Fund Performance

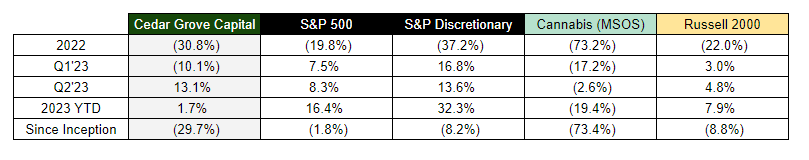

In Q2 2023, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned 13.1% gross return compared to 8.3% for the S&P 500, 13.6% for the S&P Consumer Discretionary ETF XLY, -2.6% for the Cannabis ETF, and 4.8% for the Russell 2000.

Q2 Market Commentary

The recession seems to not be here quite yet. For the most anticipated recession, it doesn’t seem like 2023 is going to be the year. Resiliency in consumer spending and job growth still defies many bearish calls, including mine.

However, while there’s still plenty of evidence that the U.S. economy is continuing to chug along, there are still worrying signs that I don’t believe the market has quite factored in.

One of these factors is student loans, which I’ve been very vocal about since our February post highlighting the dangers that might lurk around the corner should the Supreme Court strike down Biden’s forgiveness plan.

The mere fact that millions of Americans will now need to be paying back these loans after 3 years of not doing so will be quite a shock to the demand side of consumer spending. Anyone that says otherwise I feel is doing themselves a disservice but not accepting the reality that this has on people.

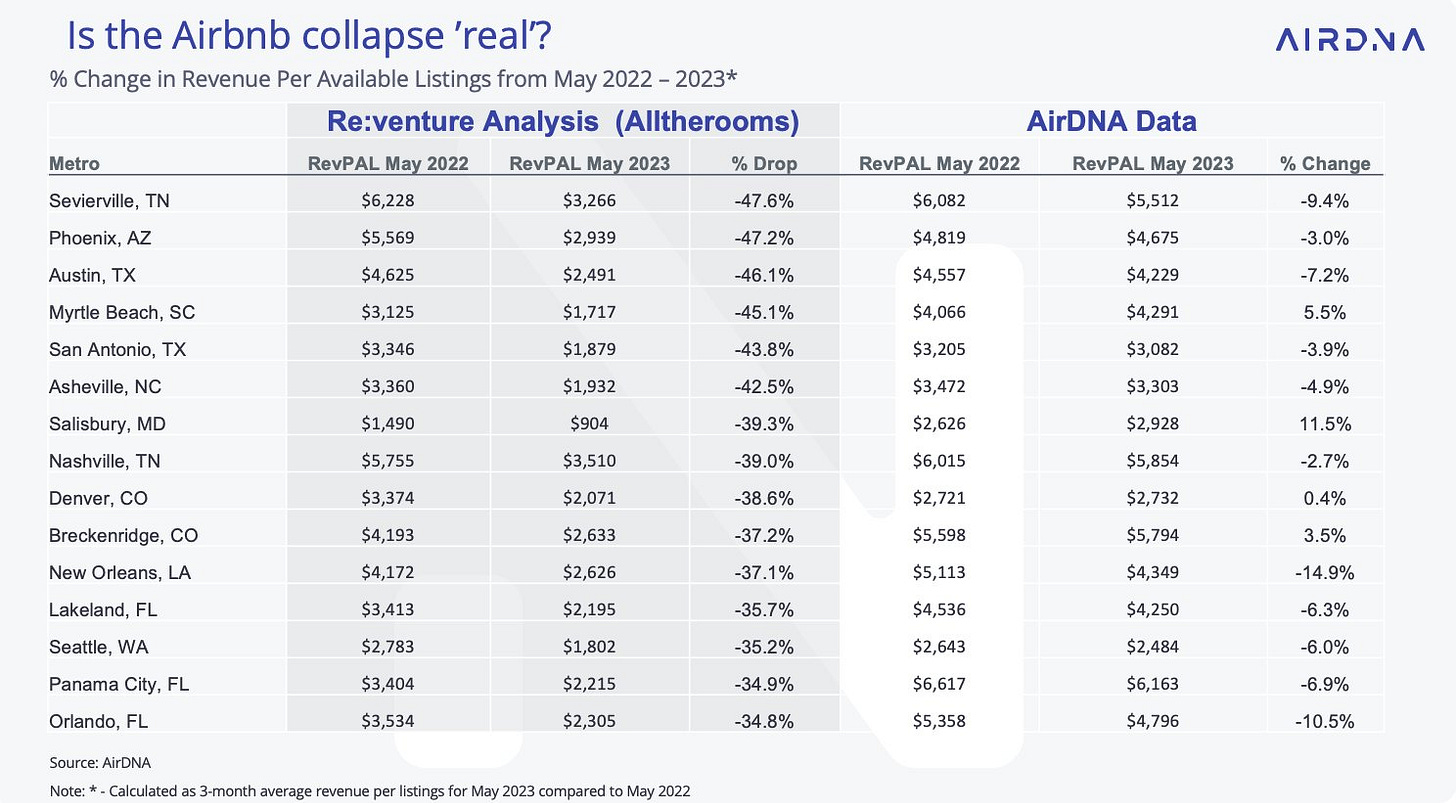

Additionally what’s interesting when it comes to consumer spending is the downturn in Airbnb rentals given that services and traveling have played a massive role in the shift from durables to experiences.

Revenge travel is seeming to slow down and turn negative in 2023 for certain once high-flying cities compared to 2022. Something to be nervous about? Not quite yet, but it’s a trend that I believe many should keep an eye out for when it comes to the health of the consumer.

And for the last chart, I wanted to show just how expensive things have gotten for the average American since 2021.

The cost of living for US households has risen over the last 2.5 years, cumulatively increasing budget outlays by over $700 per month!

Meanwhile, 60% of consumers are living pay-check-to-paycheck, and about 40% are late on bills. While the top 20% are doing well, many are not.

Not to say that wages haven’t grown alongside this but it’s important to share context for just how much of a dent inflation has caused Americans.

Given that I still believe that consumer spending will reach an inflection point, keeping an eye on how everyday prices affect CC debt levels and student loan repayments affect the consumer will be the name of the game over the next 2 quarters.

Positions

Portfolio Commentary

Since the end of Q1’23, I’ve taken much more of an active stance on positions and moved to deploy much of our sideline cash into the market towards the long side.

While we still have quite a cash war chest, our number of positions has dramatically increased. You may have noticed some positions that we’ve held in the past come back into the portfolio as conditions have changed and fundamentals have either improved or deteriorated depending on the direction of our trade.

Some of the best calls we’ve had in the 1H’23 have come from our Latch LTCH 0.00%↑ special situation call and the Activision ATVI 0.00%↑ arb trade. I’ve included both below.

While we’re still concerned about the state of the consumer, we still see opportunity in select technology names while also understanding that the time might be near to deploy cash in counter-cyclical names.

There is no perfect strategy for this and while we would like to hope for another good quarter for Q3 like we had in Q2, there are too many unknowns. This is why we’ve drawn down our cash in search of beaten-down areas that we believe make great entry points for starter positions.

Closing Portfolio Remarks

The importance of hedging and balancing risk on/off positions proved well in Q2 and we look to do more of the same in the coming months.

If you’re a student and would like to access my premium research for free for 1 year, hit the button below. You’ll need to use your ”.edu” email for it to work.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech