I remember when I was a kid, my dad would be the family mechanic and help tune and maintain our family cars. They weren’t anything extravagant but just the average family Toyota Camry and Nissan Altima that we held on to for over a decade. I’d always go with him to AutoZone to pick up parts to fix our cars and help out in any way I could, holding a flashlight or grabbing a tool mainly.

This was traditional in our family, and I’m sure others as well, and it really got me asking myself, “I wonder if people still hold onto their cars as long as we did.”

The short answer, yes.

Car Ownership Lasting Longer

When I googled the simple question, it seemed to be a hot topic that publications were reporting on. Americans were holding onto their cars for longer, and the pandemic only made the situation worse.

The average car in the US was about 12 years old in 2020, an increase of nearly 2 months over the previous year, and up from 9.6 years in 2002 as COVID-19 shutdowns kept many people at home and their cars off the road.

The pandemic lengthened the average age of cars, as cars did not tack on as many miles in 2020 and many drivers looked to save money, forcing new car sales to slump at the onset of the pandemic.

What’s the Underlying Support Trend?

There are a few reasons why Americans are holding onto their cars for longer and after you read them, they make pretty good sense.

Cars are becoming more well made

The average age of cars has been steadily increasing for about 15 years now due to higher prices for new cars and the increasing longevity of vehicles. 20 years ago, a car might have changed hands once or twice and lasted 100,000 miles, it is more common today for a car to have multiple owners and last for 200,000 miles or more.

More cars per household

New-vehicle sales have been running at a record or near-record pace for years, with the exception of a short-lived drop in the early months of the pandemic.

Instead, since cutting back in the financial crisis, more consumers have been adding to their number of household vehicles—buying a third car for the family instead of getting by on two, for example. The total number of vehicles in operation in the U.S. has risen about 10% since 2013, to around 279 million, according to IHS.

The number of households with one or two vehicles has decreased over time. However, there has been a steady increase in vehicles of three or more per household. There is a strong indication that because American households are growing in size, the number of vehicles is also increasing to accommodate them.

The data also indicates a rise in a steady income, allowing Americans to afford both the car payment on three or more vehicles in addition to the costs of maintenance and car insurance.

Prices for new and used cars hit all-time highs

Americans are always looking for a deal and when it comes to cars, trying to get some dollars knocked off the price at a dealership or when you’re negotiating off Craigslist is the name of the game. However, like many things over time, prices do go up.

The price paid for an average new vehicle in May was $38,255, a record high, according to research firm J.D. Power. New-car prices have risen steadily since the financial crisis but have soared over the past year, as supply-chain disruptions from the pandemic created a seller’s market.

Used-car prices also have marched higher for years and got an even stronger boost since the pandemic hit. Average used-vehicle prices were up 48% in May from a year earlier, according to an index produced by auction company Manheim, Inc.

With the costs of switching to a “new” or “newer” car increasing, the need or desire to want to avoid these costs as long as possible also increases.

Lower rates helped fuel overall sales

During the economic recession of 2008, the FED lowered rates to near zero in order to spur economic growth. Americans took advantage of lowered rates and began buying cars again.

The timing of such coincides well with the spurt in car buying some 11 years ago. As rates begin to rise from FED policy, many more Americans might pull the trigger before they start getting too high, only fueling the long tail of car upkeep down the road.

How I'm Thinking of Playing This

If cars are lasting longer overall, that doesn’t mean that they aren’t immune to issues. Repair and maintenance shops are poised to benefit from the lengthening life span of cars, as more car owners look to salvage older vehicles.

Also, more companies are offering aftermarket products to upgrade infotainment systems and other technology in cars, giving owners of older vehicles the ability to connect their phones to the dashboard touch screen, for example.

So who do you buy then if owners need parts and upgrades? I’ve listed a few names below and how they compare to each other.

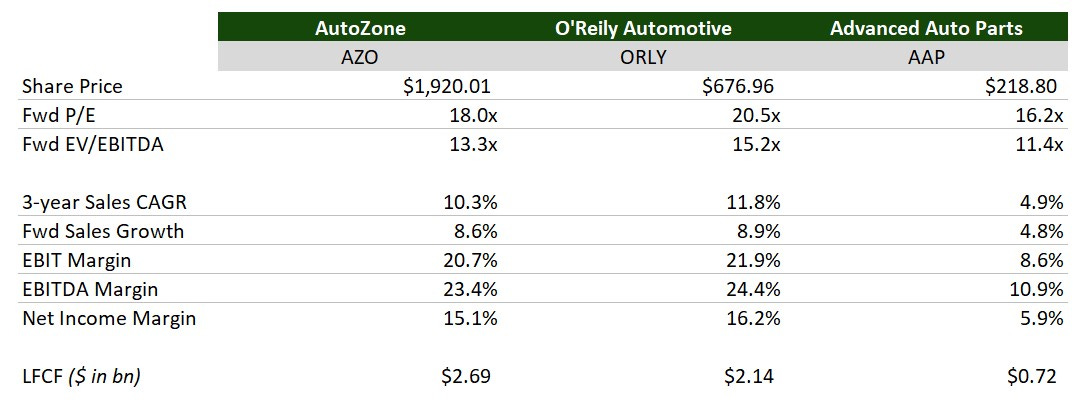

These three names AutoZone AZO 0.00%↑, O'Reilly Automotive ORLY 0.00%↑, and Advanced Auto Parts AAP 0.00%↑ are the three biggest names that deal in after-market parts. Given the nature of their business, they aren’t terribly expensive either and generate great earnings and margin profiles as well.

They’ve also had a stellar return in the last 3 years compared to the 61% return of the S&P 500.

Seems like the top two are AutoZone and O'Reilly but at face value, it doesn’t seem like you could go wrong with any of those two.

Bottom Line

Investing in any of these companies is betting on the narrative above. Americans holding onto their cars for longer, and as more vehicles hit the road, their age will only feed into the market for car maintenance.

With the run-up over the last two years, the question is which one would yield the highest risk/reward potential, if at all, and at what entry price.

I’ll be diving into this industry deeper as I think there is still long-term upside here while being semi-recession proof if the yield curve inverts. If you’re interested in following along, hit the sign-up link below to stay updated.

Until next time,

Cedar Grove Capital