If you would like to listen to this post on Spotify, click here to visit our Podcast.

If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.

Petcare has been a big COVID beneficiary given the exponential growth in adoptions during the pandemic. This significant growth led to virtually increased spending in all categories: consumables, accessories, veterinary care, insurance, etc.

With big-name public players like Chewy (CHWY) and Petco (WOOF), it might be difficult to understand which company is actually the better investment to take on the pet health and wellness space for the long term based on how each market itself.

Full disclosure, I am team Petco and have voiced my opinion on that openly numerous times on Twitter and with recent posts;

But because of that, I don’t want you to think this post is me just taking a crap on Chewy, it’s not. This post will highlight exactly why I think it is based on business fundamentals, financials, and growth strategy.

For the Chewy bulls, perhaps this post helps change your mind or perhaps I’m missing something and you can comment below to possibly change my mind. The same applies to those for or against Petco.

Let’s get things started!

Pet Industry Breakdown

To kick things off, I think it is critical to understand not only the current state of the pet industry but where it is going. Without truly understanding this, you’re not grasping the full picture and can possibly miss out on thesis-changing information. So let’s start off with a few facts that many might know, but some might not.

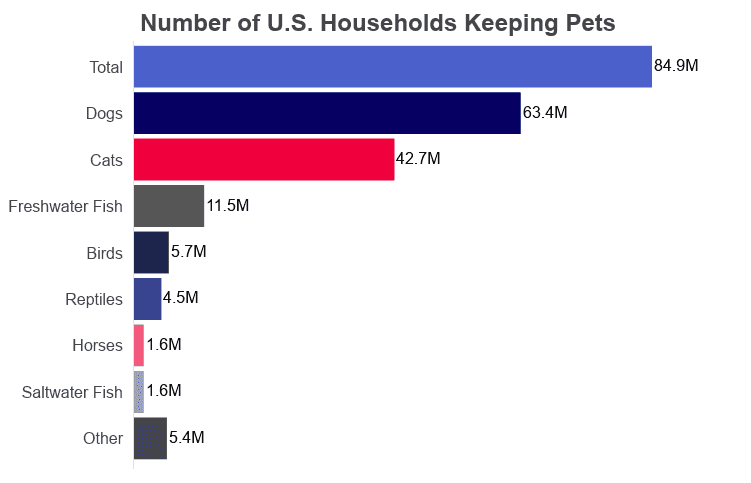

First, there are a ton of pets in American households with recent household penetration of 67 percent. This is up from 56 percent in 1988 and most recently, 65% in 2015.

With so many households having pets, you need to know one big-picture thing.

👏🏼 Americans 👏🏼 love 👏🏼 spending 👏🏼 money 👏🏼 on 👏🏼 their 👏🏼 pets!

In 2010, the total money spent on pets was roughly $45.53 billion. Within the next decade, this spending has mushroomed to $103.6 billion annually. The biggest annual increase was between 2017 and 2018, when spending quickly jumped from $69.51 billion to $90.5 billion – a growth of 30%.

The average pet-owning household spends $1,126 on their pets each year with 40% of that budget going toward food and treats and 35.7% going toward medical and veterinary care.1

This significant growth in pet spending has really been driven by two things:

Newer pet owners delaying having kids and opting for getting dogs/cats first

Treating/loving their pet more than they do their own family members

To put this into perspective, four in 10 pet parents surveyed by OnePoll (42%) said they've actually gotten their fur baby as a "starter child," using the animal as a test to see if they're ready for kids.2

Additionally, to point #2, researchers found that 57 percent of millennials love their pet more than their own sibling!3 Half of them said the same thing about their mother and 30 percent chose a pet over their significant other!4

This all matters because it trickles down into everything that involves pet ownership, not just the traditional basic needs. If you want to apply basic human psychology here, if you’d rather have a 4-legged child first and love said 4-legged child more than your own family, there are a lot of areas that you’ll spend money on historically.

Traditional spending was more geared towards food, treats, toys, home goods, and basic veterinary care. However, due to pet parents’ love, additional spending now incorporates things like technology (cameras, toys, collars, etc.), accessories (clothing), pet insurance, DTC offerings (premium pet food, medication, and genetics), and services (dog walking, sitting, training, daycare, grooming, etc.).

Prime example, pet owners spent $490 million on Halloween costumes alone in 2021.5

So basically a lot of categories have compounded over the last 5-6 years. There’s a Medium post that visually outlines the landscape if you want to read further.

This generational shift in how pet owners are handling pet ownership also translates to the digital age. Buying pet supplies online is a preferred shopping method for 77% of millennials, the biggest demographic of pet-owning parents.

In 2018, online sales of pet products only reached an estimated $9.5 billion.

However, this field currently has one of the fastest growth rates of any channel. By 2023, eCommerce is expected to double its share and make up 26% of the total pet market.

Without making this an industry deep dive, what you need to take away from this section is,

There are tens of millions of households that have pets

Americans are choosing pets over having kids

Pet parents love their pets more than their own flesh and blood

Industry tailwinds support further pet expenditure

With the basics of the industry, let’s start stacking up Petco and Chewy.

Business at a Glance

Since we touched a bit on the pet industry, now we need to address the needs of the pet owner and how the two companies stack up with one another when it comes to capturing more share of their wallet.

When I was first writing this draft, I started writing about how eaches value propositions differ and yada yada yada. Truth be told, all the points were easy enough for a 5th grader to understand, or a golden retriever.

Waste of space and time.

The conclusion that I came to is that instead of writing it all out, each company’s products/service offerings can easily be shown in just one visual.

The list above more or less maps all the categorical needs of a pet owner, and as you can see, Petco offers way more than Chewy does, and to beef up my point, I even threw Petsmart in there.

So how does Petco capture more share of a pet parent’s wallet over Chewy?

One word. Ecosystem.

What do I mean by ecosystem? The easiest comparison I can make is Apple. Apple offers a suite of products and services that keeps its customers loyal to its brand by making them a part of one system. Every product links its way back to iOS and the value proposition you get from going to the one source pays off. Laptops, tablets, watches, headphones, speakers, phones, etc.

So why do I make this comparison to Apple? Well, it’s not because I believe Petco can become a $2T company. Not even close. It’s just a concept that many can easily refer to. Come for one, stay for another.

I’ve chosen this example because I’ve said it 1,000 times already with my research, tweets, and interviews and I’ll say it another 1,000 more times.

👏🏼 Americans 👏🏼 would 👏🏼 rather 👏🏼 go 👏🏼 to 👏🏼 one 👏🏼 place 👏🏼 for 👏🏼 shopping!

Pet goods and services are not like shopping for electronics. You can go to Walmart for a TV, Target for an Xbox, and Best Buy for a new sound system. That consumer decision is mainly driven by price sensitivity.

But wait just a minute, I’m not saying that there’s something unique here between the products on Petco and Chewy, but what I’m saying is that they have a service that helps with keeping customers with them. Aka, boosting LTV.

The first basic level of granularity comes from an auto-ship service. It’s simple to understand, you just have items that get delivered to you on a regular basis, automatically. This helps companies with recurring revenue and supply chain forecasting. In return, the company gives you 5% off for doing so. Petco, Petsmart, and Chewy offer the same rate.

Considering that most recurring items purchased by pet owners are food, treats, and medicine (think flea and tick), getting 5% off just to have it come on a regular basis from one place is ideal for those that don’t want a headache and wants to save some money. This has directly led to Chewy reporting auto-ship customer sales of $1.78 billion in Q2’22 and it made up 73.1% of net sales in the quarter. Petco doesn’t disclose how much auto-ship is a part of the business but it says that its recurring revenue programs are up 54% YoY.

Here’s where Petco has a leg up though. They have another layer of granularity for a membership plan which is Vital Care.

It’s a $20 monthly membership fee but you get additional perks that you otherwise wouldn’t have from a basic auto-ship option. I talk about this in a separate post on how much power the Vital Care offering has to the financial health of Petco.

During the Goldman Sachs retail conference, a GS analyst asked how Petco views auto-ship in relation to another “competitor” (hinting to Chewy) and what role Vital Care plays in that. The company responded,

But my guess is that we're actually very, very close to very competitive as far as the percentage of our revenues that fit within our Autoship competitor repeat delivery. So we like that business. We like Vital Care a lot. Vital Care is proving to be our #1 most profitable customers, something like 3.5x higher LTV than our regular customer because of the rewards they get from it.

I won’t repeat my article from above since you can read it on your own but the gist is,

the average pet parent can save over $300 annually [from Vital Care] and from Petco's standpoint, we capture far greater share of wallet with around 30% of Vital Care customers new to food and 40% new to services, both up versus Vital Care 1.0.

Vital Care premium membership helps keep customers within the ecosystem more than just traditional auto-ship which has assisted in Petco having 24.7 million active customers as of Q2’22 (up from 24.4 million in Q1’22 and 24.1 million in Q4’21) compared to Chewy’s 20.5 million (which was down from 20.6 million in Q1’22 and 20.7 million in Q4’21).

This is all despite Chewy having a head start online.

These two points — auto-ship and Vital Care — alone offer the ability for the average pet parent to take advantage of the other services within Petco stores that Chewy simply can’t offer.

What do I mean by that? It’s basically from the flywheel above.

Petco is a retailer first, an e-commerce player second but they understand that an omnichannel approach is the future. Chewy can’t do this because they have no retail arm. Almost no DTC-founded retail company has found that an online-only model works. Not Allbirds, Warby Parker, Rent-the-Runway, etc. have stayed solely online.

Chewy has a product-market fit, but it inherently is limited.

Services are such a differentiator versus online and Max competitors and pet parents, who see the value in our training, veterinary services and grooming. They also act as a feeder for Petco into a broader health and wellness ecosystem, including OTC solutions, Rx food, Rx medicines and insurance.

With >54% of pet parents wanting a one-stop experience, the obvious choice is Petco. From a pure business sense, while you can shop online at Chewy and Petco, the latter offers many other services that get sweeter when it’s wrapped around an auto-ship or Vital Care offering.

But now how does this translate financially? Let’s talk about that.

Financial Comparisons

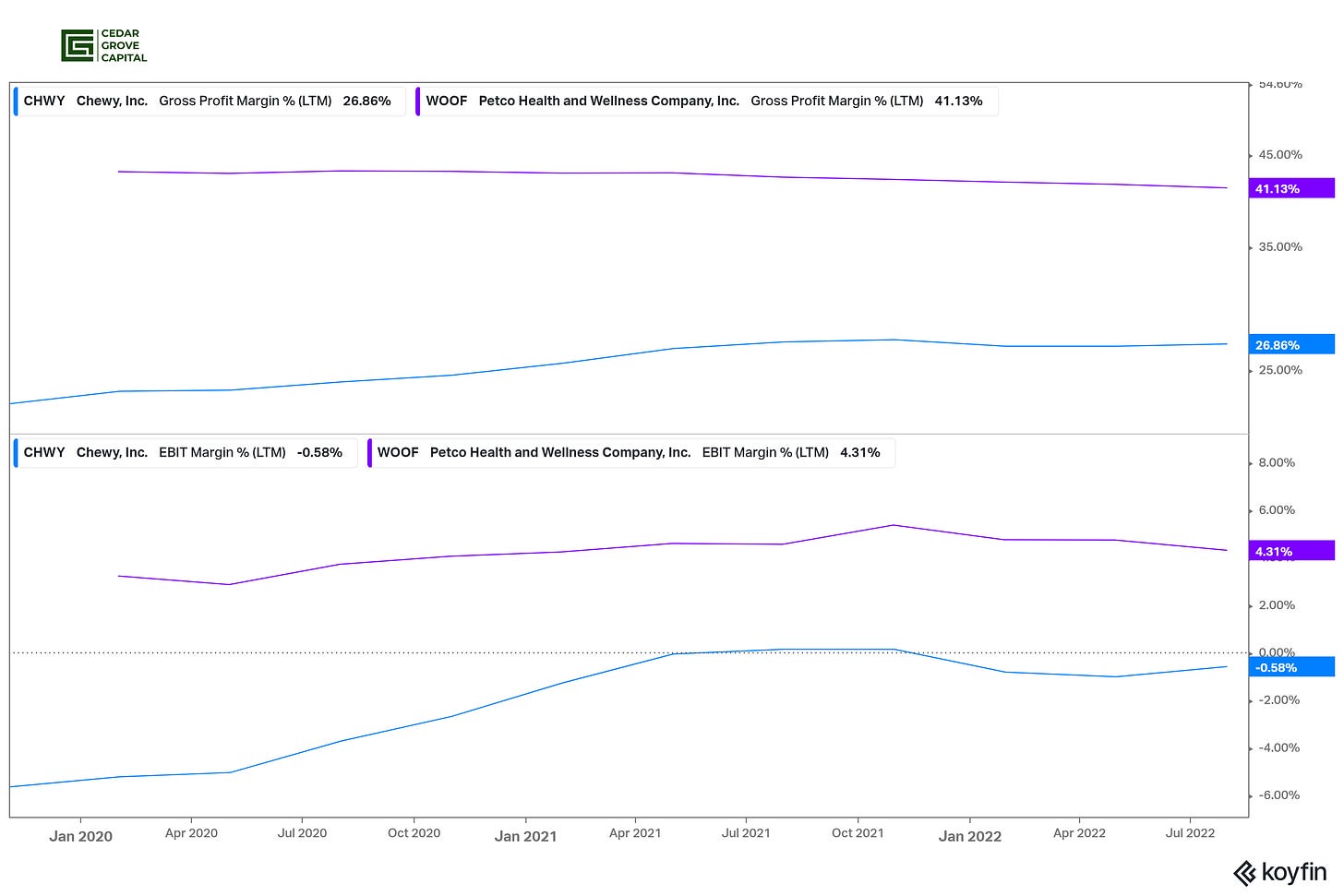

At face value, it seems that Chewy is the winner. They have significantly more sales, ~60% more on an LTM basis ($9.46 billion vs $5.91 billion), and growing top line LTM sales nearly 2x what Petco is (16.57% vs 8.58%). This makes sense since buying pet supplies online is a preferred shopping method for 77% of millennials.6

But even then, sales growth for Chewy has slowed down dramatically since COVID, only barely keeping above low double-digit percentages YoY. Petco is dealing with the same issue but based on high single-digit percentages.

While sales are nice and all, equity investors don’t get paid based on sales, they get paid based on earnings and this cannot be more true than in the non-zero rate environment we’re currently in.

So, with so much “growth”, how well has Chewy done generating earnings or even free cash flow? Pretty terribly is the answer.

The thought behind Chewy being successful is that it will eventually get economies of scale, but this really hasn’t been the case. Looking at the first 26 weeks of this year, Chewy has generated $143 million in adj. EBITDA (which is a BS metric anyways) representing a 3% margin. On the flip side, Petco generated $275 million in adj. EBITDA representing a 9.3% margin.

If we transition to FCF, CHWY generated a mere $7.8 million in the first 26 weeks versus WOOF’s -$36 million. While this may seem like Chewy is doing better, let me remind you that in FY’21, CHWY generated only $8.5 million in FCF vs WOOF with $119 million.

The reason Petco has generated less cash this year so far is because of capex in fixed assets. Something that a physical retailer needs to spend on to grow out its network.

But these are just face value numbers so let me go a little more in-depth on why such a disparity in profitability metrics.

The Lowdown

Chewy made its mark by being the online, DTC pet business model that countered the traditional in-store experience. At the time, this made sense since e-commerce was just getting off the ground in a meaningful way and many thought it would be the future (still is).

Chewy offered various different products and even one-upped standard shipping times by offering 2-day shipping. So what did they have in a nutshell? Convenience and speed.

This all made sense in how they grew so quickly but here are the problems with that which is what I’ve been trying to highlight this whole time, your growth is limited.

Because you’re online, you can only do/offer products and services that can be done online. You can’t attract customers for a plethora of the other things that pet parents need. The biggest one is veterinary care. While Chewy does offer telehealth services, it’s an offering that is simple Q&As and not prescribing-level telehealth. Even its insurance offerings are from Trupanion and not owned by Chewy.

What real operating leverage can you create from this business? The answer is not much since the story here has always been about economies of scale.

Here’s where Petco comes to eat its lunch and why I have voiced over and over again why it’s a better LT bet.

Shipping

Take shipping, for example, Chewy added value to customers by being faster than traditional retail with 2-day shipping. Sometimes, depending on where you are located, items would arrive in as little as one day. But here comes the problem, shipping EATS into margins and always has but at this point it’s pretty much table stakes as a retailer.

Can you imagine the cost of shipping an >30lb bag of dog food? If you’re ordering a simple one, call it $55 for 30lbs of food, and Chewy offers you free shipping on orders over $49, S&H has to be at least 15-20% of the order. At least.

So how is Petco different? Well, it leverages its retail space from multiple areas.

Store fulfillment → doesn’t need as many separate fulfillment centers to ship goods compared to Chewy because it just currently uses its own existing space to complete orders (real estate optimization = savings)

Same-day delivery - piggybacking off of the store fulfillment, Petco announced a partnership with DoorDash to offer same-day delivery to its customers if they have it in a local store, for free if the order is at least $35. (avoiding costly S&H costs = savings)

Store pickup - while having pet stores, Petco can offer customers savings through their buy online and pickup in-store (BOPUS) offering which provides savings and reduced time. (saves time and increases the chance to cross-sell)

Increased LTV → This is different from AOV (average order value) because you’re increasing the earnings potential of your customer over time and not just at one point in time. This comes from offering all those other businesses such as grooming, training, vet care, insurance, etc.

So if you think about this rationally, and I mean with no bias between Chewy or Petco, which company do you think has the most potential to convince a pet parent to go with them and also stay with them?

Hopefully, you have come to the same conclusion as I have.

Bottom Line

Retailers are not dead, they just had to evolve. Petco has done this and has executed very well so far. Chewy, on the other hand, has barely been able to generate adjusted profitability while generating almost $10 billion in sales. And honestly, if you can’t generate profitability, and I mean true profitability, during PEAK times (aka COVID) then you most likely never will.

Petco, however, has been able to generate profitability on all metrics recently and has strategically planned on new initiatives (like DoorDash deal) to expand margins. Its strategic initiatives to invest more in the “health and wellness” side of pet ownership will reap rewards for years to come.

Chewy has the “tech” aspect of it despite it operating in virtually the same space as Petco. When Chewy doubled off the recent June low and Petco only went up low double-digits, I asked my other hedge fund friend why he thought this was happening and he gave me the best response.

“Buy the dream, sell the execution.”

Some of the most annoying words someone has told me about an investment that I felt were some of the truest.

So ask yourself this, which *business* do you actually think is the better one to own, not speculate on, but own. Which one has the best model to drive meaningful FCF per share growth into the future?

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm