The Ticking Time Bomb No One Is Talking About

The over $1.7 trillion, trillion with a "T", powder keg

If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.

Student Loans

It’s been almost three years since people with federal student loans have had to make a payment on their debt and I think many Americans, including myself, have gotten too comfortable with that.

Since the start of the pandemic, roughly $1.7 trillion dollars in federal student loan debt has been on pause for about 44 million Americans.

Many have found relief in knowing that they didn’t need to make payments and could apply those funds elsewhere whether it be housing, food, clothing, that new car they probably didn’t need, crypto investments, etc.

The problem with this is that, in my opinion, it’s gone on for so long that many have been banking on Biden’s presidential saving grace of canceling student debt in order to never have to worry about it again.

I think this level of hope and prayers is a risk to the broader economy that no one is talking about.

What do I mean?

Biden’s Student Debt Relief Program

In the back half of last year, Biden finally came out and announced that Federal student loan borrowers could get up to $20,000 in debt forgiven if they met specific income qualifications.

*Queue a cliche savior meme here*

However, this was swiftly met with opposition from many that it was unconstitutional and challenged it in court. Because it was being challenged, Biden paused payments again, meaning that students may be off the hook for payments until as late as summer 2023.

Good news I guess if you’re banking on the justice system backing you but here’s what we know.

Currently, student loan forbearance could end sooner if the Supreme Court decides the fate of President Biden’s plan to cancel up to $20,000 in student debt per borrower before then. Right now, oral arguments are scheduled for Feb. 28.

While the court has promised an expedited final decision, it will likely come months after the arguments.

Unless the president orders forbearance to be extended once more, the repayment clock starts again 60 days after the Education Department is allowed to implement the one-time debt cancellation or the litigation is resolved, or 60 days after June 30, 2023 — whichever comes first.

However, this is just what’s going on for Biden’s plan, not if it doesn’t go through.

Let’s take a look at the repercussions if it doesn't happen, i.e. “the ticking time bomb.”

Snap Back to Reality

According to research from the Federal Reserve Bank of New York, the average student loan monthly payment is $393. They also found that 50% of student loan borrowers owe more than $19,281 on their student loans.

Even before COVID, when the U.S. economy was enjoying one of its healthiest periods in history, problems plagued the federal student loan system, with about 25% — or more than 10 million borrowers — in delinquency or default.

Thankfully for many borrowers, the pandemic pause really helped out many. Or did it?

Despite hundreds of dollars going to debt each month, balances aren’t shrinking. Among borrowers who still owe money on their student loans, just 37% of all borrowers saw their student loan balance shrink according to the Federal Reserve Bank of New York. That means a large majority of borrowers, unfortunately, aren’t making any progress.

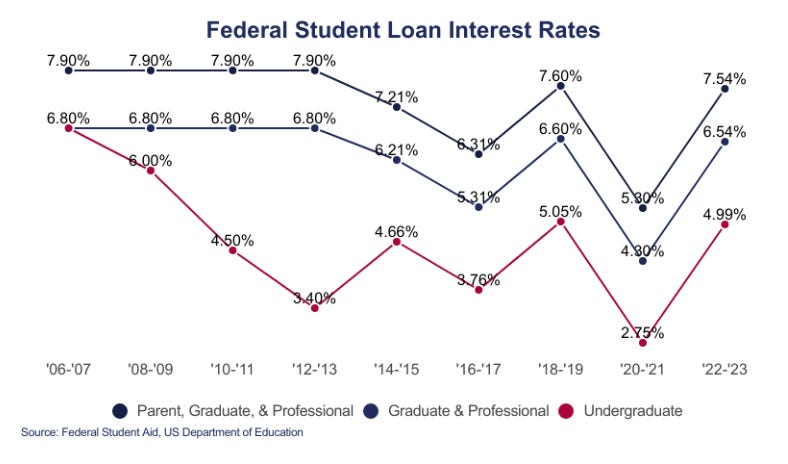

To compound this dilemma, since payments have been paused, the rates have still gone up as the Fed battles inflation so new paused student debt is much higher than it was during the pandemic.

Interest rates are set by Congress and are determined by 10-year Treasury notes plus a fixed percentage increase. Caps on interest rates are also determined and put in place; the caps are meant to prevent borrowers from paying even higher interest charges if the Treasury rates get even higher (the interest cap for federal loans for undergraduates, for example, is capped at 8.25%).

So while you haven’t needed to make payments during this time, the reality of jumping from $0 a month in payments to ~$400 for just one line item is a big move.

Experts say hardship rates are likely to only increase with the setbacks of the pandemic, the current sharp rise in prices on everyday goods and the fact that borrowers have gotten used to a budget sans student loans.

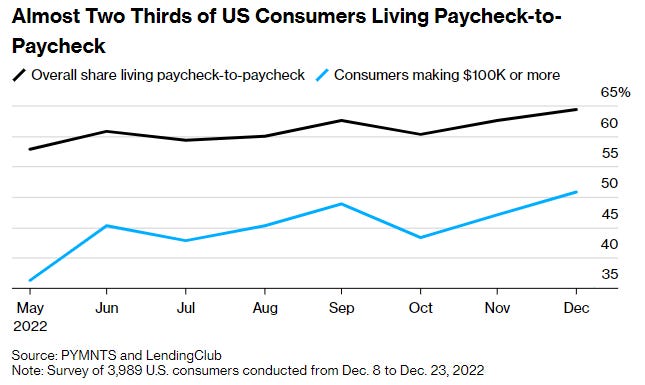

This loops in perfectly with a recent report from Bloomberg about Americans living paycheck to paycheck.

Bloomberg reported that the share of Americans who say they live paycheck-to-paycheck climbed last year, and most of the new arrivals in that category were among the country’s higher earners, a new study shows.

Some 64% of US consumers — equivalent to 166 million people — were living paycheck-to-paycheck at the end of 2022, according to the survey by industry publication Pymnts.com and LendingClub Corp.

That’s an increase of 3 percentage points from a year earlier or 9.3 million Americans. And out of that group, some 8 million were people earning more than $100,000 a year. More than half of that income cohort said they lived paycheck-to-paycheck in December, up 9 percentage points from a year earlier.

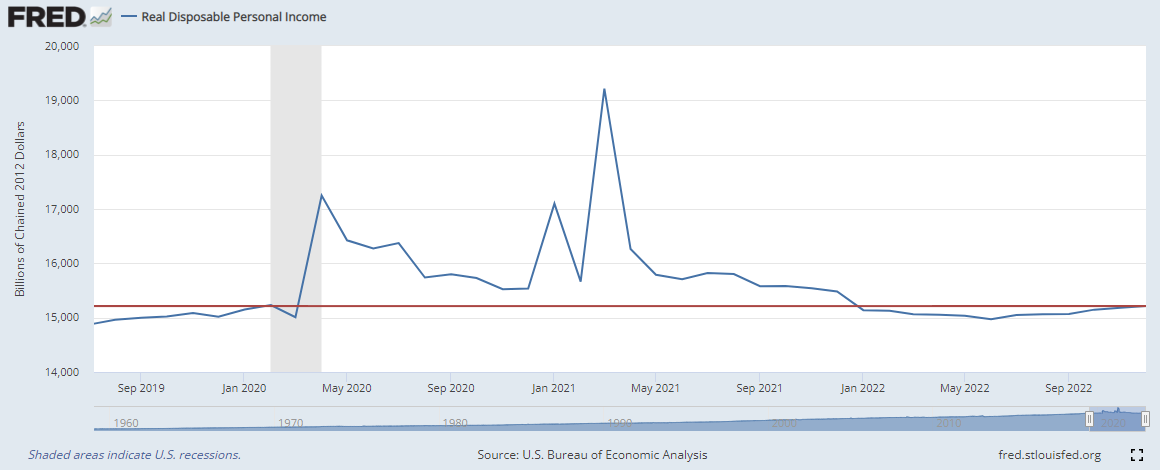

Inflation-adjusted disposable incomes remain below their levels at the start of the pandemic in 2020, indicating that consumers have seen no real income gains in three years, according to the Bureau of Economic Analysis.

Other indicators also point to some level of financial stress. The latest University of Michigan survey showed that consumer sentiment, while it’s climbed from 2022 lows, remains far below pre-pandemic levels. Fourth-quarter economic growth data published two weeks ago highlighted a slowdown in household spending.

The LendingClub report didn’t provide a definition for paycheck-to-paycheck, which typically means that people rely entirely on their monthly incomes to meet basic obligations and would be in immediate difficulty if income was interrupted.

The label doesn’t necessarily mean that people are having trouble staying current on debt payments, but the survey suggests that a growing number are. It found that 24% of respondents had issues paying their bills in December. Among those earning more than $100,000 and living paycheck-to-paycheck, the share rose to 16% from 11% a year earlier.

Bottom Line

While this isn’t quite the Titanic inevitably steering toward the iceberg, it is something to have on your radar considering this “resilient” consumer might not be so resilient when payments come back online.

If they do, which we won’t know for some months, will take ~$400/mo out of the economy for ~44 million Americans. That’s ~$17.6 billion out of the economy on a monthly basis that isn’t going towards goods, services, or experiences.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech