LNSR: LENSAR Upside Into Global Clearance Looks Compelling

Growing procedural market share, inflecting positive FCF, and a growing recurring revenue segment

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Students can get access to our research at a reduced rate by clicking here.

Preview

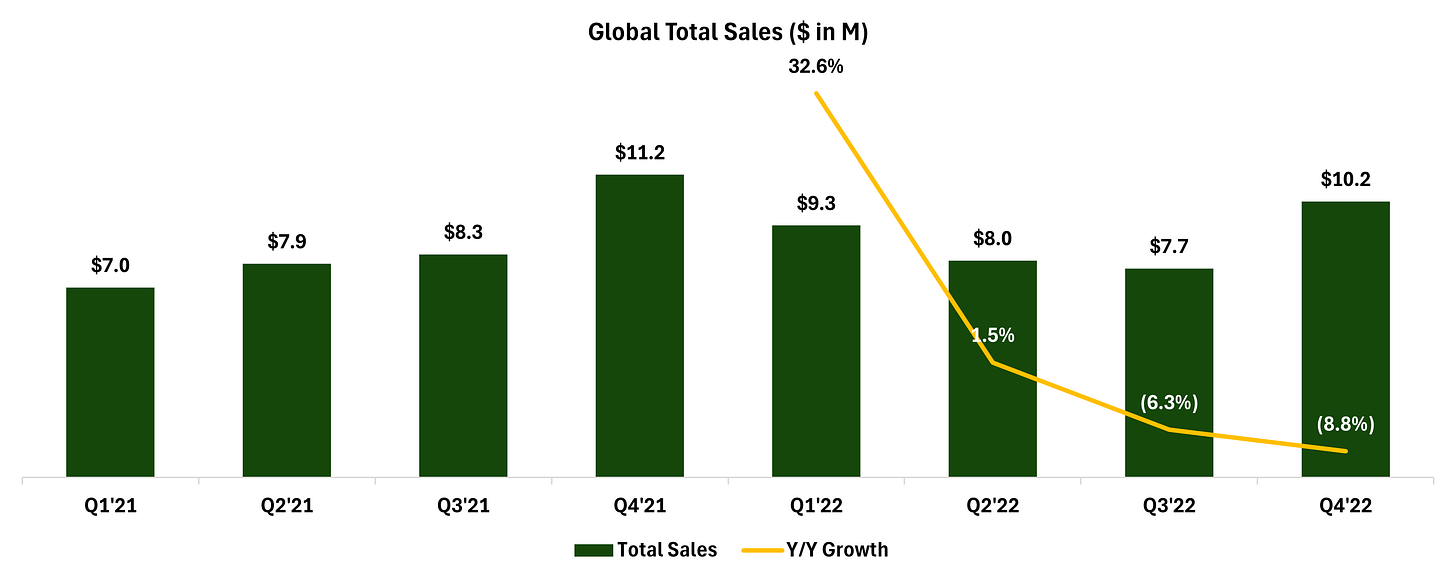

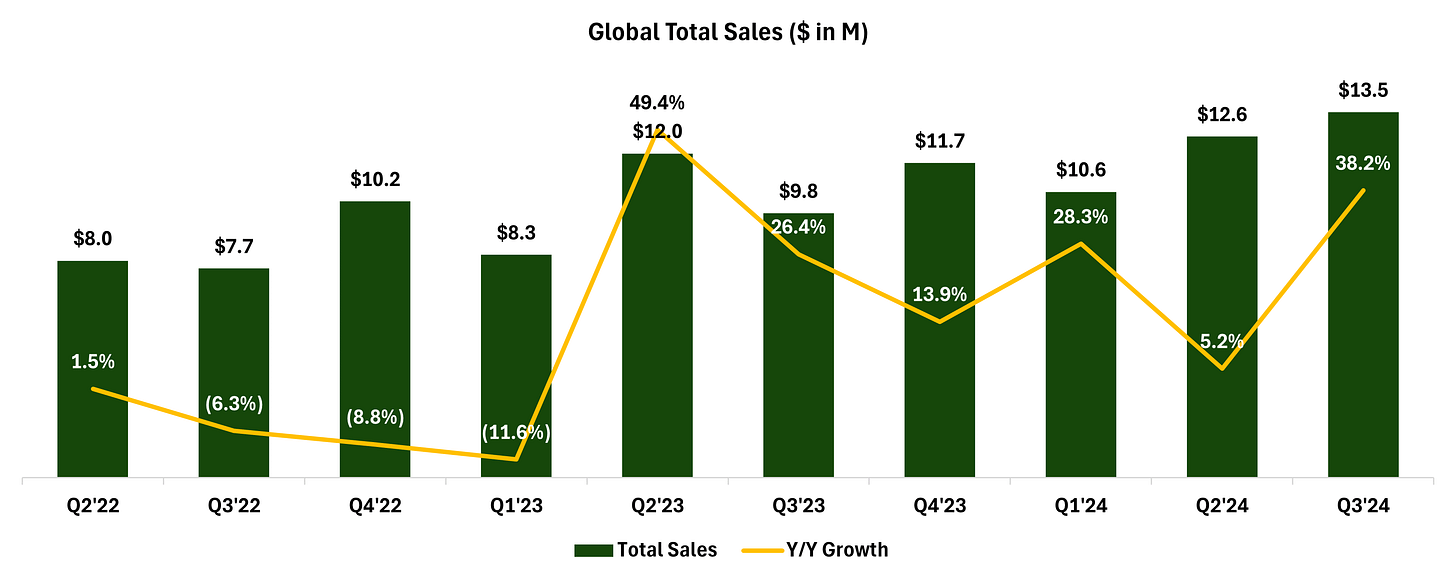

With the launch of the ALLY Adaptive Cataract Treatment System (“ALLY”) cataract system in August of 2022, the company has reinvigorated sales growth to record highs.

The ALLY system currently has a nearly 20% market share of the U.S. procedure volume (+5.8 p.p since launch) and has grown systems installed at a 4% quarterly growth rate since commercial launch.

A high-margin recurring revenue component to the company’s sales based on procedures completed allows the company to benefit from margin expansion as the company matures.

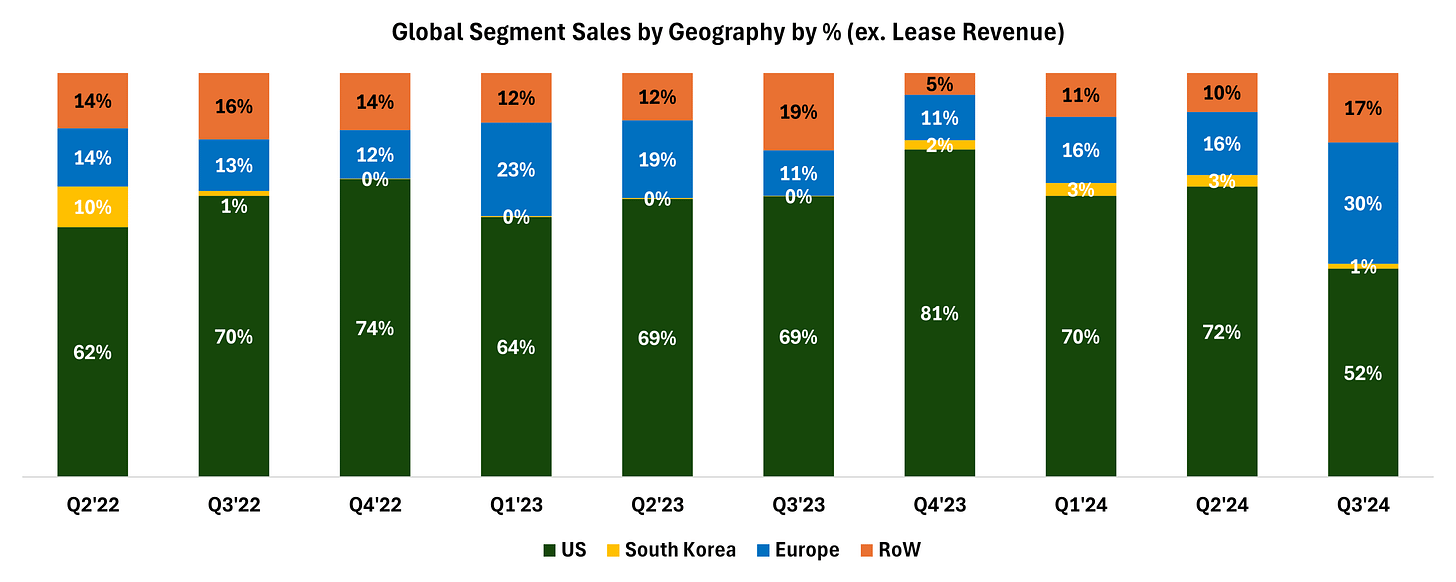

The company has recently received additional clearances in Taiwan and the EU which will further drive international growth.

LENSAR has recently inflected to breakeven Adj. EBITDA and positive FCF while having no debt and ~17% of its market cap in cash.

We think with the continued execution and push internationally, LNSR has set itself up for the potential to nearly double over the next 3 years.

Earnings are Thursday, February 27 before market open, so keep that in mind.

Disc: We are long LENSAR (LNSR).

To get our full list of research, click here to access our table of contents.

Overview

LENSAR (LNSR) is a U.S.-based micro-cap medical device maker that sells a femtosecond laser system called the ALLY Adaptive Cataract Treatment System (“ALLY”) to assist ophthalmic surgeons in treating patients suffering from cataracts.

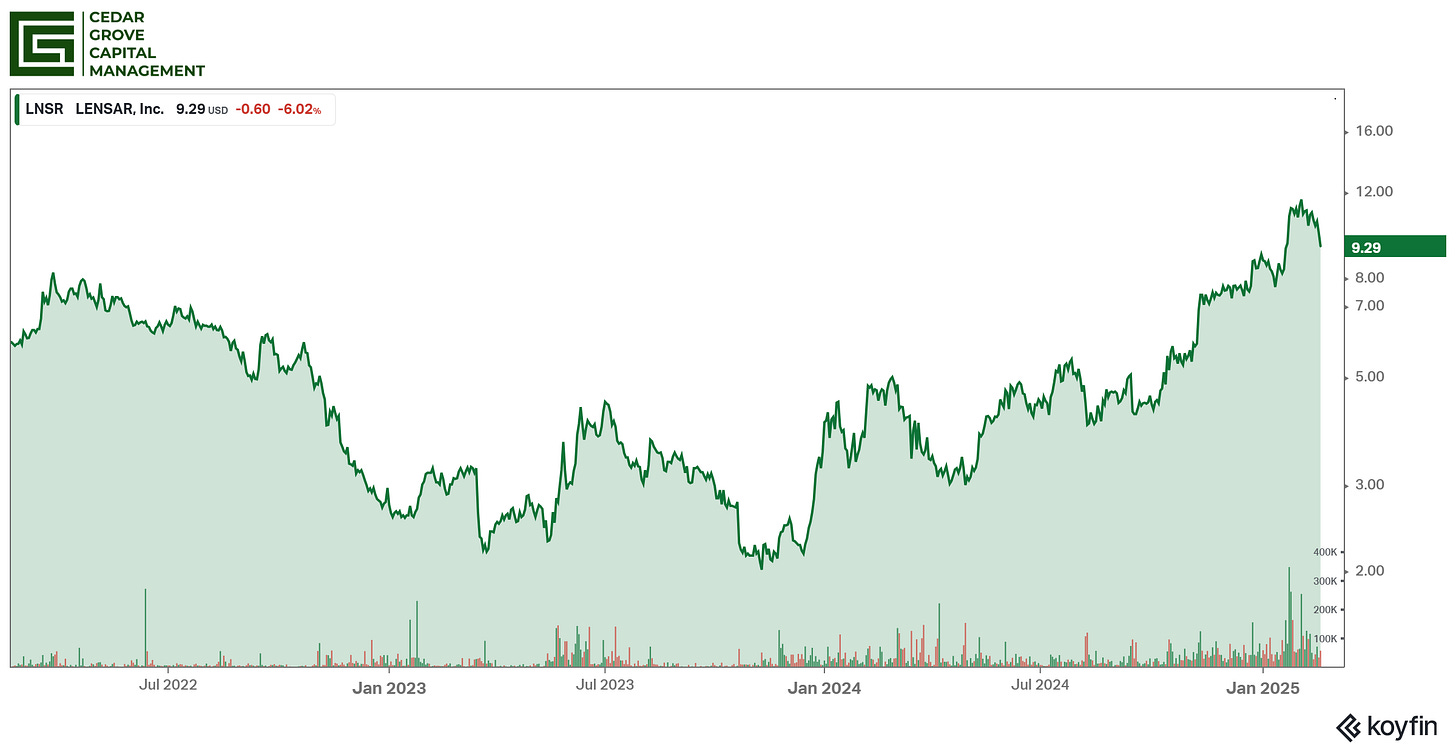

Before we go into the opportunity with the company post the run-up it’s had, it’s important to give context to why the company barely moved for the better of ~2 years.

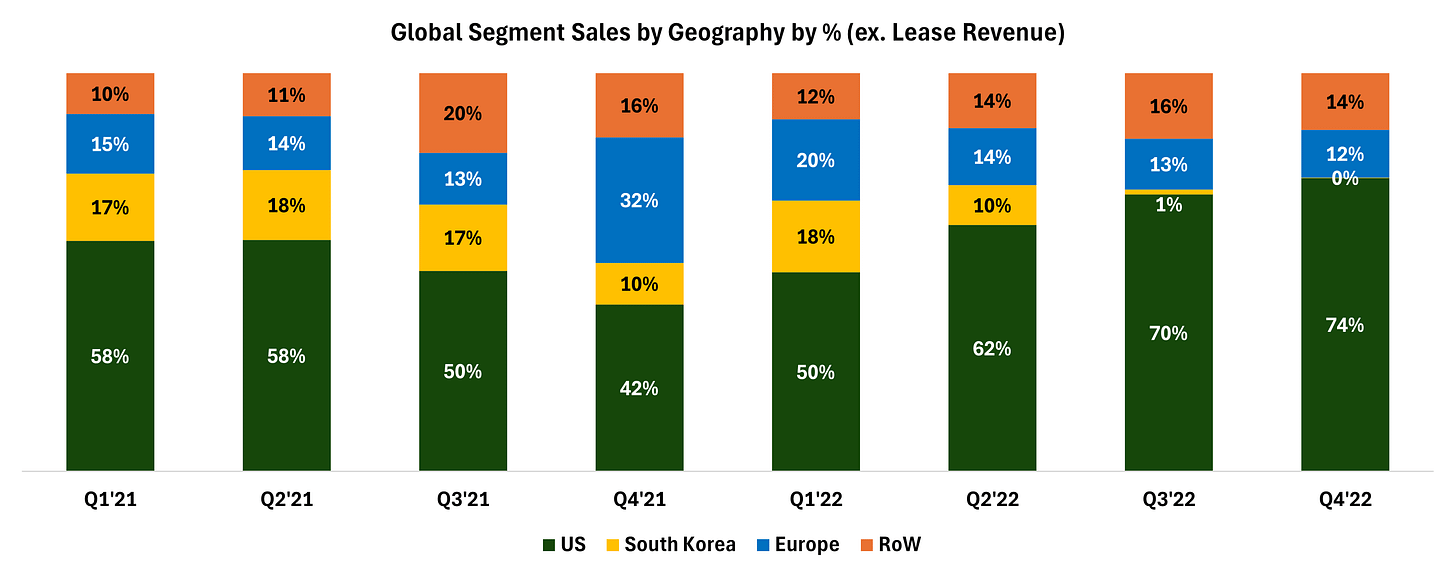

Prior to June 2022, LNSR helped ambulatory surgery centers (ASCs) by selling their LENSAR Laser System (LLS) in the U.S. and abroad with South Korea being the largest geography of sales outside the U.S. and Europe.

However, starting in Q2’22, South Korea started posing problems for LNSR sales because there ended up being a dispute between 3rd party payers and healthcare providers which eventually made procedures there non-existent (below).

Consequently, as we’re sure you can imagine, this momentum had a negative effect on sales growth in the back half of 2022 which led to a steep decline in the share price (refer to the above stock chart during the 2022 period).

But things started to take a turn when in June of 2022, LNSR’s new cataract machine, the ALLY, was FDA-cleared in the U.S., allowing it to launch mid-Q3’22 and sales started to pick back up domestically and eventually abroad.

And this is where the opportunity starts to make LNSR interesting again which is why we’re writing about it now after we took the time to do a little digging.

We’ve written out the report below in a way that continues with a storytelling format as we’ve found it challenging to present the opportunity in a classic problem/solution without providing background context.

Learning about cataracts, their treatment options, insurance coverage and truthfully all the minute details of this industry we feel is necessary for you to understand what’s going on before we even get to numbers.

Let’s first start off with the market backdrop and why the ALLY system and its technology are making this an attractive opportunity.