Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security.

Portfolio Performance

In Q2 2024, Cedar Grove Capital (“CGC”) returned 1.1% return compared to 4.4% for the S&P 500, (0.6%) for the S&P Consumer Discretionary ETF XLY, (26.8%) for the Cannabis ETF, and (3.3%) for the Russell 2000.

General Commentary

As promised, transparency and accountability are pivotal in my service offering in order to build trust and reputation. In case anyone new is wondering, the “relaunch” was not because of poor performance. In fact, as of the end of Q1’24, I was only trailing the SPY by 20bps which you can read about below if you’re interested.

This is the first quarter of performance since I launched the “paid” version of my equity research which means this letter will be set up a little differently than past letters but I hope it still adds value to you as you sift through the many that have been and will be released soon.

First off, I want to thank all of you who have supported my research since going paid. It’s surreal to me the growth that has occurred in a little over 2 months just by sharing my research. I look forward to delivering more value-additive research in the coming weeks.

Since going paid at the beginning of May, I have released 8 reports including 3 new equity ideas, 1 Arb update, 1 IPO update, and a few others. To check them out, you can visit my table of contents below and see for yourselves. Some are free.

Generally speaking, this quarter was actually one of the best quarters I’ve ever had until certain events changed that and sent me below the market return. One such callout was the hit I took on Xponential Fitness (XPOF) which I wrote about in my first portfolio update on 5.11.24. If it wasn’t for just this singular event, which in hindsight seems like a bad call to sell, I would have been up 6.3%, exceeding the SPY.

However, reminiscing about past decisions is a waste of energy and just focusing on what went wrong is all that’s needed. You’ll be able to find my position holdings in the section after the next that will break down position sizing and single-name commentary.

I am elated that my recent Hims & Hers Health research has been so widely received. It’s currently my most-read research ever and many of you have DM'd me about specifics related to their compounded GLP-1 offering. I’ll release that research, including my revenue model on Wednesday, July 10th, and what I believe the company can achieve through 2025.

Now let’s get into the thick of it.

Q2 Market Commentary

This quarter was another weird one for the books. The expectations of when the FED will cut changes like a piece of hair being held in the wind. The notion of higher for longer is pretty much guaranteed with expectations only a fraction of what traders anticipated at the start of the year.

Now I’m not trying to be a doomer, but it does seem like stress is beginning to show up in the markets. CRE continues to offload entire office buildings at fractions of what they paid for them just a few short years ago. This is something that I wrote about at the end of February and highlighted that smaller banks with larger CRE exposure could face solvency issues.

This level of stress in the banking system continues to flash warning signs which have been going on for the last few years. As many of you remember the run on the banks for Silicon Valley Bank, First Republic, and Silvergate.

As Anchor Capital highlights, there are two takeaways here.

History tells us that significant unrealized losses can be a precursor to bank failures, as we saw during the 2008 Financial Crisis. Bank solvency and liquidity can be impacted if this goes on for too long.

Bank instability can spread to other financial entities, further destabilizing the market. Investors might flee to perceived safe-haven assets like gold, government bonds, and cash, causing dislocations in other asset markets and further increasing volatility.

None of which is good which is why nearly everyone wants the FED to cut rates and hopefully correct the yield curve which has been inverted for over 1.5 years now.

Aside from banks, retailers have been seeing mixed results with not all benefitting from a “robust consumer” as many have relied on for continued growth. Lululemon (LULU) for instance is down 41% YTD but on the flip side, Abercrombie and Fitch (ANF) is up 101% as of 6.30.24, and even discount retailers like Big Lots (BIG) are contemplating bankruptcy.

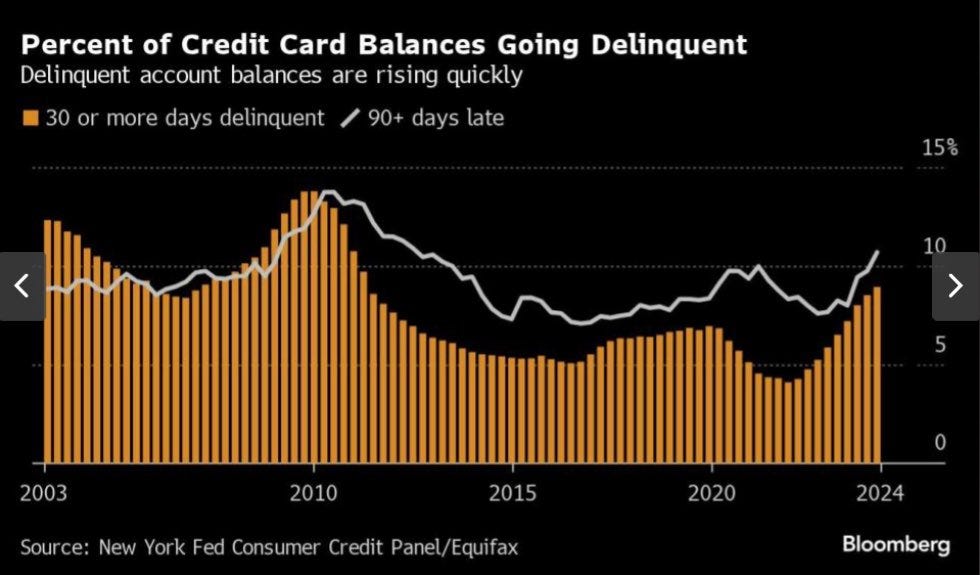

These mixed results also continue to surprise because when you look at credit card delinquencies going up, you’d expect many earnings commentary to show stress or concern which is not the case across the board.

This is all despite personal savings rates still hovering below 4% which hasn’t been seen outside the dot com or GFC recessions.

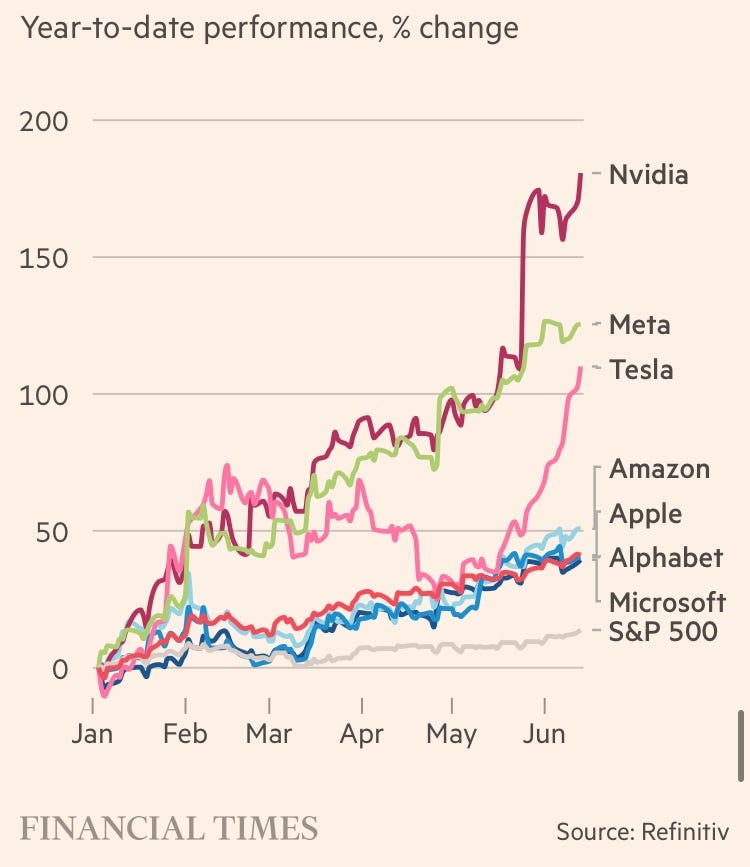

But even with select indicators flashing, the market is still crushing it this year with double-digit gains YTD for the S&P and Nasdaq, however, when you look under the hood, it’s the same culprits that are driving the returns. The Mag 7 have contributed to 61% of the S&P gains this year versus 63% in 2023 and currently makeup 37% of the weighting of the index, the highest in the last 3 decades.

Given that we all know AI is driving much of the returns this year, it’s going to be one hell of a pop once new capex investments in chips even remotely start to slow down. I’m not saying that it will happen in the next few months or even over the next year but it will happen and when it does, the same companies that held up the market will be the ones to likely bring it down.

And lastly, pivoting to unemployment which everyone is laser-focused on, Michael Kantro from Piper Sandler has been updating us all on his #HOPE research which now he’s highlighted that the “e” (employment) is flashing warning signs.

I’m not trying to call a recession but it seems like things are heating up where the FED is going to need to do something before it’s too late. I will say that one of the benefits of investing in positions for the “long term” (not buy and leave alone) is that can still grow and expand even after periods of volatility. This means that I’ll have to suffer from some painful drawdowns on the path to this but considering how I don’t write about macro trades or have a crystal ball into FED cuts or the next bank failure, I can only do with what I know which is strong management execution and debt-light/absent businesses.

The benefit here is knowing that I can sleep well at night because I’m not stressed about my position’s exposure to macroeconomic changes. That means more to me than being able to squeeze out 10 or 15% on a few trades every quarter.

Stress management is on par with risk management. Arguably, the same.