Note: All information and commentary are as of September 30, 2022.

*Correction, an earlier post/recording referenced a gross 5.9% return.

Fund Performance

In Q3 2022, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned 10.2% gross return compared to -5.3% for the S&P 500, 3.8% for the S&P Consumer Discretionary ETF XLY, -13.9% for the Cannabis ETF, and -2.5% for the Russell 2000.

Market Commentary

I will be the first to admit that 1H of this year took me completely by surprise. The beginning of the year was all about multiple compression while earnings for the most part were stable and going up.

This meant nothing to the market and speculative tech names and cyclical stocks, like consumer discretionary, took a pounding. I was on the side of the “consumer is okay” and continued to focus our capital on names that still were posting good results and that we felt could weather the storm.

However, it quickly became apparent that economic conditions were rapidly deteriorating faster than what lagging data provided. The “inflation has peaked” narrative proved to be false and we believed that the consumer was indeed “not okay.”

You can find our succinct thoughts in our post from September 6, 2022, below.

Note: The below post will cover the consumer commentary portion of this section.

Our economic research motivated us to immediately close virtually all our positions and hold only one core position, Twitter (TWTR), for the arbitrage opportunity. While we did not time the top of the rally, we did avoid the slaughter immediately after as more lagging economic data came out.

One and two-year yields spiked on the assumption that the FED would have to be more aggressive than the market previously thought since there was a poor August inflation print. This also boosted the WSJ Prime rate past 6.25%, the highest since early 2008.

This Prime Rate is directly impacting the consumer in various ways, credit card rates being one of them. Considering that now the average CC rate is the highest it’s been in more than 25 years.

The sliver of good news is that while 2/10Y US Bond spreads have been inverted since peak summer, the gold standard of 3M/10Y US Bond spreads has regained positive territory. This does not mean that a recession is not going to happen but considering that every time the 3M/10Y has inverted, we have had a recession. First time for everything but time will tell if it does remain the gold standard for the 100% hit ratio.

Aside from rising rates pushing stocks lower, there are multiple “bubbles” popping in the market. One of the biggest revolves around crypto.

Crypto Bubble

If we look at the price of the top two crypto tokens (Bitcoin and Ethereum), both are down ~59% and ~64% YTD, respectively. Speculative assets continue to crater and a flight to preserve capital continues.

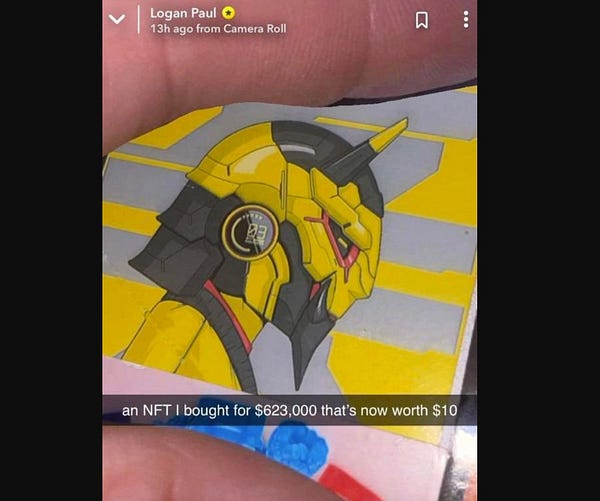

This is even more apparent in the once-hot NFT marketplace. NFT monthly sale volumes have completely jumped off a cliff as “investors” have come to the realization that JPEGs are indeed not worth anything.

Influencers that were once shilling these worthless projects to naive retail investors have also felt pain as well.

This bubble will continue to deflate as more “HODLers” tap it as a source of liquidity than the next two bubbles.

Housing Bubble

Another rude awakening was the spike in the 30-year FRM. Rates spiked to nearly 7.1% before settling to 6.8%, that’s with having an excellent credit score FYI. There are also signs that there is plenty of pent-up demand for housing. New-home sales rose in all regions, including a 29.4% jump in the South, where the pace was the firmest this year.

However, according to the American Enterprise Institute’s Housing Center, prices nationwide, measured month over month, fell for the first time in August since the depths of the COVID crisis, retreating 1.6% from July.

The falloff looks extreme compared with the two-year pandemic frenzy, marked by multiple offers and a shortage of listings that drove buyers to bid high.

Now listings are lingering longer because demand has collapsed, adding to the active inventory. One thing may help to keep prices elevated: fewer homes are coming on the market.

A significant decline in the flow of new listings to the market over the last two months – moving from 8.5% below 2021 levels in June to a nearly 23% year-over-year decline in August – shows that some would-be sellers are opting not to list, either in response to slowing sales, or in order to hold on to their low mortgage rates.

Additionally, the historic rise in home prices over the pandemic, compounded by this year’s spiking mortgage rates, has pushed the monthly mortgage payment on a newly purchased typical home from $897 at the end of August 2019 to $1,643 last month, an 83% increase from this time of year before the pandemic.1

Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate

Used Car Bubble

There is finally some reprieve in the used car market with prices declining by 4% in August and continuing to drop in September.

The Manheim Used Vehicle Value Index which tracks a collection of used vehicle prices has revealed that prices are at their lowest level since September 2021 and roughly 11% lower than they were in January 2022. In addition to prices falling by 4% in August, they also dropped by 1.4% through the first half of September.

Prices could continue to fall 1% to 2% every week, and the end of the year could yield the best deals before a potential rebound. Used car dealerships will feel the effects of declining prices and should translate positively into future inflation prints.

FX - The Silent Killer

Another point that not enough people are talking about is the strength of the dollar. In times of trouble, the dollar is the world’s refuge and strength. This is true even when the US is the source of the trouble, as happened in the financial crisis of 2007-2009. It is true again now.

The strength of the dollar matters because it tends to impose contractionary pressure on the world economy.

The roles of US capital markets and the dollar are far bigger than the relative size of its economy suggests. Its capital markets are those of the world and its currency is the world’s safe haven. Thus, whenever financial flows change direction from or to the US, everybody is affected. One reason is that most countries care about their exchange rates, particularly when inflation is a worry: only the Bank of Japan can be happy about its weak currency.

The danger is greater for those with heavy liabilities to foreigners, even more so if denominated in dollars. Sensible countries avoid this vulnerability. But many developing countries will now need help.

In a Sept. 6 Washington Post op-ed, El-Erian explained that a strong dollar can be a “mixed blessing.”

On one hand, the strength of the greenback helps to reduce U.S. inflation, but at the same time, when the dollar remains persistently strong, it can bankrupt developing nations as their dollar-denominated debt costs soar.

Another issue here is that because the world is more global, multinational corporations have the biggest risk of a strong US dollar when it comes to earnings headwinds.

"We had a great quarter, but yet again, the dollar had an even stronger quarter," - Salesforce CEO Marc Benioff

Repatriated profits from abroad, in euros or pounds or yen, are going to be worth less in dollars, because the dollar is stronger.

*% Sales exposure to Europe / % of S&P 500*

What's good news for importers isn't good for many exporters. When the U.S. dollar is strong, American-made goods become more expensive — and less attractive to shoppers — in other countries.

Additionally, people living in many other countries where the currency is now weaker than the dollar may think twice about traveling to the United States. As the dollar gets stronger, their visits will become more expensive.

Hence, depending on who you ask, why this is all a “mixed blessing.”

Current Portfolio

Even though we sold out of virtually everything, we do still believe in the underlying fundamentals of a few: Xponential Fitness (XPOF), Petco (WOOF), The Joint Corp (JYNT), and RCI Holdings (RICK) are names that we are still incredibly bullish on.

We decided that until economic trends stabilize, downward price pressure will continue and we can hop back in when we feel more comfortable.

Our Twitter arbitrage trade is still in play and we are becoming more reassured in the success of Twitter forcing Elon to buy the company as information continues to be released, especially his text messages.

While technically NAV of our AGFY options would have moved us to a 10.4% gross return for the quarter instead of 10.2%, we have ultimately written them down to zero as we believe they are worthless despite the current NAV.

Other Updates

Thematic Index Trackers

Recently, we decided to create three index trackers.

All of these trackers are free to use and you can share them with those you feel might benefit from seeing how names have performed. They are powered by Google Finance so some days may not populate immediately or a ‘break’ could occur. This sometimes happens but it fixes itself in due time.

Closing Remarks

We do not believe that now is the time to deploy capital, but rather preserve any that is left. While over 90% of our assets are in cash right now, we will only look to redeploy capital when we believe a) underlying economic conditions have improved or b) the market sells off enough for us to be more comfortable with the risk/reward potential.

If we’re eyeing a bottom for point b, intrinsic value in our opinion sits closer to 3,900 on the S&P while if we went back to a modern mean reversion multiple on earnings of 15.0x, it puts us around ~3,420 at the mid-point.

Not saying that that is the bottom or that it could get to that point (though it could) but that’s what we would feel more at ease about.

While we’re waiting on underlying trends, we do have names on our radar that we believe can benefit once unemployment ticks higher and commodity inflation continues its slow decline.

Q3 2022 is over, but I suspect the real capitulation will be coming in Q4 and into early Q1’23. Hold fast.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Share this post