My old man had a philosophy: peace means having a bigger stick than the other guy.

- Tony Stark

Ever since the dawn of time, men have been engaged in conflict primarily for economic, religious, and political reasons.

From the ashes of WW2, the United States rose to become one of the world’s superpowers and thus, a key player in shaping the new world order.

However, to be the keeper of the peace, wars still need to be fought both directly and indirectly and deterrents need to be put in place to prevent conflicts from occurring more frequently in the future.

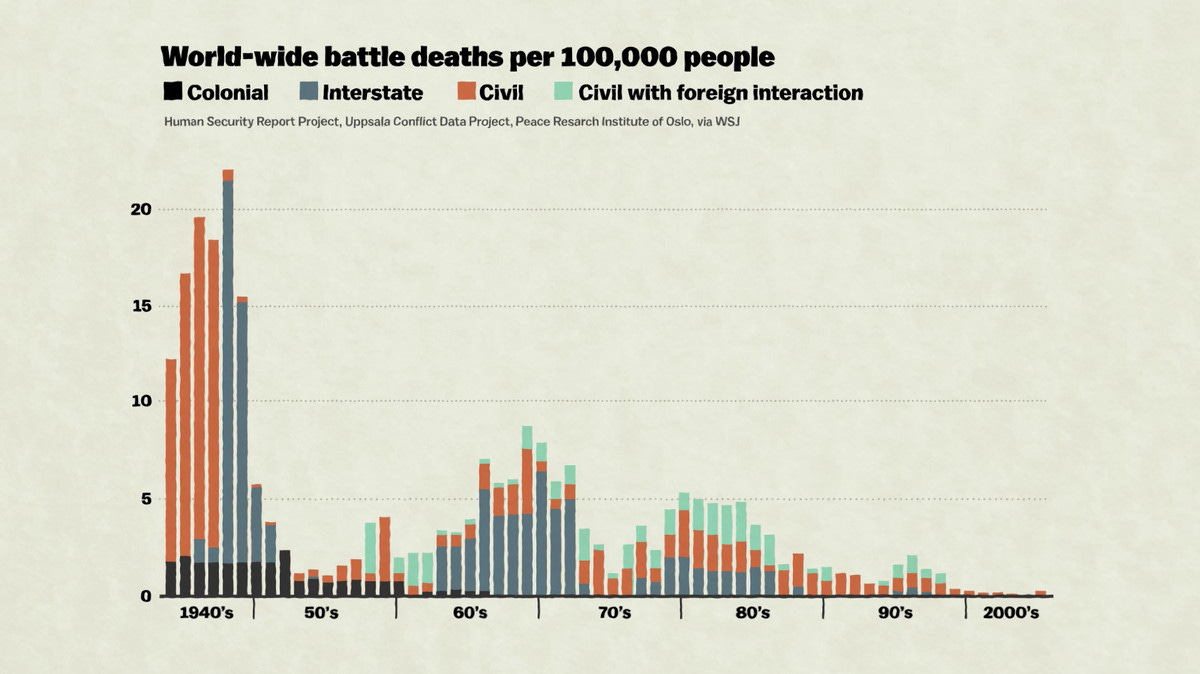

With the introduction of nuclear weapons — which to this day the U.S. is the only nation to use them against an adversary — and the adoption of globalization, both were meant to be those deterrents. Since then, the number of worldwide battle deaths has decreased dramatically since the bombs were dropped on Hiroshima and Nagasaki.

But stability and security come at a cost. With the formation of NATO in 1949 to protect Europe from the USSR, that cost was pegged at ~2% of the annual GDP of respective countries (more on this later).

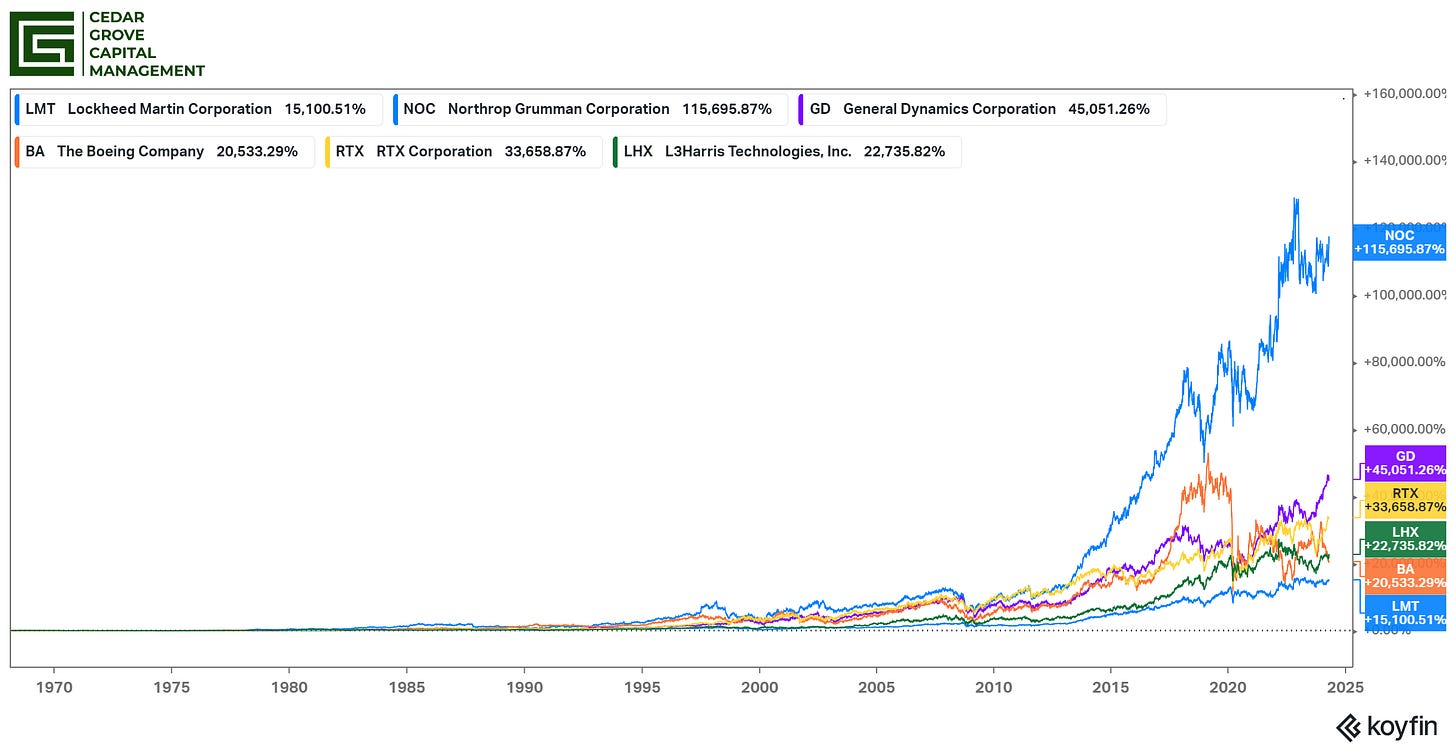

This has largely benefitted U.S. defense contractors over the years as upgrading and maintaining weapons has allowed America and its allies to be multiple steps ahead of another potential adversary.

Yes, the above returns you’re seeing are not deceiving you. After defense administration changes in the early 90s1 coupled with the first Gulf War, defense contractors seized the opportunity of looser policy and new wars.

But after we left Iraq and Afghanistan, many thought that America’s major wars were long gone and defense contractors would only benefit from conservative spending during peacetime.

However, the “Special Operation” in Ukraine by Russia quickly destroyed that logic as the largest invasion of Europe since the Second World War by some 150,000 troops put the continent on high alert. With new conflict comes new rearmament and replacement of weapons given to Ukraine in order to defend themselves.

But I write this post not to bring up history or current politics but to share my thoughts on the future and what that means from a defense contractor perspective which can be boiled down to one broad-based theme.

A rising tide (geopolitical risk) lifts all boats.

Let me break that down one part at a time.

Rearmament

Since the invasion of Russia, the U.S., NATO, and its allies have given >$178 billion in support to Ukraine. This does not include the recent $54 billion from the EU in February or the $60 billion from the U.S. This aid has come in the form of direct military hardware (weapons, missiles, ammo, etc), financial, and humanitarian assistance.

As a baseline, one would already imagine the need to ‘replenish’ their stockpiles after gifting Ukraine this weaponry which will directly cause weapons manufacturers to win new contracts associated with that.

That math is simple. For example, to meet demand for missile defenses, production of Patriot interceptors for the U.S. Army will rise from 550 to 650 rockets per year. At around $4 million each, that's a potential $400 million annual sales boost on one weapons system alone.

"Each day the munitions are being fired reinforces the need for substantive stockpiles, and I don’t see that going down.” - Tim Cahill, LMT Missiles and Fire Control business

Since increasing production volumes of older systems is always more profitable than the high investment costs associated with ramping up production of new systems, stronger demand will flow quickly to the corporate bottom line.

“We are probably looking at about $10 billion to replace everything, everything that we’ve given in terms of supplies to Ukraine.” - Pentagon official

Granted the above is more of a budget shortfall when in reality the number is closer to $20 billion though I will caveat that there’s no guarantee that the government will approve further budget increases in the future to make up for the windfall.

Making sure America has enough weapons and munitions for war plans and training is of the utmost importance, especially as aggressive threats around the globe continue to reveal themselves.

The 2% Target

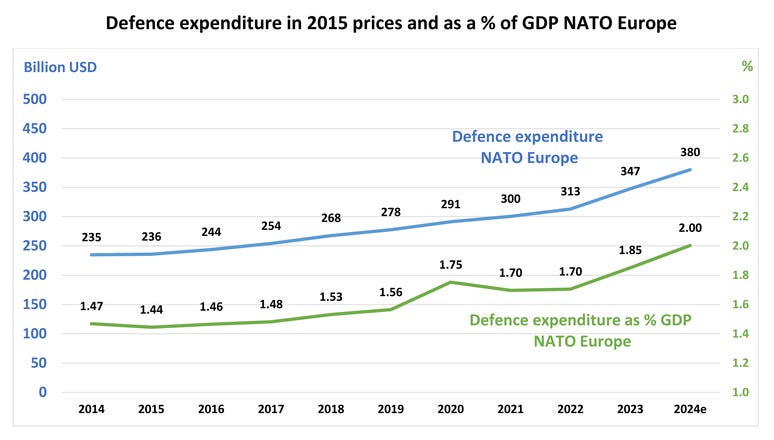

In 2014, NATO Heads of State and Government agreed to commit 2% of their national GDP to defense spending, to help ensure the Alliance's continued military readiness. This decision was taken in response to Russia’s illegal annexation of Crimea and amid broader instability in the Middle East.

The 2014 Defense Investment Pledge was built on an earlier commitment to meet this 2% of GDP guideline, agreed in 2006 by NATO Defense Ministers. The 2% of GDP guideline is an important indicator of the political resolve of individual Allies to contribute to NATO’s common defense efforts.2

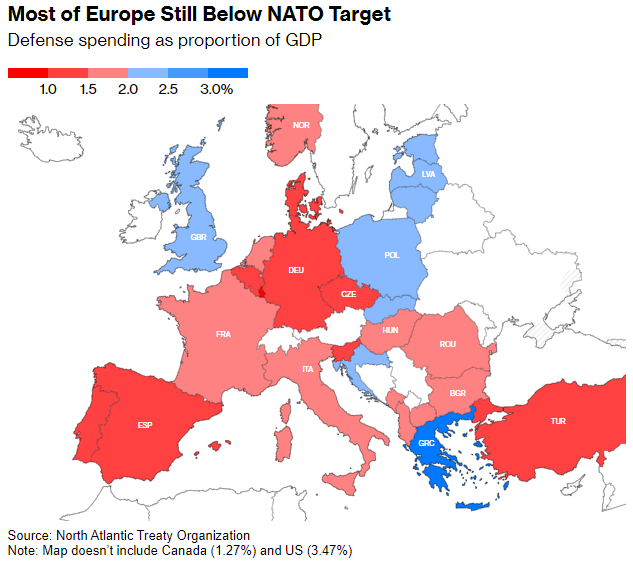

In addition to the replenishment and rearmament, Europe and its allies have come to the stark realization that from a military POV, they may not be prepared for a potential full-scale war in Europe and French President Emmanuel Macron has openly admitted this.

“There is a risk our Europe could die. We are not equipped to face the risks. There is no defense without a defense industry ... we’ve had decades of under-investment. We must produce more, we must produce faster, and we must produce as Europeans.”3

To build reassurance with its own populace and amongst its allies, additional measures need to be taken.

Historically speaking, this broader target of 2% was barely reached by its members. However, in 2024, two-thirds of Allies are expected to meet or exceed the target of investing at least 2% of GDP in defense, compared to only three Allies in 2014.

Over the past decade, NATO Allies in Europe have steadily increased their collective investment in defense – from 1.47% of their combined GDP in 2014, to 2% in 2024, when they are investing a combined total of more than $380 billion in defense.4

Aside from the increased urgency in commitments from existing NATO members, we’re also seeing the introduction of both Finland and Sweden into the alliance.

Finland has already stated it plans to spend 6 billion euros ($6.48 billion), or 2.3% of its GDP, on defense in 2024, which has increased significantly in recent years, even before becoming a NATO member.

Sweden also has boosted its military defense spending to ~2.1% of GDP to $2.44 billion which is nearly double what it was in 2020.

With the introduction of two NATO allies on top of increased spend from existing members, we’re looking at an increase of tens of billions of dollars in incremental defense spending from this region alone.

U.S. officials have indicated that they intend to starve the Russian arms export industry, encouraging their allies in Europe and globally to buy American weapons instead.

These massive deals will help reduce European reliance on Russian arms, especially the eastern block of NATO members.

The World Prepares for Future Conflict

In September of 2023, I hosted a Twitter space with

specifically on defense stocks and shared our thoughts on how geopolitical risk was changing faster than people were acknowledging.You can find the link to hear the recording below.

The short end of the recording is that I believed the world was becoming an increasingly less stable place and that continued conflict would only grow larger as a result of increased global instability.

Since then,

Hamas attacked Israel

Israel invaded Gaza

Israel is under constant threat from terrorist organizations that want nothing else than to wipe it off the map

Tit for tat missile exchanges with Iran

Houthis are seizing ships in the Red Sea

China keeps taunting Taiwan and reaffirming its unification

oh, and Russia is still pressing its invasion of Ukraine

Not things you want to hear when you’re trying to live in a world of peace instead of conflict however, U.S. arms manufacturers are there to remind the world that weapons are still needed.

Last year, spending on defense by countries around the world reached $2.43 trillion with the U.S., China, and Russia leading the way. While global military spending has grown every year for nine straight years, the nearly 7% rise in 2023 from 2022 marks the sharpest year-on-year increase since 2009.

‘The unprecedented rise in military spending is a direct response to the global deterioration in peace and security” - Nan Tian, Senior Researcher with SIPRI’s Military Expenditure and Arms Production Programme

This is by no means a coincidence. With Russian aggression on the eastern front of Europe, China's aggression in the Pacific, and now conflict again in the Middle East, surrounding countries are fearful of new conflicts and relying on the U.S. to protect them.

In the Pacific, China’s more frequent comments on the reunification of Taiwan have countries on edge, especially as they build manmade islands in the South China Sea for military purposes.

Just last month, China announced a 7.2% increase in its defense budget, which is already the world’s second-highest behind the United States at 1.6 trillion yuan ($222 billion), roughly mirroring last year’s rise.5

China’s defense budget has more than doubled since 2015, even as the country’s economic growth rate has slowed considerably, but that’s not stopping them from growing their forces in what could only mean future active conflict.

In a direct response to China’s military growth, Japan allocated $50.2 billion to its military in 2023, which was 11% more than in 2022. Taiwan’s military expenditure also grew by 11% in 2023, reaching $16.6 billion.6

Estimated military expenditure in the Middle East increased by 9% to $200 billion in 2023. This was the highest annual growth rate in the region seen in the past decade.

Military spending in Central America and the Caribbean in 2023 was 54% higher than in 2014. Escalating crime levels have led to the increased use of military forces against criminal gangs in several countries in the sub-region.

No matter where you look, states, countries, and regions are all becoming more unstable and dozens of countries are already re-militarizing for a potential future war which contractors will benefit from.

Military Exports

While the previous sections mainly talked about the U.S. and its allies, do not forget that many other countries also need weapons to defend themselves. It’s no secret that the U.S. is really good at making weapons which is why many countries around the world love to get their hands on them.

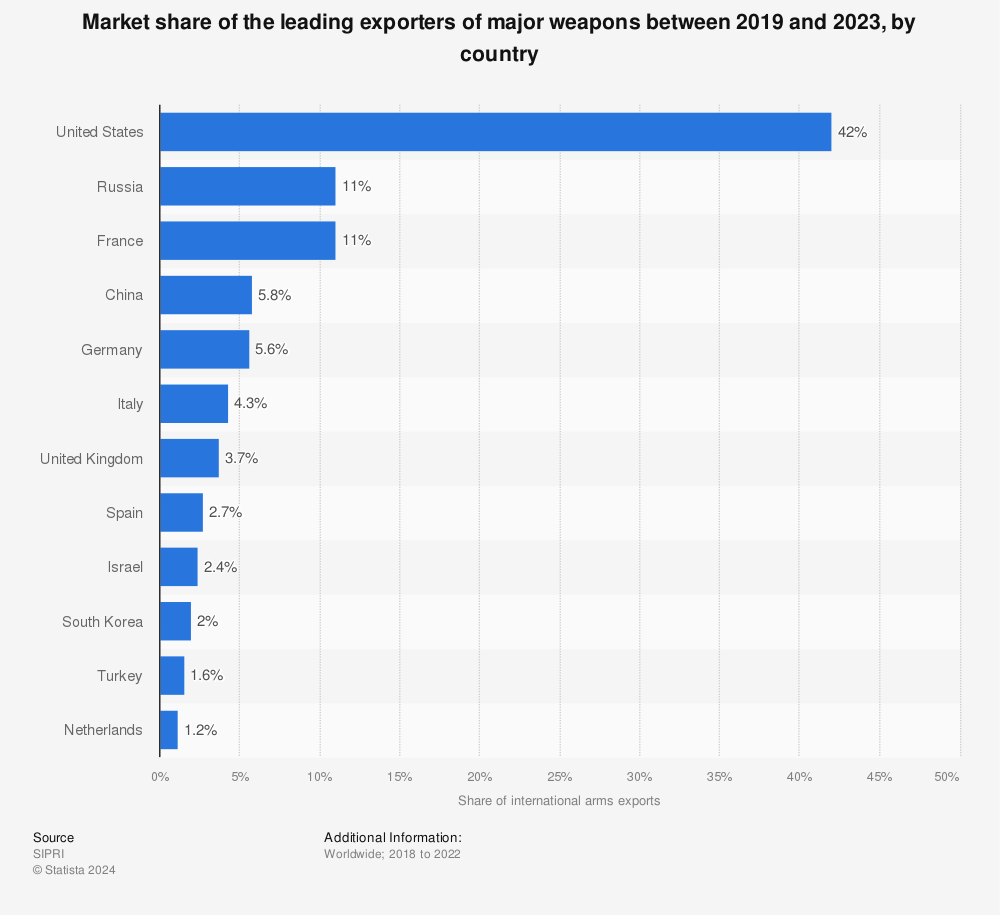

The U.S. accounted for 42% of total exports from 2019-2023, up from 33% in the previous five years, while Russia declined from 22% to 11%.

Just looking at foreign military equipment sales, the U.S. sold $238 billion to foreign governments in 2023, a 16% increase from the year prior.

The U.S. provided more than half of the weapons purchased by 13 of the top 17 arms importers, with Saudi Arabia, Japan, and Australia buying the most from the U.S.

“Arms sales and transfers are viewed as ‘important U.S. foreign policy tools with potential long-term implications for regional and global security’.” - the State Department

There are two major ways foreign governments purchase arms from U.S. companies: direct commercial sales negotiated with a company, or foreign military sales in which a government typically contacts a Defense Department official at the U.S. embassy in its capital. Both require U.S. government approval.

The direct military sales by U.S. companies rose to $157.5 billion in fiscal 2023 from $153.6 billion in fiscal 2022, while sales arranged through the U.S. government rose to $80.9 billion in 2023 from $51.9 billion the prior year.7

Looking at just a few examples outside of Europe, we have South Korea paying $5 billion for F-35 jets and Australia spent $6.3 billion on C130J-30 Super Hercules planes and separately, nuclear-powered submarines back in early 2023. Japan reached a $1 billion deal for an E-2D Hawkeye surveillance plane.

As countries continue to order hardware, U.S. companies will be there to continue fulfilling these contracts which have pushed backlogs to the highest they’ve been in nearly a decade.

Closing Thoughts

Sometimes it’s hard to invest in companies that directly sell products/services that result in deaths around the world. However, the reality is that war never stops, it just changes from conflict to conflict. The defense industry is a necessary cog in a machine we call world order and for the right investor, backing this industry could reap plenty of rewards.

While I didn’t go directly into company-specific financials, capabilities, or capacity, I hope this quick article at least piqued your interest in this industry that will massively benefit from a multi-year, even potentially multi-decade shift.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm