come down significantly. As of December 5th market close, the probability of the deal going through stands at just 62%.

At current prices, there’s about $9 worth of takeover price still on the table. While I disclosed that CGC had taken a small starter position in our Q3 letter, our thesis was never that it was going to be acquired.

Because of this, I decided to take a further look at why the market believes that this isn’t going to happen and address the points below that I crowdsourced from my conversations with various investors and Twitter folk.

FTC Involvement

Just like every deal that gets announced, in comes the FTC. The issue with everyone pointing this out is that there really isn’t any. Unlike coming under the scrutiny of technology acquisitions, retail goods don’t carry the same weight as you might imagine.

In retail, there is a long track record of brands buying each other to create the behemoths we know today. A perfect example is LVMH.

Their portfolio of brands has been acquired over decades and drives over $85 billion in annual sales. Hell, the current companies of discussion were built off their acquisition of other brands. So why should this be any different?

Answer: It shouldn’t.

Just like pre-COVID, LVMH was allowed to buy Tiffany’s and continue rolling up brands. Kering, the other luxury European brand that drives over $22 billion in annual sales has a similar story.

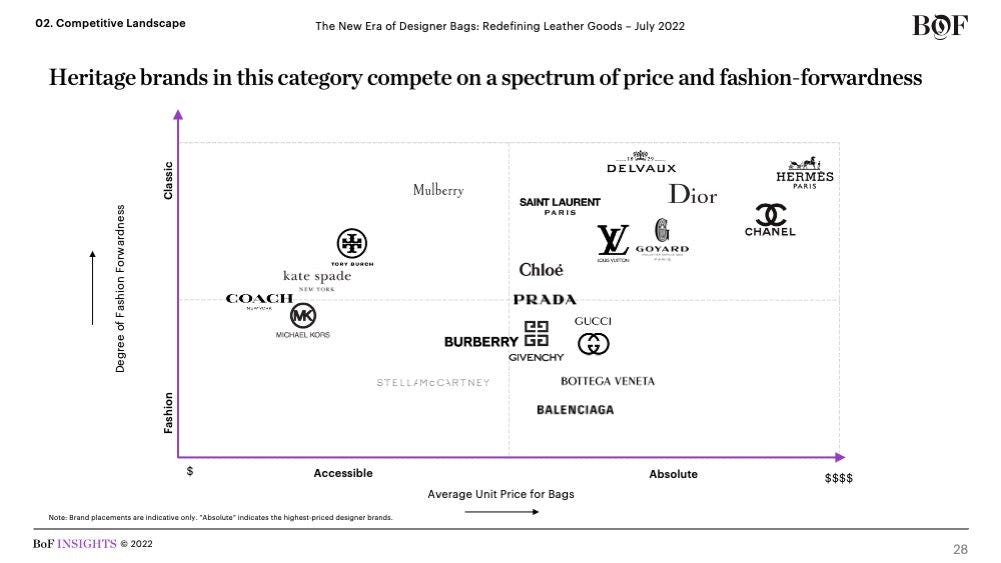

But while I’ve already addressed precedents in this happening, others have pointed to the second request from the FTC as a potential threat. But I think that is unwarranted too. Should this deal go through, the merger would create the fourth-largest luxury goods firm with a market share of 5.1%.

Considering the current luxury market stands well over $220 billion, a 5% market share in its respective industry isn’t threatening. The issue is that there are just too many brands, too many suppliers, creators, designers, etc. that would raise anti-trust concerns. Not to mention why both these companies are buying each other in the first place which both are predominately American brands with struggling growth looking size up together.

That’s why I believe this second request is more of a formality than of any cause for concern.

The real concern, if any, would be in the EU.

European Commission

One valid argument is the commission’s recent investigations into European luxury companies with anti-trust concerns. While the commission raided Gucci offices in April, they also cleared the Farfetch deal of YNAP back in October.

Again, considering the sheer size of two of the largest luxury brands (LVMH & Kering), there’s still too much fragmentation in the market for them to say no.

This is why I’m also not concerned, especially as they want to break out more internationally from the American market.

Chinese SAMR

Another point people made was getting the blessing of the State Administration for Market Regulation of China (SAMR). This point also makes no sense to me, especially given the history of merger approvals by the SAMR.

Pulling info from Meritas,

The SAMR concluded 741 merger review cases in 2022. Among these, five were conditionally approved and the remainder were unconditionally approved. No prohibition cases were announced in 2022.

The hit ratio of approvals by the SAMR is incredibly high. I imagine it’s because the party wants more activity in its country as well as its ability to get its hands on more IP. Generally speaking.

However, recent changes provide a different outlook.

Once the new AML supporting regulations come into effect, especially with the implementation of the increased turnover standards for merger filing, the number of notifiable merger cases is likely to fall considerably in the future. At the same time, the new filing standards imply that the SAMR will maintain a rigorous attitude towards merger control review of 'giant enterprises' (i.e., undertaking with a turnover of more than 100 billion yuan in China) even if the target generates insignificant turnover. The risk of giant enterprises being punished and investigated by antitrust competition authorities will increase steeply.

While this might change things for other industries, I believe retail goods is not one of them.

SAMR = non-issue.

Tapestry Financing

This one I also found this to be unwarranted. Probably because of my stint as an investment banker who actually helped with the financing of Capri (formerly Michael Kors) acquiring Jimmy Choo.

A general rule of thumb for a company to even entertain an acquisition by someone is to know that they can actually do so. Individuals calling out Tapestry debt are missing the actual picture which is even though TPR does have leverage on the BS, historically speaking, and also in terms of an LBO, they aren’t bad at all.

If we look at what TPR and CPRI said about the deal, it paints a picture that both companies aren’t quite as nervous about the debt as investors are.

The combined company will generate over $12 billion in annual sales, nearly $2 billion in adjusted operating profit, and will eventually realize ~$200 million in synergies.

Given the $8 billion bridge loan taken on by TPR, and adding that to the already $900 million of net debt, we’re talking ~4.5x let leverage. TPR believes they can get that down to 2.5x leverage in 24 months. While I think that is quite ambitious, as an M&A arb play, that doesn’t really matter since the banks have already agreed to fund.

Declining Sales

The last point here is the call that sales are slowing down for both of them. People who called this one out clearly didn’t read over the transaction because this was one of the very reasons why both of them agreed to merge.

They both understand that times are changing and for American brands to break further into international markets and leverage each other’s strong points, doing so together makes more sense than separately.

And I can’t believe I have to say this but each company is well aware of each other’s financial state before this happened. It’s not like they were surprised by CPRI earnings.

Options Chains

When looking at option chains 8 months out, nothing to really show as far as what the market in anticipating. Prices generally aligned with how things are currently trading which suggests implied moves aren’t extreme at the moment.

Especially since we don’t have a date yet on when this will close, timing is important if you’re going to structure a trade using options.

Parting Thoughts

This deal spread truly surprises me since I do not believe there are any anti-trust issues from any regulatory body, funding issues, or repricing of the deal.

Clearly the market is spooked by the second request and perhaps what could change in the event of a recession. To remind you all, LVMH tried to get out of buying Tiffany’s during COVID because of a sales collapse but were stuck buying them after the courts ordered them to, albeit for a slightly smaller price.

It will be interesting to see how this plays out but if you have any additional arguments or counterpoints, I’d love to hear them.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

can the deal be extended?

Great post. I'm looking into it and my thoughts are that this could be played via options buying puts of Tapestry, as the stock has recovered after the initial negative reaction once the deal once announced. The idea is that TPR would fall again if the deal is approved by the FTC. This approach would benefit from lower implied volatility in Tapestry than Capri, while providing a free hedge on a macro slowdown. In case of sticking to Capri, I would sell puts short term, using the proceeds to purchase calls expiring in August.