Fund Performance

In Q1 2023, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned -10.1% gross return compared to 7.5% for the S&P 500, 16.8% for the S&P Consumer Discretionary ETF XLY, -17.2% for the Cannabis ETF, and 3.0% for the Russell 2000.

Q1 Market Commentary

Q1 had an interesting start to the year as buyers that took advantage of tax loss harvesting looked to restart their positions. Heavily shorted companies were squeezed and holders looking to quickly cover their positions only added fuel to the fire.

However, the narrative that inflation was quickly coming down, and a soft landing would be achieved created a false sense of reality as more poor economic data kept coming in on the contrary.

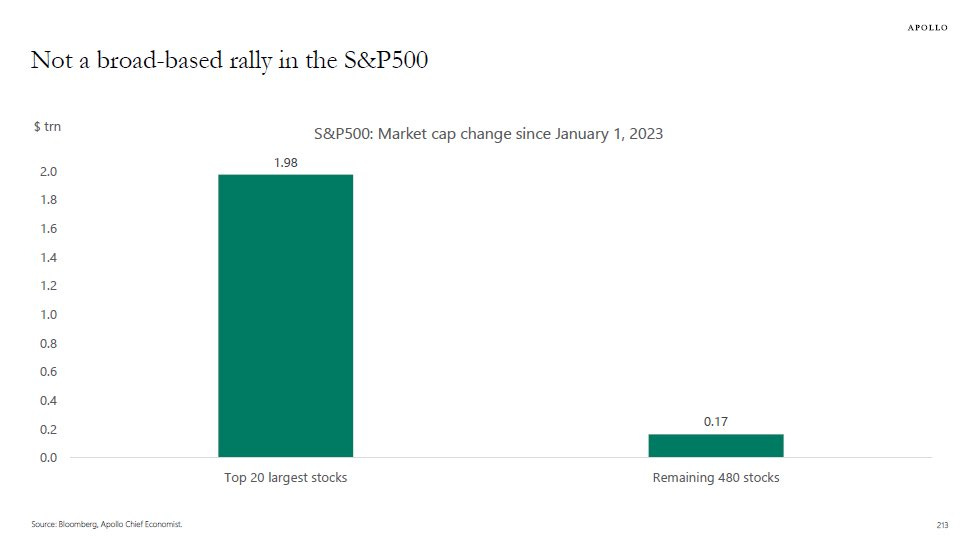

What is interesting to note however is that the market rally since the start of the year is not a broad-based one.

Only a handful of companies in the S&P 500 have contributed to its increase this quarter. This lack of a broader uptick in companies leads us to believe that this rally is one of the last breaths upwards that we’ll see this year before the rest of the index begins to deteriorate below the October lows as earnings get repriced.

Given the recent bank failures, continued layoffs, slowdown in consumer spending and delinquencies all continue to have me worried about what’s to come.

With the 10Y/3M yield curve the most inverted ever, it’s hard not to see just how much havoc the Fed raising rates is doing to asset prices.

As we signaled the alarm back in September about the deteriorating state of the consumer, in our opinion it seems to be materializing at a faster clip since the start of the year.

J.P. Morgan believes that consumer excess savings will be all spent up by the summer of 2023. This means that much of the cash on hand that was still fueling the economic growth in the services sector will most likely come to a halt soon.

This tracks against end-of-year 2020 earnings call commentary when speaking on demand.

To further add to this “weak demand”, signs of credit card data spending have been decelerating since the start of the year according to Barclays.

Long story short, I think the bad news is good news narrative is slowly starting to mean less and less and we’re quickly approaching that bad news is indeed bad news.

Have a look at the market was pricing rate cuts as more information was coming out.

The expectations flip flop more often than a piece of hair in the wind. However, the problem with presumed rate cuts, while much of the market would initially cheer for a pause or a cut, is what that actually signifies.

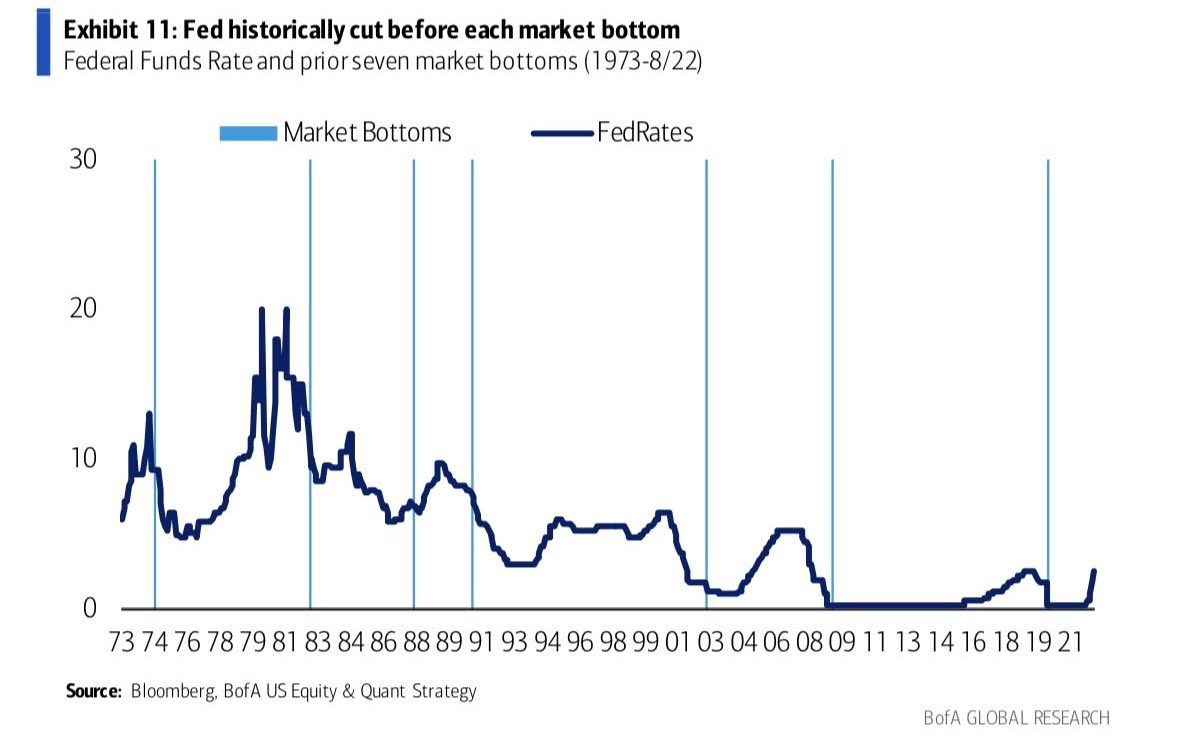

The Fed has never cut rates because the economy is fine, rather, they have cut rates to spur economic activity mainly due to a recession. Look at the chart below when analyzing rate cuts and market bottoms.

In each of the last 7 Bear markets, the S&P 500 did not bottom until AFTER the Fed began cutting rates. On average, the market bottomed 11 months after the first rate cuts.

And then if we look at the past when lending standards have been tightening, there are only a few instances where a soft landing has been achieved. More often though, a hard landing has taken place.

Given that I continue to believe, and find support for, a slowing of the economy, I believe we are indeed in for a hard landing and the portfolio still reflects that expectation even after a wild Q1.

Positions

Portfolio Commentary

Given we entered into 2023 with a net short position, the market rebound in January and into February took us by surprise. While we believed it would be short-lived, we did need to trim positions to stay within appropriate risk ranges.

Notable Updates

We’ve officially re-entered into cannabis positions via Green Thumb Industries (GTBIF) which despite the price, has been an operational favorite of ours. We also entered into Urban-Gro (UGRO) as a continued play on vertical farming products/services considering it still has a healthy cash balance and a small promissory note to be paid in full by the end of this year.

While we have gone long some positions, they’re currently only starter positions and will look to build them out throughout the year. Some of these positions you might have seen on our last update as short but that was more a factor of price rather than business fundamentals.

We do believe that there’s still value in the names, hence why we flipped. RH (RH) being a notable one.

Other tech names that we were not short prior to EoY ‘22 have become overextended in our opinion which leaves room for us. Our biggest short position to reflect this thought is in Nvidia (NVDA) where we believe reality has been completely disconnected from the price which has mainly been driven by Ai hype.

At 60x fwd earnings, it’s still nearly double the historical average prior to COVID despite deteriorating macro conditions and a supply chain glut of chips.

Tesla (TSLA) is another notable short that we initiated as we’re in the camp of price cuts not being as advantageous to overall volume as everyone believes. Given the last update on deliveries, it seems that the price cuts are indeed not moving in favor of the expectations that Elon and other analysts have set out.

Wall Street was expecting Tesla to report deliveries around 432,000 vehicles for the quarter. Total deliveries only numbered 422,875.

While also moving in and out on our short book, we’ve taken an active long position in the Microsoft (MSFT) and Activision (ATVI) trade as we believe that the weight holding back the deal has become virtually null. The big announcement out of the UK towards the end of March coincided with us publishing our part 1 on the deal which you can read below.

Besides the 1 arbitrage trade we have engaged in during Q1, there are other special situation opportunities that we have been doing work on, and should they be of interest, we’ll initiate a position.

While we do not like trading in and out (learnings from Q2’22), the volatility in weak names does create opportunity and we will continue to nibble should they present themselves.

Closing Portfolio Remarks

2023 will be a stock pickers market and we believe that there is still more pain to come. While timing will be incredibly difficult, we’ve already begun building out positions in names we believe will deliver long-term value.

CGC aims to deploy the rest of our remaining capital (which has been sitting on the sidelines) during Q2.

There are plenty of asymmetric trades that have been on our radar and are just looking for the right time to begin.

If you’d like to receive our monthly position updates or premium notebook content, you can enjoy a trial below.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech

Share this post