Fund Performance

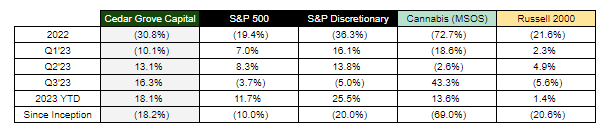

In Q3 2023, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned 16.3% gross return compared to -3.7% for the S&P 500, -5.0% for the S&P Consumer Discretionary ETF XLY, 43.3% for the Cannabis ETF, and -5.6% for the Russell 2000.

Q3 Market Commentary

If you think about how the last three months have played out, it’s been even more apparent that no one knows what’s going on.

Nobody - and I don't care if you're Warren Buffet or if you're Jimmy Buffet - nobody knows if a stock is going to go up, down, sideways or in circles. - Matthew McConaughey, Wolf of Wall Street

I can’t agree more with the above given every data point that comes out makes you think twice about what’s really going on.

However, it seems that confusion amongst macro data and channel checks has left many switching views while still keeping polarizing views on opposite sides of the spectrum. Many Wall Street analysts have flipped from being bearish in 2023, including Goldman Sachs which lowered its odds of a US recession over the next 12 months to 15%, down from a prior forecast of 20% and well below its 35% projection in March amid spring turbulence in the banking sector.

Others are now estimating the recession to be kicked out to 2024 and some believe a liquidity event is imminent.

While I have had bearish views on the consumer, my timing of Q1’23 being the beginning has been wrong. However, as much as everyone was happy that Taylor Swift was keeping the economy afloat, elsewhere the summer has proved to be an interesting one given how there seems to be plenty of evidence of a consumer slowdown.

There are just too many required costs for the consumer that have been exploding which makes matters worse for the spending engine to continue being sustainable.

For example, the average US family health insurance premium has increased from $6,000 in 2000 to $21,000 in 2022. That’s a 249% increase, or 5.8% per year. That’s more than double the annual increase for overall US prices (CPI of 2.5% per year).

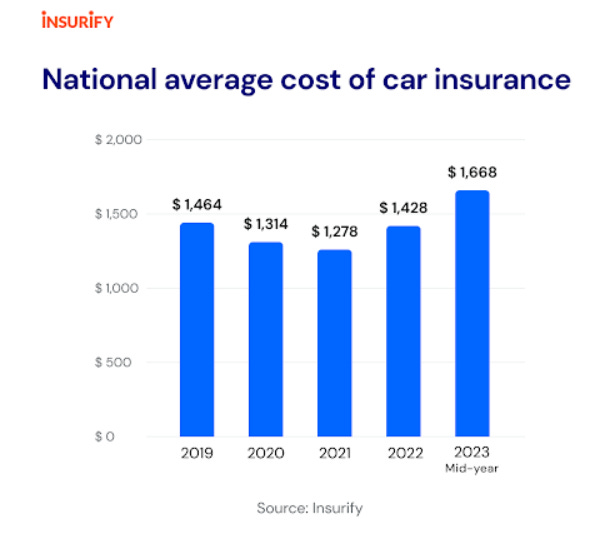

Another interesting point is the average annual cost of a car insurance policy surged $240 to $1,668 in the first six months of 2023, up from $1,428 in 2022. Prices are expected to increase another 4% before the end of the year.1 Most of the increases insurers are experiencing are due to high losses as a result of soaring auto repair prices and the effects of climate change.

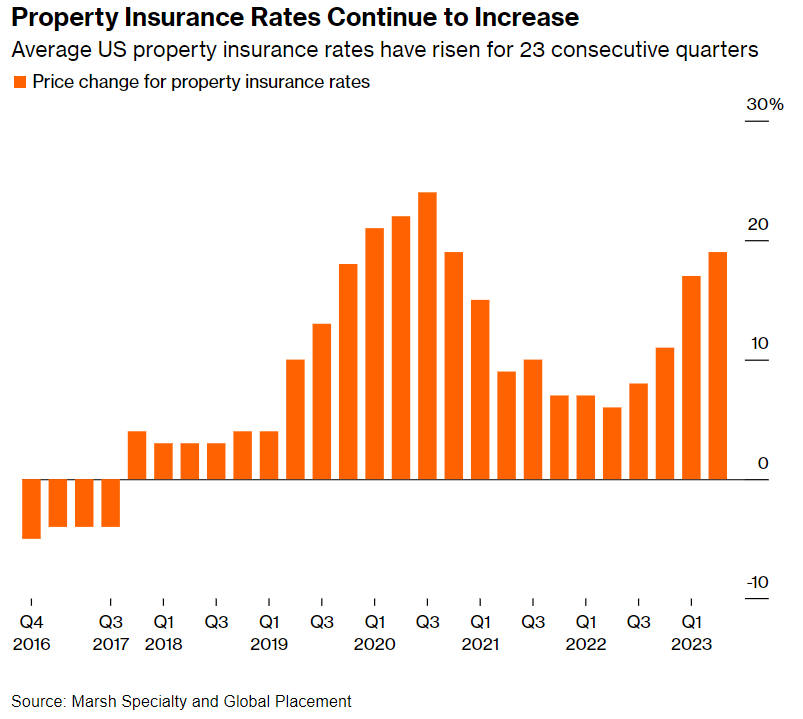

In other areas, many homeowners are now facing the harsh reality that climate change is a real threat and that insurers are either flat out not insuring them or charging them a ridiculous price.

Lastly, which was the ticking time bomb that I highlighted earlier in the year, student loans as of September have come back online with interest starting Sept 1 and payments to resume Oct 1.

To make room in American budgets for their loan payments, they’re expected to cut back other spending — to the tune of more than $100 billion annually.

About 50 percent of households making less than $50,000 a year believe they won’t be able to make all their loan payments

Even high-earning households are feeling the squeeze, with 71% of those earning at least $100,000 saying they expect to miss at least one payment when they resume

Three in four borrowers said they would need to reduce spending on nonessentials like entertainment (Netflix, Theatres, Movies, Parties) in order to afford to make their student loan payments again, while 2 in 3 said they would work extra hours to earn more or find additional work.

Several retail brands including Walmart, Target, and Levi Strauss have warned that the resumption of payments could negatively affect their earnings in the second half of 2023.

I won’t go into the whole credit card debate but my views are much like the above, consumers are getting tapped out and I still strongly believe that there will be a tipping point for consumer spending.

While unemployment has continued to be resilient, I can’t imagine there’s much more gas in the tank to allow the past spending to be sustainable.

As such, I’m still bearish on the consumer and have positioned accordingly.

Positions Quarter-End

Portfolio Commentary

In July I went shopping eventually reducing the cash position from 32% to just under 4%.

Historically, I’ve tended to run a more concentrated portfolio and didn’t trade often. This means I’ve typically had 10-15 positions in a L/S capacity across mainly tech and consumer. However, 2022 proved that my over-optimism in the consumer and later over-pessimism led to subpar returns.

Growth is all about learning from your mistakes and 2023 so far has been the rebound year for Cedar Grove Capital Management. Aside from the face-ripping short rally in Q1, the fund has been able to bounce back in Q2 and Q3.

To be clear, I’m still not optimistic about the current state of the economy and I still believe that we’re due for a sizable consumer slowdown. Keyword: slowdown.

Because of the volatility that we’ve experienced this year, I’ve upped my diversification in names from the 10-15 range to 25-35 names. This might seem overdone but considering how we just don’t know where the economy is going, running the same strategy I did in 2022 wasn’t the logical step in the right direction.

This new strategy still has me going net long but still protecting my downside via options contracts, structural shorts, and diving into large-cap value and lesser-known micro/small caps.

Cheap SPY and QQQ PUT contracts bought in early July proved to be very fruitful come August when I realized high double-digit returns in a matter of a few days.

On top of the broader theme, I’ve increased positions in M&A arb deals like iRobot (IRBT), Albertsons (ACI), and Capri Holdings (CPRI). Unfortunately, Tapestry announced the acquisition of CPRI before I could build out a full position. However, I did exit our longstanding Microsoft (MSFT) / Activision (ATVI) trade for a total return of +43.7%.

Deviating from my traditional investment in tech and consumer names, I took positions in energy (uranium + oil) and healthcare (pet health + weight loss).

In July, I posted my thoughts on the GLP-1 market and how I was bullish on the name.

Shortly after publication, I initiated a long position in Novo Nordisk (NVO). However, while I am incredibly bullish on the drug, the hype spread too far in other weight loss names such as Weight Watchers (WW) in which I also initiated a short position.

This has officially become a pair trade for GLP-1s specifically.

Closed Trades

Another great trade that I closed in July was Latch (LTCH). I initially posted my event-driven trade idea back in April.

This trade led to an over +200% ROI after the company announced its M&A deal with Honest Day’s Work and getting closer to the drop date for updated financials.

Nvidia (NVDA) was a name that I was certain would come back down to Earth but unfortunately became a face ripper. While I understand the potential of AI and the chips needed to make that a reality, the pull forward of NVDA demand seemed overdone.

Once the opportunity presented itself, I closed out the position at a loss and moved on. While time might prove me right, I was not willing to tie up capital until that might have happened and rather deploy capital elsewhere.

Closing Portfolio Remarks

I still believe the effects of higher rates and the recent end to the student loan pause will have a deeper effect than many believe. Tough decisions are going to be made, priorities will be shifted, and an exhausted consumer will look to preserve what is left in their wallets.

The name of the game going into uncharted waters with no map or a horizon is the preservation of capital and protecting the downside.

Opportunities to hedge, while not as abundant as two months ago, will still present themselves for brief pockets of time.

In the interim, I’ll still be looking to size up less volatile names and consolidate positions where necessary.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech