Last year in my “Winter is Coming” post, there was one particular callout I made around housing that I was concerned about if it materialized.

Post below and link to callout.

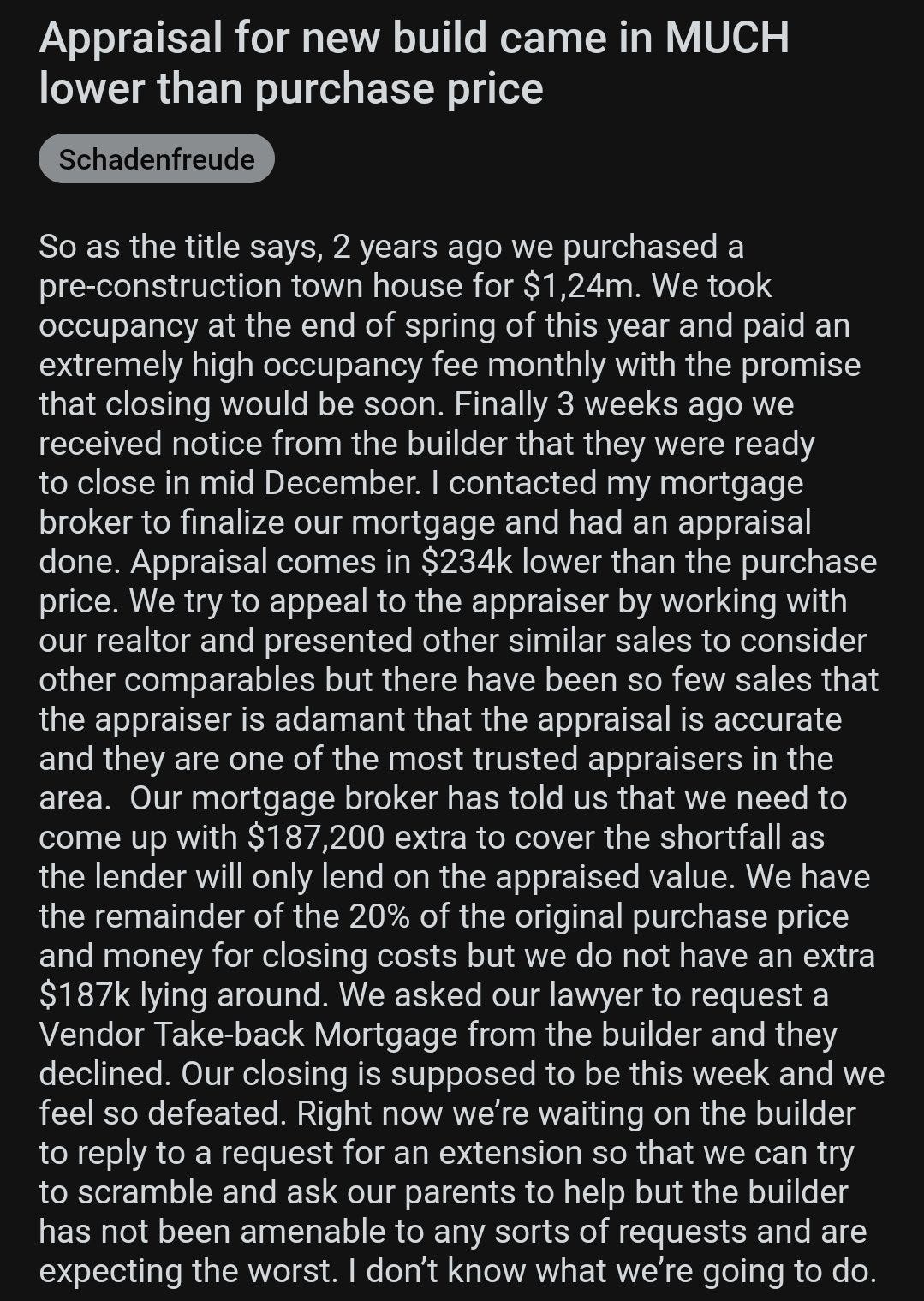

The call was regarding homeowners who, in a rush to purchase a home, would see their equity in the home significantly decrease or even face a total equity wipe. This was largely due to them paying ridiculous prices while rates did the job that rates do, affecting the homes’ value as they kept rising.

My example from the article is below.

For easy numbers, we’re looking at a home that was valued at $500k in 2020, and sold for 50% more in 2021 (more common than you think). With a 20% down payment for a 30-year FRM, that means that you’re putting up $150k in cash (excluding fees, etc) for the home and the mortgage is $600k.

Now that prices are coming back down to reality, the overpriced home you paid for is worth 20% less, at $600k.

You’ve been making payments for ~1 year but the value has taken such a hit that your equity is virtually wiped. Meaning, that $150k you put down to obtain the house in the first place is down to ~$12k after making nearly one year of payments.

This means that you’ve basically paid $150k to only own ~$12k worth of a home in just one year. Not ~$12k in incremental equity, but ~$12k in total equity.

Now why do I bring this up? For 2 main reasons.

People offloading their homes (whether for STRs, moving, etc) likely either can’t or will need to significantly outlay some capital to pay back the bank debt leaving them in a worse-off financial status.

This might set up a trade for homebuilders as supply comes back online and demand softens.

1) Selling Pressure

If you’ve been looking around Twitter, Reddit, or other “news” places, you’ve probably come across takes/experiences like the few examples that I’ve included below.

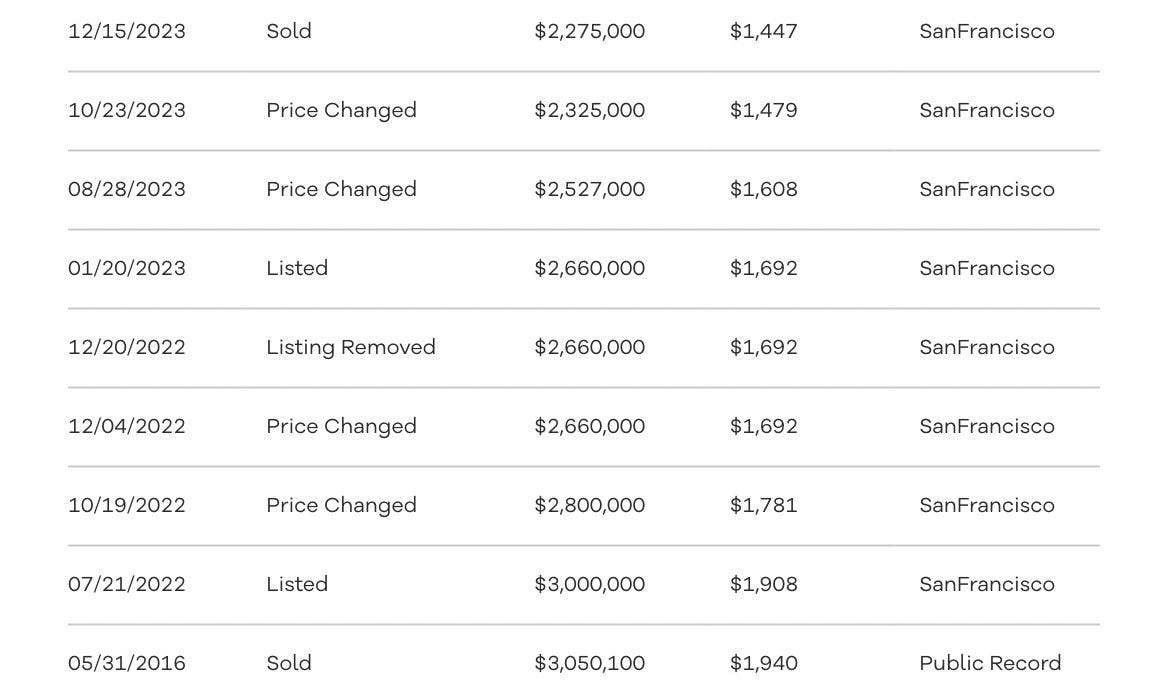

While the above is an extreme example, it is a reality for some. However, the next few examples are happening largely across the country at the moment.

They’re in a gallery format so you can select which one’s you’d like to look at.

Either way you slice and dice it, there are plenty of owners out there that are taking some massive losses on their properties, whether as a primary residence or investment, just to move on.

Now I want to clear up 2 important parts of my take on this.

Despite the worrisome headlines and fear-mongering, I don’t believe this is a systemic issue at the moment.

While people are offloading their properties, I still stand by the mortgage affordability claim since a majority of homeowners have a sub-4% rate.

So why do I find this important? Because not many people can afford to take on a loss of hundreds of thousands of dollars on a home let alone a loss in general. Not to mention you still need to pay your realtor commissions which just makes it even worse.

Taking a huge loss in order to move on just puts the consumer in worse shape especially if it’s them selling to relocate or for other reasons. What’s interesting is that I also shared this “negative equity” issue on Twitter about cars.

Edmunds released information on the issue of negative equity in relation to car values and now they’re back up to pre-pandemic highs. However, while homes are a different situation because you can still rent, downsize, etc. cars are a bit trickier. Pulling from the Bloomberg article;

"It’s a big challenge for owners looking to trade in their vehicle for a new one, since they would still be on the hook for the remainder of the loan balance. Plus, your insurance provider will typically only pay out the current market value of the car if you get in an accident and the car is totaled. If that amount isn’t enough to pay back the loan, you’ll have to come up with the rest yourself.

It’s particularly tough for people who are realizing they took out a larger car loan than they can afford. For instance, say someone borrowed $20,000 on their car and can’t keep up with the payments. They might try to trade in the car, only to find that the vehicle is worth only $18,000 now, and they still owe $19,000 on the loan. That means they have to come up with the $1,000 to repay their lender. "

Since the mechanics of a car owner’s lifecycle are different, the implications are much worse but for this article, I want to remain on the topic of homes but sprinkle in the contagion of falling asset prices on the everyday consumer.

2) Homebuilders Trade?

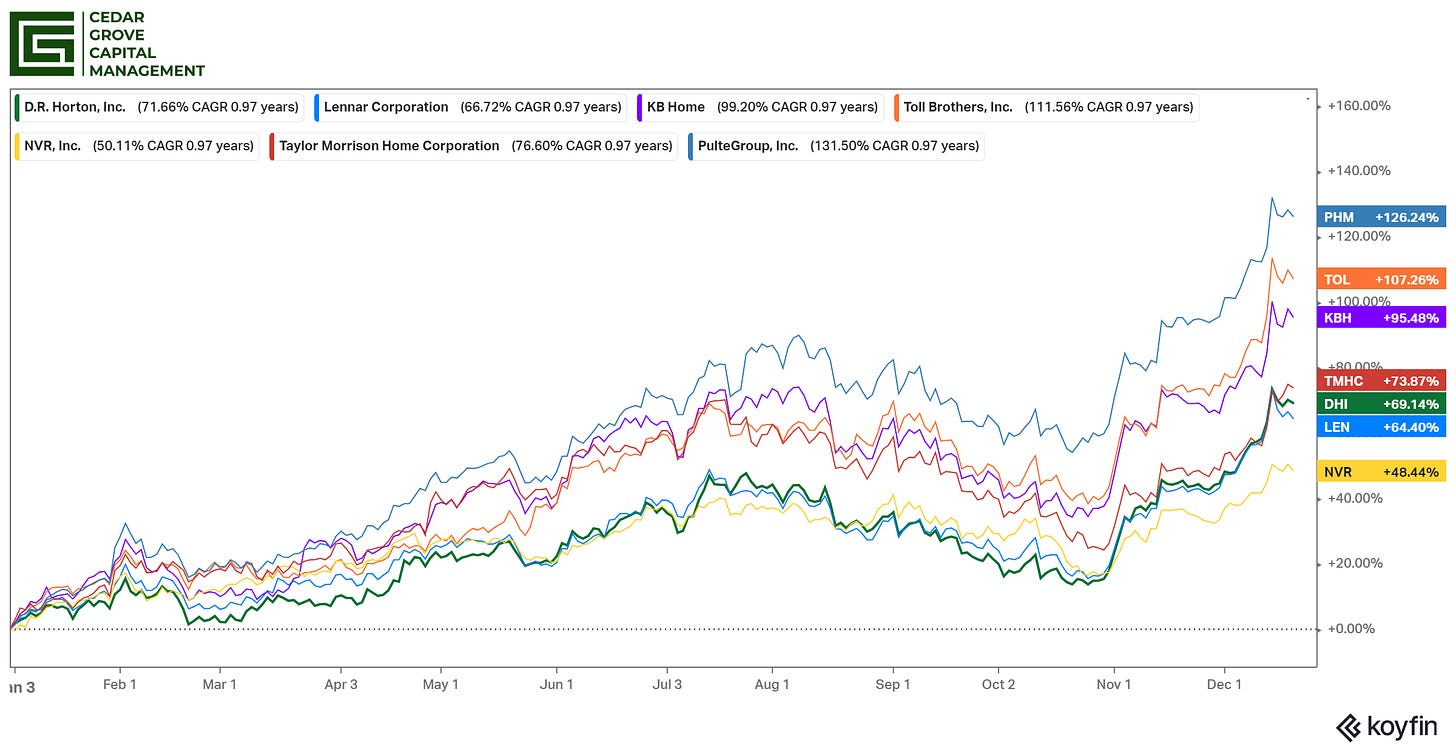

So far this year, homebuilders are on an absolute tear this year.

After bottoming out in 2022, many believed that despite rising rates, homes would still be in high demand, which in hindsight, seems to be very accurate.

However, this is where I believe a trade could potentially come into play in the very near future. The premise of when homebuilders continue to construct new homes is when they believe they can still be paid handsomely to do so. Homebuilders will never build if they believe prices will come down significantly.

It’s just a statement of fact. Why commit time, money, and resources to build homes in areas where the prices are going down? Doesn’t make financial sense.

Historically speaking, the U.S. has been in a housing deficit of roughly ~1.5 - 2 million homes over the last decade since the recovery from the Great Recession. While that is terrible, to say the least, it’s even worse now. Recent estimates are putting the housing deficit closer to 4 million units, over 2x what we were seeing just over 5 years ago.

If you’d like to read more on this topic, look at Kevin’s recent work on housing below.

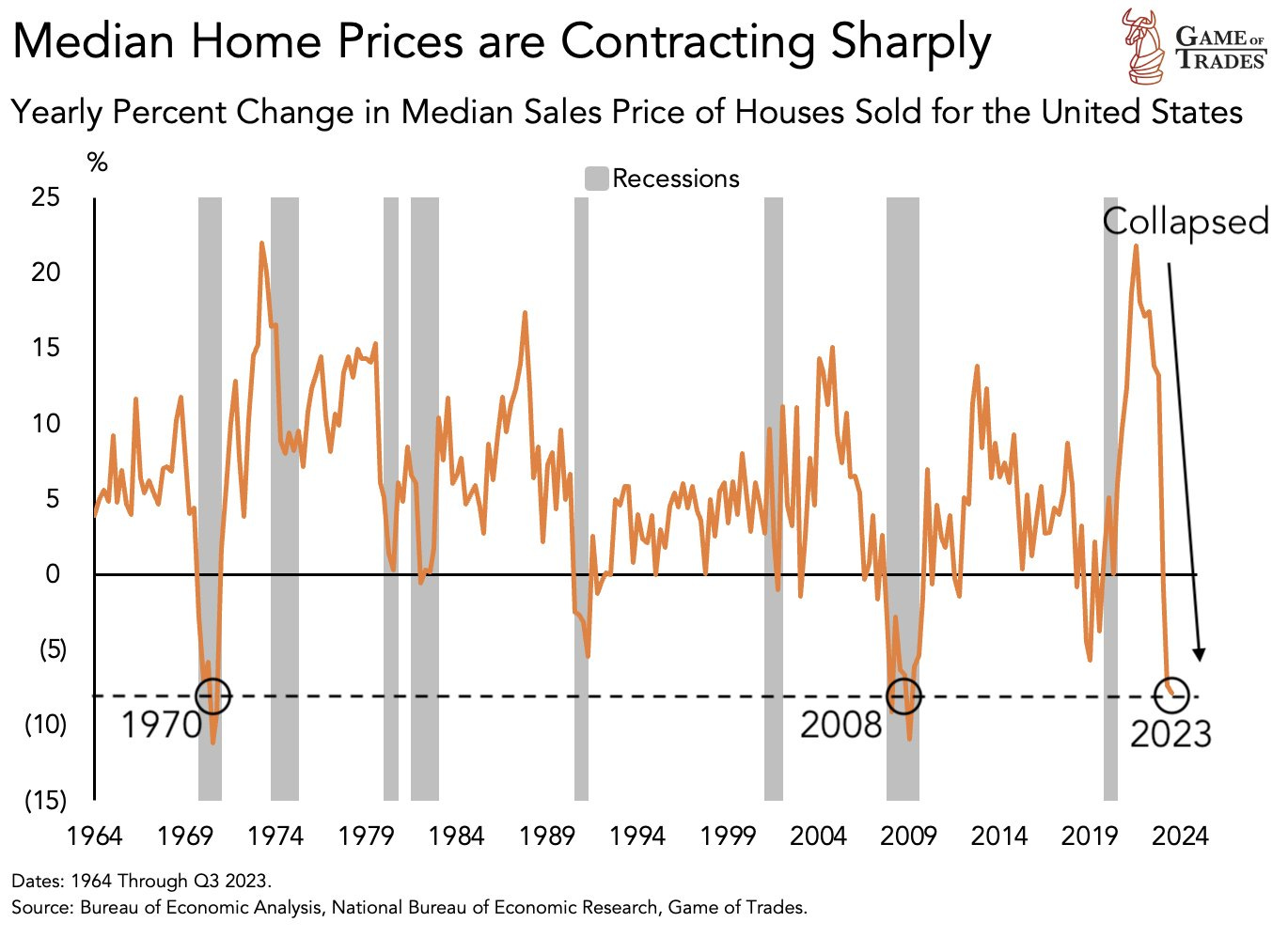

But here’s the point I’m getting at. Rates have “peaked” (we hope) and people are deciding to get out while the going is still good and others are debating to jump in as prices are coming down and refinance later when rate cuts begin to happen.

Both of these situations on opposite sides of the fence still leave all parties stuck between a rock and a hard place.

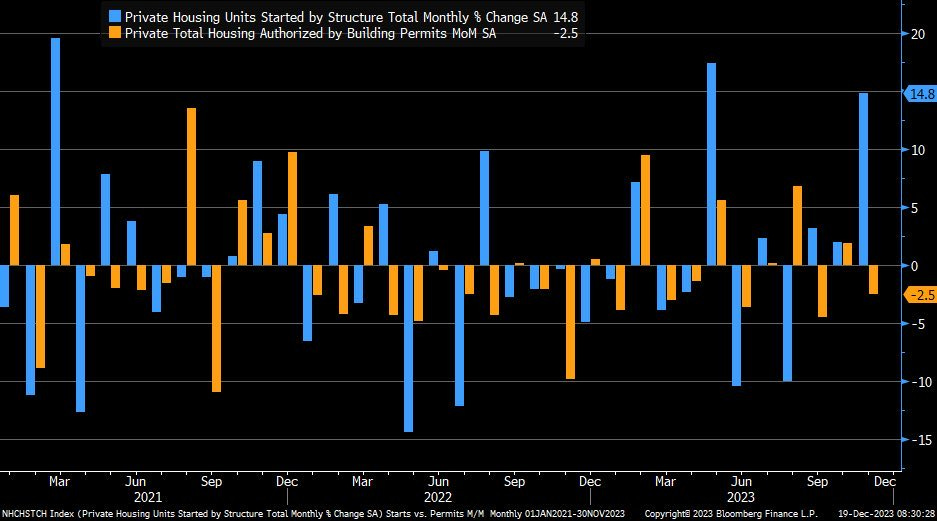

Builders on the other hand just recently saw a very large uptick in housing starts from what was a disappointing summer.

To be frank, even I’m surprised at the rapid rise of starts. But here’s where I believe the trade could come from. Despite the rates, layoffs, inflation, etc, we still have quite the supply and demand imbalance for homes.

As rates come down, more people will want to sell before prices continue their downward trend.

Those people who were waiting on the sidelines will most likely snatch them up and play the refinance game when the time comes. This will give a temporary bump to housing prices as people rush to buy.

The issue lies with what happens when builders, perhaps similar to the run-up to ‘08, build too much too quickly as a) the supply-demand imbalance begins to normalize as rates come down and more supply hits the market, and b) consumers already burdened with everyday expenses increasing (insurance, food, etc), despite “flush accounts” begin to rethink what they can afford.

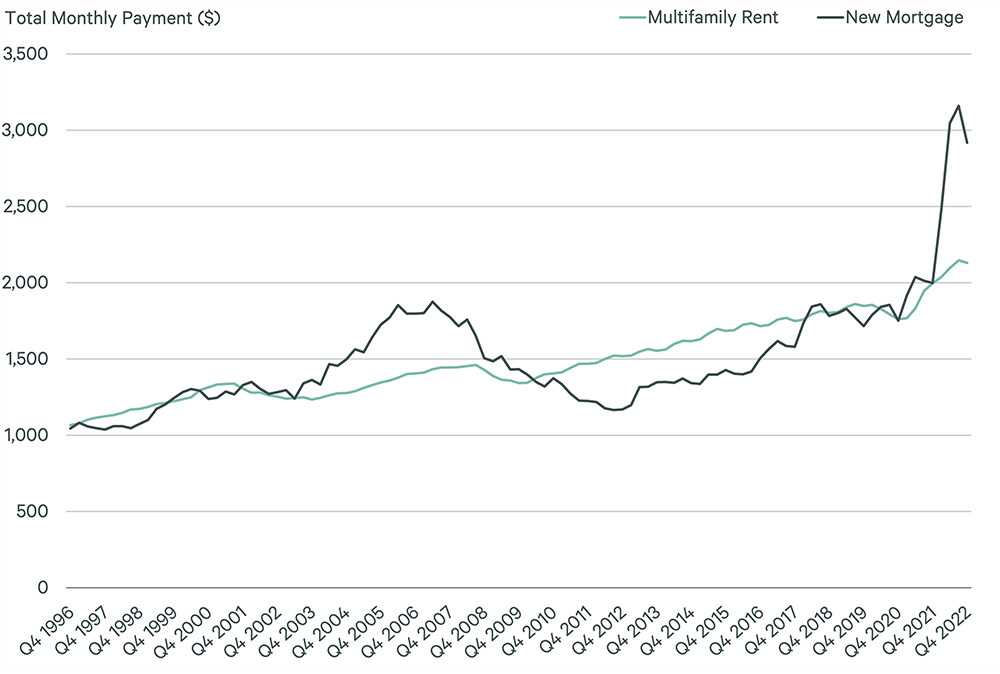

Currently, housing affordability is actually lower than it has been since the early 90s and when you factor in the cost of a new mortgage vs renting, consumers might think twice before signing on the dotted line.

So if a slowdown happens, homebuilders will definitely take the brunt of it. Take a look at D.R. Horton’s DHI 0.00%↑ earnings estimates since the start of the year. They’re up nearly 60%, priced for perfection.

If you believe that everything will continue to go smoothly, they might retain their current prices (albeit choppy) but if you believe more pain is coming and the supply/demand imbalance starts to correct, it seems taking the short side of this trade might actually play out.

Until more meaningful data comes out to convince me otherwise, this is just something I’m monitoring for the moment but actively considering how a play could be made.

If you think there’s something that can or can’t be done, comment below. Would love to hear your thoughts on the matter.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm