Amer Sports, an outdoor and sports equipment maker, recently announced that it was going public and is looking to begin trading on February 1st, 2023 under the ticker symbol (AS). F-1 here.

The Finland-based company is looking to raise ~$1.7 billion at an $8.7 billion market cap.

For those of you who might not recognize the name (not surprising), you should hopefully recognize some of the brands in its portfolio.

I know I use Arc’teryx and Salomon for a lot of my footwear and outdoor gear for hiking/backpacking trips. They’re high quality and considered premium in their respective universes.

But how is the company doing and does the proposed IPO valuation make sense? Let’s dive into the numbers.

Overview

Amer Sports was bought out by Anta Sports-led group in 20191 for $5.3 billion to combine expertise in their respective fields and create value. Since then, the company has expanded into >100 countries, 300 retail locations, 3 brand categories, and a portfolio of 11 brands (after having divested Mavic in 2019, Precor in 2021, Suunto in 2022, and its whole Russian operation after the invasion).

For their retail locations, they currently have owned retail stores in 24 countries with layouts ranging anywhere from 1,000 to 10,000 sqft.

They segment their categories as you see in the above.

Technical Apparel

Outdoor Performance

Ball and Racquet Sports

The 3 core brands that drive most of the revenue for the company are Arc’teryx, Salomon, and Wilson. Wilson, I’m sure many of you know from a lot of tennis starts; which as of Sep’23, is proud to support 27% of the top 100 men’s tennis players and 42% of the top 100 women’s players in the world.

The business itself is a straightforward one to understand so it’s not really rocket science which is a plus when you’re trying to learn about the company.

Financials

So since the Anta Consortium buyout, sales in the company have been doing quite well. From 2020 to 2022, the company has grown topline by a 20.4% CAGR.

How did they achieve such stellar sales growth do you ask? One word: China.

Like many other retail brands that found their origination in America or Europe, when looking for growth and consumers with wallets to spend, they all expand to Asia. Luxury brands have done this, most notably LVMH, Burberry, Moncler, etc. Amer Sports saw the same opportunity and took it.

Looking at their sales figures based on geographic location, Asia Pacific (excluding Greater China) and Greater China (includes: China, Hong Kong, Macau, and Taiwan) have seen YoY growths at mid to high double-digit percentages.

However, despite the impressive growth rates of the Asian territory, Greater China is what is really driving the top-line sales growth.

Looking at the chart below, Greater China, as a percent of total sales, has grown from 8.3% in 2020 to 19.4% as of the first 9 months of 2023.

This is on the back of slowing YoY sales growth in EMEA and the Americas. Not bad considering the company more than doubled a region’s sales in 3 years and will triple it by the end of 2023.

But here’s where things start to get interesting for me. While topline has grown, so too has operating income.

When you imagine a company really pushing into a new region heavily to drive sales, you’d typically imagine that margins would take a hit in order to get the growth you’re looking for.

Not an off assumption. However, Amer has been able to work with over 176 suppliers in 32 countries with 19 distribution centers to really cut down on supply chain costs and interruptions allowing for more timely and efficient manufacturing and logistics.

Gross margin has expanded from 47.0% in 2020 to 49.7% in 2022, while S&M and G&A have both grown as well albeit at a much slower rate. Sales and marketing increases mainly stemmed from the increased campaigns of their territorial pushes as well as headcount in retail locations and wholesale teams.

Because of this, adjusted operating income (adjusting for impairment charges) has been on the up and up.

Adjustment charges totalling $201.7 million in 2022 was a result of $19.1 million in trademark impairments and $179 in goodwill related to the Peak Performance brand.

Much of this margin expansion has actually come from the company’s shift from a predominantly wholesale model to DTC. For those of you who don’t know, brands make a lot more on DTC (retail + online). Wholesale margins are a lot thinner because while you can get growth and expansion of the product into doors, you still need to sell to these retailers at a rate where they can also make money.

This shift in strategy has really helped the company (see below).

DTC sales as a percentage of total was 21.7% in 2020. This has grown by 780bps to reach 29.5% in 2022 with the first 9 months of 2023 showing almost 1/3rd of sales being derived from the DTC sales channel.

All great news until you start looking into the brand segment-specific information.

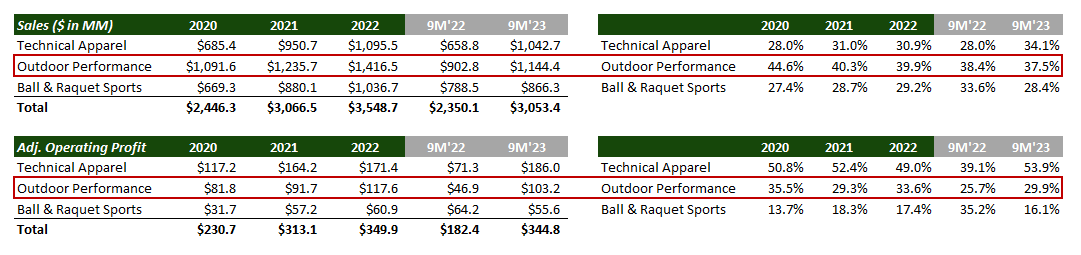

While Technical Apparel (Arc-teryx) and Ball & Racquet Sports (Wilson, etc) have continued to grow and contribute more to adjusted operating profit, Outdoor Performance (Salomon, etc) has been slow to grow.

The Salomon brand has historically been wholesale (lower margins) with 60% of revenue coming from footwear in 2022. Despite having 114 stores with 30 being in China alone, this particular area of the business isn’t doing the best. Let me reiterate that it’s not doing the best but that doesn’t mean it’s doing bad, just not great.

DTC growth as a percent of total sales for this category has only expanded just shy of 200bps in three years, while Technical Apparel has grown almost 2,000bps in the same timeframe.

Even the search results for Arc’teryx have really grown over the years. (FYI - this business is seasonal so most of the sales actually come in Q4).

So with so much good going for it, why am I skeptical about this IPO? Let’s talk about it.

Valuation

Based on the company being able to sell the 100 million shares it hopes to between $16 - $18/share, the valuation post raise comes to ~$8.7 billion.

Figuring LTM adjusted EBITDA of $613 million, that means the company (ignoring opening price) would be pricing at ~16.1x EV/EBITDA (proforma IPO proceeds).

Valuation seems a little rich since its brands are sports-related but not quite on par with NKE 0.00%↑ but much closer to COLM 0.00%↑.

Factoring in the opening price, this could easily get even more expensive. But besides the rich valuation here the use of proceeds is what really gets me.

Based on management’s commentary,

We intend to use the net proceeds we receive from this offering to repay all of our outstanding borrowings under our existing shareholder loans, JVCo Loan 1, JVCo Loan 2, Co-Invest Loan 1 and Co-Invest Loan 2 (each as defined below), after giving effect to the Equitization, and any remaining net proceeds to repay a portion of our outstanding borrowings under the Revolving Facility...

Looking at the cap table that they provided, you can see that a large portion of their debt will be eliminated.

What’s interesting is that given the IPO net proceeds (ballpark ~$1.6 billion), $4 billion of debt is basically being wiped out. How so?

They’re equitizing the debt of their existing debt holders. Prior to the offering, the company had ~115 million shares outstanding and is doing a 3.3269:1 split to bring it all under 1 ordinary Class A voting share.

Given a potential 15 million share over-allotment, shares outstanding could be just under 500 million shares. The kicker is that with the various ESOPs the company has, dilution can be another ~70 million shares under the plans,

While I’m not too concerned about that, it just seems like this company is going to be priced to perfection and I’m not sure if there’s really any value not being recognized in this IPO to capture. At least not right out of the gate.

Closing Thoughts

I love the brands and they do make some high-quality products and garments. While I’ll be cheering them on from the sidelines, I won’t be participating in this IPO.

For those interested in the company, I think this is definitely one to keep on your radar if growth continues the way it has been.

We’ll see what the appetite is for the capital markets to start off 2024 and perhaps will set the stage for what’s to come later this year.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm