Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or “the fund”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Students can get access to our research at a reduced rate by clicking here. If you’re interested in using Koyfin (I highly recommend it), you can get 20% off your plan using my link here.

Peformance

In Q1 2025, Cedar Grove Capital Management (“CGC”) returned 0.38% compared to -4.27% for the S&P 500 and -9.51% for the Russell 2000, which is both a +465bp and +989bp spread from each benchmark, respectively.

Brief Portfolio Commentary

Hims and Hers Health (HIMS)

There are usually a few trades in an investor’s career that really stay with them, and it can be for a number of reasons, both good and bad. While still early in my career, I think one of them will forever be cemented as the short position we initiated with Hims and Hers Health (HIMS).

I think, without a doubt, getting squeezed for nearly a month on the name has to be one of the hardest financial and psychological trades I’ve ever been a part of. Not because I was wrong, I wasn’t, but rather because I had never anticipated a delay in the catalyst coming to fruition that would result in a short squeeze.

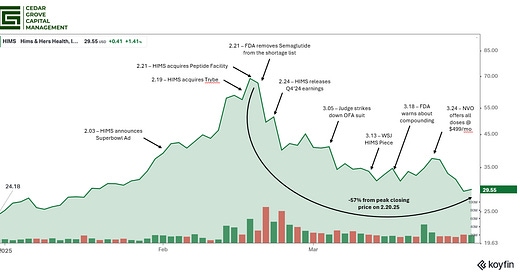

Just look at the chart below to see how much of a face ripper the name was in Q1.

The most annoying part of this trade is that we weren’t wrong and still had to deal with the pain and manage risk without blowing out the position. Just like we were able to do in Q4 of last year, we needed to get creative towards the top (without knowing it was the top at the time) to salvage the trade and buy time until what we all knew was inevitable.

We ended up sizing up our short position through the rise (via shares) and shorted long-dated options that paid out very attractive premiums — more on this in the position commentary section.

The takeaway from this trade is that while we did all the work to prove that our expected outcome was correct, there are always those external factors that can blindside you despite being right. Shorting is hard, but our track record continues to show that not only do we pick good opportunities to bet against, but even during the toughest times, managing risk and rightsizing opportunities in our favor is a skill we’ve been able to excel at thus far.

Excited to share with you the rest of the commentary on this trade and how it will positively affect the PnL by year’s end, further below.

LENSAR (LNSR)

LENSAR was a recent name that we pitched long near the end of February, calling it deeply undervalued and having many characteristics that were ideal for an outsized return in the coming years.

What we didn’t anticipate was how well the market would digest their earnings release just a few days later, and the stock ended up returning ~80% in a month, not that we’re complaining.

The annoying part is that the company announced a buyout offer from Alcon (ALC) on March 24th for $14/share with a CVR attached. Annoying because the stock is worth >$20/share, but unfortunately, it looks like the odds are not in our favor to strike down the deal despite our call for one in our recent open letter.

Here’s the additional trade, for those who are new to the position, which could work out for those who are interested.

LNSR makes its money in two ways.

Selling the actual medical devices (or leases) and,

Charges for each procedure that is performed.

The CVR attached to this transaction is a $2.75/share based on the company being able to achieve 614,000 cumulative procedures with LENSAR’s products between January 1, 2026, and December 31, 2027.

To put things into perspective, ending FY’24 the company was able to achieve nearly 170,000 procedures.

While the goal might be farfetched, it might not necessarily be, and here’s why. The company’s number of procedures jumped by ~24% y/y between 2023 and 2024, and that was mainly from the drive domestically. Since getting additional clearances internationally in Q3’24, we should be seeing a meaningful uptick in system sales in FY’25, which should fuel additional growth in the international markets.

In order for the condition to be met (614k procedures in FY’26 and ‘27), over the next 3 years, the number of procedures would need to compound at 26.5% p.a.

While aggressive, you do need to factor in that the network effects from being under Alcon should help them break into new territories and utilize sales teams to penetrate further into existing ones.

This is where the trade gets really interesting. We see no reason why the buyout offer wouldn’t go through, so currently, the $14/share price is the floor that the stock should trade at, and anything above is considered the “option price”.

At the time of writing this letter, the “option” is being priced at -$0.15 due to the transaction being priced under the takeout offer of $14. The deal is expected to close in Q3’25, and once that happens, you’ll be entitled to the possible CVR that could pay out if the company meets the conditions by the end of FY’27.

So at the current moment, ALC is effectively paying you $0.15/share (~2% annualized yield) with a $2.75/share payout if they meet their target. This means that your CVR call option is effectively free, and you get the upside benefit of the CVR coming to fruition.

However, this is not without regulatory risk.

Alcon, along with Johnson and Johnson Services, holds around 50% of the market share for cataract surgery devices. That is not an insignificant number, and though LNSR is very small at the moment, we shouldn’t discount the probability that the FTC will move to block this deal.

Given it is a new administration and not Lina Khan’s old one, the jury is out on how they’d respond.

The bright side, we think LNSR should be a standalone company, as the buyout price doesn’t reflect the full value of the company, in our opinion. The trade-offs here are that you have the deal go through and you’re paying very little for the option (mentioned above), or it doesn’t, and the price slumps and arguably sets up net new investors for the upside that should materialize in the coming years.

So, if you’re new to this trade, this seems like an interesting situation to take a risk on if you think it fits your investment criteria.

General Commentary

Coming into the year, I did not know what to expect. Truly. However, I did know that Trump wasn’t going to be as good for the economy as many were thinking, but I didn’t know how long it would take for that to play out.

While I knew he wasn’t going to be good, I was one of the people who thought the tariffs weren’t going to happen and that they would be used as a negotiation tactic. This seemed like the right assumption, especially after the first round of tariff threats got postponed in February as he got concessions almost immediately.

Clearly, this didn’t end up being the case, and now we’re all in the same position of being dumbfounded that these tariffs are the new normal. It’s no surprise that the markets have responded negatively to this new strategy, which has proven to be difficult.

As I’ve sat here thinking about what to write everyone during the quarter, I’m not sure what “new” information I can give you regarding the market, as I’m fairly confident that this has been the most tracked first 100 days of a presidency since probably the Obama era.

But one thing I will share is this. While I was only just a teenager at the start of the GFC, I was working on the street during the 2018 drawdown and obviously, the (hopefully) once-in-a-lifetime pandemic of 2020 and the drawdown in 2022.

What I have personally learned from those experiences, which I failed to realize until apparently enough reps had taken place, is that

There’s no way we’re going to time our investments perfectly or even well, for that matter, and

Unless the world comes to an end, the market does eventually rebound, though the ride down might be a painful one.

This has been proven time and time again, and while the move here under Trump is unprecedented at this scale in the modern era, I do think eventually push will come to shove and we’ll find another way out of this. I’m not sure how this will get retracted, but I think it will come from Trump’s party once their own GOP constituents come together in uproar over the changes and policies being implemented.

Though, how does anyone effectively navigate this level of uncertainty? I think that’s where our approach as a multi-strategy fund, while remaining disciplined in both risk and deployment of capital, has led us to the outperformance that we’re currently seeing against our IWM benchmark.

As a reminder, our multi-strategy approach encompasses holding a majority of our capital in core long positions that we believe can greatly appreciate over the next few years while also deploying capital in opportunistic special situations (M&A arb, turnarounds, spin-offs, etc) and short trades.

This balance has allowed us to generate alpha when markets are functionally normally and protects us against aggressive drawdowns like we’re seeing right now, not to mention our decision to go into the new year with a sizeable amount of cash and taking some off the table as the quarter progressed.

I think there are some areas that we will continue investing in and entrenching our position while keeping an eye on how others are developing.

Have a look below at some of those thoughts, as well as our current holdings (buys/sells) and notable commentary.

What We’re Keeping An Eye On

The Bond Market is Telling Us Something

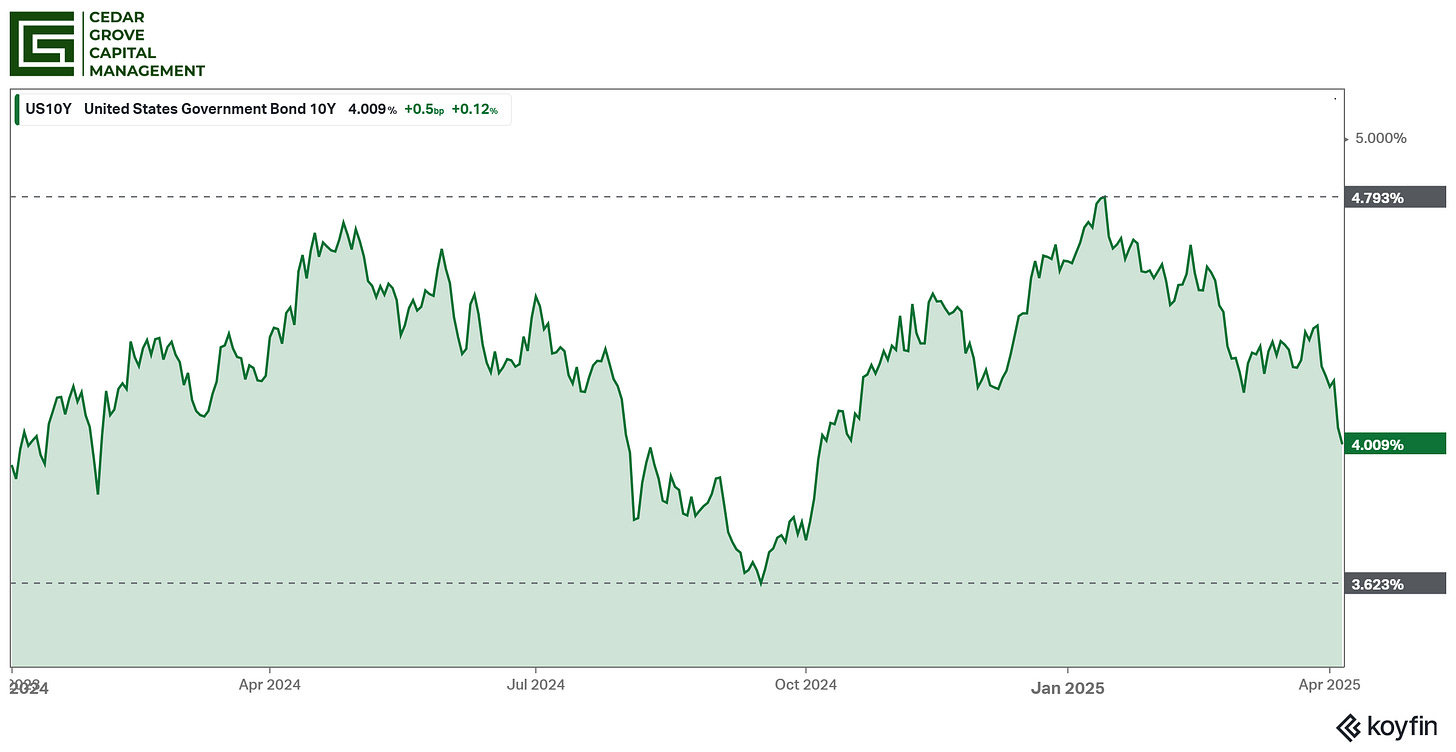

Since Trump was announced the next president and he started picking his cabinet, nominated (and then confirmed) U.S. Treasury Secretary Scott Bessent has been saying that we need to get the 10Y yield down in order to right-size our budget and help bring down the deficit.

At first, Wall Street believed that the Trump 2.0 administration would be very pro-business and therefore, risk-on assets were the trade.

That led the 10Y to spike up to the highest point in well over a year before people started waking up to the fact that there would be volatility ahead.

Since then, the 10Y has dropped >70bps and briefly broke 4% on Friday during the second hard day of the sell-off.

The reason we’re watching this is because we all know how the bond market reacts when it comes to instability or uncertainty. We highlighted on Twitter at the start of the year a clip we saw from one of our go-to podcasts, called The Compound, where they interviewed Nick Colas, Co-Founder of DataTrek Research, about the recent FED Cut (back in December).

This video really stood out to us, which we included below.

“If the 10Y ends next year [2025] at 3, then you know something went wrong.”

That’s been in my mind ever since I saw that podcast, but I just didn’t necessarily know how we’d get there. Speed up a little, and now I’m pretty confident in how we get there, which doesn’t bode well for risk-on assets.

A slew of research shops and banks have already come out raising their odds of a recession, ranging anywhere from 35% to 60% vs 15% - 40% before the tariffs were announced.

So while we’re not banking on a recession happening since we hope these tariffs won’t stick, we’re certainly keeping an eye on the 10Y and a possible position into long-duration rates via TLT.

RFK Jr. Assault on Healthcare Agencies

We knew that RFK Jr. was not going to be good for healthcare, but we were also under the impression that, at least for the most part, there would be checks and balances in place to hopefully keep him in check.

Recent purges in HHS, the FDA, and other government-funded programs are significantly deepening worries that the review process for new drugs will slow the bringing of new treatments to market and hinder future innovation.

While we were bullish coming into the new year on healthcare, going forward, absent any tariffs, our scope will narrow for opportunities in the space that aren’t already FDA-approved, on-market, and limited from reliance on insurance coverage for access.

We do hold one pure-play position in pharmaceuticals, which we’ll discuss below.

Positions Quarter-End + Commentary

Below, we’ll show our current positions, divestments, and commentary on HIMS, CPRI, BBW, NVO, and a quick note on PRKR.