Back in January of this year, we released our research on Xponential Fitness XPOF 0.00%↑ and revealed our long position in the name. A link to original research that breaks down the business and our thoughts can be found here as well as my chat with Chit Chat Money about the company as well.

What we didn’t touch base on was how their growth will help expand their operational leverage and thus, profitable margins. So this is that post. How Xponential Fitness is a homerun based on our original findings earlier in the year.

It starts at the top.

Note: This is to help visually help understand the potential of what the company can achieve, all projections are a matter of illustration based on past performance, management guidance, and conservative growth figures.

Studio & AUV Growth

In the most recent quarterly statement (Q1’22), the company stated that it had 2,030 studios open in North America with another 1,870 contractually obligated to open under existing franchise agreements. Additionally, they had 199 studios open internationally with another 950 contractually obligated to open in 12 countries.

So in total, we have 2,229 open studios with another 2,820 that need to be opened. Not bad!

Understanding how the topline grows so well comes from a few factors.

Average unit volume (AUV)

Studio growth (units)

Without an enticing AUV for the franchisees, there will be less demand to open one which slows down studio growth and overall revenue for the company from the fees that the studios will eventually generate.

So, how do we quantify these two points? Well, management believes that system-wide sales (SWS) will be at ~$1 billion at the midpoint with the expectation that they will open 500 - 520 studios this year. Call it, 510 as what we’ll use as our annual studio opening run rate. Additionally, The company said that run rate AUV is at $477k in North America but we’ll go off of the $450k in the Q to loop in international and newly opened studios as well.

AUVs have been making progress to getting back to pre-COVID levels and are just a stone’s throw away. It’s also near the $500k 2-year target that management outlined in their S-1 which with 25-30% EBITDA margins represent a cash-on-cash (CoC) return of ~40% based on a $350k opening cost.

Factoring in the above with a modest +2% annual increase to AUV (whether it be from pricing or increased attendance) with a mid-quarter opening cycle for the studios, we arrive with the below.

Given linear growth (for visual purposes only), the company can double SWS by FY’26E and have nearly 4,600 studios open at the same time. I will caveat this by saying that this is a very conservative model as management might be able to speed up the pace of openings which then has a direct impact on SWS and other fees, especially when it comes to international openings and how those license sales get recognized.

So now that we can visually map out SWS based on unit growth, let’s start addressing the operational leverage component of the business.

Asset Light Model

As I mentioned in my original article, Xponential Fitness is not an owner and operator of boutique fitness studios. Their end goal is to own the brands (IP) and sell the licenses and collect fees from those studios operating. While they have historically owned studios in the past, these were taken over by them with the sole purpose of turning them around and reselling them to new franchisees.

So since they don’t technically own or operate any stores as their core model (currently they operate ~20 but plan on getting rid of them by end of the year), their operating expenses are quite different. Because they derive most of their money from fees, they don’t need to pay for:

Store level employees

Store level leases

Backend store level infrastructure

Basically, anything else to operate a business

All these take up a huge amount of expenses but the company gets to forgo all these (when they don’t have studios on the books) and gets to limit their exposure to just corporate-level expenses.

Core Expenses

So if we then don’t have to worry about the burden of store-level costs weighing down on margins, what are the main expenses that XPOF recognizes?

Costs of product revenue - primarily consist of the cost of equipment and merchandise and related freight charges.

Costs of franchise and service revenue - primarily include commissions paid to brokers and sales personnel related to the signing of franchise agreements, travel and personnel expenses related to the on-site training provided to the franchisees, hosting expenses related to their digital platform revenue, and expenses related to the purchase of technology packages and the related monthly fees.

SG&A - costs associated with administrative and franchisee support functions related to an existing business, as well as growth and development activities.

The first two points are a function of doing business from selling actual licenses etc. while the last point is an expense that in theory, doesn’t need to scale quickly as growth scales since it’s more of a support-related expense. So if we take the expenses above and how they’ve been trending over the last few fiscal years, they’re very encouraging.

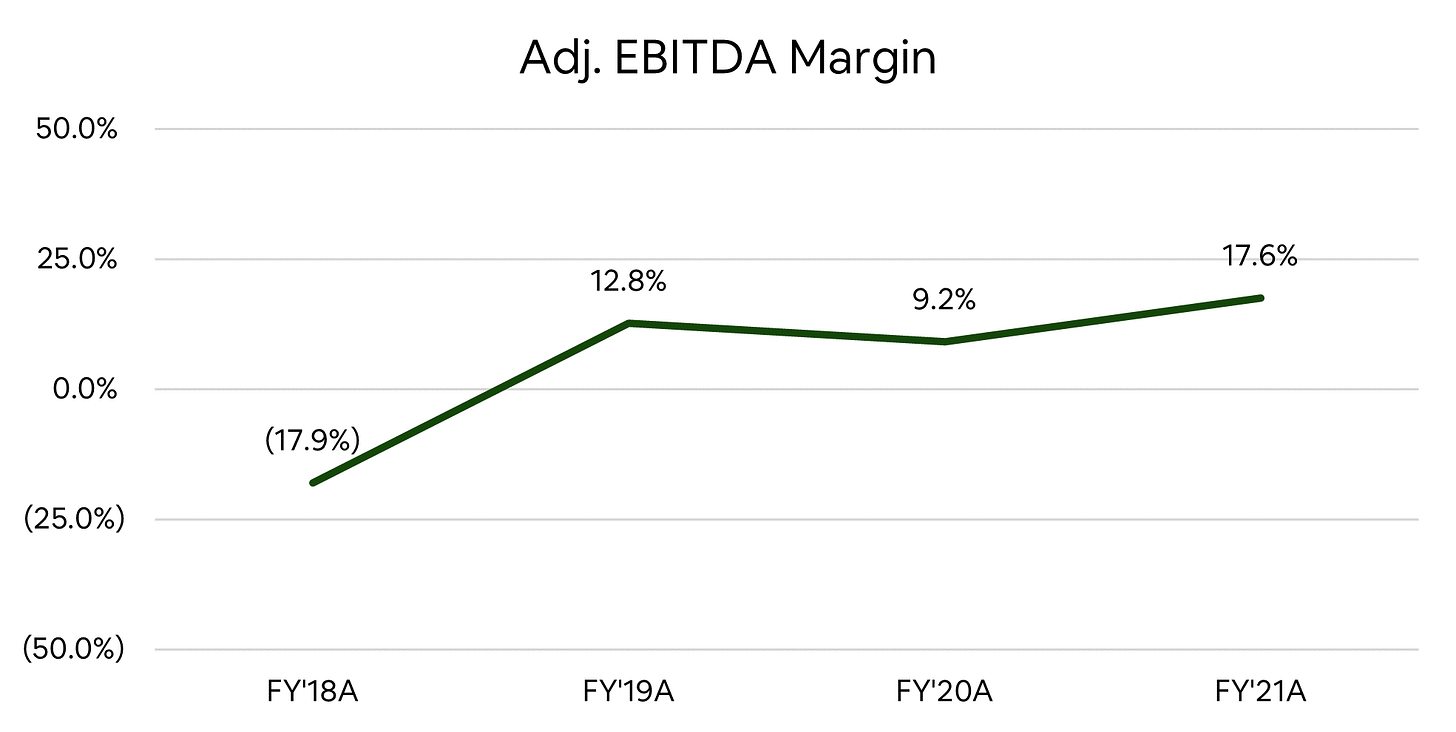

I will note that the uptick from FY’20 to FY’21 in SG&A is mainly a result of the franchises the company took over but are again, are planning on rolling off. The growth in topline and decrease of expenses related to doing business has really helped XPOF with adjusted EBITDA margins expanding ~3,550bps over the last three years.

So to do a quick recap of how this is playing out

Post-COVID return to in-person fitness → fueling AUV growth

Growing AUVs → more franchisees wanting to open studios

More studios → more SWS and more revenue

Faster topline growth with slower-growing expenses = margin expansion

Margin expansion is key here from the expanding operating leverage and is also one of the three main drivers of total shareholder returns. More on that here if you’re interested (very quick chart).

Growth Potential

So, while I visually mapped out how the company will grow topline, here’s what I’m thinking about for what type of margins the company can eventually achieve.

To get what kind of margins the company is capable of getting, we need to understand how the company gets its revenue, which is derived from a few areas.

Franchise revenue - includes revenue XPOF earns from franchise agreements and area development agreements including a 7% royalty fee off the top of all franchisee gross sales.

Equipment revenue - includes equipment revenue for new studios, installation of equipment, and replacement equipment for existing studios.

Merchandise revenue - is generated from the sale of branded and non-branded merchandise to franchisees for retail sales to members at the studios.

Franchise marketing fund revenue - XPOF collects a marketing fee of 2% of gross sales from all franchisees.

Other service revenue - includes digital platform revenue earned from subscriptions to XPOF web-based classes, commissions earned from certain of franchisees’ use of preferred vendors and vouchers sold through third parties allowing trial classes at local studios operated by franchisees, all of which we consider recurring revenue.

There are five categorical revenue streams with points 1, 4, and 5 considered recurring revenue based on how its components are recognized on a rolling basis. Given now you understand a little more about how the company makes money, visualizing how the company can quickly scale growth and margins are highlighted below.

As you can see, growth can continue ramping up as long as the company can continue selling licenses, and collecting revenue for all the intricacies of doing so (think training, territory, technology fees, etc). The recurring revenue is a big component of the business because it really helps create the snowball effect to push things to the next level. This growth will help XPOF achieve the >40% margins that they’re aiming for.

Even if you factor in zero multiple expansion, 11x FY’26E adjusted EBITDA factoring the same net debt and shares outstanding (they’re FCF positive), you arrive at a price of ~$79 a share.

Granted, this is all for illustrative purposes and should not be taken as proper DD. All this is based on the continued success of the management team but I would be amiss if I didn’t outline the potential risks involved.

Risks

Just like this post started, it will be at the top of the list of potential risks for this whole model.

1) Unit Growth Stalls

Given rising rates, financing a store opening might become more difficult which leads to slower annual growth. The requirements to open a studio vary widely but the same still stands for all of them no matter which one you open. All require liquid capital of at least $100k and a minimum of $500k net worth so people who qualify are in good standing financially.

2) Global Recession

Rising rates and record modern inflation are making the everyday consumer feel the pain in their wallets. All this chatter has many speaking about a recession soon if we aren’t in one already. With consumer sentiment in a free fall at an all-time low, consumers might decide to pull back on many areas of discretionary spending. Fitness is one of them.

With lower attendance comes lower membership revenue and thus lower AUVs. This all funnels down to XPOF’s bottom line.

I will admit that boutique fitness studios typically have higher intent members than traditional gym goers due to the community and social aspect of these classes. While not perfect, they do attract a different type of fitness enthusiast. Additionally, the average member pays ~$90 a month for their membership at XPOF while the average gym-goer pays ~$50/month.

IHRSA also released positive trending data stating

An increasing overall percentage of Americans used at least one health club or studio, reaching 27 percent of the population—the highest total on record.

Goes to show, at least for now, that tailwinds are still there.

Bottom Line

Xponential Fitness XPOF 0.00%↑ has the right idea for rolling up new fitness concepts and staying an asset-light model. It will allow them to scale quickly and efficiently across all markets and reach profitability much faster than other new consumer brands.

Having a management team that was former operators adds to the validity that they know how to grow and scale strategically which has been shown in their past financial statements.

I’m excited about this opportunity for a relatively new and coming fitness company and understand the potential that it can realize.

Until next time,

Paul Cerro | Cedar Grove Capital