EDIT: We exited most of our positions as of market close 9.1.22. A previous version said 9.2.22.

If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.

This whole year so far, investors have been trying to gauge whether the consumer is okay. Many have pointed to various different data points that all have provided positive reassurance such as:

Retail spending

Travel data

COVID era savings

Low fixed mortgages

Company earnings beat, etc.

I know because I’m one of those investors. Investing in consumer and retail is what I do and while I have been burned in a few areas I have been more or less optimistic about the consumer based on all the other information that many of us have all been looking at.

However, despite near-record inflation in both broad-based and core numbers, there are still many out there that say the consumer is fine.

I think they’re wrong.

I’ve officially moved over to the camp that the consumer is not “okay.” Because my sentiment has changed, as of market close on 9.1.22, Cedar Grove Capital (“CGC” or “the Fund”) has exited all its positions except for Twitter (TWTR) and call options on Agrify (AGFY).

Twitter is strictly for the arbitrage opportunity (research here) while options on Agrify have been already written off as zero but hey, you never know.

In no particular order, here’s why I changed camps and why I think the consumer is only beginning to feel pain.

Layoffs

I have thought about this a lot because the most common misconception about unemployment is that layoffs equal a bad economy. Not necessarily because despite layoffs, unemployment still remains near its all-time low.

However, what many fail to realize is that it’s not about the number of layoffs (in this instance) but rather what else is happening in relation to jobs.

I came across Nnamdi Iregbulem’s Substack article called “Layoffs Don’t Tell the Whole Story” and he put my exact thoughts into words, so I’ll be referencing bits and pieces from that article. If you have time, I would implore you to take some time out of your day to read it.

“Layoffs aren't even half the story – they're 10% of it.”

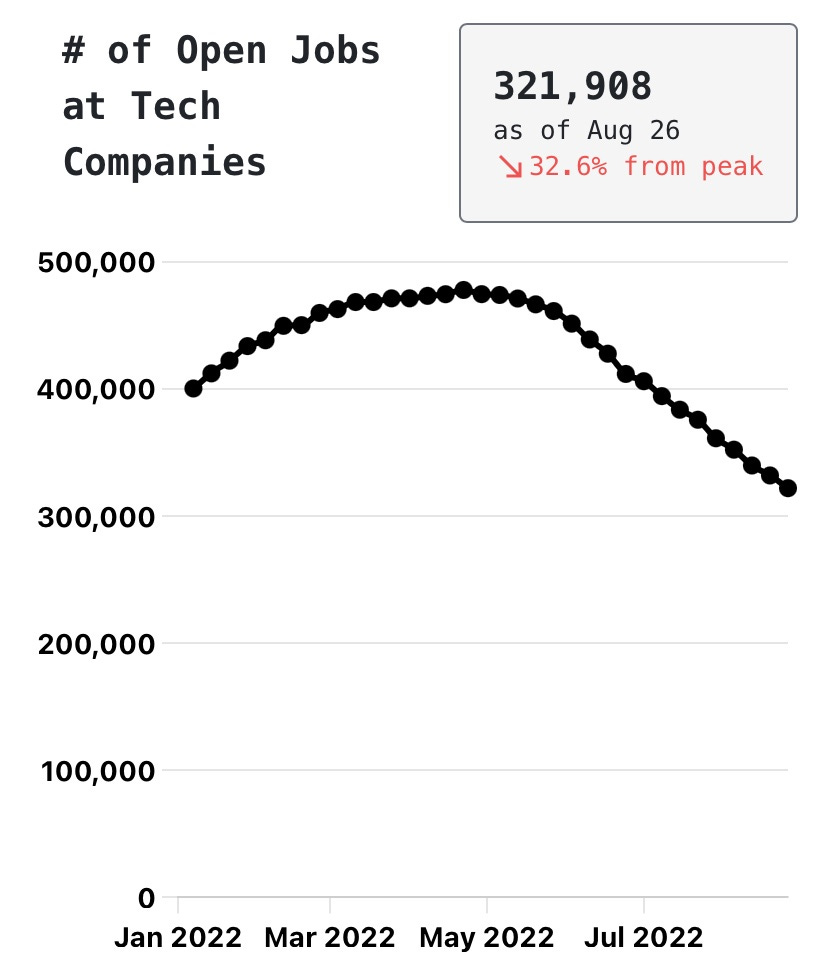

The real story is hiring freezes, not layoffs.

During the great resignation, an abundance of capital and the desire to succeed left many to jump ship for better opportunities. Companies flush with cash had no issues lighting money on fire in the name of growth and needed to support that growth by hiring more.

At the start of this year, there were over 11 million job openings and only ~3.5 million Americans claiming unemployment benefits. About 3 open positions for each American claiming unemployment benefits.

Seemed good, right? At face value, yes. However, what’s been going on now is that these job openings are going away (aka, freezing).

Employers simply stop hiring during recessions. Because planned headcount gets drastically reduced during events like this, you might lay off 100 people but you forgo hiring 200 employees in the future (as an example).

This becomes a double whammy because now you have a set of people not joining your company that will be entering the workforce but also an existing set that’s currently fighting for another job.

Additionally, getting laid off puts a reality check in workers’ minds about perhaps needing more of a safety net in their bank accounts and will thus pull back on spending. Even though there are jobs to be filled, it’s more a psychological effect of how ill-prepared they might be especially when the government is backstopping with stimulus anymore.

Takeaways:

1. Jobs getting pulled → future growth unpredictable

2. Layoffs = reality check for more emergency savings come unexpected events (money not in the economy)

Inflation

The FED has two jobs; control inflation and maximize employment. That’s it. Unfortunately, U.S. inflation has been on the up and up over the last year even though it eased slightly to 8.5% in July, but remained close to a four-decade high despite cooling energy prices.

Prices are going up throughout the economy, but not uniformly. Grocery prices were up 1.3% in July from the prior month and rose 13.1% in July from a year ago, the fastest annual pace since 1979. Dining out costs also rose.

Additionally, consumer spending, which accounts for more than two-thirds of U.S. economic activity, edged up 0.1% last month after advancing 1.0% in June. Economists polled by Reuters had forecast consumer spending would gain 0.4%.

However, the so-called core personal consumption expenditures (PCE) price index increased 4.6% on a year-on-year basis in July. The smallest annual advance in nine months followed a 4.8% rise in June.

Though oil prices have dropped significantly, rental costs have remained hot, leaving some economists hesitant to declare that inflation has peaked.

Rent and wages have been the two of the biggest culprits of high inflation and the nasty part about them are that they are sticky, meaning they don’t just come down all of a sudden like energy or used car prices.

Rent in major metropolitan cities like New York has seen the median 1-bedrooms renting for over $4,200/month. Restaurants and retailers are advertising starting wages at over $20/hr for certain low-level positions.

My concern with inflation is that it will stay elevated for longer than people expect and with the FED’s job of taming it, sustained inflation means J. Powell will have to continue raising rates until it slows. This is what might trigger a recession if we aren’t already in one.

“These are the unfortunate costs of reducing inflation…but a failure to restore price stability would mean far greater pain.” - Powell said in a high-profile speech at the Fed’s annual economic symposium in Jackson Hole

There are only so many hikes to rates that consumers can handle before they wake up in mass and start pulling back. Could this coincide with the seasonality of winter? Perhaps, but we won’t know in hindsight but what we can use is management’s commentary on earnings calls.

More on this shortly.

Takeaways:

Inflation is eating into savings and some consumers are already not able to keep up. If inflation continues the way it has, drawdowns on credit cards will only get worse exacerbating the debt issue.

Debt

I remember in a college interview for Investment Banking in a leveraged finance group, I made a joke about how Americans run on debt just like they run on Dunkin. I got a chuckle out of that one but the point still stands. Americans love using money that isn’t their own. It’s what fuels the economy.

If we look at the graph above, Revolving Consumer Credit took a serious dip during the pandemic. Makes sense since we couldn’t do anything or go anywhere but, since the economy reopened, many Americans have been taking on more debt at a record pace and then some.

Consumer credit has jumped to over $1,125 trillion and shows no sign of slowing down. Now I’m team debt, mainly because using cash is for rookies but when debt starts getting too much to bear, that’s where problems start to show.

Let’s look at how debt payments as a percentage of disposable income have faired.

Short answer. It’s jumped. Though many of you might point to how it’s still lower than pre-pandemic levels, the concern here is not the relative percentage, but at the rate that it’s increasing. Commonstock even tweeted how Bank of America data shows that the highest income group in the US has now seen three consecutive months of contraction in discretionary spending on a MoM basis.

The speed at which debt payments are taking up disposable income is alarming and rapidly tracing back to pre-COVID levels. But this brings me to my next point. If consumers are taking on more debt than they have in the recent past, and the percentage of which debt payments are taking up disposable income is increasing, then pressure should start to form, right?

Right.

If we take a look at the graph above, there historically has been a relationship between unemployment and delinquency rates. This makes sense because the fewer unemployed individuals there are, the fewer delinquencies there should be. Not hard to wrap your head around that one.

But what’s interesting to note is that unemployment has still been trickling down and the delinquency rate has been ticking up. An inverse move from historical patterns.

Research by Athreya, Sánchez, Tam, and Young (2015) shows how this relationship can emerge in a model where low-income households may skip credit card payments (“informal default”) to sustain a minimum level of consumption.

This holds true when it comes to simple everyday expenses like phone bills. This is why it’s interesting to see the recent negative correlation between unemployment and delinquencies suggesting that consumers are already starting this tactic of “informal defaults.”

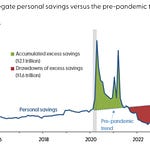

Consumer Savings

At their peak in December 2021, Americans' excess savings totaled $2.7 trillion, according to a Moody's Analytics analysis. In July, the personal savings rate in the US ticked down to a 14-year low of 5%.

That's nearly half the rate it was in December and roughly a third of where it was the year before.

Many households are already in negative savings territory, meaning they are increasingly tapping into their savings to cover purchases each month.

"This isn't a normal recovery, and that fiscal stimulation is still in the pocketbooks of consumers…they're spending it, they're spending at very strong levels." - JPMorgan CEO Jamie Dimon

But, he added, the drawdown could mean that consumers have only about six to nine months of spending power left.

Dimon's remarks echoed comments from PayPal CEO Dan Schulman at the World Economic Forum in Davos. The combination of high spending and high inflation means Americans are burning through savings at a rate that could have them running out by the end of this year.

According to a recent survey from NPD Group, more than eight in ten US shoppers are planning to buy fewer things in the next three to six months. The survey also found that consumers bought 6% fewer items in the first three months of 2022 than they did during the same period in 2021.

Considering that consumers make or break the economy, a slowdown in spending can send us into a recession which UBS pegs at a 60% chance of happening in 2023. That's a 20 percentage point jump from its June recession odds of just 40%.

Company Reports

Long has it been that consumer stapled goods have had some sort of safer refuge during market volatility. Meaning that because consumers more or less need these goods, they will cut other things in order to pay for things that will, you know, keep them alive.

This means food, water, shelter, and clothing, but mainly food. So this section is going to highlight recent Q2 earnings data and how many companies from both the staples side and discretionary side have beat/missed and either cut/withdrew guidance.

This can help imply financially what the consumer is doing. Let’s look.

*Note: I calculated my results based on if the company beat on sales, beat on earnings, and overall raised guidance for the fiscal year. If they did not raise guidance on a net basis (ex, sales up-eps flat, sales flat-eps up) I counted that as no change. Any earnings results that were labeled as “in-line” were marked as not a beat.

Consumer Staples

Consumer staples ETF (XLP) has done relatively well this year, down only 5.89% vs the S&P 500 down 17.89%. While many have flocked to staples for a sense of security, recent Q2 earnings have started to show cracks.

Take for example my research into earnings. I analyzed 29 consumer companies that reported since Aug 1 (the list of those tickers is in footnotes in alphabetical order).1

Of those 29 companies, 41% missed or met sales estimates, 48% missed or met earnings estimates, and 72% either reaffirmed or cut guidance.

Given that staples have been fighting supply chain issues, rising input costs, labor challenges, and a weakening consumer, they more or less have been able to take price. However, the results of Q2’22 suggest that the ability to take price is beginning to waiver.

Consumer Discretionary

If you think that’s bad, consumer discretionary hasn’t faired any better. YTD, the Consumer Discretionary ETF (XLY) has returned -26.07% vs the S&P 500 -17.89%.

For this set of companies, I analyzed 156 discretionary companies and applied the same logic as above.2 Of those 156 companies 54% missed or met sales estimates, 44% missed or met EPS estimates, and 85% either reaffirmed, cut, or withdrew guidance.

While I’m not as concerned with the discretionary names having issues—mainly because they’ve been beaten down so much this year—the staples should really have you worried.

Company Commentary

Now let’s move on to what current companies are saying. Given that they deal with how consumers spend their money, they should more or less know how their company is and might weather the storm.

Here are excerpts from both consumer and retail companies about their view on the state of the consumer.

As the year has progressed, we've seen more pronounced consumer shifts and trade-down activity. - John David Rainey, CFO of Walmart

Now I think it's worth noting, we have assumed in our most recent price increase we took in July, we've assumed elasticities revert back to what we saw historically, which means more negative than what we've seen over the previous 2 price increases. And we just think that's a prudent assumption to make given the pressure consumers have been under, and we expect they will continue to be under going forward. - Kevin B. Jacobsen, CFO of Clorox

And as Ron said earlier, 40% of some of these -- of the purchases in supplies and companion animal are delayed, not canceled. - Brian LaRose, CFO of Petco

The slump in consumer spending also caused retailers to reduce purchases above and beyond the drops in demand for gaming gear and more than we expected. In addition, high gaming accessory inventories have led to increased promotional activities as retailers and competitors look to bring down inventory levels. - Juergen Stark, CEO of Turtle Beach

And I think you've got a very uneven consumer who is making corresponding choices depending on how long inflation lasts, and like I said in my prepared remarks, especially in those core categories like food, rent, housing. So I'd love to say it's perfectly stabilizing, and we can predict it, but I still think you have a lot of factors at play that are influencing consumer behavior. - Corie Barry, CEO of Best Buy

Wrapping Up

There’s so much data that is slowly materializing into not-good news for the consumer. Even if inflation has peaked, sustained high inflation will continue to put pressure on Americans’ wallets and it’s not just going to go away overnight.

While many will argue that things are not as bad as they historically have been, what they fail to realize is how different the environment is compared to last time. We have an active war in Ukraine affecting oil/energy prices, supply chain issues, commodity inflation, wage pressures, rampant rent increases, 30-year mortgages at 6%, more than doubling in just 6 months from the start of the year, personal savings dwindling and savings rate not keeping up to replace dollars spent.

I’ve done my best to stay positive this year and try to find the bright spots in the consumer market but now it seems that things are rolling over. Not to be dramatic, but we could be coming up on something massive. What exactly would it entail, I have no idea but I can’t see any end result here being a good one.

Could I be early? Yes.

Could I be wrong? Yes.

Could I be wrong by being early? Also yes.

But my confidence in the consumer has waned and that’s why CGC will be sitting this one out until more substantially supportive data arises and not mere speculation of what the FED may or may not do at any given week.

Even shorting in this market is risky given how much things change at a moment’s notice. Let’s see how things play out but if you have comments or feedback about how crazy or dumb this sounds, reply to this post and I’ll answer.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm