If you like today’s post, please like and share. I run a combination of a free and paid newsletter that highlights my notes, thoughts, opinions, and trade ideas.

You can do so by subscribing via the link below and selecting which part you would like to be a part of.

Hey folks, thanks for joining me again for another post by Cedar Grove Capital Management. Today I’m revisiting the Microsoft MSFT 0.00%↑ and Activision ATVI 0.00%↑ deal that we originally wrote about in April of 2022.

If you’re interested in our thoughts and our trade structure, you can have a look below.

As far as the update goes, I think to better understand the real risks here, we first have to go back in time and relook at a deal that has recently faced immense scrutiny that the FTC allowed it to go through over a decade ago.

This deal is important because it shows just how many warning signs there were but also the side effects of not knowing what the future really holds.

This post is part one of a two-part post on the deal. If you’re interested in catching the next one when it comes out, please subscribe below, it is free at the basic level.

With that, let’s dive in.

Live Nation 🫱🏼🫲🏽 TicketMaster

In 2009, Live Nation and TicketMaster agreed to a $2.5 billion merger1 that many at the argued could reignite the ticket sale industry for live performances or it was nothing more than just delaying the inevitable.

Granted, this merger was announced during peak great financial crisis and many were still struggling to get back on their feet. Hell, the market bottomed just a few months later.

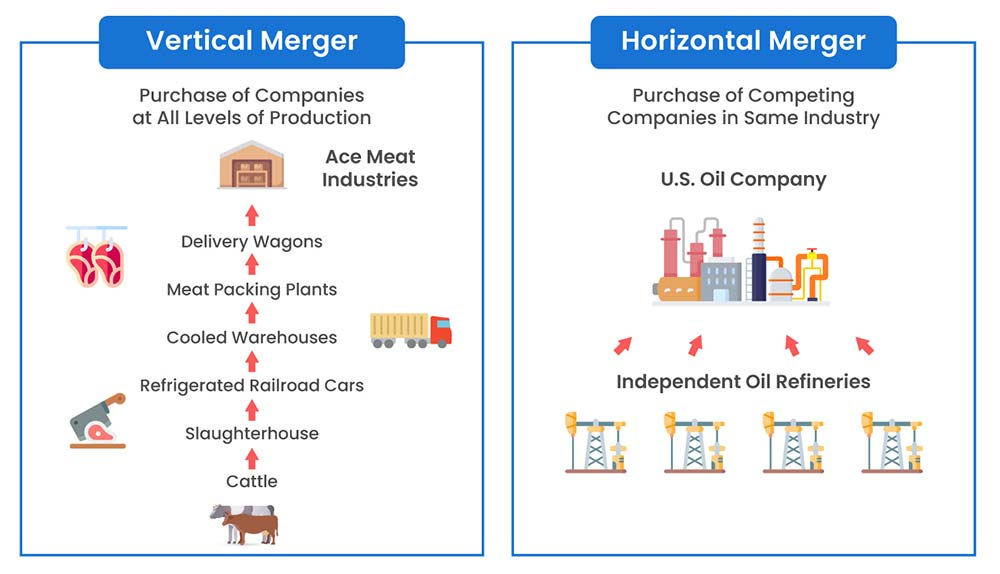

Typically, FTC isn’t as scrutinous (but not always) on vertical mergers as horizontal ones. Vertical integrations are usually mergers of non-competing companies where one's product is a necessary component or complement of the others. Such mergers can achieve procompetitive efficiency benefits.

Vertical integration can lower transaction costs, lead to synergistic improvements in design, production and distribution of the final output product and thus enhance competition. Consequently, most vertical arrangements raise few competitive concerns.

However, that is not always the case and if we’re looking at the anti-competitive nature of this particular deal, it almost seems like an obvious merger that needed to be blocked but somehow made its way through.

Both Ticketmaster and Live Nation enjoy monopoly-like dominance in their fields, but they achieved those positions by different means: Ticketmaster through technological innovation, like Microsoft, and Live Nation through consolidation, like Standard Oil.

But what were the possible net benefits that were allegedly supposed to come from the deal?

1) The Movie Theater Model

For those of you that aren’t familiar, the movie theater model is quite simple. Movie theaters don’t make much money on the actual sale of the movie tickets themselves but rather on what they charge you once you get in there. That includes popcorn, drinks, snacks, and any clothing associated with the movies.

This similar approach was proposed by Glenn Peoples who was a senior analyst at Billboard.com back in 2009.

There are seats that aren't being filled at a lot of concerts, and so some of the prices are going to go down so they can get people in there so they can get their parking money, so they can get their beer money, so they can get their merchandise money. And on the other side of it, the good seats, the in demand seats by people who really place the most value on these events, well, they're going to be paying more.

The logic here is that the “surge” pricing of in-demand tickets can help people come in for the not-so-nice seats (more ticket sales) and also get more stuff once they’re there.

A win/win/win/win (Live Nation / venue / artist / fan). The fan is included because they, in theory, get the seats they want at the price they’re comfortable with.

2) Scalpers

The other problem that plagued the industry was scalpers. These were the guys that sniped tickets when they went on sale only to list them on the secondary market to make a quick profit.

The thought was that Ticketmaster was limited by artists and venues who want to keep prices low to sell more tickets. But that helps create a thriving secondary market for the most popular concerts.

A thriving secondary market that Ticketmaster had through TicketsNow which actually landed them in the hot seat in 2009. More on this in the next section.

The new Live Nation might be able to squeeze some of those middlemen out. Congressman Brad Sherman said that would be good for artists.

The highest prices are when you have to pay scalpers. And I believe that these changes will make sure that when you buy a ticket the majority of that money is going to the band you're a fan of rather than ticket resellers.

But let’s look at the clear reasons why the deal should not have gotten approved.

Why The Deal Needed to Die

1) "This deal is not in the best interest of fans"

Michael Hershfield, the co-founder and CEO of LiveStub -- a secondary ticketing company much of whose business would disappear if Live Nation and Ticketmaster merged said that,

"This deal would mean that Live Nation would have direct access to Ticketmaster's ticketing solution, including its resale marketplace TicketsNow. Live Nation could potentially harness Ticketsnow and begin to offer performers the opportunity to list tickets on the resale system without ever listing in the primary market."

This was all too true when TicketMaster sold tickets to a Bruce Springsteen show through TicketsNow, rather than through its primary ticketing system.

Springsteen complained about his fans being subject to a "bait and switch." When they went to Ticketmaster.com to purchase tickets at their $95 face price, many were directed to TicketsNow (secondary market) where the tickets were priced as high as $2,000.

Congress was not too fond of this play by the company and the FTC ended up fining them as a result.

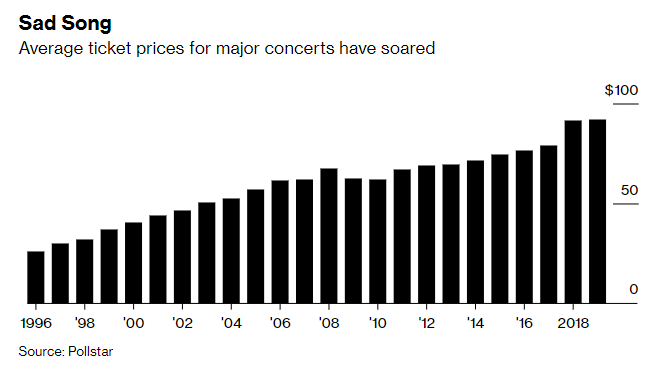

2) The Fan Pays More

Even leaving aside the idea that these two live music behemoths would no longer have to compete with each other for venues and tours, the more immediate threat to fans is that tickets could be sold by auction rather than at a single price.

While the combined company might take the opportunity to ditch the

"convenience" fees that are detested by fans -- or at least internalize the fees (which are divided between Ticketmaster, the promoter, and sometimes the performing artist and other parties) -- the idea of bypassing the primary ticketing market entirely and introducing them directly into the Ticketsnow auction system could give prospective audience members with more cash to burn a big edge over impecunious fans -- even if those other fans are quicker on the draw when it comes to buying tickets.

In other words, thickness of wallet -- and not quickness of response -- would become the salient factor when trying to buy tickets for hot shows.

If you read the above right, then it basically insinuates that ticket inequality would now exist since there isn’t a fixed price system anymore.

3) Ownership Drives Fees

Congressman Schumer, in a signed letter to Attorney General Eric Holder, estimated Ticketmaster’s share of the ticket sales market at 65% while Live Nation was at 15%.

Combined, you’re looking at a market share of ~80%. Having ownership to that degree allows the company to give itself an edge when charging fees.

These fees make it difficult for consumers to know the true value of concert tickets. Primary ticketing companies — the box office or ticket booth at the venue itself, say — impose fees that, on average, amount to 27% of the original ticket price.

Secondary ticketing companies, such as the eBay subsidiary StubHub, charge an average of 31% of the ticket price.

Because Live Nation controls a significant portion of both markets, the extra fees give the company an enormous competitive edge.

But how did the deal get done?

FTC Cuts A Deal

After nearly a year of scrutiny, the Justice Department filed a proposed settlement that would allow the companies to merge — if certain conditions are met.

The settlement required some concessions that were supposed to create more competition in the ticketing business that Ticketmaster currently dominates.2

Ticketmaster was required to license its primary ticketing software to Anschutz Entertainment Group (AEG), the second-largest concert promoter and operator of major venues.

Within five years, AEG could either buy the software, create its own or partner with another competitor.

In truth, as I mentioned in the beginning, vertical integration is less frowned upon in the eyes of the FTC.

“The Justice Department had a very weak hand. This is vertical integration, which our antitrust laws generally allow. They were able to successfully negotiate for significant concessions.” - U.S. Representative Brad Sherman of California

This is key because back then, the financial crisis was just turning a corner. The FTC was less hard on mergers in general in an effort to spur growth and market activity in a very dormant market environment and this was allowed to happen.

When you really don’t look into all the details too much, or don’t apply enough weight to them, you get a behemoth that survives the financial crisis and comes out much stronger than the FTC could have imagined.

That is what’s important here when we look at the MSFT/ATVI merger.

Takeaways For MSFT Merger

It’s not just about what the market conditions are now (declining sales, performance, shows), it’s what they could be down the road.

Really dig deep into where the “leverage” lies and who it lies with. This will be important in part II.

Go hard with the worst-case scenarios and let the companies dig themselves out of them to prove it’s not as bad as it is.

Concessions should never be lenient if the gut reaction is this is a bad deal.

That’s it for part I to set the stage for what I’ll be sharing in my notes for part II. I always felt case studies are a great way to use historical events to help understand and predict the future. I’m sure that Lina at the FTC has also been doing the same.

If you’re interested in joining our premium community, you can enjoy a free trial below.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech

Share this post