First and foremost, if you haven’t heard about the spaces that I held the other week on HIMS, you should do so. Over 1,200 people tuned in and it was a great conversation with Andy (HIMS Co-Founder) who chimed in and shared his thoughts on things.

But for today’s research, there’s been a lot of chatter on Twitter regarding the expectations of compounded GLP-1s on the Hims & Hers Health HIMS 0.00%↑ business. It’s a product offering that everyone is excited for and despite analyst estimates not reflecting forward guidance on the GLP-1 business, it is priced into the stock.

But with all the chatter comes a lot of unrealistic expectations brought on by what GLP-1s “could be” vs what the reality would end up being.

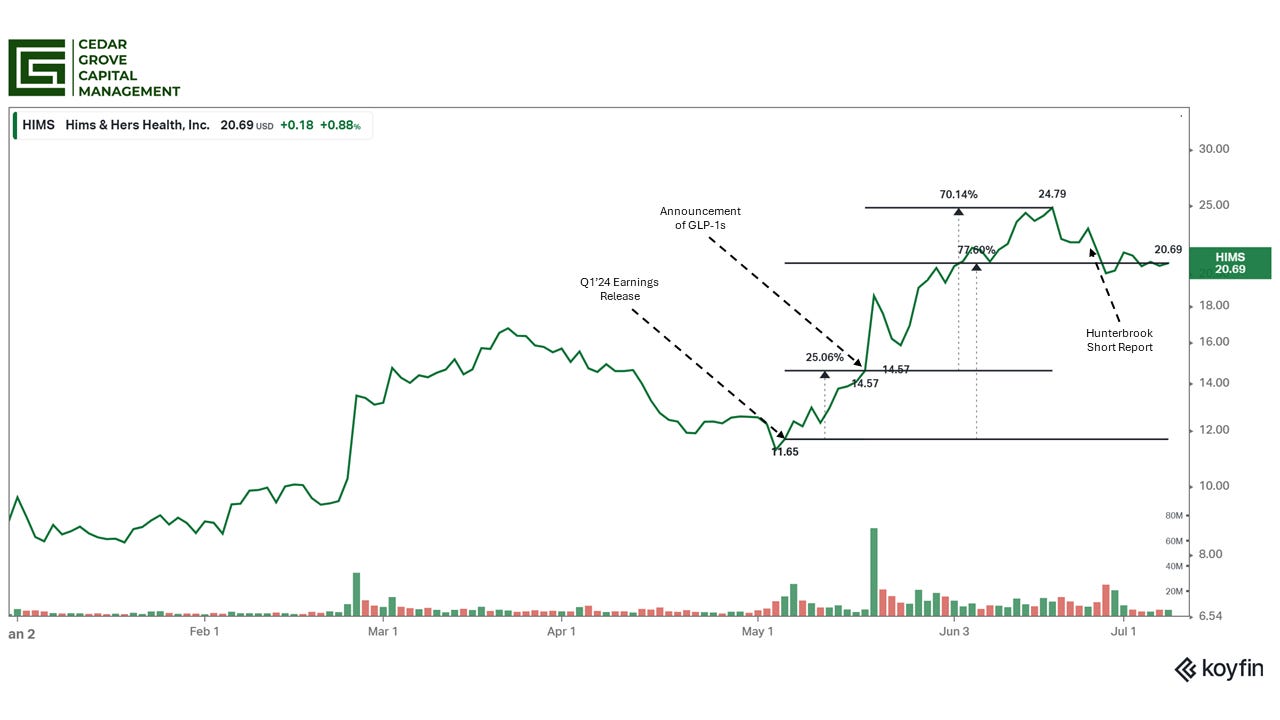

This has led many to claim that the current market valuation isn’t pricing in the move at all or is partially recognizing it. I think both are incorrect. Before the announcement of the GLP-1 offering and post-Q1 earnings, the stock was already up 25%.

Factor in the announcement of the GLP-1s and from post-Q1 ER to today, the stock is up ~78%. So yeah, any rational person would assume that the market is baking in the GLP-1 announcement well in advance of earnings revisions.

Despite this, I wanted to take the time in this post to lay out the math behind what I believe are realistic business assumptions, which should help give you a better picture of revenue expectations.

What I’ll go over is

The limitations of the compounded GLP-1 offering under HIMS

What it will take to get to the $1 billion a year revenue mark

What are my estimates for the compounded GLP-1 business through 2025

If you haven’t already, you can read my more in-depth research on HIMS via the link below which includes my holistic projections.

Given how this type of modeling was quite literally part of my job at Ro, I’d say that I’m equipped to model this out for HIMS with basic assumptions and knowing nothing else about the minutiae of the product lines.

I need to emphasize the last part because there’s quite a lot of nuance when you’re doing a top-down modeling approach to a new product offering that I don’t have access to (and shouldn’t).

Regardless, let’s jump into the research.