Hey everyone, welcome back to another article by Cedar Grove Capital Management.

If you like today’s post, please hit the heart button, comment with any feedback, and share it with friends if you find it useful.

This post might be too long for your email so if it abruptly cuts out, just open it in your browser to see the whole thing.

Introduction

Back in September, we published our thoughts on the consumer and what led us to liquidate our positions due to what we believed was not a light at the end of the tunnel but in fact, another train.

Since it’s been three months since we posted that piece, we thought it would be best to send out another update on our thoughts while touching on different market segments this time.

In this post, we’ll be sharing our thoughts on

State of small businesses in America

Homeownership and how asset prices have destroyed the future

Used car market and what that means

Consumer savings rates not seen since before ‘08

The dinner table is still costly

With that, let’s begin.

Small businesses, the backbone of America

According to the U.S. Small Business Association (SBA), small businesses of 500 employees or fewer make up 99.9% of all U.S. businesses and 99.7% of firms with paid employees.

These range anywhere from your local mom-and-pop place around the corner or that small local/regional company.

Of the new jobs created between 1995 and 2020, small businesses accounted for 62%—12.7 million compared to 7.9 million by large enterprises. A 2019 SBA report found that small businesses accounted for 44% of U.S. economic activity.

Without small businesses, the American economy and workforce would be a pretty wild landscape to imagine.

In fact, in 2021, there were 5.4 million new business applications. That’s 23% higher than 2020’s record.

So, small businesses are important, and lots of people have wanted to start them recently. Hell, we just bought one ourselves.

But if we’re looking at the economy, we need to see how small businesses are viewing it themselves.

Recession Scaries & Inflation Pain

To find out how inflation is affecting small businesses, in June, Digital.com surveyed 1,000 owners and co-owners of small businesses with 500 or fewer employees. The results show that inflation – and rumblings of a recession – present a serious threat to the survival of the majority of small businesses.

Key Survey Findings

65% of small businesses say it’s ‘very likely’ or ‘likely’ they’ll permanently close if inflation continues at its current rate

The prospect of a recession has 95% of small business owners ‘very’ or ‘somewhat’ concerned

Businesses that are in danger of closing are more likely to have already been impacted by declines in revenue and customers, pandemic-related shutdowns, and supply-chain issues

38% of small businesses facing closure plan to lay off employees to stay afloat

“Small businesses have struggled to survive two years of COVID lockdowns. Many of those that made it through are likely to be low on the resources and energy required to now survive the highest levels of inflation in 40 years.” - marketing consultant Dennis Consorte

Additionally, the ongoing economic impact of inflation has led to the threat of a recession.

Small business owners are taking note of this as well, with 60% of all small business owners saying they’re ‘very concerned’ about a possible recession in 2022. Thirty-five percent are ‘somewhat concerned.’ Only 5% of small business owners say they’re ‘not at all concerned’ about a recession.

Referring to the increase in business applications picture from above, inflation might be about to make that boom go bust. Sixty-two percent of businesses founded since 2020 will ‘likely’ or ‘very likely’ close down without relief from inflation.

Businesses founded just before the pandemic, between 2017 and 2019, are even more likely to be struggling. Seventy-three percent of these businesses say closure is likely.

Even the majority of well-established businesses are being threatened by inflation. Fifty-seven percent of businesses founded between 2007 and 2011, and 55% of businesses founded before 2007 say permanent closure is ‘likely’ or ‘very likely’ if inflation doesn’t ease up.

To add to worrying statistics, more than 40% of U.S. small business owners say they couldn’t pay rent on time or in full for the month of November, the highest this year.1

Analyzing trends in rent delinquency rates, this is up ~4 percentage points from October (37%) and 10 percentage points from September (30%).

A survey of 4,789 small business owners by Alignable was conducted between Oct. 15 and Oct. 27. The findings partly reflect how inflation is affecting small businesses. More than half say their rent is at least 10% higher than it was six months ago, and one in seven say rents have increased at least 20%.

About 49% of restaurants were unable to pay their rent this month, up from 36% in September, while 37% of real estate agents couldn’t pay their rent, up from 27% last month, reflecting the fallout from a slowdown in home sales as higher mortgage rates chill the housing market.

Takeaways

Small business owners are genuinely concerned about inflation and its effect on their businesses

Many are concerned about a recession and the very likelihood of their business closing

The pace of small businesses not being able to afford rent is at its highest point this year

Now let’s move on to home ownership.

Poorer Than Before

With COVID shooting the median existing-home sales price to a peak of $413,800 in June of this year. Since then, prices have come down ~10%, and are looking to continue that way.

However, with mortgage rates pushing past 7% recently and settling at a national average of 6.6%. This has led to existing home sales plunging over the last year.

November clocked in a 28.4% y/y decline in existing home sales, which was the worst since February 2008.

But this isn’t what I’m concerned about. New home sales only affect those that are taking on new loans at much higher rates than before but as you can see from above, no one is lining up to do that.

In fact, nearly a quarter of Americans had clinched a mortgage rate of less or equal to 3%, according to data from the Federal Housing Finance Agency, as of the end of June. Only 7.2% of homeowners have a rate higher than 6%.

This means that while many Americans paid a lot more for a house, their mortgage payments are still very much under control due to them locking in low rates.

But here is what I am concerned about. The asset prices of homes are tumbling. As I mentioned above, prices are already down ~10%, but why am I worried about that?

I’m worried about the equity wipe of homeowners that overpaid, which was basically everyone.

What do I mean by this? Well, let’s look at the example below.

For easy numbers, we’re looking at a home that was valued at $500k in 2020, and sold for 50% more in 2021 (more common than you think). With a 20% down payment for a 30-year FRM, that means that you’re putting up $150k in cash (excluding fees, etc) for the home and the mortgage is $600k.

Now that prices are coming back down to reality, the overpriced home you paid for is worth 20% less, at $600k.

You’ve been making payments for ~1 year but the value has taken such a hit that your equity is virtually wiped. Meaning, that $150k you put down to obtain the house in the first place is down to ~$12k after making nearly one year of payments.

This means that you’ve basically paid $150k to only own ~$12k worth of a home in just one year. Not ~$12k in incremental equity, but ~$12k in total equity.

Terrible return.

This means three things though.

Unlocking equity from your home via a HELOC/home equity loan is not possible because you basically have no equity left in the home currently

If you had a HELOC or home equity loan, your line of credit from your lender might freeze or reduce your line of credit but you’ll still be on the hook for the payments regardless

Assuming a 2.5% annual appreciation rate, it would take another 10 years after the 2022 drop to get back to the value that you initially paid for it

My concerns with this are that it will tie people up with little to no equity in their homes for years to come which doesn’t allow homeowners to tap their equity to fuel other economic growth with said funds.

Additionally, you can’t sell either without taking a massive loss due to the underlying price of the asset crumbling.

You’re basically held hostage to your home but instead of like in 2008, your mortgage payment is not making you go underwater and into foreclosure.

An expensive and not financially rewarding purchase if you ask me.

Used Car Market Collapsing

Remember during the pandemic when you could sell your old used car for basically double what it was worth? Yea. Those days are long over.

The Manheim used car index has cratered this year as supply chains for chips have eased which has allowed those on the waitlist for new cars to finally get theirs.

While it surprisingly ticked up last month, that’s more a function of people finally pulling the trigger and swapping out their cars before it’s too late for something slightly newer.

But, here’s the real kicker, the market for getting a new/used car is severely under pressure with rates.

Looking at the below chart will show you what the average used car loan rates are on a state-by-state basis.

According to Edmunds, the average interest paid over the life of a car loan hit an ALL-TIME record in November.

New car loan: $8,436 in interest

Used car loan: $10,204 in interest

In October, I was lucky enough to lock in a used car rate at 4.54% on a 5-year term. Mind you, I have an 820 credit score and yet people were still saying I paid too much.

That’s laughable at this point considering the average is now double that.

But not only do you have supply chains easing, rates going up, and people coming to the realization that their used cars are no longer assets but once again liabilities, this puts consumers in a very peculiar spot.

Consumers NEED cars for daily life like commuting to work, family things, etc. Waiting to get a car because prices were too high has backfired since now that prices are down, rates are up and that means people are falling behind on payments.

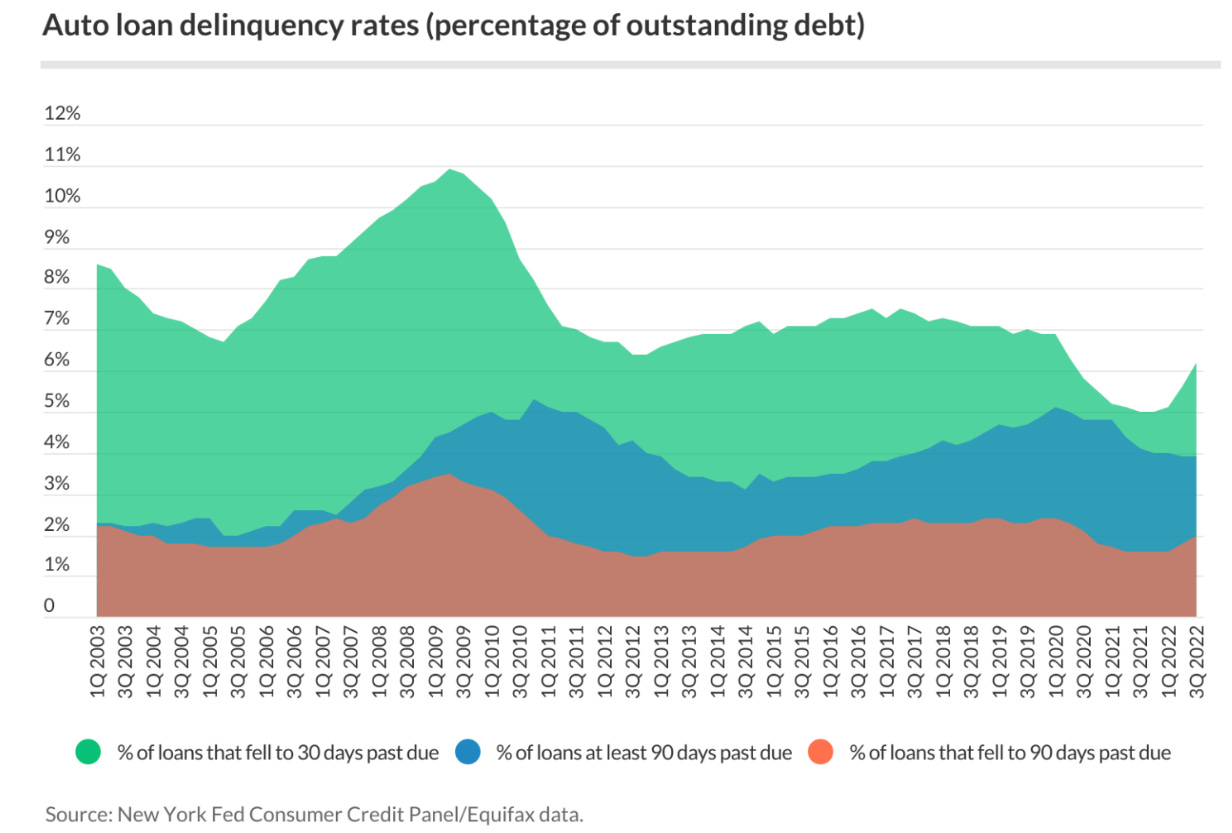

This is causing delinquencies to start climbing at a faster clip not seen since pre-2008.

Another notch on the belt of what’s holding the consumer down.

Overextended

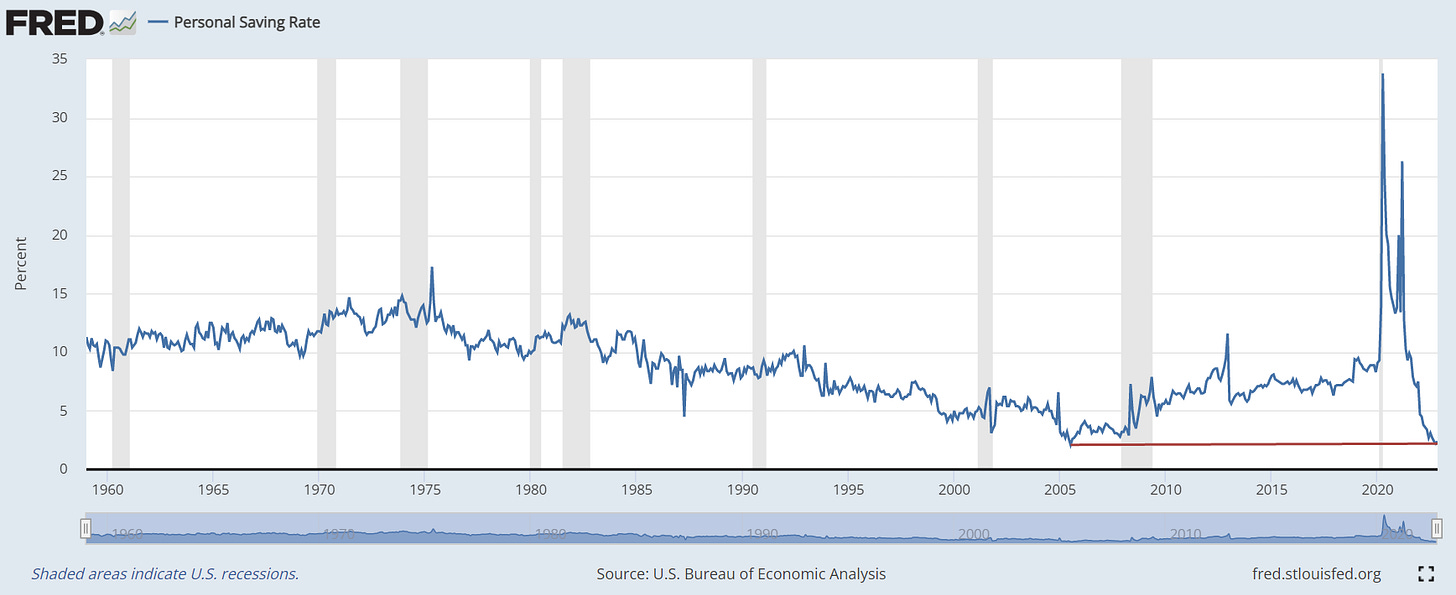

This is one that we touched base on back in our September post but back then it was 30bp higher than what it is today.

While it stands at 2.4% right now, it was 2.2% back in October which was the second lowest rate on record only being beaten by July in 2005.

What’s interesting to call out here is the trend. Moving from a 2.2% rate to a 2.4% rate suggests to us that consumers are starting to wake up to the fact that they cannot keep up their spending habits as they have been.

The fact that there was a decent savings rate uptick in virtually nothing but declines since 2021, a slowdown in retail sales, and an increase in BNPL all confirm this hypothesis in our opinion.

Time will tell just how quickly rates continue to change if they change at all and whatever disposable income is left is not used towards just maintaining an already stretched lifestyle.

The Dinner Table Looking A Little Slim

Have you noticed that food costs have continued to go up? Perhaps you’ve already made changes to your weekly grocery store run in order to not spend as much.

Well, according to Bankrate’s Nov. 23 analysis of the cost of holiday essentials, six of 10 of the most inflated prices were for food, including turkey, bakery items, eggs, flour, and prepared mixes.

Let’s take a look at the most recent holiday that just happened, Thanksgiving.

The overall average cost of a "classic" Thanksgiving dinner for 10 people, which includes things like a 16-pound turkey and a dozen dinner rolls, is $64.05. That’s almost $11 or 20% higher than the average for 2021.

How about the upcoming Christmas dinner? Well, ham is up 7.8% year over year, frozen and refrigerated bakery products are up 19.4%, and eggs are up 49.1%.

To pick at eggs real quick, look at Cal-Maine foods.

This company literally does nothing but sell eggs. A company that sells eggs has beaten your tech-heavy, innovation-driving story-type stocks. Eggs…

Because of the rising costs of food, more and more consumers are trading down to private labels in an effort to find value.

About 78% of Americans currently purchase in-store brand products, 61% are buying more private-label pantry items, and 58% are buying more private-label household merchandise.

So with prices still going up for our everyday food, and consumers already buying more private-label products just goes to show why we’re concerned about where discretionary funds will eventually be shifted to.

Concluding Thoughts

While we do not want the underlying consumer to be feeling the pressure that they have been, the data as we are interpreting it, all points to nothing but more pain ahead.

One of the easiest ways you can check the pulse of the consumer, aside from the data, is to look and see if you’ve changed anything. If your friends or family have. Odds are you know someone who’s suffering from something from the above. Whether it be trying to get a new/used car, having the price of their home drop, etc.

Our concern is that the market, and many investors, are not seeing the forest for the trees and are too dependent on inflation data and what the FED may or may not do.

That is all short-term thinking and the exact reason why we sat out market volatility for a few months before finding it appropriate again to start new positions.

While this isn’t 2008 with a main point of failure (housing), the consumer is getting hit from all angles and time will continue to show how an earnings recession is coming and quite frankly, has already come.

Thanks for reading everyone and I hope you and your family have a wonderful Christmas holiday!

Until next time,

Paul Cerro | Cedar Grove Capital Management

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Share this post