Soft Landing GDP "Bros" Are In La La Land

Why the soft landing club is getting real GDP expectations widly wrong

If you like today’s post, please like and share. If you’re interested in premium content, be sure to subscribe to our paid newsletter.

If you need a reminder of what you get by going paid, click this link and you’ll also find a promotion at the end of this post.

Hey everyone and welcome to another post by Cedar Grove Capital Management where we’re going to break down a chart of the week.

Cheers. 🍻

“Just Look at GDP”

Poking at macro yet again because an interesting perspective has crossed my desk and I’ve really started to look into it more since I am team no soft landing.

What I wanted to poke at is GDP and technically, by definition, a recession is at least 2 consecutive quarters of negative GDP growth. While that’s technically called a recession, I like many others think that measurement is complete bullshit.

Why do I say that? Because even during recessions we still have the occasional positive quarterly GDP growth in the middle of general slowdowns.

This existed in the recessions of the early 60s, 70s, 2000s, and the GFC. That’s why I think that measurement of us being in a recession or not is BS.

So here’s the argument of the soft landing club that I think makes them either be on cloud nine because they choose to ignore it or that they haven’t even really looked. They argue that the economy is still going strong because GDP is still positive, spending is still going on, and bubbly asset prices have finally started to come down from their late 2022 peak.

They continue to argue that as CPI + Core CPI comes down, the FED will finally admit victory and cut rates starting at the end of this year and into 2024 and all will be right in the world.

Wrong.

This economy is still being fueled by whatever excess savings consumers have left which from my October post was down a third and on the fast track to being gone by mid this year. You can read about that below.

So apparently with high CPI, the economy is still “strong” and posting great GDP prints despite said inflation.

However, as I’ve mentioned most of last year, the effects from monetary policy take on average anywhere from 12 - 18 months to start rippling through the economy which would mean we’re just about there to get things rolling.

So while we haven’t had a “technical recession” just yet, this is what I need you to ask yourselves if you’re a part of this camp.

What makes you think the economy is going to hold out at the current rate and only either maintain or improve?

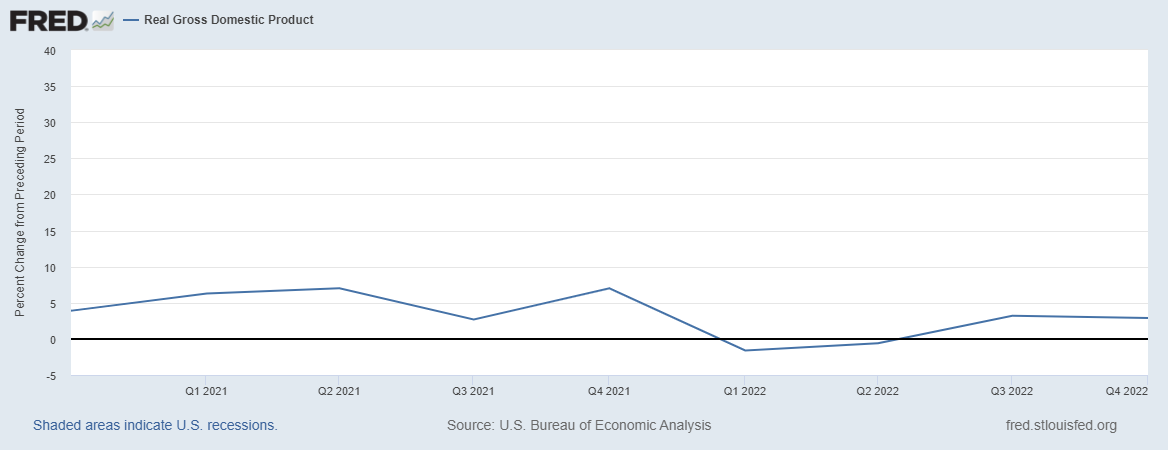

Here’s the chart to highlight this.

What I’m basically looking at is the relationship between real GDP and the Fed Funds Rate in the decade leading up to the pandemic.

That means I’m looking from Jan’10 to Jan’20 for growth in real terms.

So when I ask the above question, here’s what I mean. If over the last decade, we had on average a 0.682% Fed Funds Rate, why did we barely have 2% real GDP growth?

Literally. We had rates flat for nearly a decade so the cost to borrow money was borderline nill and yet we couldn’t get more than 2% real growth? I say 2% but in reality, the average is 2.08%.

Still, the point still stands that the soft landing camp arguing the GDP perspective somehow thinks that with nearly 5.1% terminal FFR (which could be higher now) will still mean real GDP will be okay.

Yea, okay…

Real GDP is holding up for now but I can’t imagine in a world where we have over 5% rates that we don’t get a massive economic pullback if historicals have anything to say about it.

Anyways, thanks for stopping by. For those of you that don’t know, I do run another newsletter for our private side of the business through

. This newsletter is all about SMB topics in case you're interested.Lastly, if you’re interested in joining our premium community, you can enjoy a free trial below.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech