Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or “the fund”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Students can get access to our research at a reduced rate by clicking here. If you’re interested in using Koyfin (I highly recommend it), you can get 20% off your plan using my link here.

Interested in becoming an LP? Click here to fill out the contact form.

Today’s report is going to cover quick updates on a lot of companies in one report because we hate getting spammed with emails and wouldn’t do that to you. If you have an interest in only some of these companies, they’ll be in the order that you see below, so you can jump around if needed.

Soho House (SHCO) - Update on the “take private” deal

LENSAR (LNSR) - Second Request from FTC

Liquidia (LQDA) - Legal Ruling / Launch

Capri (CPRI) - Post earnings update regarding Versace sale

Gen Restaurant (GENK) - Might have already bottomed out

DICK’s Sporting Goods (DKS) - Acquisition of FL and what NKE had to say

Hims (HIMS) - Acquiring Zava might not be the good thing everyone thinks it is

Soho House (SHCO)

Earlier in January, we sent a follow-up to our M&A arb trade of calling BS on the Soho House (SHCO) take private offer. There were plenty of reasons why we thought the offer was complete crap it looks like we were right.

As a reminder, the “offer” was announced ~1 week before Christmas last year and typically, it would only take a few months for that offer to be accepted or denied. Fast forward to SHCO’s Q1 earnings release on May 9th, the company updated shareholders on the transaction.

As previously announced on December 19, 2024, the Company received an offer from a third-party consortium to take the Company private for $9.00 per share. The Company set up a Special Committee to assess the offer and the parties continue to assess the offer and a potential transaction, however no assurances can be given that the Special Committee’s assessment will result in any change in strategy, or if a transaction will be undertaken. The Company will make a further public comment regarding these matters at such time as there is a material development in the process.

This, ~6 months later, reaffirms our original concerns around the legitimacy of the deal not being “real.” Stock is down ~15% since the time we published our trade idea, though we remind you that it was down 34% at its trough post-liberation day.

We don’t foresee any further materialization regarding this deal or the prospects of SHCO turning around in the near term.

LENSAR (LNSR)

For those of you who read our initial report on LNSR, you most likely did well if you decided to buy. Through market close yesterday, the stock is up 45.7% (since Feb). If you were to factor in the takeout price by Alcon (ALC) for the $14/share + the $2.75 CVR, the potential return could be upwards of 80% since we published.

However, there’s some red lining here. When the announcement came out that they were being sold for $14/share, we quickly put out an open letter for shareholders to reject this offer because we thought the company was worth closer to $20/share, if not more.

In our Q1 letter, we highlighted that between ALC and JNJ, they own about 50% of the global market for cataract surgery devices, which isn’t an insignificant number. Because of this, the FTC has now made a Second Request on the deal. It doesn’t necessarily mean that the FTC might block, but it’s something to keep an eye on since the stock is now trading under the takeout price (currently $13.51).

Honestly? We’d rather the deal not happen and size up our position post-deal-break since we’re confident LNSR is worth much, much more. However, if the deal does go through, there’s obviously a bit of juice left in the spread that could be worth it for someone looking for an arb trade.

**Reminder, the special meeting for this deal is on July 1st, and if you’re a current shareholder, you should have received the Yes/No vote the other day electronically.

Liquidia (LQDA)

Battles hard fought and won. If you read our research on Liquidia (LQDA) back on January 7th and decided to act, congrats! The stock is up ~42% since then. It has been a long and bumpy road for those who got into it this year and for others who have been holding on for much longer than that.

Thankfully, United Therapeutics (UTHR) most recent hail mary to stop Yutrepia from coming to market through a temporary restraining order (TRO) was shot down by a judge last week. Court doc here.

With the approval of the FDA on the 22nd, LQDA has already begun its first commercial shipment of Yutrepia, which is what we’ve all been waiting for. With the TRO out, we’re still not quite out of the woods yet, but the upside for LQDA is looking brighter.

In our original note, we outlined the math on what we think LQDA could do with Yutrepia and the conservative price that could reward shareholders. Emphasis on conservative, which would still signal a multiple of where it’s at today.

We are very optimistic about the future of this company and our current position.

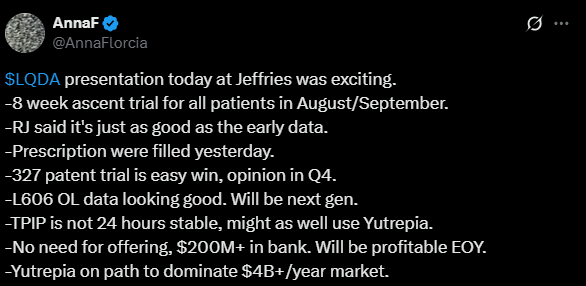

As a reminder, LQDA presented at Jefferies yesterday with some very positive commentary - hence the >6% move in the stock.

Capri (CPRI)

Capri has been a love-hate relationship for us. We were long the original arb trade with Tapestry (TPR) in 2024, which didn’t end up well for a lot of people. We then shared the trade idea for CPRI divesting Versace before Liberation Day. Needless to say, we got rugged on price but ended up being right on the outcome of the divestment (1:1?)

Anyways, since our post-sale update on April 13th, the stock is up 23% when we reiterated that the financials still showed a healthier company could come out of this rut with value-accretive options for shareholders.

This was further reinforced when the company announced its Q4’25 earnings, which signaled to us that the bottom was most likely in. A few things stood out to us that build on our conviction that a turnaround for CPRI (MK + Choo) seems likely.

Already seeing Q1 trends in a positive light

Improvement in sales momentum → store traffic + average unit retail (AUR)

moderation in store traffic decline ✅

Full price retail sales QTD turned positive ✅

Have not seen traffic turn positive in the US/China, but are seeing nice trends in Europe

Sequential declines have decelerated significantly ✅

Tariffs

Jimmy Choo is largely made in Italy

Choo + MK combined represent just 5% of production volumes in China ✅

$60 million in increased inventory should help mitigate tariffs ✅

Deferred tax assets of ~$545 million will be able to offset gains in the future ✅

So there’s been good things going on, and management highlights the positive trends it’s seeing at MK with their new brand storytelling and product initiatives. It makes us believe that the bottom from the Liberation Day tariffs is in, though the unfortunate part is that CPRI was not one to rebound quickly despite the reciprocal tariffs being paused → most of MK sourcing comes from Vietnam, Cambodia, and Indonesia.

But here’s how we’re still looking at the valuation going forward, and caveat that it will take time to get there if the tariff pause and sale are any indicators of investor sentiment for the future.