Good morning everyone 👋🏼!

Happy Thursday! If you’re reading this but haven’t subscribed, join our community of edgy investors interested in learning more about the markets and receiving recommendations on single-name stocks in the consumer, cannabis, and tech industries. Subscribe 👇🏼, it’s free!

For this week’s post, I wanted to do an Industry Deep Dive [IDD] of the fitness industry and how it not only has but will continue to drastically change in a post-pandemic world.

I’ll go over what it was, is, and will become of the industry and ways that as investors, we might be able to capitalize on the shifting floor beneath our feet. My points in reference include.

Fitness Pre-COVID (what life was like)

Fitness During COVID (how fitness evolved)

Fitness Post COVID (post reopening)

Key Takeaways

How to Play This Industry

These are broad-level topics but I will dive deeper into each while mentioning shifts to at-home fitness, the digital revolution, focus on mental health, and what consumers are looking for going forward.

Pre-COVID Age of Fitness

As some of us might remember, working out or getting some type of exercise involved being outdoors or going to a gym/fitness studio in order to achieve this goal. Before the coronavirus pandemic, the global health club industry finished the decade with record performance. Worldwide, industry revenue totaled $96.7 billion in 2019, as more than 184 million members belonged to nearly 210,000 health and fitness facilities.1

Just like my girl Fergie said,

I be up in the gym just working on my fitness, he's my witness

Alright enough with the corny jokes.

What’s interesting is that more than one in five Americans (21.2%) belonged to a health club or studio in 2019. In fact, the growth of United States health club consumers grew 27% from 58 million in 2010 to over 73 million in 2019.

Additionally, the gym and health club industry, some would argue, almost had a monopoly on what traditional exercise was pre-covid. Among gym members who actively used their membership in 2019, 55.4 million went to the gym at least twice a week, while 14.3 million went to the gym at least once a week.

There really wasn’t another true option for consumers to use.

Digital workouts were slowly being introduced to the market but not with the intention of replacing traditional in-person fitness but rather as a potential additional source of revenue and effort of retaining existing customers.

MindBody, a fitness-software company, said 7% of customers it surveyed in 2019 used live-streamed workouts. Other tech companies were looking to allow fitness enthusiasts to buy ‘credits’ to various fitness clubs so that they didn’t just belong to one, *cough cough*, Class Pass. Though this wasn’t a digital experience, it was a digital way to access physical brick and mortar places and the consumer base went along with it.

Bottom line

People’s only widely available option was in-person and whether you bought single memberships, credits, etc., being physically present was the super dominant option to take advantage of exercising.

Fitness During COVID

Come March of 2020, as many of us so vividly remember, the world went into lockdown in what we all believed was going to be a nice two-ish week vacation. Joke of the year! Anyways, once we all realized that this was not going to just be a two-week furlough, consumers needed to get access to exercise in their quarantine-ridden life, aka, their home/apartment.

With in-person gyms and clubs temporarily closed, everyone went to grab whatever fitness equipment they could get their hands on. Resistance bands, free weights, yoga mats, physical fitness machines, pull-up bars (I waited weeks for mine) flew off the shelves as quickly as they would be listed. eBay listers were even pricing gouging weights for 3-4x the going price because of how much demand there was.

For those that couldn’t get access to any legitimate equipment, DIY equipment ballooned during the lockdown, with YouTube views of at-home DIY equipment/workout videos (the ones where you create a barbell from water jugs, etc.) surpassing over 100 million views.

So, with no access to in-person classes and little to no access to equipment, where did people turn to? Drum roll please, digital! Any industry that could be turned digitally did so during peak COVID. Fitness, telehealth, grocery shopping, those ultra-fast delivery options, everything. This was the tipping point that digital fitness needed to become mainstream.

Just like I reported above with Mindbody, they said 7% of customers surveyed used live-stream fitness in 2019 which then jumped to 80% after lockdown.

There are actually some very interesting figures to support just how much of an impact this shift was since March of 2020.

73% of consumers are using pre-recorded video versus 17% in 2019

85% are using live stream classes weekly versus 7% in 2019

56% of respondents exercising at least five times per week #fitlife

Also, consumers who reported that body image issues or feeling embarrassed by lack of experience had previously kept them from joining studio classes, live streaming has made them feel more comfortable trying new classes than prior to lockdown.

Digital classes were much cheaper than in-person gyms and studios too! In fact, the average cost of a digital class is $11—about half of the average in-studio class.

Peloton even got its day of reckoning proving that their mere tablets on stationary bikes had a massive market by selling out so fast that their waitlist was months long for those that had already purchased its bike.

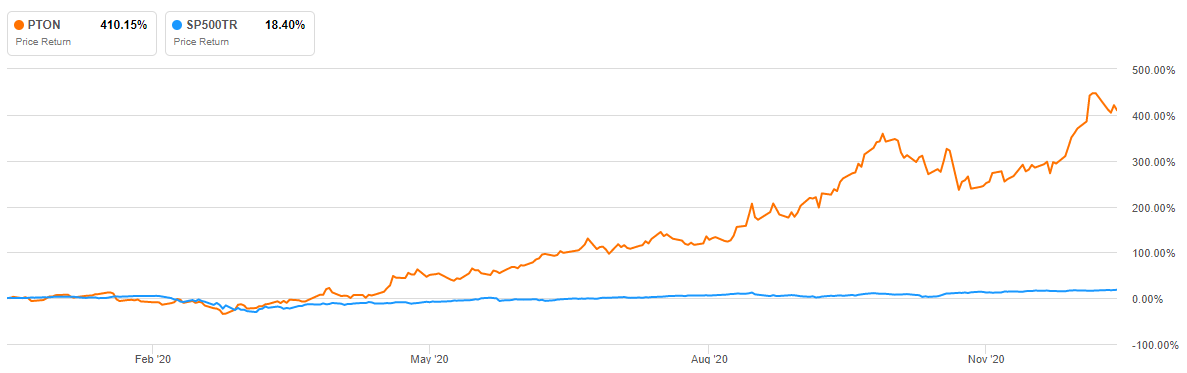

Their stock price reflected this boom in demand, surging over 400% in 2020, eclipsing the S&P 500’s 18% return.

However, for physical brick-and-mortar clubs to survive, they needed to adapt. This meant that a once back of mind thought of offering digital content or services now became the key to their very survival.

ClubIntel found that 27% of the 2,000 people who participated in an online survey said their fitness clubs offered digital fitness options during Covid closures. While this allowed them to stay in the game, this was by no means a full replacement of the $15 billion lost revenue from clubs and fitness studios being closed.

In fact, eight major chains filed for bankruptcy and 17% of fitness centers closed permanently, according to industry trade group IHRSA.

But even with this tremendous shift in how people work out, what does that mean for the future of fitness?

New Age of Fitness

With the shift in how people exercised during the pandemic, let’s talk about what will continue going on or will change in a post-covid world.

Health and wellness 👉🏼 key to success

From the start of the pandemic, many Americans decided that this event was the catalyst needed to help put more emphasis on their health. In fact, 40% of the general population surveyed in a Mckinsey report now consider wellness a top priority in daily life.

Additionally, 68% of survey respondents reported that they prioritized their health more after the onset of the pandemic. Exercise is also the most commonly reported tool for relieving stress: 65% of gymgoers surveyed reported using exercise as stress relief.2

Bottom Line

Individuals are prioritizing themselves first these days. This even trickles down to what perks and benefits companies provide their employees such as wellness stipends, discounted gym memberships and digital resources free of charge.

Don’t count in-person fitness out just yet

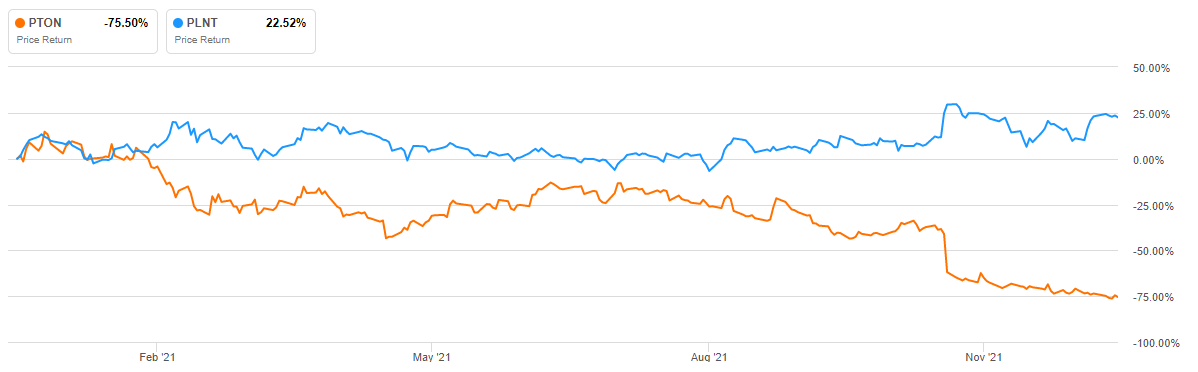

Just like Peloton had a spectacular rise in 2020, it sure as hell crapped the bed in 2021. The stock was down over 75% for the year as many investors abandoned the stock as they noticed a slowdown in the companies growth, and life returning somewhat back to normal.

At the same time this was happening, investors were rotating out of high flying, not yet profitable, companies in favor of stable, cash flow generating ones. In this instance, Planet Fitness PLNT 0.00%↑. While that gym stock was only up a meager 4% in 2020, the sector rotation into safer names sent the stock up over 22% in 2021.

Looking at it face value, there seemed to be a big shift in investor sentiment towards reopening plays and not necessarily believing so heavily for returns in expensive tech names.

Aside from price movements in the public market, consumers actually do want to get out of the house when they exercise.

According to Mindbody, a third of consumers surveyed stated that they plan to visit more studios after trying new workouts virtually and that 40% of consumers are booking workouts with studios they have never physically visited before, allowing businesses to reach “digital-first” clients.

Adding fuel to fire, from the same McKinsey report that I mentioned earlier, 70% of fitness consumers reported missing their gym as much as they miss family and friends. And while many long to return to their gym again, overall engagement is higher than previously recorded. Amongst fully vaccinated consumers, 35% went to the gym3 in the first few months of 2021, an improvement over gyms’ pre-pandemic market penetration of about 25% in the United States.

Bottom Line

As economies reopen, gyms and studios should reexamine their value propositions and place them in the context of consumers’ portfolio approach to fitness, particularly embracing their potential as third places—community hubs—where members can focus on themselves.

Digital fitness is here to stay

In the end, digital-enabled solutions have evolved from low-cost alternatives and add-ons to stand-alone offerings that are a regular part of consumers’ lives. In fact, 46% of Mindbody survey participants stated that they intend to make virtual classes a regular part of their routine, even after studios reopen.

With the overall shift in how working is conducted (WFH vs. on-site), people are integrating their lives with more technology. This is where society is, and it’s just going to get more integrated.

To prove a point, one Peloton user described the convenience of at-home fitness as providing extra flexibility in her life, saying,

“I can roll out of bed and not worry about running to the gym…and I don’t have to add an extra half-hour for my commute.”

In a world where the demands of your daily life seem to only go up, having the ability to trim some fat off of your day (and hopefully your body) just can’t be beaten when your fitness studio is in your house.

Community and interactions are important

While many of us had to turn to digital classes to exercise during the pandemic, a key component was missing that is just difficult to achieve virtually which is a sense of community.

Downloads and use of fitness and health apps grew during the pandemic, but the people seem to be the real draw. During the first few weeks of lockdown—March 9–24, 2020—overall downloads of health and fitness apps grew 27%, but apps that include a community component saw four times as many downloads.

A sense of community that really stems from personal interactions with others helps develop new bonds and holds individuals accountable.

Research shows that the healthy actions of others tend to rub off on us. One study found that participants move towards the exercise behaviors of those around them. Another study found that overweight people were more likely to lose weight if they spent time around their fit friends.

Bottom Line

It’s hard to get that sense of feeling from a virtual class compared to in-person. There’s something about having an instructor yelling in your ear to keep going or seeing the other person lifting more beside you that really brings out that inner competitive nature in you.

Key Takeaways

The future of fitness will by hybrid → consumers having a mix of at-home and in-person exercising options → gyms and fitness studios not dead

Fewer pickings → with the closure of many fitness gyms and boutique studios, total supply (availability) has been reduced helping support the gradual increase in AUVs (average unit volumes) for physical locations

Emphasis on one’s health and wellness will continue to be at the forefront of individuals minds leading to increased exercising engagement

Vaccine or not, people will continue to exercise in some sort of capacity

How to Play This Industry

So with the future of fitness not leaning towards one end of spectrum (digital vs. in-person), betting on the future of fitness will need to be targeted.

A few ‘themes’ to potentially target

Reopening play 👉🏼 betting on people returning back to physical locations that not only meet but exceed pre-pandemic levels

Wearables and at-home fitness 👉🏼 connected fitness in general is becoming a big focus for health and wellness tracking

Continued shift from corporate wear 👉🏼 continued growth in athelesiure occurring as a result of the WFH momentum and generally increased engagement in exercising

Below I’ve listed out fitness names in various categories that could support these themes:

Direct Fitness

Peloton PTON 0.00%↑

Planet Fitness PLNT 0.00%↑

F45 Fitness FXLV 0.00%↑

Xponential Fitness XPOF 0.00%↑

Mindbody (MB)

Nautilus NLS 0.00%↑

Life Time Group LTH 0.00%↑

Indirect Fitness

Apple AAPL 0.00%↑

Google (through Fitbit) GOOGL 0.00%↑

Dexcom (glucose monitoring) DXCM 0.00%↑

Lululemon LULU 0.00%↑

Under Armour UA 0.00%↑

Nike NKE 0.00%↑

I think if you plan on investing directly into a fitness name, one that is either currently at, or near profitability will be able to withstand more FED tightening and interest rates rising.

Some names I like

I personally like Xponential fitness (disclaimer: I am currently invested in the company) mainly because it is a basket of boutique fitness studio brands which I almost view as a psuedo fitness ETF. The company is not yet profitable but should be reaching profitability in the next year. They operate through a franchise model so it’s very asset light and only succeeds if its franchisees succeed.

If you want to invest indirectly into the health and wellness fitness trend then you can’t discount the big players like Apple and Google. Their software and hardware is getting heavy attention and investment since the total addressable market is quite large. They also have large balance sheets to throw plenty of money into R&D to see who can get to market faster and really get a good grasp on market share.

Closing Thoughts

Being focused in the consumer industry, fitness is something that I can really get behind (literally) and makes for pretty simplistic due diligence given the nature of how tangible it is. Picking a winner(s) in the space will be a combination of analyzing fitness trends (for growth) but also management execution to not fall behind with the times.