“Food is one part of the experience. And it has to be somewhere between 50 to 60 percent of the dining experience. But the rest counts as well: The mood, the atmosphere, the music, the feeling, the design, the harmony between what you have on the plate and what surrounds the plate.”

– Alain Ducasse, Chef.

Investing in the restaurant space is hard. Your end goal is to get customers in, and back again as much as possible while having to worry about a million things that could possibly go wrong in between all that.

Hell, just look at the AdvisorShares Restaurant ETF: EATZ.

This doesn’t mean that there aren’t any clear winners in the space that can make investors a lot of money.

Take a look at McDonald’s MCD 0.00%↑, Domino’s DPZ 0.00%↑, and Chipotle CMG 0.00%↑ all up hundreds of percent in the last 10 years.

But this is not about them nor is it about the restaurant industry in general. This post is me sharing my notes on the recent CAVA IPO S-1 and where I believe it fits into the next Chipotle or the next Sweetgreen.

What I’ll be going over.

CAVA IPO

IPO deal dynamics

Company S-1

Positives/Negatives

Next CMG or SG?

Am I buying or not?

Given that this IPO is definitely one of the hotter brands to go public in a mostly dead IPO market environment, I have a feeling that the hype is more geared toward what people thought when Sweetgreen went public.

With that, let’s begin.

CAVA IPO Pricing

Initially, back in May, CAVA was aiming for $100 million in an IPO that would have valued it at ~$1.5 billion. Fast forward just a few weeks and now they’re aiming to raise $260 million at a ~$2.2 billion valuation at roughly $17 - $19 a share.1

Nothing says “this is definitely not hype” like adding $700 million in perceived value by just announcing that you’re going public.

Will they be able to get this valuation once the roadshow is done? Not entirely sure. It seems that investors will definitely want to be cautious, especially after Sweetgreen SG 0.00%↑ was priced at $28/share and closed >100% above that on the first day to $53 only to do nothing but go down since then.

Company S-1

When it comes to restaurants, there are a few key things that I look for when evaluating them. While there are many keys, there are two broader categories they fall under. Restaurant (unit) economics and broader company financials.

The importance of unit economics is to see exactly how well each unit does and if it can scale to be something much bigger.

These entail KPIs and items like,

Restaurant-level EBITDA margin

Average Unit Volume (AUV)

Same-Store-Sales (SSS)

E-commerce (in-house/3rd party ordering)

Broader company-level financials, etc.

Profitability → Free cash flow

Operating expenses like sales & marketing

Whitespace

Etc.

There are many things but the big picture that we need to understand before I dive into the S-1 is how profitable is each unit, whether it can scale, where are the risks, and how is the corporate entity doing based on how the units are doing.

In essence, where can this company be exposed and where is it doing well based on these risks?

So let’s get into it.

For those of you that don’t know, CAVA is a Mediterranean-style fast-casual restaurant that serves its cuisine in a similar style to Sweetgreen.

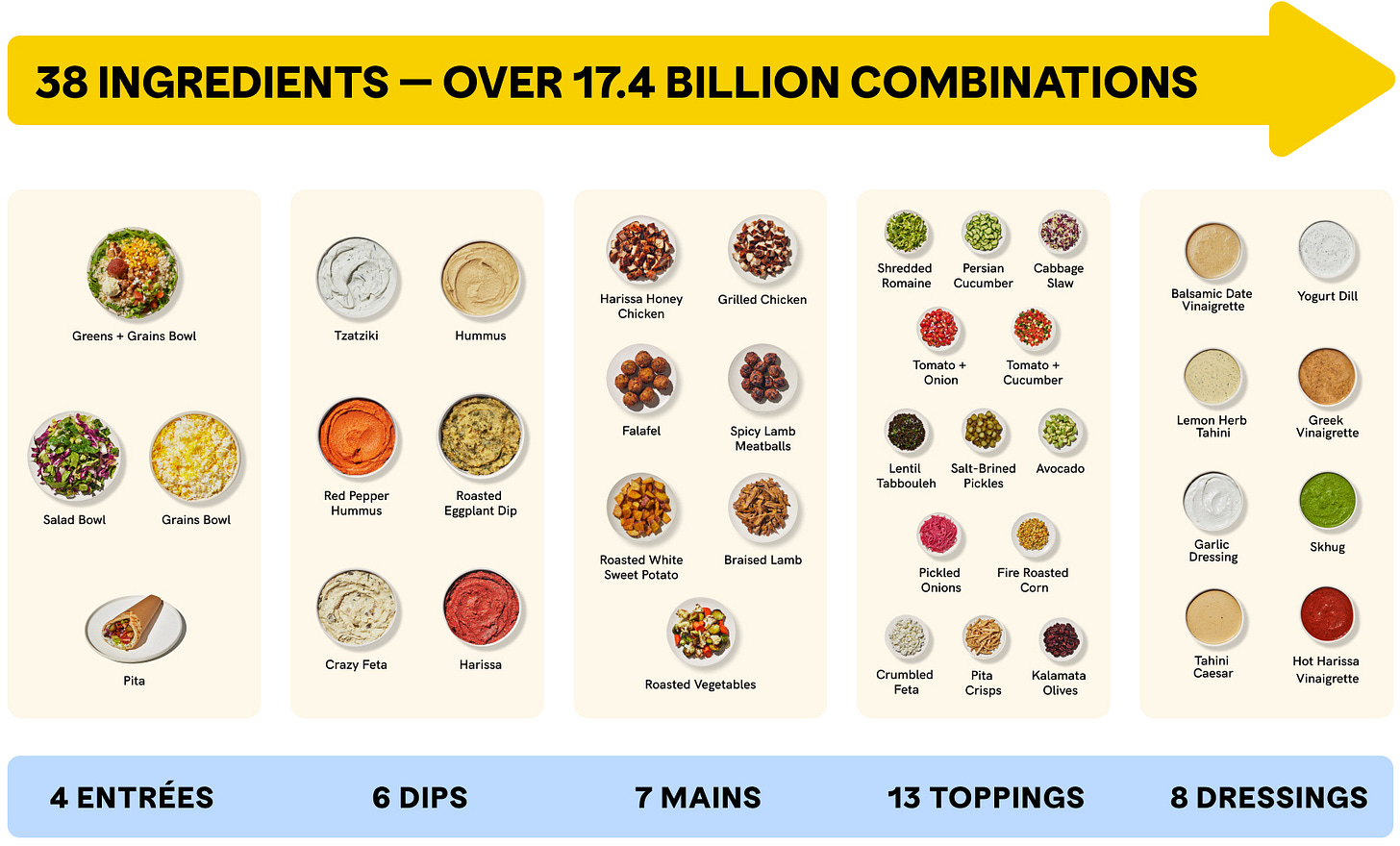

It boasts many different combinations that allow it to address many different consumer tastes and preferences. This is why ~80% of its guests opt for a custom meal instead of a predetermined menu option.

Considering that CAVA is a lunch and dinner restaurant (no breakfast), its daypart split is ~55% lunch and ~45% dinner while its channel mix is ~65% in-restaurant ordering and ~35% digital for the fiscal year 2022.

This digital ordering has actually been very beneficial for the company. On average, digital ticket orders are 27% higher than compared to in-restaurant orders.

But before you wonder if this is a Sweetgreen-esque geo play, you’ll be interested to know that 82% of their unit counts are in suburban areas, 14% are urban and just 4% are considered a specialty location mix.

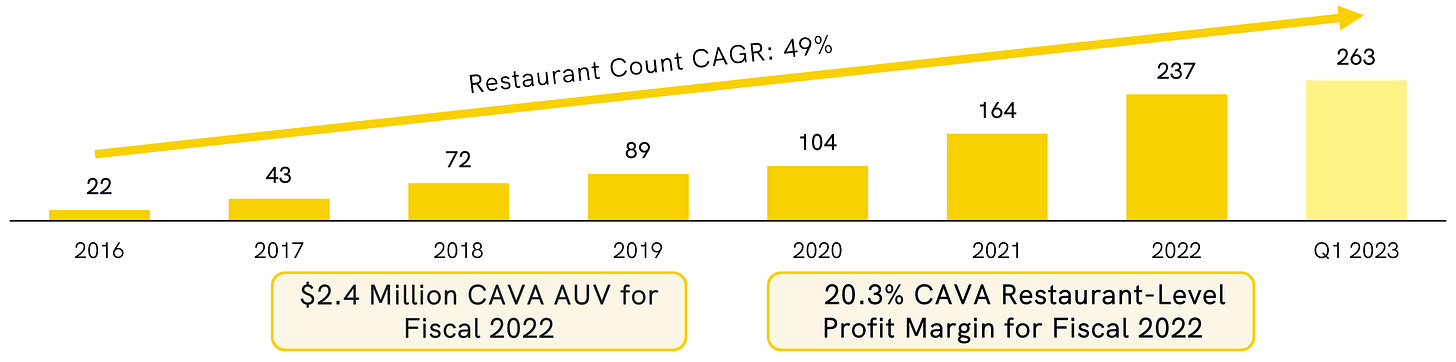

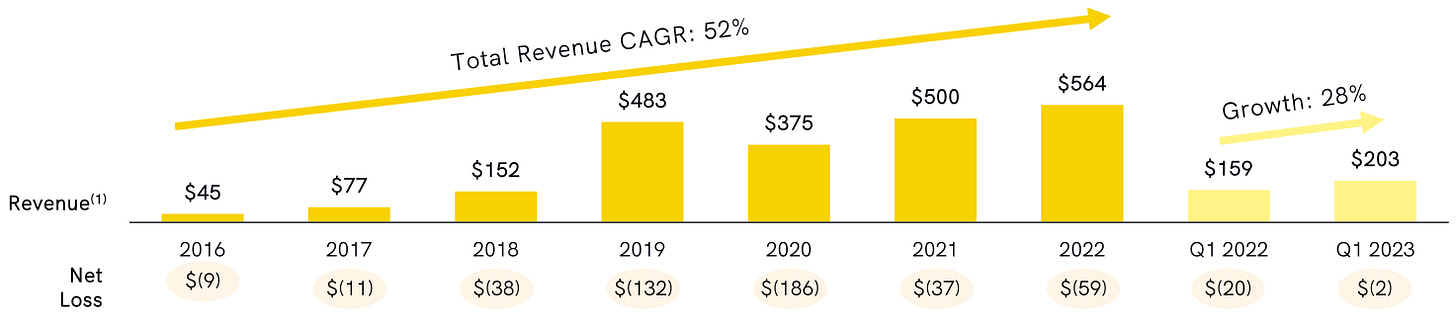

This unique mix of ingredients, ordering channel options, and geographic locations have done well for them. Since 2016, they’ve grown from 22 locations to over 250 while being able to deliver 20% restaurant-level operating margins.

What’s interesting to note is that in fiscal year 2022, CAVA was able to expand its restaurant margin from 18% → 20% with just less than a 5% increase to its in-restaurant menu price.

These economics are not bad at all but frankly, they kind of NEED to be good or otherwise, the concept wouldn’t work.

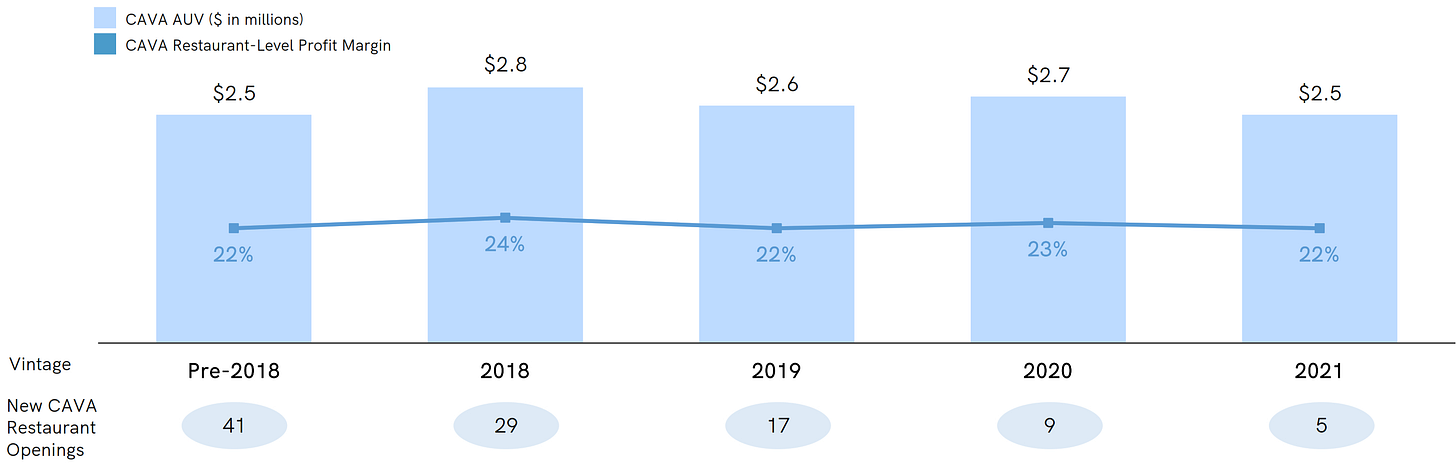

Right now, restaurant AUV is ~$2.4 million (FY’22) with ~20% margins.

The company is targeting

$2.3 million in AUV for a unit’s second full year of operations

$1.3 million in capex for a new build which is interesting since that’s the *net* amount

Cash-on-Cash (CoC) returns of 35%

In the S-1 however, CAVA says that they’ve achieved 40% CoC returns for all restaurants prior to 2018 to eliminate the comparison with COVID. This makes no sense given that nothing bad happened in 2019 but being a former sell-side, this is just to fluff things up and hope no one notices. 🚩

One last thing that I wanted to note on the restaurant front was its loyalty program. These programs are almost table stakes at this point for any food retailer and CAVA has ~3.7 million customers in its program.

The program isn’t rocket science either, it’s very simple. Sign up, the more you spend the more you earn. Easy. It’s basically catered to people that are power users or just want to make something additional if they don’t order religiously on a set basis.

This 3.7 million base also accounted for 25% of sales in Q1’23 which is good considering that you can estimate that a quarter of them are “sticky” and will continue to order frequently.

So to recap the restaurant-level commentary.

Unit growth, good ✅

Restaurant margin, good ✅

AUV, good ✅

Capex, meh but alleged CoC returns supposedly make up for it 🟡

Strong customer base, good ✅

However, when we go to the company-level commentary, that’s when things go downhill.

CAVA From The Top

Quick background before I get into it, CAVA started out in 2011 and in 2018 acquired Zoe’s Kitchen (which was a public company) and has slowly converted them to CAVA restaurants to aid their expansion into the suburban market.

For those of you that need a refresher on what Zoe’s Kitchen was, see the image below.

Fun fact, it was very on par with what CAVA offered but just in a different fashion.

Anyways, back to CAVA.

Right off the bat, just like Sweetgreen, CAVA is unprofitable. If we use their numbers in the S-1, it looks like over the last two full years, the net loss actually isn’t improving.

In 2022, CAVA burned $120 million in free cash flow (FCF) and, as of April 16, 2023, had just $23 million in cash and cash equivalents on its balance sheet.

Pulling a quote from David Trainer from New Constructs, which I hold to high standards due to the analysis that he publicly posts, he says,

In the two years we have full financial data, CAVA has not generated positive net operating profit after tax (NOPAT) or economic earnings, the true cash flows of the business. In fact, even as revenues grew 13% year-over-year (YoY) in fiscal 2022, economic earnings fell from -$49 million to -$62 million.

What’s important too when looking at the corporate level are the expenses as revenue grows. This means I really care about marketing and SG&A costs. As an example, part of the reason why Sweetgreen is still unprofitable despite restaurant-level economics being favorable is that expenses keep rising as revenue rises.

You can read about that one by clicking the link below.

But when it comes to the economics, let’s take a look at what CAVA is telling us.

In Q1’23, G&A as a percentage of total sales was 14.3% which was up from 13.2% in Q1’22 which worries me that they aren’t being as efficient with headcount.

However, operating expenses are down from 86.1% of sales in Q1’22 to 75.1% in Q1’23. Should Q1 trends hold up until the end of the year, this could be very beneficial for CAVA and I’m not going to discount that.

With no debt and ~$23 million in cash and cash equivalents, CAVA believes there is potential to have more than 1,000 CAVA restaurants in the United States by 2032.

It’s funny because for some reason I don’t know why all these emerging restaurant brands land exactly on 1,000 locations. Sweetgreen says the exact same thing too only they can get it done by the end of the decade.

Even if we look at how SSS has done over the last 2 years, the numbers are still promising.

Ignoring the 3-year stack, CAVA *is* growing, there’s no doubt about that. However, just like Sweetgreen, I do have concerns about their supply chain.

In order to source and get healthy, unique, and truly artisanal ingredients, CAVA directly sources its ingredients from 50 trusted growers, ranchers, and producer partners.

They even call out

We source 85% of our ingredients (based on total spend for fiscal 2022) directly from growers, ranchers, and producers that serve as our dedicated partners.

By not using national distributors, CAVA adds complexity to its supply chain, which will make it more difficult and potentially more costly to scale. This inefficiency leads to higher operating costs.

There are plenty of pros and cons related to how this company looks but I don’t want to shadow the negatives with the positives.

CAVA going public in a market environment like this only means one thing, they *need* cash. They aren’t generating any free cash flow, their growth of stores that requires ~$1.3 million in capex only sounds good when you’re not down to your last $22 million in cash.

Just like Sweetgreen, they mention the word “technology” 45x in their S-1, albeit not all directly related to growth or cost cutting. The CEO actually gets a $14.6 million dollar IPO RSU award that vests over 5 years.

CEO Award –Mr. Schulman. In connection with this offering, our Board of Directors approved the grant of time-based RSUs to Mr. Schulman, pursuant to the 2023 Equity Incentive Plan, which we refer to as the “CEO IPO Award.” The CEO IPO Award will become effective as of the completion of this offering and has a grant date value of $14,625,000.

The RSUs will vest in substantially equal annual installments over the five-year period beginning on the completion of this offering, subject to Mr. Schulman’s continued employment through each applicable vesting date. The RSUs are subject to the following vesting acceleration terms:

Upon a termination of Mr. Schulman’s continued employment by us without cause, by Mr. Schulman due to his resignation for good reason (a “qualifying termination”), the portion of the then-unvested RSUs that would vest within the 12 months following the date of the qualifying termination will fully vest in connection with such termination.

He even gets 12 months of unvested RSUs if he leaves for a good reason and not cause. Talk about a good deal for a CEO to take a company public on top of his already $618,000 salary, $69,000 cash bonus, $1.16 million in stock awards, $386,000 in options and $365,000 in non-equity incentive plan compensation.

Factoring in other compensation, CEO Brett Schulman made $2.6 million last year and once he takes the company public, he’ll be sitting on quite a large about of cash and 1.9% of shares outstanding once they go public.

So let’s recap the positives and negatives.

Positives

The company is growing its unit count base

Restaurant operating expenses are going down, technically

Restuarant-level margins getting better, on par with other FCR

No debt aside from the ability to draw down on a credit facility

Healthy, can apply to many different consumer tastes

Negatives

G&A as a percent of sales is going up in anticipation of growth

Company is still unprofitable in any way you want to cut it

Not generating any positive free cash flow

Burn rate is quite scary

Going public in an environment that actually sucks does not instill confidence

But that’s not really where things really matter. We need to see what this IPO valuation means and if it’s a buy or not.

That’s why I’ll be diving into valuation and comparisons next.

CAVA Valuation Is Looking *Hefty*

Piggybacking off of what I said earlier about the hype around this name, it seems like that’s the case.

Let’s first take a look at unit economics.