It's not a paid ad but just wanted to let everyone know that if you’re wondering what I use to get my information for my research, it’s largely Koyfin. I use it daily and rely heavily on it to get the necessary information for my reports. If you’re interested in checking it out (highly recommend it), you can get 20% off your plan if you use my code here.

Hims and Hers Health (HIMS) is reporting earnings on Monday (tomorrow, after the market closes) and it seems that many investors got quite the reality check on Thursday when Eli Lilly (LLY) announced that their tirzepatide shortage would be ending soon. Despite the notice, many weren’t expecting that by Friday (the next day) the shortage would be marked over, though not officially by the FDA yet.

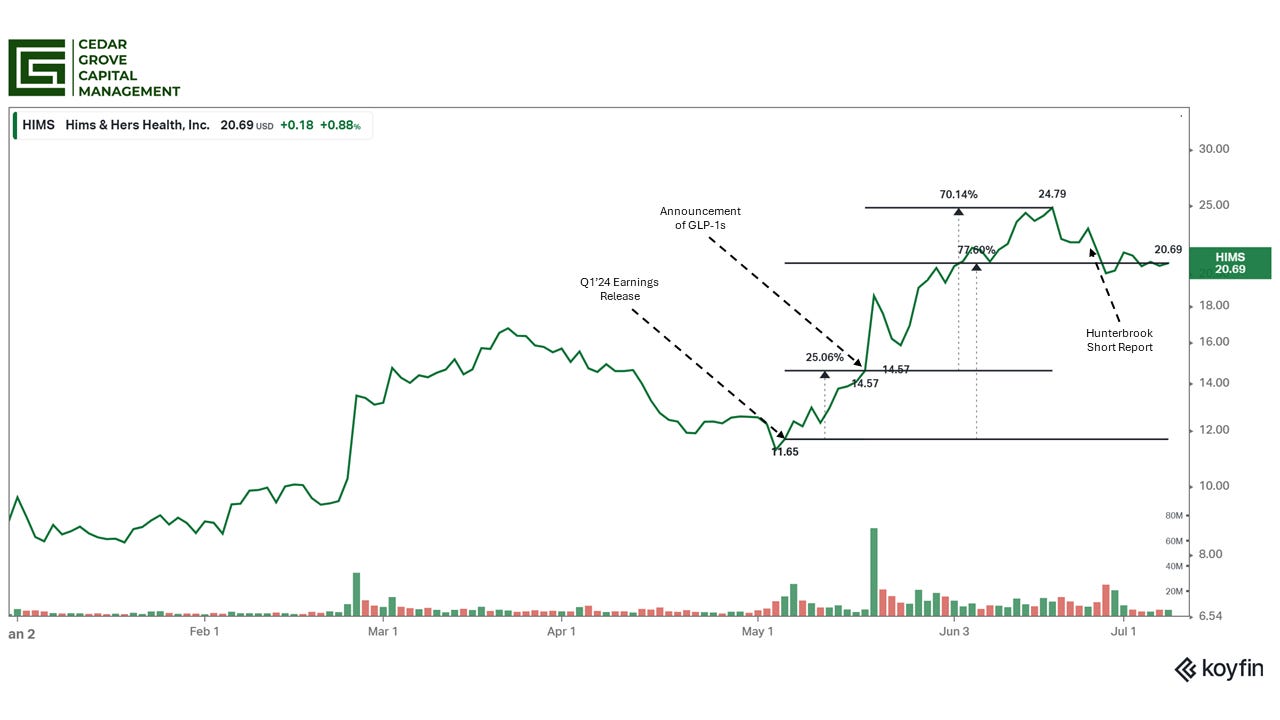

This news sent the stock down ~18% over 2 days before settling at $17.58 by the end of market close Friday. What puzzles me is why so many retail investors initially thought the market wasn’t pricing the future of GLP-1s despite the incredible run-up it had post-earnings and post-GLP-1 announcement.

Even pulling a chart directly from my HIMS GLP-1 post from July 9th proved it right there that it was baked in. You don’t just add an additional $1 billion in market cap after a 25% jump after earnings for no reason.

Despite my calls for realism, I should also note that my initial report from June 12th highlighted that I was bullish on HIMS overall but implied that the valuation seemed fair considering the pricing-in of compounded GLP-1s into the overall valuation post-earnings.

The title of my research report highlighted that point and the stock closed at ~$24/share that day.

However, with the recent pullback that the stock has had, I think the margin of safety has significantly improved for long-term investors who see HIMS as more than just another GLP-1 telehealth provider.

While many would like to just hear information that is generic, only positive, and there-in just confirmation bias, I don’t do that and have no desire to do that. The research that I share with you all is meant to help you with your decision making but to be completely frank, it’s to not feed you bullshit you want to hear.

In the below post, I’ll go over

How recent news of LLY changes the prospects for HIMS compounding.

How I’m viewing WW International’s (WW) clinical business when analyzing headwinds regarding HIMS.

Updated HIMS valuation with an isolated GLP-1 sales model.

As I’ve mentioned in the past and will mention in every HIMS research I publish, I need to disclose that I was previously an employee of Roman Health Ventures (“Ro”), a direct competitor of Hims & Hers Health (HIMS). While I have not been an employee of them for several years, I’m still very knowledgeable about the inner workings of this industry and still hold shares as a previous employee.

While I may drop in publicly available information about Ro for this particular research, I am not speaking for or on behalf of Ro nor do I have any inside information about anything since I left that position. This research will be strictly focusing on Hims and why I believe it’s a multi-year success story.

With that, let’s get to it. First, what the recent LLY news actually means to the HIMS business, and why every investor should adjust their future expectations.