M&A Arb: Dick's Sporting Goods (DKS) Acquires Foot Locker (FL)

The asymmetric opportunity after the DKS sell-off last week

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or “the fund”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Students can get access to our research at a reduced rate by clicking here. If you’re interested in using Koyfin (I highly recommend it), you can get 20% off your plan using my link here.

Interested in becoming an LP? Click here to fill out the contact form.

Deal Overview

On Thursday, DICK’s Sporting Goods (DKS) announced that they were going to acquire Foot Locker (FL) for $24/share (~$2.4 billion), +86% premium.

As part of the deal, DKS gave FL shareholders the option of taking the $24/share in cash or electing to take 0.1168 shares of DKS common stock in exchange.

DKS investors, apparently, did not like this deal, and the company sold off ~15% from the previous day’s close, about $2.4 billion in market cap (basically the entire value of the deal).

While the deal is confusing as to why DKS decided to acquire FL, investors were quick to dismiss not just the arb trade at hand but also the new company going forward.

Given the aggressive sell-off in DKS post-announcement, we think that this arb trade leads to a very asymmetric opportunity at these levels for those looking to get involved.

*Disclaimer: We’ve taken a position in this trade and highlight not only a) why we structured our trade this way, but also b) why this asymmetric opportunity exists.

With that, let’s begin…

***If you’re new to our research, you can take a look at our recent Arb trade with Soho House (SHCO) here, for free.

Analyzing the Deal Fundamentals

Before we dive into the trade structure and outcomes, we first need to go over not just why DICK’s Sporting Goods (DKS) wants to acquire Foot Locker (FL) but also why the market had such a negative reaction to it.

Both of these will segway into why we decided to take a position. In the meantime, we will plug in our fellow C&R research resident, Matt McClintock, who shared his thoughts on the trade via Twitter.

It’s not a long read, but it will give you a taste of our seemingly overlapping viewpoints. But now, back to the paid programming.

Why DKS Wants FL

At first glance, it seems very weird for DKS wanting to acquire FL, given that they have some overlap, but overwhelmingly, they don’t. Ed Stack (chairman) and Lauren Hobart (CEO) both seemed to have a bullish stance on incorporating FL into their company.

According to Ed, there’s plenty to “give” to FL as far as what DKS has accomplished.

"We believe there is meaningful opportunity for growth ahead. By applying our operational expertise to this iconic business, we see a clear path to further unlocking growth and enhancing Foot Locker's position in the industry. Together, we will leverage the complementary strengths of both organizations to better serve the broad and evolving needs of global sports retail consumers."

Pay attention to the boldened part around “applying operational expertise,” we’ll touch upon that shortly.

But in their PR, they highlighted the five key reasons why they think it makes sense.

Create a global platform within the growing sports retail industry. → DKS doubles its TAM to $300bn globally with 3,300 stores across 26 countries.

Serve a broader set of consumers across differentiated concepts. → Allows DKS to offer its expertise with apparel & team sports, better innovation and high heat product access.

Strengthen relationships with brand partners through global reach.

Invest in future growth through an industry-leading omnichannel experience.

Unlock operational efficiencies that create shareholder value.

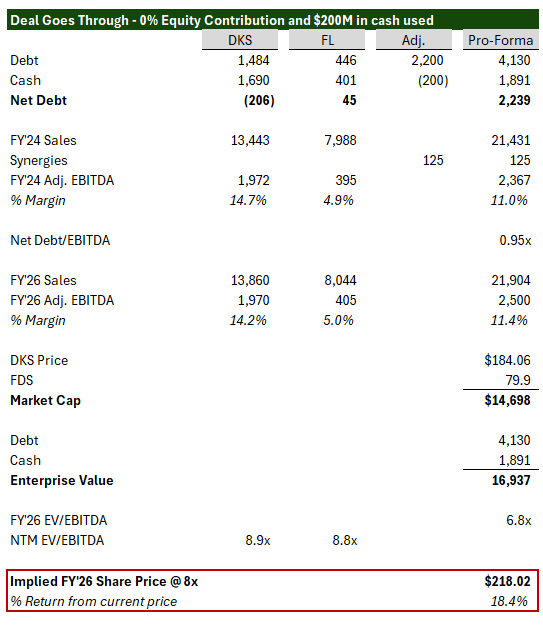

And to point #5, DKS expects to deliver between $100 to $125 million in cost synergies in the medium-term achieved through procurement and direct sourcing efficiencies.

If you’ve ever worked in investment banking, you know just as well as we do that M&A synergies rarely ever go according to plan, so take that number with a grain of salt.

All seems well in their eyes, but clearly their investor base didn’t think so, which is why they discounted DKS stock by the full $2.4 billion as if the entire deal was being underwritten with the exchange ratio, which doesn’t have a minimum or maximum, by the way.

Another point that we wanted to bring up, which was shared with us by another analyst, was that maybe this acquisition was just DKS realizing that FL is a distressed asset, and they could acquire it for a reasonable price.

Not saying that’s the case, but with DKS management seeing a brighter future under this transaction, we do see things slightly differently.

Synergies? Are You Sure?

What initially confused us about this deal is that DKS was preaching about how the combined company makes a lot of sense when they’re trying to appeal to a similar customer and expand their reach, but at the same time, they’re going to operate Foot Locker as a standalone business.

It confuses us because the two businesses, while having some similarities, are very different, which is why the whole “applying operational expertise” didn’t make much sense and why we think investors didn’t like the transaction.

Different Models

DKS, for instance, is a big box retailer of sporting goods and equipment that operates under a low-touch (LT) model. I.e., if you’re a customer who walks through the door, you more or less know where you need to go, can shop for yourself, and only if you have questions, will you reach out to a sales associate for help. That’s generally how their LT model works, which is why the store can throttle employees up and down, dependent on need, because that’s just how the nature of that business works.

For Foot Locker, it’s entirely different. They are not a big box retailer, and by the nature of their business, they are considered a high-touch (HT) business model. I.e., when you go into a Foot Locker, the odds of you going there to try on shoes to make a purchase are high, which almost always requires you to need a sales associate to help you.

This is partially why DKS can achieve 14.7% adjusted EBITDA margins in FY’24 vs 4.9% for Foot Locker, despite DKS generating ~68% more in annual sales ($13.4 billion vs ~$8 billion).

They’re just different models, so to leverage their expertise at Foot Locker, it doesn’t make much sense, but that doesn’t necessarily mean there aren’t synergies there.

Vendor Sourcing & Procurement

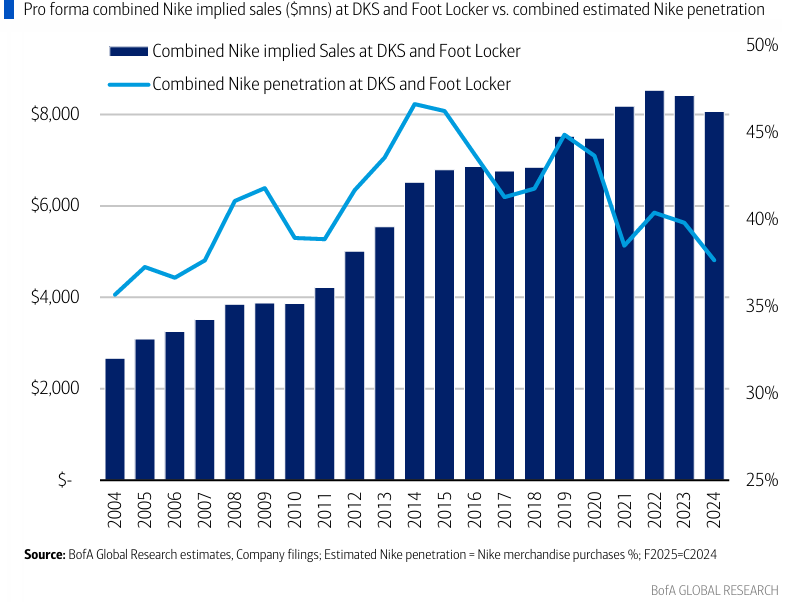

DKS plans to at least make up for some of the synergies on this deal revolves around the procurement and sourcing of their products. This is largely dominated by each of their allocations to Nike (NKE), which, depending on which company you’re looking at, has either had a bumpy relationship or not.

With both companies now being able to leverage larger purchase orders, favorable pricing, and better allocation to brands with “hot” launches (more merchandise sold at full price). The allocation comes from brands that have limited releases (typically better margins), and given the newly pro-forma shoe penetration that they’ll have, it seems that they’ll be able to get better pricing just from the sheer size of the company.

This is the most obvious cost synergy that would come from.

But just like many companies that want to further push into the category that they’re in, that doesn’t necessarily come without a scratch.

Why We Think There Could Be Issues

Potential FTC Involvement?

Here’s where it gets interesting. If you look at the closing price of FL on Friday at $23.85, the market is implying the deal closes with a spread of just 0.62% to the offer price of $24/share.

However, we’re not so sure it’s that clean cut. The reason we suspect this is because of two distinct reasons.

On a pro-forma basis, DKS will have significant market penetration in the US footwear category.

Both have significant exposure to Nike's (NKE) wholesale revenue.

1) Market Penetration

If you followed our hotly covered research into the Tapestry (TPR) acquisition of Capri (CPRI) last year, you might have PTSD just like we do. However, taking our learnings from that debacle, we think there could be issues with their newfound market share.

For instance, based on BofA market data, DKS currently has a U.S. footwear sales penetration of ~28%, and with the addition of Foot Locker, that number is estimated to go up to ~50%.

However, BofA notes that pro-forma U.S. share is 15.3% based on Circana and proprietary data DKS uses for the industry.

“We think some scrutiny is warranted given Euromonitor shows historical PF share of ~26% (close to ’23 merger guidelines of >30% share being anticompetitive).”

As a reminder, the TPR/CPRI merger was terminated because of their U.S. handbag market share, and Sportsman’s Warehouse and Great Outdoors Group merger was terminated in 2021 on product market review, while competitive effects on vendors were likely also considered.

2) Exposure to Nike

Historically speaking, Nike predominantly sold a lot of its merchandise through wholesale channels. However, under John Donahoe, they dialed back the wholesale channel significantly and opted to push for their own DTC arm and omnichannel approach.

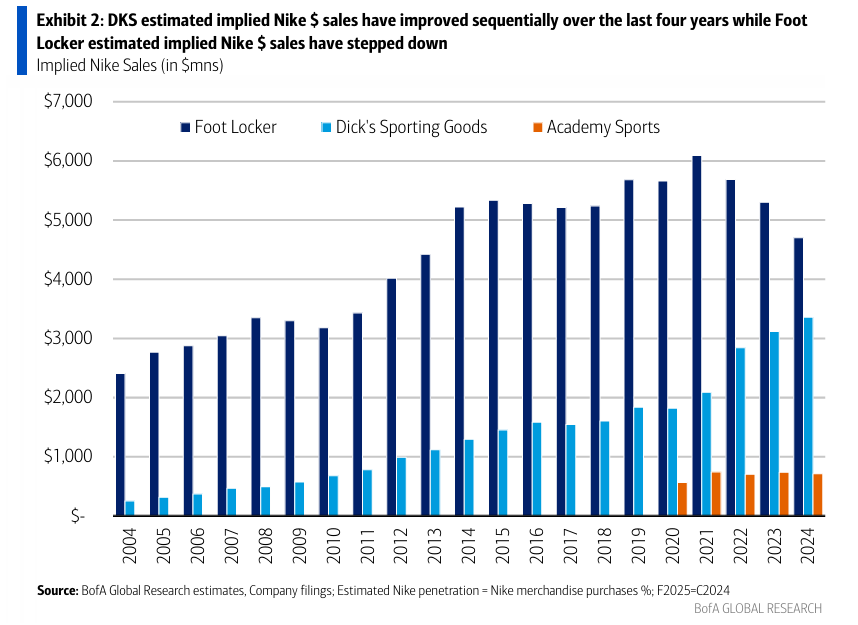

This meant that retailers like DKS and FL weren’t able to get better allocations of NKE footwear, and given how exposed FL was to NKE wholesale merchandise, they took the biggest brunt of it.

Donahoe isn’t around anymore, and Elliot Hill (new NKE CEO) has started to dial back the DTC push (mainly because they understand there are issues with doing that), which has been favorable to FL, given they’ve returned to allocation growth with NKE in Q4.

As of FY’24, Nike represented 25% and 59% of DKS’ and Foot Locker’s respective merchandise purchases. On a pro-forma adjusted basis, NKE penetration could be ~38% of the new company.

The reason this matters is because of a double-edged sword. On one hand, NKE is at the mercy of allocating wholesale merchandise to one company now instead of two. This could be meaningful in the eyes of the FTC if they’re trying to avoid a similar situation with the aforementioned Sportsman’s Wearhouse and Great Outdoors merger.

So, while an argument can be made that NKE would be at the mercy of any potential bullying from the new DKS company, it actually cuts both ways.

With the newly formed company, DKS could argue that IT could avoid being bullied around by NKE regarding allocation, and that this safeguards their future business relationship by having both parties aligned.

We’re not saying one POV is better than the other, but we are saying that this exposure with NKE is something to take seriously, and while the new FTC is headed by a Trump appointee now (no longer Lina Khan), it’s not entirely accurate to assume that no issues could be found.

These two points (market penetration/share + NKE exposure) are why we’ve decided to structure our trade this way (below).

Our Trade

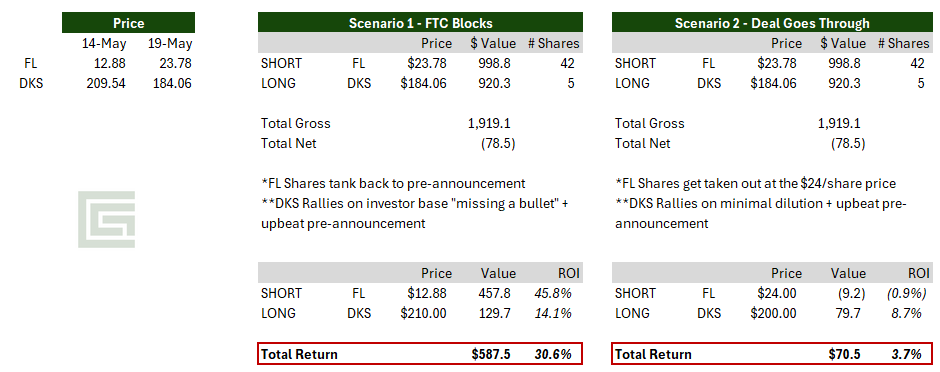

On Thursday, we shared with paid investors our note that we decided to enter this trade. There’s actually a lot we liked about this trade, which is why we structured it via common shares, which allows us to be neutral on the position but bring up our overall gross.

Long: DICK’S Sporting Goods (DKS)

Short: Foot Locker (FL); annualized borrow @ ~0.3% annualized

While keeping our position value neutral, we think that this is where the greater outcome comes from, whichever decision comes to fruition.

We’re only outlining two scenarios that have the highest likelihood, and these scenarios only encompass the deal ahead of us and are not inclusive of anything Trump may do to derail things in the broader economy.

***The example below is just a scenario using $1,000 per leg as the trade. This is not advice on how to structure the trade. It is just for illustrative purposes of how we did it.

Scenario #1

The reason we lean towards Scenario #1 is that there are some risks associated with this transaction. As we highlighted before, pro-forma DKS and FL will have a sizeable portion of the footwear market with market penetration of ~50% and market share not that far behind it. 🚩

Additionally, it leaves the potential for the new DKS to leverage its position against NKE, which relies heavily on its outlet channels to sell wholesale merchandise. 🚩

If the FTC moves to block, then we can assume that both FL will drop significantly, despite the $59.5 million break fee, and DKS will rally on “missing a bullet.”

Scenario #2

In the event that the FTC does not move to block, then the “cost” associated with the short leg of FL ($0.22/share) is lost, while DKS could rally once the market rewards it for its upbeat earnings pre-announcement where it claimed F1Q comp +4.5% (ahead of Street +2.6%) and non-GAAP EPS of $3.37 (ahead of Street $3.21), and with minimal dilution from FL shareholders converting their stock.

In either of these scenarios, a fellow paid investor put it eloquently that if you’re entering this trade via a LONG leg for DKS, you’re effectively trading the $205 calls since that’s where the stock was trading prior to the announcement.

How we get there is a different story, with scenario #1 being more favorable to that call outcome.

Summing It Up

We’re surprised by this particular announcement, but not consolidation in the consumer space in general. Prada just recently acquired Versace, 3G Capital just made a bid to acquire Skechers (SKX), and WHP Global is going after GUESS (GES).

The market doesn’t think there will be any regulatory hurdles, but we’re skeptical of that fact. Given that the market is currently pricing FL at near buyout offer levels, this leaves us with a relatively ‘cheap’ put option on the potential for a deal break while aiming to recognize the upside of DKS should Lauren and Ed not screw the pooch of the combined company.

We add to our confidence that the $2.4 billion market hit last week to DKS was alleviated somewhat by the pre-announcement that was released, which signaled strong growth in DKS by itself.

Given that we can still effectively keep a neutral position on the company and still make money, especially in this environment, we felt it was worth the risk.

As always, we appreciate your support of our work. If you have any questions, please make sure to message or comment below. If you think others would benefit from the research/commentary we release, we would greatly appreciate your sharing.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm