To recap, back in April of 2022, I wrote my first piece on Domino’s Pizza (DPZ) once it started turning over after its incredible run-up of just over 100% from COVID lows in a little under 2 years.

In that piece, I acknowledged that inflationary pressures and labor costs/shortages were hurting the company going from food basket costs rising 1-3% for 2020 (based on FY’19 guidance) to 12% in 2022.

However, after a 35% drawdown in 4 months, that didn’t mean the company should be left for dead.

In fact, in my model (see below), I accounted for this as near-term price risk should inflation persist and the company was not able to fully solve its labor shortage issues and capacity would come offline (store hours) leading to earnings decline.

My 2023 EoY PT for DPZ of ~$460 assumed a modest 28x NTM EPS multiple (2 turns less than the 5-year median) on $16.43 of earnings, and my near-term price target was at $303.75 based on $13.50 EPS on a 22.5x NTM multiple.

Funny enough, the stock bottomed at $293 in October of 2022 at ~22.1x NTM EPS and closed CY’23 at ~$411 at 27.2x NTM EPS.

Pretty damn close all considering.

My misjudgment in the impact of how badly inflation would hit food costs as well as the labor shortages meant I came up short on my projections. However, the stock did break the $460 mark less than 3 months into 2024 and topped out at $506 before the market started pulling back.

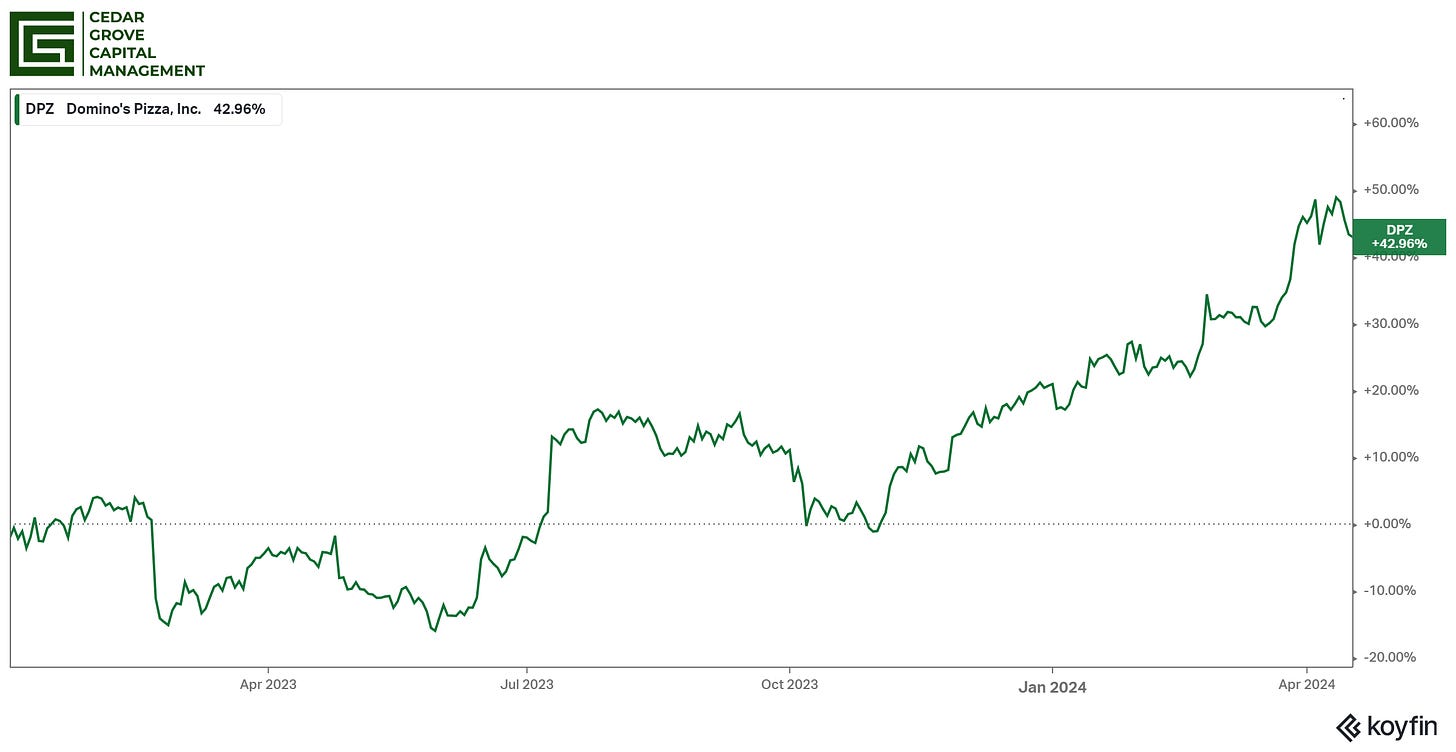

Here in lies the problem though, after a ~43% total return for the stock since the start of 2023, I’m not convinced that holding shares of DPZ into the future — at least at this current moment — is worth the risk or reward.

In my post today, I’m going to break down the key problems that I see DPZ facing on its next leg up and why I believe the stock is fairly valued (based on my model at the end), and why I’ll be deploying capital elsewhere.

The whole premise of why I’m writing this is because of how I’ve been viewing risk-adjusted returns when it comes to my investments in the portfolio. This matters immensely and when it comes to portfolio construction, it’s not just a matter of if a stock can outperform but how much, if at all, can it above benchmarks.

Right now, I don’t believe that DPZ has that opportunity, and here’s why.

Domino’s has done an excellent job navigating the high inflationary markets we saw in 2022 and took measures into 2023 to bring the company back to its former status. This is a testament to management’s ability to access the problems at hand for both domestic and international franchisees and develop solutions to combat them.

While sales hadn’t necessarily surpassed FY’22 figures, gross margins and operating margins both bounced back to pre-inflationary levels and management has guided for modest 1-3% increases in food basket costs going forward. A far cry from the 12% in 2022.

To help with labor shortages for both in-store and delivery, the company pushed heavily into carryout, expanding that business from 43% of total transactions and ~33% of total sales in 2021 to 52% of total transactions and 42% of total sales by the end of 2023.

Emboldened to get demand back on track, DPZ took to menu changes over the years with new additions to Mix-and-Match, online-only offerings and pricing, carryout “tips”, “Pinpoint Delivery”, and the incredibly successful emergency pizza promo. Not to mention its share buybacks which have dropped total share count by ~4 million shares over the last 3 years.

This is all fine and dandy but my issue doesn’t really lie with management’s ability to continue to get growth going. My issue is with so much having gone “right” for the company over the last 2 years, are future expectations already priced in and if not, is DPZ worth my tying up my capital?

It starts with looking at management outlook. Back in 2019 in their Q4 earnings release, the company stated that they were looking for (two to three-year outlook)

Global retail sales growth of 7% - 10%

U.S. SSS growth of 2% - 5%

International SSS growth of 1% - 4%

Global net unit growth of 6% - 8%

Now we all know what happened in 2020 so I don’t bring this up to knock on them at all but rather to bring up what the targets were before everything went to crap.

Fast forward to now based on the company’s newly titled “Long-Term Guidance” ranging from 2024 - 2028 powered by the M.O.R.E Hungry plan, DPZ is targeting

7%+ annual global retail sales growth

1,100+ annual global net store growth

8%+ annual income from operations growth

Here’s the issue. With targeting 7% annual global sales growth, you need to estimate significant acceleration in unit growth both domestically and internationally while also making sure to power demand and price increases.

DPZ has already stated that they do plan on modest price increases in the low single-digits and are optimistic about unit growth in general.

This is important because on a unit-level basis, targeting 1,100 net new units annually (new target) puts us well below the 2019 target of 6% - 8% — about 5% average over the next 4 years.

It doesn’t take a rocket scientist to understand that much of the future growth of DPZ is heavily reliant on the ability to expand internationally. With ~6,850 stores in the U.S., management’s LT market has always been 8,000 - 8,500 stores. To combat the “saturation” problem, “fortressing” was introduced years ago to allow current franchisees the ability to overlap territories to boost overall sales and EBITDA while the underlying units would take a modest hit.

This makes sense and has been relatively successful. Based on the 2023 investor day, management is targeting 7,700+ stores by the end of 2028 which means at the current number of U.S. stores, they just need to open ~900 more in 5 years to reach that minimum target.

Based on the above, they had 3 straight years of being able to open >900 net new units in the U.S. This unit growth target I’m not worried about, and to add to that optimism, we can also see that the U.S. average EBITDA (chart below) is also bouncing back after bottoming in 2022.

My actual issue is that the net expansion of international stores continues to be the real driver of growth well into the future though I’m not sure how easily obtainable it is.

Looking at international net store opening targets, management has set the expectation to hit >18,500 units by the end of 2028 and >40,000 units long-term. Now I don’t have any doubt that the international whitespace is 40,000 units but opening up just under 5,000 stores in 5 years might be hard to achieve (current is ~13,700).

Looking back to 2019 (above), on a rolling basis, the company hasn’t been able to open up even more than 4,000 stores in that same time frame.

To make matters worse, I was curious about closures internationally and noticed an interesting trend. If you look at international closures as a % of international units at the start of the year, absent 2020, they’ve been ticking higher over the last two years.

Granted, management has addressed this concern by stating the below in response to an analyst’s question

“Internationally, I think we’ve got a lot of closures behind us. That was probably one of the things that was driving down the number this year. But those closures really focused on 3 areas. Domino’s Pizza Enterprises, and they talked about their number, Russia and Brazil. Those 3 were over 80% of our closures and no other market closed more than 5 stores.” - Q4’23 earnings call

While the stat is certainly true, it’s something to keep an eye on to make sure it truly just isn’t a one-off thing from the Russian invasion of Ukraine and consolidation in the Brazilian market from underperforming stores or fundamentally something hindering international franchisees from opening more units.

All this isn’t meant to diminish the progress the company has made over the last two years from what was a pretty crap situation to navigate. However, based on my model, I can’t see a path where the upside here is a slam dunk as opposed to other opportunities currently out in the market.

Let me explain.

Based on the above, I think I’ve been pretty generous and still don’t see the crazy upside. From the top, I’ve already taken up growth for ‘24 and ‘25 to just over 6% a year. Figuring management not being able to achieve their full net unit growth goal for both years (as mentioned before why), I can’t justify sales surpassing the 7% target.

This is interesting because average estimates for sales in ‘24 are $4.81 billion and $5.13 billion in ‘25. Not too far off from me.

Management has already given us thoughts on the U.S. business with expectations for international though they are relying heavily on the increased promotion of Uber Eats — which only has a 1-year exclusivity — and the repurchases from DPZ’s loyalty rewards system which currently stands at 33 million active members.

With a newly issued $1 billion share repurchase authorization bringing the total to ~$1.1 billion, I’ve factored in a modest $240 million of share buybacks annually with debt paydown of $60 million in ‘24 and $80 million in ‘25.

Even with that, most of my 2024 estimates are pretty on par with consensus the problem is my EPS is lower ($15.64 vs $15.75) and my 2025 figures represent another year of good but not great growth.

Looking backward, the 5-year average NTM earnings multiple now stands at 28.1x, two turns lower than when I did the same comparison in April of 2022. I’m applying a multiple of 30x to account for the rebound out of a crappy ‘22/’23 period to give them the benefit of the doubt.

When you think about the above, we’re talking 4% and 8% earnings growth against S&P earnings growth of 9.8% and 13.6% in ‘24 and ‘25, respectively, based on Yardeni Research1. Hell, you even have 2-year Treasury Yields at 4.9%.

With that, I just don’t believe that holding DPZ warrants capturing further upside over the next 2-years as opposed to holding the S&P or another investment. This by no means suggests that I think the stock is a short but rather just that what’s occurred and believed to occur has indeed been priced in.

This is why I’ve completely exited my position in DPZ the other week.

If you have any comments or feedback, or perhaps you believe I’ve overlooked something, I’d love to hear them.

If you haven’t already, consider subscribing to support my notes and research. I’ll have an exciting update for subscribers in the next week or so.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm