Slowly at first, then all at once.

- Ernest Hemingway

The dialogue above is from Ernest Hemingway's 1926 novel, The Sun Also Rises. It's often attributed to Mark Twain or F. Scott Fitzgerald, or misquoted as something like “At first you go bankrupt slowly, then all at once.” But the theme is the same.

Not much happens at the drop of a hat. A car traveling very fast down a road doesn’t abruptly slam into a wall without “things” happening along the way.

Just like nations, banks, and consumers, they don’t eventually run into trouble without there being warning signs. The problem is that the warning signs are only evident in an “of course” moment when looking backward. In the interim, you’re not entirely sure if the warning signs hold weight, if they’ll get worse, or if they’re even warning signs.

That’s when people get into trouble because it starts to happen very slowly until it reaches an inflection point where it just all comes at you at once.

The key is to position yourself in the best risk-adjusted way to capture momentum if and when it does take a massive dip but also not beat yourself up when it’s wrong.

Hell, Michael Burry had to wait almost two years before his infamous insurance swaps trade paid off.

So what’s the current state of the consumer as we see it? Let’s dive in.

Back in December of 2022, I posted my thoughts on the state of the economy from a consumer lens which incorporated many different data points. If you’d like a refresher, you can find it below.

The general gist was that things weren’t looking too great but the economy wasn’t falling apart.

My biggest call going into 2023 was two things.

Consumers were going to run out of excess funds and spend would decrease

Retail earnings were going to get hit and hit hard

Looking at the first point, it appears that consumers have indeed been running out of excess cash reserves.

Latest St. Louis Fed data reveals that around 76% of post-pandemic excess savings in the US have been depleted. With the remaining excess savings projected to run out by year-end, coupled with reduced household credit loans, US consumption is set to continue its slowdown.

This also tracks small business data from Bank of America when it comes to payment growth.

According to them, small business payments have continued their long slow decline through April as many Americans pull back on spending and businesses focus more on deleveraging rather than growth.

This brings me to point #2. Retail sales.

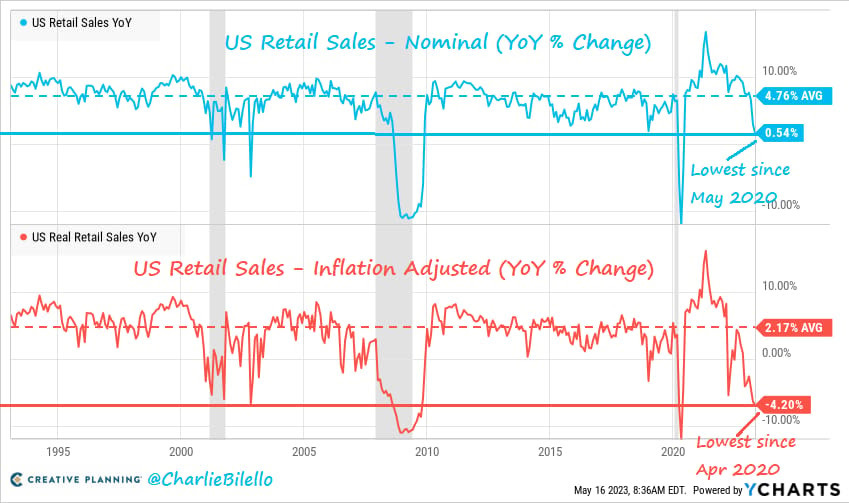

While nominal retail spending data has still been positive, looking at the inflation-adjusted growth has put YoY percentages well below 0% for some time now.

Since many in the market are praising consumer resiliency given the absolute dollar spend, it’s not really the case.

Home Depot HD 0.00%↑ cut its annual profit forecast, citing a customer pullback. Target TGT 0.00%↑ and Walmart WMT 0.00%↑ warned that recent sales were at their strongest in February but weakened in March and again in April.

The reports signal rising anxiety about US shoppers, who are forgoing purchases of furniture, apparel and electronics in order to afford basic goods. That’s stoking fears of a long-term drag on the economy that some analysts see playing out for years.

With high rates of inflation, shoppers are on the hunt for deals. At TJX TJX 0.00%↑, the parent of discount apparel chains T.J. Maxx and Marshalls, average sales per customer was down in the first quarter, but overall store traffic rose. That suggests the company is adding new customers who are looking for lower-priced products.

Walmart, meanwhile, noted that demand from wealthier households was showing up in apparel and grocery, a sign that some shoppers are trading down. That helped it achieve robust sales growth, despite the expiration of a temporary boost in food-stamp benefits that hurt lower-income customers.

While US comparable sales beat expectations in the February-through-April period, Walmart CFO John David Rainey said the retailer is taking a cautious view on the health of its customers.

No matter how you cut it, consumers are just trying to keep up with price increases coming in from all sides.

About 90% of consumers are skimping on grocery bills, only buying what’s absolutely needed and ditching goods such as air fresheners and lawn fertilizer, according to NIQ. In March, 35% of shoppers were only buying essentials, up three percentage points from October, based on an NIQ survey.

If you want to talk about grocery bill increases, just take a look at something incredibly simple that many Americans rely on every morning. Cereal.

The issue here is that while many CPG players have taken advantage of inflation to significantly increase prices, they aren’t lowering them as cost inputs go down.

Hamdi Ulukaya, CEO of Chobani, in an interview with CNN earlier this month, said,

“Of course, you have to pass on some increases in prices to customers, but those inputs are coming back down and that hasn’t been reflected in the price of goods: They’re still elevated. It is troubling. I think food makers have to be very conscious that people are having a hard time affording food.”

This is what I believe is partially contributing to the rise in credit usage that’s putting many consumers on or near the edge.

While about 38.5% of American adults — or 89.1 million people — faced difficulty in paying for usual home expenses between April 26 and May 8, that’s down from the peak of just over 40% 6 months ago but up from 34.4% a year ago and 26.7% during the same period in 2021.

To combat these budget problems, many households are turning to credit cards for help.

Households added $148 billion in overall debt, bringing the total to $17.05 trillion, according to a report released by the Federal Reserve Bank of New York last week. Balances are now $2.9 trillion higher than just before the pandemic.

More than 25 million households say that they used credit cards or obtained a loan to meet spending needs. That’s up from 22.4 million a year earlier.

Pulling an interesting callout from Bloomberg in relation to credit card loans in first quarters of every year,

Consumers typically build up more credit-card debt at the end of the year, during the holiday season, and then reduce those balances at the start of the following year, sometimes with the help of tax refunds. But for the first time in 20 years, that wasn’t the case this year, suggesting some households are under strain from higher prices and may be relying on credit cards to maintain their spending.

The overall delinquency rate remained low by historical levels, at 2.6%. But the share of debt that became delinquent — meaning it was at least 30 days late — is rising for most loan types, including credit cards and auto debt.

But how Americans can afford everyday expenses is trumped by another type of debt. Mortgage debt.

Many Americans took advantage of super low interest rates during the pandemic to buy homes but the problem was that the prices went parabolic.

So while many locked in a lower interest rate, as the economy has begun to slow,

The low mortgage payments have become assets → stable, secure, and predictable

The home has become a liability → asset price crash, potential equity wipe

Mortgage originations dropped sharply in the first quarter, to $324 billion, the lowest seen since the second quarter of 2014. Balances on home equity lines of credit increased by $3 billion at the start of the year, rising for the fourth straight quarter after declining for nearly 13 years.

But everything isn’t all worrisome on that front. According to CoreLogic, U.S. homeowners had $270,000 more equity on average by the end of 2022 than they did at the start of the pandemic.

One of the more underappreciated aspects of the housing market is the number of people who don’t even have to care about interest rates anymore.

Almost 40% of homeowners have their houses completely paid off. That’s more than the proportion of people who rent in this country (around a third).

And when you combine that with the fact that nearly 30% of homeowners have at least 50% equity in their homes, we’re talking close to 70% of households who have more equity than debt in their houses.

So the good news is at least that unless unemployment ticks up, many will be okay in paying their mortgages, saving more (savings rate continues to tick up) from what seems out of necessity, and hopefully making payments towards their CC debt.

However, there is still a looming time bomb closing in on the horizon that might indeed blow things up. Student loans.

I wrote about this thought more fully but that was a few months ago. As of now, the time to destination is fastly closing in.

Americans are nervously waiting to hear back from the Supreme Court on whether or not their student loans will be forgiven (not all). Many point to the Biden promise as not happening which means that consumers are going to be even more stretched.

According to research from the Federal Reserve Bank of New York, the average student loan monthly payment is $393. They also found that 50% of student loan borrowers owe more than $19,281 on their student loans.

If the Supreme Court decides to block Biden’s proposal, that will take ~$400/mo out of the economy for ~44 million Americans. That’s ~$17.6 billion out of the economy on a monthly basis that isn’t going towards goods, services, or experiences.

However, the recently announced and tentative debt ceiling deal has effectively taken student loan forbearance out of purgatory.

“The pause is gone within 60 days of this being signed. So that is another victory because that brings in $5 billion each month to the American public,” - Senator McCarthy

As my fellow consumer and ex-investment banking refugee @NeelyTamminga put it so eloquently in a recent podcast she did,

"People spend in good times or bad. They don't spend when they're fearful or angry. Student loan forgiveness if not passed, will make them angry and cause a deep bruise and hopefully not a laceration"

Based on the above, people will most likely be angry that they were betrayed by this and then get pretty fearful about the potential new monthly costs entering their life.

Time will tell just exactly how bad it will be but there’s no way that people do not see $400/month coming out of Americans’ pockets as a tailwind for future spending towards the economy.

Wrap Up

While the economy is still chugging along and virtually no one knows with confidence where things will be in the next 6 - 12 months, it’s hard to see the warning signs not materializing further.

That’s why I started this post with that opening quote because things do move slowly until something happens that just causes the acceleration of deterioration to rapidly gain momentum.

Many thought the bank runs over the last few months would have been it but governments and central banks stepped in to reassure investors and their citizens.

Where will the next events come from?

My guess is to continue looking at jobless claims and where that eventually leads to with unemployment.

Either way, the consumer spending shift is looking to get another speed bump in the next few months at the very least.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech