**First and foremost before I dive into today’s post, I want to apologize for not sharing this note sooner with you all. 2023 was quite a hard year personally as I had both parents dealing with cancer-related issues and a portfolio company to manage.

Because of that, I wasn’t able to really post my notes much last year as I clearly had other priorities. Thankfully, they’re both in the clear and the portfolio company has been sold. Going forward, I’ll be much more active and be back to my old self.

With that, let’s get into today’s note.

“As science advances rapidly, we know there is a significant opportunity to improve outcomes for those using medications…It is our responsibility, as the trusted leader in weight management, to support those interested in exploring if medications are right for them.”

- Sima Sistani, CEO

I’m all for companies trying to expand their TAM by adding new products or services that benefit their customers. Thousands of case studies prove how important it is in a rapidly changing business environment. However, Weight Watchers WW 0.00%↑ pivot to offering medication to help customers lose weight was anything but realistic from the start, and it has taken investors for a ride.

Before I dive into why WW’s acquisition of GLP-1 servicer Sequence made this a short trade, I need to highlight the issues that WW was dealing with before this pivot.

You see, WW’s historic record of helping people lose weight through their “points” system actually works. It worked so well that Oprah, who lost weight via the system, decided to invest in the company, buying a 10% stake in 2015 for $43.2 million and getting a board seat.

Given WW’s declining sales at the time (10 straight quarters), the company thought it made sense to bring on such an inspiring brand ambassador to be the company's new face and add validity to weight loss seeking customers of its program.

Initially, this investment worked. The stock doubled the same day as the announcement adding roughly $400 million in market cap. However, this was very short-lived, as the push to revitalize sales still resulted in a consistent decline after 2018.

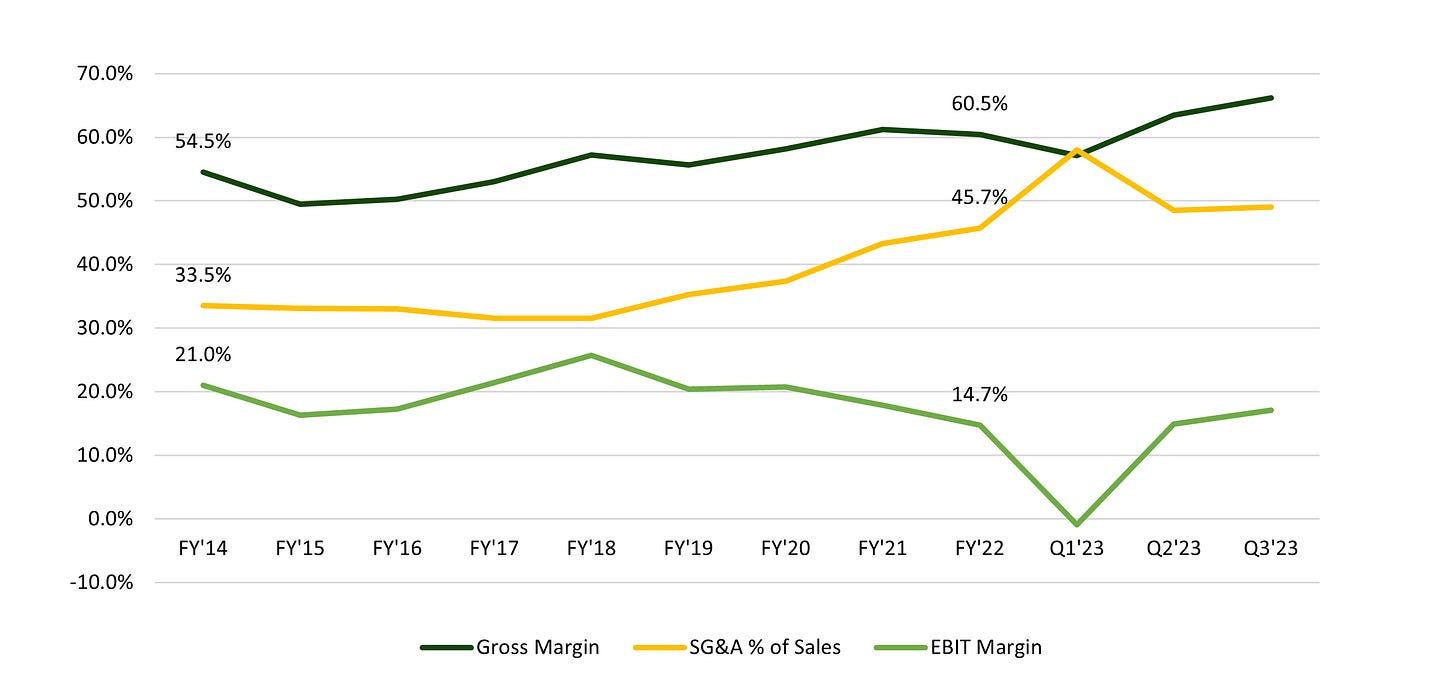

Despite the increase in gross margin from 54.5% in FY’14 to 60.5% in FY’22, SG&A as a percent of sales still saw a greater increase of 1,200bps over the same time frame (33.5% to 45.7%) pictured below.

So, with a major celebrity brought on to try and reinvigorate sales failing, what does the company turn to in order to help its customers lose weight? Drugs.

And herein lies the problem with WW announcing this acquisition and why I decided to short the company.

March 6th, the company announced that it was acquiring 2-year-old weight loss startup, Sequence for $132 million (including $26 million of Sequence cash).

Quick deal highlights:

$100 million at closing

$65 million to be paid in cash (includes Sequence cash)

$35 million of newly issued WW shares — 8.065 million

$16 million to be paid on the first anniversary (coming up)

$16 million on the second anniversary

So you had a little bit of dilution (11%) and were able to defer about 1/3 of the net cash needed for the deal between 1 - 2 years after close. Not a bad deal structure given you’re keeping cash on the sidelines for reinvestment and growth in a new category.

However, multiple issues arise for WW right off the bat.

1) Deviating From Core Competency

Everyone brags about how many “subs” the company has (those that may a monthly fee to be a part of the weight coaching point system) and how easily it would be to convert many of them to prescription weight loss customers.

Looking at their most recent 10-Q, at the time of the acquisition, WW had ~4 million subscribers and given its seasonality, ended Q3 with ~4 million.

Just from a very brief look, you can also tell that the number of subscribers has also been decreasing over time with that start quarter making lower highs. Not good.

Now here’s the problem besides the underlying business of their weight loss program struggling; subscribers don’t want to be fed medication. That was literally the whole point of why people signed up for WW in the first place.

If customers wanted the medical offering, they would have explored other options already. Historically, this decision to stay out of medical treatments benefited the company, especially during the whole Fen-Phen fiasco decades ago.

For decades, WeightWatchers taught dieters there was only one way to shed the pounds: hard-won behavioral change. However, with the news that WW was moving into prescription weight loss offerings, many customers voiced their negative opinions about the decision.

“Really disappointed by this news. I joined WeightWatchers in January. Their scientific approach to lifestyle changes has been transformative. I’m down 30lbs by changing my habits and relationship with food. I’m sad they’ve joined the quick fix bandwagon.”

-Journalist and WW customer Joe Enoch

“They’re not practicing what they preached … and now all of a sudden there’s a drug involved.” -Christine Sisterhenm

“WeightWatchers has kicked us to the curb.” - Bob Kline

Customers were in-fact, pissed. Not to mention that in an effort to cut back on costs, the company was also closing down physical locations where customers would normally meet together to share weight progress and support one another through the community.

It’s clearly a change in times for WW but optimists thinking that conversion amongst its current customer base is going to be immense don’t understand how quickly brand loyalty goes away when it starts doing something you don’t support.

2) Financial Upside

If you’re going to invest in a company that’s making a serious pivot to its business model, you really need to understand the upside that you’re underwriting. For most investors, they underwrote the broad-based theme of the GLP-1 hype coming out of Novo Nordisk and Eli Lilly.

Don’t get me wrong, I’m not against these drugs at all, in fact, Cedar Grove Capital Management (“CGC”) is long NVO 0.00%↑ and wrote about the bullishness of the industry below.

GLP-1s: Effective But With A Catch

“There is no silver bullet. There are always options and the options have consequences.” Foreword: This is actually my first notebook post on something related to healthcare. It revolves around the ho…

The problem is, when you looked at the chart above and saw the stock price jump from ~$3.90/share pre-Sequence announcement to ~$13/share by the middle of October (+240%), you must have been incredibly bullish on the future despite WW interim financials still diminishing.

Looking at the sales estimates through 2026, the initial spike has since tapered off since the summer.

If you were long and sold out near the top, good for you. If you kept holding on because you didn’t bother to do work, sucks.

Looking at the transaction details one more time, we know that Sequence had ~$25 million in run-rate revenue with ~24,000 customers.

Now while we don’t know the specifics, the “turned cash flow positive in late 2022” can mean a lot of things. Operating under the assumption that it’s legitimate and not just financial engineering, we can assume that at the very least, it’s self-sufficient but not booming.

With the acquisition of Sequence, forward earnings estimates shot up to just over 85x EPS and have settled in the 50x range over the last 3 months. This is a stark contrast from the historical 3-year average of ~12x pre-announcement.

In order for this acquisition to make any financial sense, the company a) would really ramp up GLP-1 adoption through their platform, or b) would need to control their ability to create operational leverage.

So let’s first talk about point A.

A) Incremental Business

To kick off the business of Sequence under WW ownership, have a look at my model below.

With low expectations for growth in the core business, these are my expectations in the model above.

Core business decline to the tune of -3%/year with subs decreasing annually at 1%

Conversion of current subs to GLP-1 membership at no more than .2% annually which I think is generous

Flat $99/mo membership fee which does not account for any cross-selling or exact fee from medication

With a flat interest expense from their debt of ~$90 million a year

Modest 1% annual dilution in FDS

Even if WW can scale Sequence to a $100 million dollar business by the end of the year 2025, the forward estimate even at today’s prices is still nearly 2 times higher than the historical average.

Had you looked at this trade 4 months ago like we did, the multiple was senile. Complete and utterly euphoric.

So aside from the incremental revenue not really being able to help them, that brings me to point B.

B) Bloated Balance Sheet

Do you really want to know what makes a business pivot a reality? Make sure you do it without a bloated balance sheet. Something WW has.

As of the last Q, they had $107 million in cash and $1.4 billion in long-term debt.

With some simple math there, LTM EBITDA was $164 million putting net leverage to a whopping 7.4x. For my PE folks out there, you and I both know that even pressing the 5x line was stretching things and it usually was with massive assets as collateral.

WW really doesn’t have that.

While the company has been able to generate positive FCF over the years, it will take considerable investment to get the growth going. Even when you look at interest coverage, it’s been declining heavily over the last year.

Call me skeptical, but the execution risk of Sistani being able to accomplish this pivot while having to deal with the weight of over a billion dollars of debt should speak for itself.

What Differentiator?

With hype comes competition. The problem is that there really isn’t a defining reason why someone should stay with one company unless it is for a good reason. Aka, no real moat.

With GLP-1s, there’s hardly a moat. Plenty of telehealth companies have been moving to offer a GLP-1 solution, some faster than others.

Ro, Calibrate, Eden, and Weight Watchers (Sequence) are just a small sample size with others like Hims HIMS 0.00%↑ offering different medicated weight loss solutions.

Hell, even Eli Lilly announced their own telehealth offering to side-step middlemen like WW.

With no real moat, the costs can amplify if churn becomes a problem.

Even if WeightWatchers can satisfy Sequence customers, it could still fade into irrelevance. Kelly Steffee, a 46-year-old mom who lives in an Orlando suburb, was a WeightWatchers member on and off for years before she joined Sequence last fall. A clinician there prescribed Mounjaro, and she lost more than 50 pounds in six months. But the most dramatic results were the ones she felt inside. “That food noise, the lady in your head telling you to eat all the time—‘Get a cheeseburger from McDonald’s, it’s really, really good’—she’s not there anymore,” Steffee says.

Although Sequence helped WeightWatchers recapture her as a customer, it wasn’t a stable situation. For one, Steffee’s insurance wasn’t covering Mounjaro, and a coupon she’d been using, issued by the drug company, expired in June. She also wanted to keep losing weight, but her Sequence-appointed doctor didn’t want her to drop any more. So she quit and found another telemedicine provider that prescribed her Ozempic, at a dose she wanted. This time, her insurance covered it. As for WeightWatchers, Steffee isn’t interested in going back to paying for the warm and fuzzy sense of community it monetized for so long.

No moat and high competition will hurt their ROI to ramp Sequence up to be a formidable name in the space.

The funny thing is too that you openly had Oprah come out and say,

It would’ve been “the easy way out” to utilize a drug like Ozempic (in regards to her own weight loss journey).

However, she does use medicated products as a “maintenance tool.” Something to add to the list of things you don’t want the face of your company saying as a differentiator.

Parting Thoughts

Reiterating once again, I understand why Sistani is making this move. I would chalk it up there with, “change or die.” It’s a nascent market at the moment that is expected to have exponential growth in the company decade.

However, the numbers speak for themselves. Even if you quadrupled the business from 2022 numbers, it’s still hard to re-right this ship after the core business is slowly declining and the current base is upset about the facelift.

The other thing I wanted to point out, without saying names, is to also be careful of pushers of hype names. We all know people peddling shitco’s which don’t amount to anything but there was one large account on Twitter that was all for the future of WW on this news.

Did they make money? Yes.

Did they actually know what they were underwriting? I think they’d like to think so.

With the help of said Twitter bull and understanding of the GLP-1 market, CGC officially exited our position on December 13th for a 42% gain.

Again, I’m bullish GLP-1s, though not with WW. As I mentioned on Twitter before, I do think there’s still some juice left on the short side but at the moment, we’re not in it anymore.

Either way, YTD the stock is down 36% and price drives narrative…right?

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm