Prisoner's Dilemma: When (If?) to Run for the Exit

Investors currently facing tough decisions heading into the end of the year

2024 has been one hell of a year. As of writing this post, the SPY is up 28.3% and the QQQ is up 29.1% on a total return basis, respectively.

Everywhere you turn, everyone seems to be making money hand over fist. Records are consistently reached in many speculative names, assets, and ETFs. In fact, the S&P (SPY) has hit 57 new all-time highs in just this year alone and the beloved Bitcoin (BTC) finally breached $100k for the first time.

It’s crazy to see considering that ever since Trump won the presidency, nearly everything that wasn’t nailed to the ground has only gone up and to the right. This makes even the most inexperienced investors feel like geniuses and value-investing veterans like David Einhorn are left scratching their heads.

But with the S&P up over 24% last year and another expected >25% gain this year, this would be just the 4th time in the past 100 years the index logged 20%-plus returns two years in a row.

What does history suggest for the third year and why it’s putting funds in a very tough spot? BofA shared their commentary below.

Twice, in the 1920s and 1930s, after two years of 20%+ returns, the S&P 500 pulled back in its third year. After big rallies in 1927 and 1928, the year 1929 included the infamous Black Monday, when stocks fell 13%, setting in motion the events that led to the Great Depression.

The 1935-36 rally represents what turned out to be a false dawn amid the Great Depression. Just as the New Deal seemed to have put the U.S. economy back on track, it plunged back into another steep recession that lasted until World War II.

After big gains in 1954 and 1955, the S&P 500 merely eked out a narrow gain in its third year in 1956. It was the tail end of the long post-war bull market that started in June 1949 and ended in August 1956.

In 1995-1996, the S&P 500’s rally kept going, with stocks posting big gains in each of the next three years until 2000 when it saw three straight years of losses.1

So the takeaway here is that history is mixed. There’s no clear outcome or even a high confidence in one way or another that investors can lean on.

Given that history can’t help, this puts investors in an interesting predicament.

Normally, tax-loss harvesting would have already occurred ahead of a potential Santa Rally, but because there are hardly any mainstream stocks (think broader indices) that are down for the year, there’s little harvesting to be done.

For instance, in the S&P 500, there are technically 181 companies with a negative return for the year as of market close 12.12.24.

However, only 28 of the 181 have negative returns that exceed 10%. That’s not that much, and as a fund manager, do you sell off your “losers” that are down less than 10% on the year? Probably not.

So this brings us to the next issue. If tax loss harvesting has been delayed for the time being, how do managers prepare for what’s to come?

Do they try and front-run any potential sellers in the new year to lock in gains and thus incentive fees but realize 2024 tax gains? Or do they start selling in the new year to realize these gains before others and delay tax implications for at least a year?

It’s tough to say because, in reality, you have arguably one of the most pro-business/government change administrations due to come to office in two short months.

It’s not like you can diversify either. The U.S. has been and is quickly becoming the dominant place for investors to deploy their capital. For instance, U.S. stocks as a percentage of Global Market Cap represent >60% of the total equity market globally.

The U.S.’s nearly $60 trillion market cap is almost 2x that of ALL Asian and European stock markets combined.

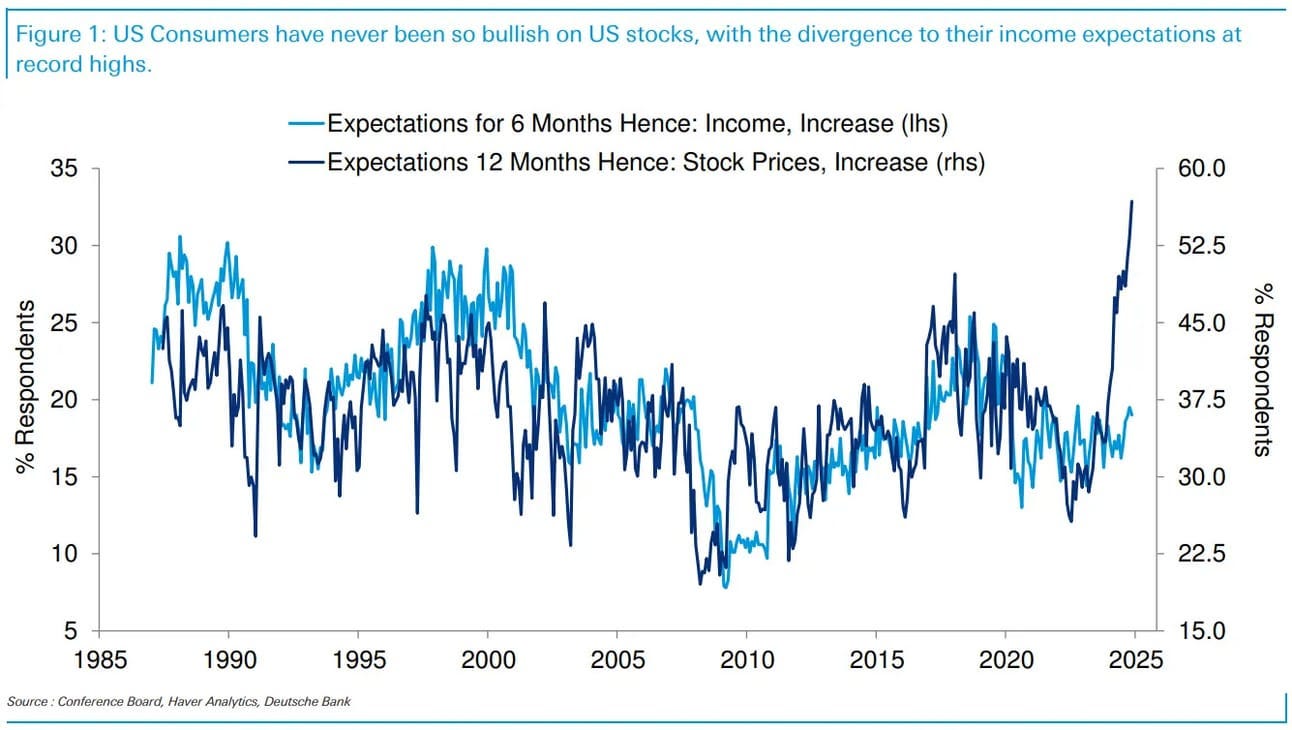

This has led to massive net inflows of cash into U.S. equity funds over the last ~5 years, even surpassing the heights of the 2021 COVID mania.

With so much money coming in and riding the coattails of what a Trump Presidency can bring (ex, corporate tax cuts), this is pushing U.S. stock market valuations to more than what we saw in 2021 and 1929.

A measure of valuation that we can link to this claim relates back to the ratio of the market capitalization of U.S. non-financial companies to “gross value-added” or corporate revenues generated incrementally at each stage of production.

It’s a valuation metric that has reliably been a gauge for the subsequent returns and potential losses of the S&P 500 index over the following 10 to 12 years.

Quoting the Financial Times regarding the above chart,

A security is nothing but a claim on some future set of cash flows that will be delivered to investors over time. Regardless of short-term outcomes, the higher the price investors pay for a given set of future cash flows, the lower the long-term return they can expect. A reliable valuation measure is simply shorthand for such an analysis.

Similar to its predecessors, this speculative episode has been accompanied by exuberant sentiment about innovation-led growth, perpetual expansion in profits, and a tendency among investors to root expectations about economic and investment prospects in optimism. As The Business Week observed in 1929: “This illusion is summed up in the phrase ‘the new era’. The phrase itself is not new. Every period of speculation rediscovers it.

The problem is not that investors believe in a new era. Rather, the problem is the failure to recognise that the entire history of entrepreneurial capitalism is made of no substance other than the repeated succession of new eras, one upon the next, like layers of sedimentary rock, or rings in the trunk of an ancient tree.”2

Because the newest layer of economic innovation is typically the most profitable, each new era is accompanied by the belief that high-profit margins justify market valuations far beyond historical norms.

The tendency of megacap stocks to lag the market is temporarily suspended during advances to extremes as glamour companies gain lopsided capitalizations. The persistent increase in U.S. corporate profit margins in recent decades seems to offer some justification for this behavior.

And when you have markets that are hell-bent on this innovation and growth, you end up paying up for names that just convince algorithms and other investors to follow suit and create broader “momentum” which continues to snowball.

Then the problem becomes when momentum slows down, which is what we saw earlier this week. On Monday, December 9th, the market saw the worst day for momentum names in all of 2024.

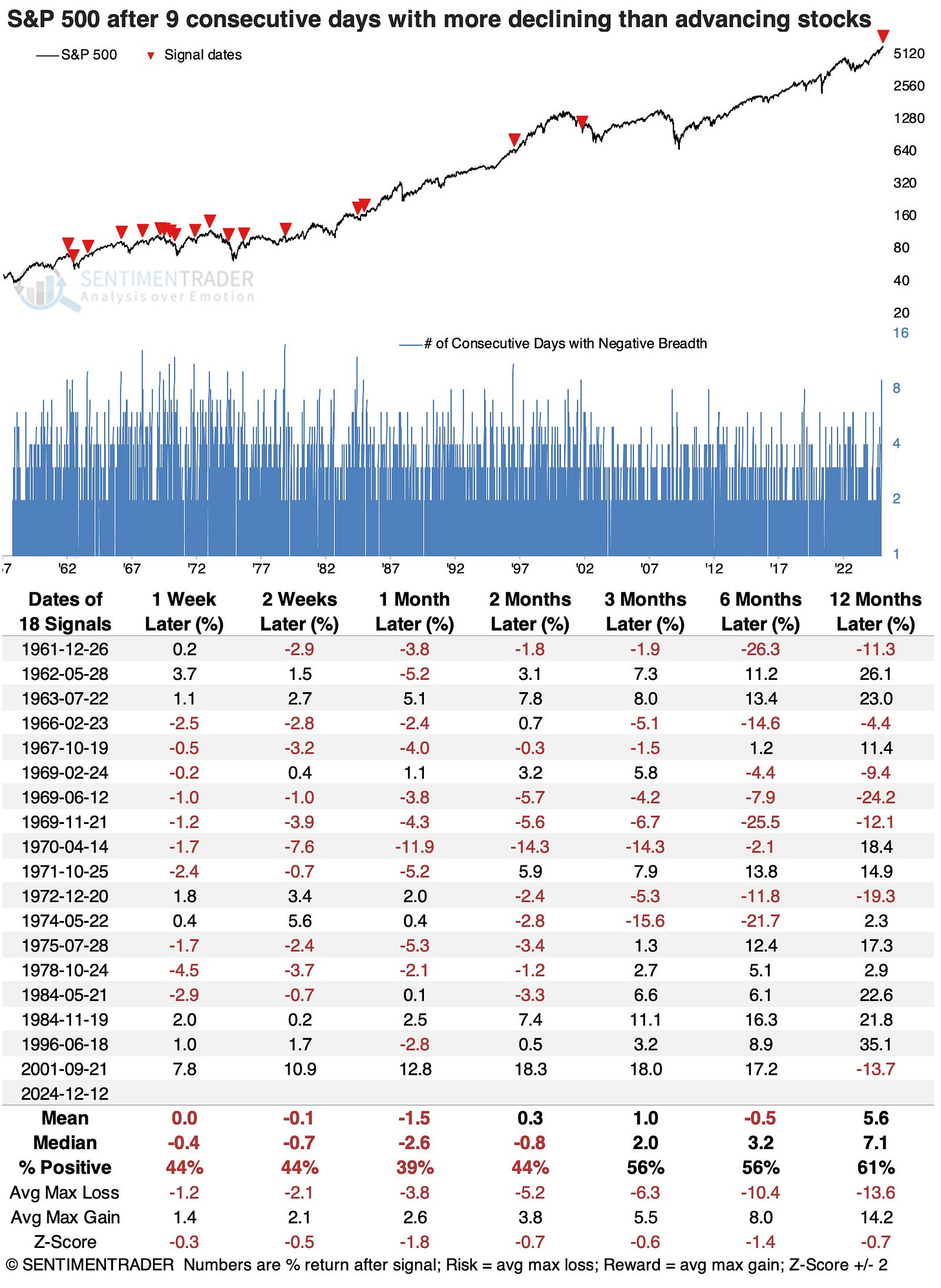

Additionally, yesterday marked the S&P 500's 9th consecutive session with negative breadth.3

That's happened fewer than 20 times in ~70 years.

On average, the S&P has been -12% from its high during these streaks. Yesterday marked the closest the S&P has been to its high.

The 2 most similar were Dec 1961 and Feb 1966, both within 2% of a high at the time.

And that might scare people but based on a small sample size on Twitter, it doesn’t seem like the majority is all too nervous about momentum slowing and perhaps just further reinforces dip buying.

Though I’m not sure just how long this optimism will last. As the market keeps going up and people are still optimistic about the future, is there a sign that someone might know something?

I now present you insider selling.

Record numbers of U.S. executives are selling shares in their companies and setting a record high for any quarter in two decades, according to VerityData.

While insider selling is routine — especially as the stock market was already breaking records before Trump’s win — the surge following November 5 underscores how U.S. executives are already profiting personally from his return before he re-enters the White House.

The S&P 500 jumped 2.5% the day after the election, its best day in more than two years.

“Generally with selling, in terms of predictiveness, insiders are early by about two or three quarters. As they start seeing froth in the market is when they try to generate liquidity more aggressively.” - Goldman Sachs

Perhaps it’s a sign, but also, who knows?

I’m not saying any of this is a reason to sell either. I’m optimistic about the future but I’m also not naive to think that everything that’s been going on makes total sense.

I, like many others reading this, am also in that prisoner’s dilemma and am trying to figure out how to strategically preserve capital while not missing out on further upside.

Parting Thoughts

I think as a market participant, you have to take Trump at his word. His whole campaign was based on radical change that was going to get the U.S. back on track and ‘Make America Great Again’ (MAGA).

Promising radical change means you have to commit to it or you’re screwed come the next election cycle. With a full sweep in all three bodies of government, a lot can get done with that kind of power.

The problem with change is that it’s typically painful and hardly ever pleasant. People can promise you the stars, moon, and sun but that doesn’t mean that getting them is going to be easy.

I think people are overhyping the positive effects that Trump’s proposed measures and cabinet picks thus far and completely discounting the negatives.

Blowing out the deficit by reducing taxes and not enough spending will dramatically slow the economy.

Imposing tariffs is inherently inflationary and that might mean the FED pauses its rate-cutting cycle in 2025 and might even raise rates.

Deporting illegals (with what money or means?) constricts the labor supply and increases wage expenses for businesses.

Oh, and creating a national Bitcoin reserve isn’t going to solve anything.

Time will tell what happens but things are priced for perfection right now and unless you think perfection is coming, it’s just a matter of who’s going to be headed for the door first and when.

I hope you enjoyed today’s post. Consider subscribing to get more content like this and please make sure to tell your friends.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.

According to research from Bank of America Securities worth noting the report looks at price returns, not total returns which include dividends, and that the report counts a multi-year streak in the late 1990s as one instance.)

I'm a little baffled by all the US value investors mulling what they can do now that the S&P is pretty clearly in speculative territory. Crazy idea but... look elsewhere?

UK stocks are super cheap. The FTSE100 has grown earnings 200% since 2005, versus the S&P's 300%; and yet is up just 70-80%, versus the S&P's 500%. That means >80% of the outperformance has been multiple expansion.

There are some fantastic opportunities in emerging markets too. Or even sticking in the US, as long as you're willing to wade into small cap.

At a high level, value investing is not very complicated. Buy undervalued things, sell overvalued things. If you REALLY can't find anything undervalued, cash is fine - you're probably near a top anyway.

Thank you for the insightful article! I personally think there is a need for more clarity on Trump’s stance regarding Bitcoin and cryptocurrency. It’s baffling that he doesn’t seem to grasp how every dollar funneled into Bitcoin is a dollar diverted from productive investments that could benefit the broader economy. Beyond that, the real-world utility of crypto and blockchain right now seems limited to speculation and, unfortunately, facilitating illicit activities like money laundering. While blockchain tech has potential, its current misuse often overshadows any legitimate benefits.