If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.

For those of you that may or may not know, I’ve said one or two negative things about Peloton (PTON) in the past.

Okay, so I’ve been pretty pessimistic about Peloton, but how could you not be? The stock has performed so poorly that PTON is down >68% from its IPO day closing price back in 2019!

Once one of the best-performing darlings during COVID, this company has fallen off the poor management tree and hit every branch on the way down. Who would have guessed that bikes with TVs on them wouldn’t be worth an almost ~$50 billion market cap when you only have a few billion in sales?

💥SHOCKED💥

Besides the obviously poor decisions by management and internal strategy teams, many bagholders were hoping for a bottom to form or even a saving grace from a buyout. I even wrote about the potential Amazon buyout rumor in February and how there was no chance it would happen.

With so much turmoil at the company, what didn’t help reassure investors was the mass exodus of executives, including co-founder John Foley himself. Let’s take a recap of who has left just in the last two months.

September

John Foley - Co-founder, ex-CEO

Dara Treseder - Head of Marketing

Kevin Cornils - Chief Commercial Officer

Hisao Kushi - Chief Legal Officer

October

Shari Eaton - Chief People Officer

How encouraging. Anyways, today’s post isn’t about pulling PTON through more shards of glass and reminding all the bagholders why they should have seen this coming. No, today is about their turnaround plan, what I think it could be worth, and what the worst-case scenario is should McCarthy (new-ish CEO) fail.

So, let’s dive in.

“Everything But The Kitchen Sink”

Barry McCarthy was brought on earlier this year as the new CEO (replacing Co-founder John Foley), to turn around the company. McCarthy is a seasoned veteran with large companies being the CFO of both Spotify and Netflix.

Nice.

In relation to Peloton, with any sinking ship taking on too much water, you need to plug up the holes. Only then can you actually start removing the water and hopefully sail on to greener pastures.

How big are PTON’s holes? Well, pretty big.

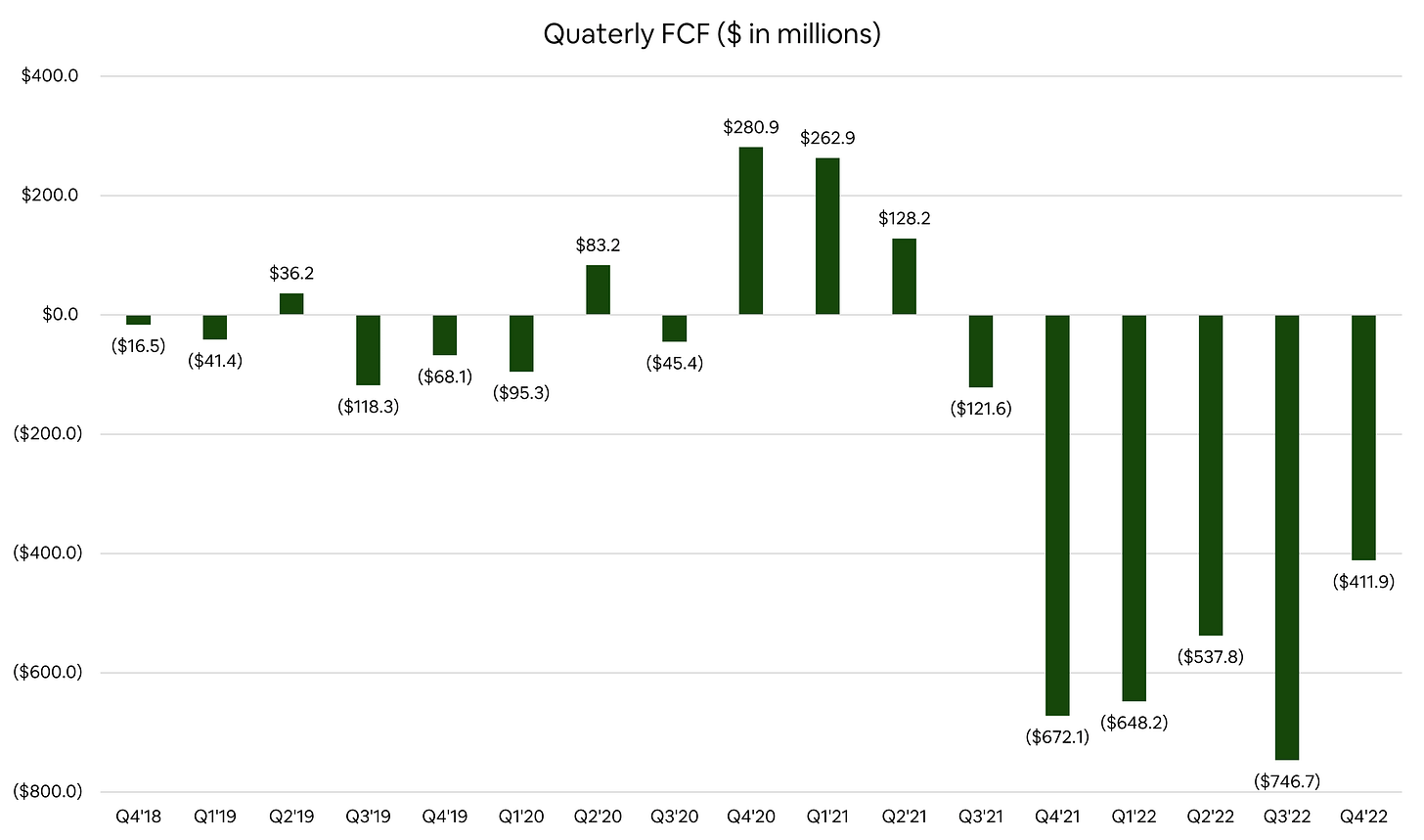

If we look at the company’s LTM FCF, their most recent quarter showed a cash burn run-rate of -$2.4 billion. This is less than the over -$2.6 billion reported one-quarter prior. Mind you, their sales alone were ~$3.6 billion in the LTM. Crazy how that even happened.

One obvious place that they were spending way too much money on was, people.

Bloated Workforce

SG&A margin was over 51% of sales in the LTM. Being too heavy with human capital, once PTON made the February announcement that they were bringing on McCarthy, they also made the announcement of laying off ~2,800 employees.1

On top of the announced layoffs, they also said that they were reducing the number of warehouses it owns and operates and expanding delivery agreements with third-party providers, and winding down its first US factory plant in Ohio.

The company believed that this round of changes would save the company >$800 million in annualized costs. This was just the start. In July, Peloton said it would cut about 500 Taiwan-based manufacturing jobs. A month later, it announced plans to cut 530 employees from its North American delivery workforce and 250 customer-service positions in North America.2 Most recently, PTON cut about 500 jobs, roughly 12% of its remaining workforce in the last round of cost-cutting measures to turn the company around.

This fourth round of job cuts left Peloton with roughly 3,800 employees globally, less than half the number of people the company employed at its peak last year. It also has eliminated about 600 more jobs since June than previously disclosed through retail store closings, attrition, and other moves.

In-House → Out-of-House

Additionally, aside from cutting its workforce, Peloton decided it would cease all in-house production of its bikes and treadmills and move manufacturing to partners in an effort to simplify its operations and reduce costs.3

Given how the company prided itself on wanting to own the whole system end-to-end (E2E), this change was surprising but not that surprising.

While there’s no direct callout for how much the cost savings of this change would be, it can’t hurt the company’s burn rate.

SALE! SALE! SALE!

One of the biggest issues that Peloton was facing was that as the economy reopened and it was becoming more evident that consumers were favoring out-of-home (OOH) activities. This meant that any company that grew exponentially during COVID because of limitations of being able to leave the house were having major issues with inventory.

This led to PTON having their inventory ballon triple digits while revenue was dropping off a cliff.

To add insult to injury, I even did some channel checks on second-hand equipment. While this level of diligence is imperfect, in my mind, it put forth the idea that some PTON users were over their bikes and wanted to get rid of them.

In the NYC region of FB marketplace, the list kept going on and on for residents selling their bikes, some at even half the price of a new one. I understand that correlation ≠ causation but this definitely should have been on people’s radar.

Consequently, to improve cash flow and move inventory, PTON took it upon itself to lower prices. While this did somewhat help, it’s apparent that it didn’t do enough and most likely diluted brand premium and pissing off customers.

All these cost-cutting steps, while painful, were necessary to help stem the bleeding.

McCarthy said the company has drastically reduced the amount of cash it is burning through by cutting jobs, outsourcing all manufacturing and reducing costly unsold inventory, and isn’t at risk of running low on funds. Peloton went through more than $1.7 billion in cash in the past three quarters combined, ending June with $1.25 billion in cash reserves and a $500 million credit line.

If you remember what I mentioned previously, current run-rate post-cost-savings don’t leave too much time to right the ship before cash reserves start getting low and break covenants.

Those covenants can be tripped in two ways.

“requires us to maintain a total level of liquidity of not less than $250.0 million and maintain a minimum total four-quarter revenue level of $3.0 billion (which are replaced with a covenant to maintain a minimum debt to adjusted EBITDA ratio upon our meeting a specified adjusted EBITDA threshold).”

Again, not too much wiggle room even on the revenue side of things if they don’t want to break covenants.

The Numerator

So while there’s only so much that a company can do to stop the bleeding (all the above), what you can also work on is growing revenue. After all, it’s all one big equation anyways.

Historically, Peloton wanted to keep a premium brand image and control the supply of its goods. That’s why it only sold its equipment online and in its own retail stores while not allowing its content to be placed on other equipment. This was the whole point of its connected fitness offering.

However, with the absolute need to grow revenue, they’ve changed this up in the name of survival. Here’s a list of changes that Barry has done so far.

Fitness as a service (FaaS) - renting out the bike and content for a monthly fee4

Launch of the Peloton Rower5 - what a dumb idea.

Growing the Peloton digital app with paid tiered services

Freemium model where users can get access to their library on the go and upgrade

Selling equipment at other retailers like Dick's Sporting Goods6

Putting bikes in Hilton hotels7

Selling select products on Amazon8

Basically, a lot of things which is why bond investors seem to feel a little better about the state of the company given how PTON’s recent bond offering is trading. Recent price of $0.72 on the dollar vs a low of $0.62 in July shows that reinforcement in sentiment.

But what Barry and management don’t know is if any of these initiatives are actually going to work. In hindsight, a lot of these ideas might be dumb but given the situation that they’re in, they need to try anything and everything before time runs out.

“There comes a point in time when we’ve either been successful or we have not,” Mr. McCarthy said in an interview, saying that point will be in about six months, or a little over a year since he took over as CEO.

Tick tock. Tick tock.

What I Think It’s Worth

One of the biggest points that everyone fought me on was how profitable PTON’s connected fitness (CF) portion of the business is. They aren’t wrong since in the most recent year they generated ~$1.4 billion in sales with a 71.3% contribution margin. Impressive, but this part of the business used to be straightforward but isn’t anymore.

You see, you had ~3 million subscribers paying $39/month (recently increased to $44/month), and that number seemed to keep growing. However, over the last two quarters (Q3-Q4), the number of CF subscribers only jumped by ~4,000.

In essence, the most profitable part of the business is barely growing if at all anymore. When you look at the chart above, growth seems to be not an option at the moment and analysts have called for the next Q to have flat growth. I’m skeptical that number will hold at that level given commentary from PTON.

With the US market for connected fitness down an estimated 51% YTD and our market share up an estimated 17% YTD, we expect the market for connected fitness to remain challenging for the foreseeable future in FY23.

Before this year’s change of strategy, the way to value PTON was much easier to understand. You could model out CF subs, digital subs, and hardware. However, with all the changes going on, it’s incredibly difficult to model that out.

How do you count hardware sales through Amazon or Dick’s Sporting Goods? How do you factor in conversion from Hilton rewards members after they’ve stayed at one of their hotels? How do you model out its FaaS offering? Its conversion post-free 2/3 month trials?

It’s hard to and to even try is foolish and more a guessing game than anything. So below is how I’m thinking about it.

Revenue Forecast

If we’re looking to model what we can, I’ve taken into account CF subs, digital, and hardware. I don’t know who in their right mind would think this company grows into a recession when you have product starting costs at $3,195 (Rower) and $3,495 (Tread).

It’s just not going to work out. Additionally, when you factor in the price hike from $39/mo to $44/mo for CF subs, you can notice the drop in total CF subs between Q3’22 and Q4’22 of just 4,000 net additions.

Adding fuel to fire, there are many Peloton members that are no longer using the bike yet still paying the monthly membership. Those fringe users are likely to cut the cord in the coming months and years ahead, especially as monthly sub prices are increased by the company. This is also exacerbated by the fact that the company is handing out free 1/2/3 month trials like they’re candy.

As I’ve said it no less than 1,000 times but gyms and studios are back in a very big way and that’s where the money is going at least in the near term.

My above revenue for FY’23 of $2.86 billion is drastically lower than FY’22 of $3.58 billion and FY’21 revenue of $4.02 billion. As I said, high-priced hardware going into a recession off of fitness transition to in-person doesn’t make for beneficial tailwinds.

SaaS Multiples

Once high-flying SaaS companies were trading at over 14x median sales during COVID. Once the economy started to turn, many wondered where the floor was, and here comes Thoma Bravo with his buyouts suggesting the floor was in.

JOKES.

SaaS multiples have completely collapsed and while there are multiple versions of what type of SaaS to count for (enterprise, cloud, etc), it’s easier to just use the blended median to get to an answer.

SaaS valuations have officially collapsed. We’re back to pre-2016 levels. Of the 123 SaaS companies we follow, the average public SaaS business is trading at 7.5x revenue while the median is 6.3x.

The other concern about using the above info is that the median SaaS business had trailing twelve-month revenue of $483mm, EBITDA of -$35mm, but positive operating cash flow of $35mm thanks to up-front collections on annual contracts.

So long as you’re growing cash efficiently (the median annual growth rate is 25%), investors will overlook negative EBITDA especially if the business is cash flow positive after working capital changes.

While Peloton has significantly more sales, it has terrible EBITDA and cash flow, not to mention that debt overhang, low morale, new employee stock options, etc. Basically, everything is working against them.

Valuation

Right now, PTON is being valued at $3.84 billion enterprise value. If we take the Q2’22 median multiple of ~6x on its revenue, which isn’t correct given that its connected fitness arm only grows with the hardware, you get ~$17 billion EV.

There is no way that will happen. Let me repeat myself. A zero percent chance that will happen.

If we look at what the street is giving PTON 0.00%↑, right now it stands at 1.3x NTM EV/sales. Again, I think that’s aggressive. The problem with getting the multiple lift that many argue it should get is the fact of just how bad it’s burning cash.

With so much uncertainty with the company, I think many investors are trying to invest in a turnaround because any inkling of positive news moves PTON up faster than tweens toward the Jonas Brothers.

In the current situation with bleeding cash and a slowing economy, I think 1x NTM EV/sales seems appropriate and even then it’s leaning towards the generous side.

NTM EV/Sales: 1x

FY’23E Sales: $2.855 billion

Debt: $2.37 billion

Cash: $1.25 billion

Market Cap: $1.73 billion

FDS: ~328 million (RIP all PTON employees with strikes above now)

Price: $5.29

That’s why I said that I didn’t think the market bottoms until PTON goes under $5. We got kinda close already when it touched $6.66 (lol) but no dice yet.

But here’s the thing, what if Barry can get to BE cash flow? A Long shot but if he does, that can help with the sentiment from its investors and a case to be made about a future turnaround.

Still, with declining expected sales and a 2x multiple on hopes and dreams, that gets you to ~$14/share.

“We’re Still Sinking”

If Barry can’t get Peloton to breakeven FCF, the odds of the company’s viability are quite low and don’t leave many options for them. By the end of 1H’23, if FCF can’t be reined in and growth can’t be kick-started again, I’d imagine their cash position is drastically reduced and their debt burden might start to wane down on them.

But what happens? Do you file for bankruptcy? Wind things down? Sell? Realistically, I don’t think they would file for Chapter 11 since I bet there’s some more they can do to just “exist” but I think they would sell. But who to?

I have a hard time believing that PE would touch this company given the FCF problems it has. Even transformative PE shops would have a hard time fixing this trash pile better than what the company was already doing on its own so that’s why I strike them out.

However, I DO think that a strategic would buy them. It would have to be someone that’s big enough to absorb the losses while it figures out how to engrain them in their overall plan, AND can leverage an existing base or platform to kick start it up again.

But, with that being said, I don’t think that current shareholders would get the saving grace that they believe they will. Because the company has so many issues, because it will most likely be in desperation, and because its base might already be in the current PTON demographic, a strategic wouldn’t pay top dollar for the company.

If we’re talking about obvious suitors, I’ve compiled a list below.

Large strategics with demographic overlap

Amazon - could roll into Prime

Apple - could roll into Apple Fitness+

Google - potentially a hardware play with Android?

Others with overlap

Lululemon

Nike

Adidas?

Honestly, these are the only ones that I can think of and even then, they aren’t going to be paying much for the company. Maybe in a firesale but my bet would be Amazon if any. As I mentioned in the embedded post about a takeover at the beginning of this article, Apple prides itself on being able to build its own stuff and I find it hard to believe that they would buy it. The last big hardware acquisition I can remember them doing was Beats audio and that just ended up propelling them into the headwear space after that with the pods.

Closing Thoughts

Peloton will forever be a case study taught in universities of its terrible management decisions but if Barry can get it going again, it will also be taught as one of the best turnarounds investors have seen in this century.

High-level though, this turnaround is not an obvious one and sooooo many things can still go wrong. Considering that we’re most likely entering a recession and consumer discretionary spending is already being dialed in, the company will have more hurdles to deal with besides terrible management and operations.

I would treat this trade like someone would about crypto. Only risk what you’re willing to lose if it went to zero because it very well might.

Personally, I’m waiting for it to go much lower before I think about betting on a turnaround. Until then, given the level of volatility in the market and the name itself, going short at these lows seems far too risky.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm