IPO Notes: KinderCare Learning Centers (KLC)

Why I'm not convinced that this company is worth going along for the ride

It's not a paid ad but I just wanted to let everyone know that if you’re wondering what I use to get my information for my research, it’s largely Koyfin. I use it daily and rely heavily on it to get the necessary information for my reports. If you’re interested in checking it out (I highly recommend it), you can get 20% off your plan using my link here.

Summary

Kindercare Learning Centers (KLC) is the largest provider of early childhood education (ECE) with over 1,500 centers across 40 states.

The company was looking to offer 24 million shares between $23 - $27/share and ended up pricing at $24, opened at $27, and is marginally up since then (~$28).

The point of the IPO was largely to raise capital and pay down the ~$1.6 billion in variable-rate debt.

KLC was devastated by COVID but has improved significantly since with acquisitions (Creme School), cutting underperforming locations, increased occupancy, and overall financial improvement.

We believe that while the company has done well ahead of an IPO, the “strong” points highlighted by the company in the S-1 are more about “fluff” and “marketing” rather than a solid growth strategy that would get an investor excited.

It was noted that it pulled its IPO in 2021 due to “regulatory delays” despite questionable reporting controls, and auditors were even concerned and confused.

With that, let me go over what I believe is important from the S-1 and then the issues that I have that convinced me to not go long this company post-IPO.

What the S-1 Tells Us

The first rule about researching an IPO via the S-1 is deciphering what is real, and what’s bullshit and I think we have some bullshit in here.

KLC has been around since 1969 and has over 2,000 locations (sites + centers) across 40 states and was acquired by Partners Group (PG) in 2015. The company specializes in early childhood education (ECE) for children as young as 6 weeks to ~12 years old.

Early childhood education is grounded in the understanding that early childhood is a critical period of development, where children learn foundational skills, attitudes, and learning patterns.

The importance of early childhood education lies in its impact on a child's emotional, cognitive, and social development. Early childhood education also provides a crucial support system for families that offers guidance in nurturing their child’s development.

The company operates in 3 main core brands:

KinderCare Learning Centers (KCLC)

Community-based early childhood education centers.

1,520 locations as of June 29, 2024; 1,450 centers + 70 onsite employer-sponsored centers.

Represented 88.3% and 93.5% of total revenue for FY’23 and FY’22.

Crème School

Premium provider of community-based early childcare.

>40 schools across 15 states; ~10,000 children.

Was an acquisition completed in Q4’22 (October ‘22).

Represented 5.2% of FY’23 total revenue.

Champions

Before and after school programs.

Provides staff, teachers, and curriculum to deliver high-quality supplemental education and care.

> 900 sites of preschool to school-age children.

Represented 6.6% and 5.5% of FY’23 and FY’22 revenue.

This business makes money in a few ways.

Net new enrollment to their centers/sites as well as how often they attend (occupancy).

Tuition adjustments (price increases).

Annual registration fees.

Summer programs.

Learning adventures.

Other supplemental enrichment programs.

When it comes to this company’s health, it seems like things are going quite well for it.

Over the years, KLC has made great strides to optimize the business and improve profitability. From 2012 - 2017, KLC closed 380 centers, improved same-center revenue by 4.5%, and increased center occupancy from 56% to 69%.

Between 2018 and June 2024, the company acquired 256 centers and opened new greenfield centers.

The company is profitable and has seen quite a rebound in revenue growth since COVID.

Not only are financials improving, but the occupancy rates have been as well which as I mentioned above, directly feeds into overall revenue growth.

The broad-based pitch here by the company is that the need for early childhood education is growing (6% CAGR) in a fragmented industry. Private expenditures on education-focused care for children 0 - 5 years old was ~$19 billion according to the BEA.

Because so many of these local towns and cities exist to fill this need, there are over 90,000 centers in 2022 and KLC estimates that the top five companies in the space represent just 5% of the total capacity as of the end of 2023.

Because options are abundant and the demand is there, KLC also claims it can differentiate itself from the others because of how long it’s been in business (proven track record), and that >80% of centers are accredited which just adds to the legitimacy of its mission.

In order to drive further growth, the company is emphasizing,

Improving occupancy rates with more price increases.

Better access to employees and retention with competitive compensation.

New sites and centers along with a further push into employer-sponsored locations.

Acquisitions in the fragmented space.

But while there are things to like about this company, I don’t think going long is the move here. As I dug deeper into the S-1, I kept noticing more and more marketing points that made me think that while KLC might not be a clear short, it isn’t exciting or convincing to go long.

The “Fluff” That Made Me Say, Pass…

Debt Load

First and foremost, the whole reason for this IPO was for the company to pay down debt. Their First Lien Term Loan Facility had a balance of $1.579 billion as of June 29th, 2024.

Of the net proceeds from the IPO (~$535 million), $527.2 million is going to be used to pay down debt and just $7.3 million is going to be used for other expenses. After the debt paydown, they’re still stuck with just over $1 billion in debt.

Because the debt is variable, the interest expense in 2023 alone amounted to ~$153 million which is ~58% more than it was in 2021. A testament to how quickly variable rate debt can go wrong.

So right off the bat, the IPO wasn’t even so that the owner could realize a liquidity event or even use the capital to fund growth strategies, like acquisitions, but rather take some burden off their shoulders with their debt load, even in the face of a rate-cutting environment.

Sure, it makes them financially healthier, but this is just a classic PE way to help themselves out by using the capital markets, which brings me to my next point.

Post-IPO Ownership

After the sale of the 24 million shares, PG will still own 79% of the shares outstanding. Speaking from past experiences, the writing is already on the wall for future share blocks being sold so the owner can recognize a return, especially after 10 years since they first acquired KLC.

It would be one thing to have high ownership from a founder but this is predominantly one group with historical intentions of realizing a gain.

No thanks.

Occupancy Rates

While I showed you occupancy rates above, which don’t forget were down 150bps y/y, what’s convenient is that KLC originally had broken down quarterly occupancy rates back in the original S-1 and the 2024 S-1 but failed to update it past Q3’22. 🚩

*Occupancy rates = utilization of center capacity operating for at least 12 months.

Based on their KPI definition, it should at least extend into 2023 as a trailing indicator.

Originally, they meant to show just how quickly occupancy rates were rebounding since the lows of COVID, but it’s highly suspicious that they stopped reporting quarterly rates as of the recent S-1.

What’s another 🚩 is that even after 4 years since the lows, they still have not been able to get occupancy back to pre-COVID levels and either stay or exceed them (prior occupancy image).

Thankfully, the company was able to showcase its location breakdown into quintiles to try and highlight its performance of them.

Based on this chart, it’s made to try and convince us that things have gotten better, however, I view it as 20% of the locations got worse, 40% are arguably flat, and the other 40% have improved.

Not necessarily a vote of confidence in my opinion.

Government Subsidies

A lot of early childhood education is subsidized by the government. Admittedly, this can represent stable expenditures to those who are able to take advantage. In this case, KLC.

KLC does try and calm investors down on this point by stating that no matter which political party is in office, the growth in government funding still continues.

While this may be true, I’d rather not be so heavily reliant on government subsidies as a growth driver, especially as it’s making a larger and larger portion recently which should be trending the opposite way after peaking during COVID.

A safeguard to help with downside, sure, but not something to bet on for increased support. Not to mention either but COVID stimulus that KLC has been receiving will end at the end of the year ($150 million in 2023). They do back this out in adj. EBITDA (makes it lower) but something to note going forward.

Employee Happiness

One of the bigger red flags I came across was the company highlighting how much employees loved the company and how its Gallup polls were above average and that’s how it would help retain talent.

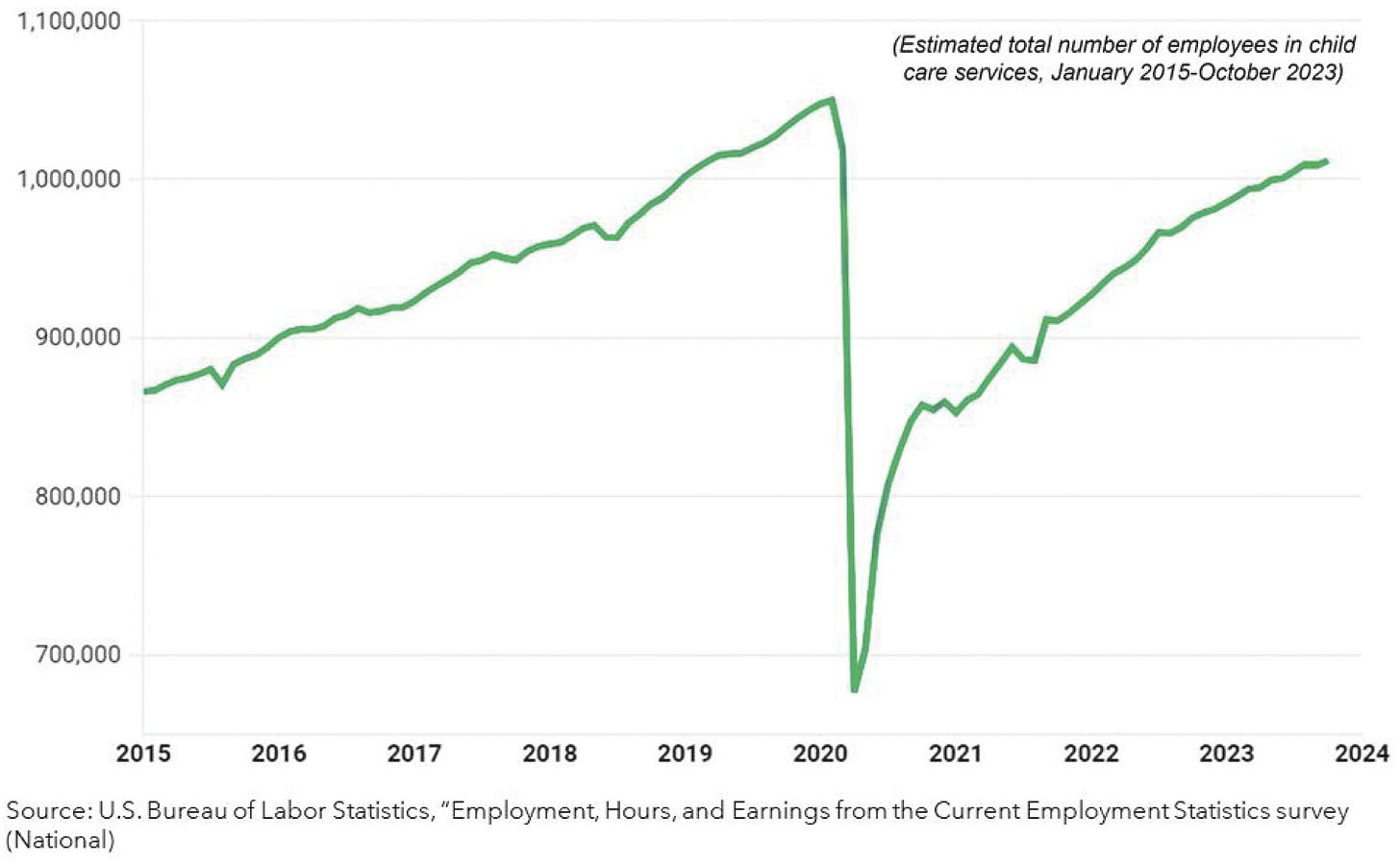

The fact of the matter is that the ECE sector has not fully recovered with the amount of employees in the industry. The industry peaked at 1.05 million employees in 2020 and is still sitting under that 4 years later at 1.01 million.

Aside from the number of employees sitting lower than before, the Gallup employee engagement poll I mentioned before is a point of focus for them in attracting talent.

The issue here is that if you go elsewhere for reviews, employees seem to hate it. Glassdoor reviews are quite low for the company.

The same for Indeed for KinderCare Learning Companies - 2.6 (parent) and KinderCare Learning Centers - 2.9.

Reddit also has popular threads of employees venting on them highlighting how much they hated working there.

I’m not sure how compelling that is for investors but feels like BS to me.

Lawsuits

They were also recently sued for not wanting to take a child who needed insulin injections. The parents sued the company claiming that the company should be willing and able to help a child with these needs and not doing so was against the Americans with Disabilities Act (ADA).

They were also sued, and found liable, for over $500,000 in labor law violations which is interesting because of how much they touted that Gallup poll above.

Postponed IPO

In 2021, the company filed for and then pulled its first attempt at an IPO. Usually, that happens because market conditions change but for them to pull it in a still relatively hot IPO market was suspicious.

They blamed regulatory delays and stated,

“We have identified a material weakness in our internal control over financial reporting. If not addressed, the deficiencies in KinderCare’s internal controls could lead to a “material misstatement” of its quarterly or annual earnings, it reported.”

Deloitte & Touche, KinderCare’s auditor, weighed in, calling it a “critical audit matter.” The issues “relate to accounts or disclosures that are material to the financial statements,” the auditor said in its opinion letter that accompanied the offering.

That’s not a good look for a company seeking to convince the world it’s a worthy investment, said Roy Tucker, a senior lawyer at the Perkins Coie firm in Portland.

“I’ve done bunches of IPOs over the years, and I’ve never seen this. Obviously, you want to try to get these things fixed before you put a registration statement in front of investors.”

Portland lawyer Keith Ketterling, who has represented investors in investment fraud cases, questioned why regulators would allow the offering to go forward.

“No company should go public with an IPO while it is receiving information about a critical audit matter from its accounting firm. If there is uncertainty about the accuracy of its financial reporting, the company has no business trying to raise money from the public.”

Not quite the vote of confidence but that needs to be assumed a past issue.

Parting Thoughts

Despite the laundry list of reasons I gave on why I passed, looking at it from a valuation perspective, it’s insane.

Proforma EV / LTM Adj. EBITDA: 14.9x ($4.1B EV / ~$280M LTM Adj. EBITDA)

Proforma P / LTM Adj. Earnings: 164.1x ($3.2B MC / ~$20M LTM Adj. Net Income)

Adjusted earnings are negative from FY’23 to FY’22 but up 27% from 1H’24 vs 1H’23. It’s a sign of progress, especially when considering the company will “save” >$20 million in interest expense going forward.

For a company that grew revenues just 6.1% y/y, calling for a sector growth of 6% going forward, with an engineered bottom line, I’m not too enthusiastic that the future of this company is a good use of capital.

These are all the reasons why I decided to pass.

Happy for opposing thoughts here but I believe there are way better opportunities to deploy capital.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm