Q4'23 CGC Quarterly Letter

Rates, rallies, covers and trades — how Q4 was full of surprises

Fund Performance

In Q4 2023, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned 15.2% gross return compared to 11.6% for the S&P 500, 11.3% for the S&P Consumer Discretionary ETF XLY, -11.7% for the Cannabis ETF, and 14.1% for the Russell 2000.

For the full year, “CGC” returned 36.2% gross return compared to 26.2% for the S&P 500, 39.6% for the S&P Consumer Discretionary ETF XLY, 0.3% for the Cannabis ETF, and 15.6% for the Russell 2000.

Q4 Market Commentary

Much like the rest of 2023, uncertainty was much the name of the game. While much of the market was still trying to determine the state of the economy and how the Fed would react, Q4 also showed why we cannot invest beyond what we cannot control.

Who would have accounted for Hamas to conduct the largest assault on Israel since the Arab summer? Or that Iran-backed Houthis would start terrorizing global shipping lanes in the Red Sea sending the prices of containers back up to levels not seen in over a year?

Much of this uncertainty, while potentially beneficial, is exactly why the noise surrounding investing should be taken as that. Noise.

Thankfully, unbeknownst to us, we were long defense contractors before October 7th, long oil before Houthis attacked shipping lanes.

Despite the random events, the market caught a bid at the beginning of November and was further supported by the Fed indicating potentially a peak in rates and suggesting rate cuts in 2024. Something investors have been holding on to over the last year.

Even though this rally was exacerbated by short covering and little tax loss harvesting, we see this rally as purely a rate rally. An unsustainable rally for the next leg up.

Forward multiples for the S&P are right back up to where they were earlier this summer, despite underlying earnings in many areas having declined.

This can be further reflected in the top 10 stocks “carrying” the rest of the market on its back.

Without these large-cap equities (magnificent 7), returns for the year would have been a fraction of what they were. Since most of this rally was rate-driven and the performance of many individuals and funds was beta-derived, the markets priced for perfect execution in a bounceback of earnings supported by rate cuts.

Statistically speaking, rate cuts are not generally a sign of strength in the economy. While that doesn’t mean that’s not the case this time, the yield curve still suggests that a recession might be around the corner.

US 10Y and 3M spread were finally making a rally in Q4 and have since reversed course. Something to keep an eye on as one of many indicators going into the new year.

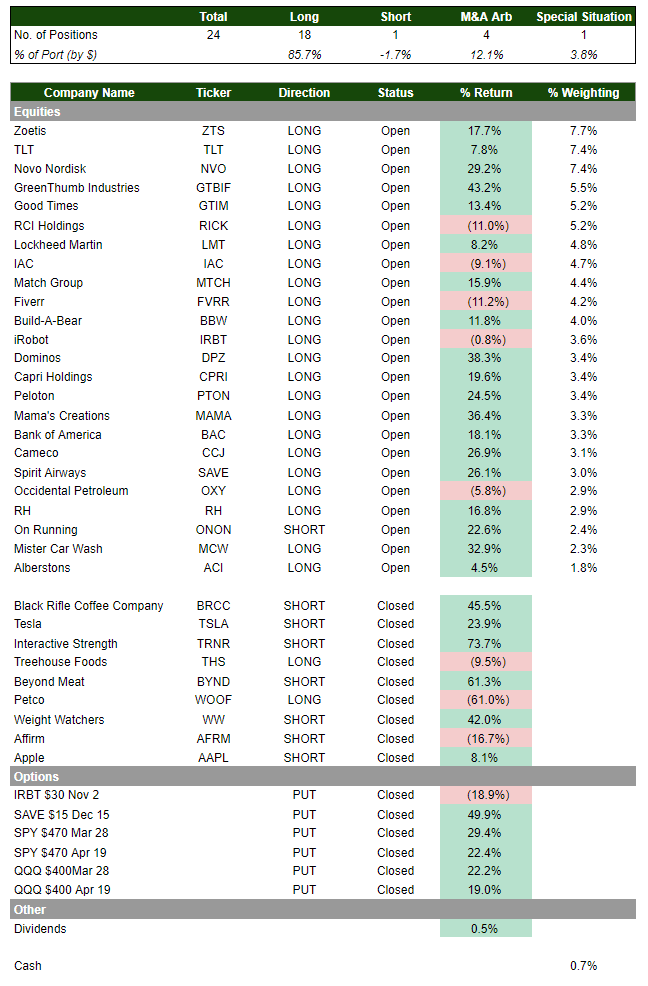

Positions Year-End

Lessons learned from the past, when it comes to shorting equities, greed can get you killed. When equities declined in October to kick off Q4, we did not want to get greedy and instead, exerted discipline in covering those positions.

We liquidated our short positions in

Black Rifle Coffee Co BRCC 0.00%↑

Tesla TSLA 0.00%↑

Interactive Strength TRNR 0.00%↑

Beyond Meat BYND 0.00%↑

Weight Watchers WW 0.00%↑

Affirm AFRM 0.00%↑

Apple AAPL 0.00%↑

Specifically calling out Affirm and Beyond Meat, we believe that BNPL is still a cancer to the everyday consumer, and this particular fake meat company is headed towards zero.

Despite our thoughts on this, market rallies such as the one in Q4 represent exactly why irrational exuberance is quite the face ripper for L/S funds.

In addition to closing most short positions, we had 3 and 4 month dated PUT contracts on both the SPY and QQQ to hedge the portfolio.

Coincidentally, while we had these positions on for anticipation of selling in the new year, the market pulled back slightly and the IV gave us double-digit returns in a matter of days.

One of our pain trades was Petco WOOF 0.00%↑. While we were so bullish on the pet theme overall, we were shocked at just how much the industry reversed. Given the industry entirely relies on consumers adopting and spending more than bare necessities for their pets, it was rather alarming when we dug more into ancillary data that supported the potential notion that consumers aren’t doing as well as many suggest.

We highlighted this reasoning in our December note below if you’re interested in understanding more.

We’ve also increased our positions in a few M&A arb trades that we believe are mispriced and can provide decent R/R depending on trade structure — Capri CPRI 0.00%↑ & iRobot IRBT 0.00%↑ — and shared our thoughts on them below.

2024 will likely see more consolidation in various industries that could lead to asymmetric returns which we’ll be on the lookout for. For those of you who haven’t yet, you can subscribe below to get our thoughts on new, actionable ideas.

Closing Portfolio Remarks

Historically speaking, CGC ran a concentrated portfolio of anywhere between 12 - 15 stocks on both the long and short side. In 2023, with so much uncertainty, we decided to deviate from this standing and increased our positions to the 20 - 30 range.

While not ideal, we wanted to diversify our risk profile across various industries, sectors, and strategies. In 2024, we’ll look to start consolidating into names we believe can still generate meaningful growth, without compromising margins, and avoid “hype” names.

Diversification amongst different industries and sizes will still be the theme in 2024 while strategic hedges (reloading short positions) will also take fold to protect the downside.

Looking forward to what surprises 2024 brings.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Impressive performance!

I just subcribed, looking forward to your updates

Yes, the only two companies I’ll consider owning in this space are $DECK and $CROX, both with best-in-class management. I do own $Crox