It's not a paid ad but just wanted to let everyone know that if you’re wondering what I use to get my information for my research, it’s largely Koyfin. I use it daily and rely heavily on it to get the necessary information for my reports. If you’re interested in checking it out (highly recommend it), you can get 20% off your plan if you use my code here.

Quick Update

Hello everyone, I just wanted to quickly reassure everyone that while I’ve been covering Hims and Hers Health (HIMS) in-depth recently, including the Q2’24 update in this post, but I don’t want it to seem like that’s the only thing I’m lined up to write. There’s still plenty on my list and since I’m going on holiday in the middle of September for a few weeks, I’m sending you all a lot before then to make up for it.

On my list to send you all through the end of September and Q3/Q4 is listed below. It’s not an exhaustive list as it’s ever-changing but it’s what I have right now.

Additionally, I have one super quick question for you all. Suppose I started a podcast on behalf of Cedar Grove Capital talking about the businesses I write about. Would you want to receive them here (automatically sign up) or via a new distribution where you can decide if you want to sign up with no effect on your subscription here?

On to the programming.

Hims Q2’24 Post-Earnings Update

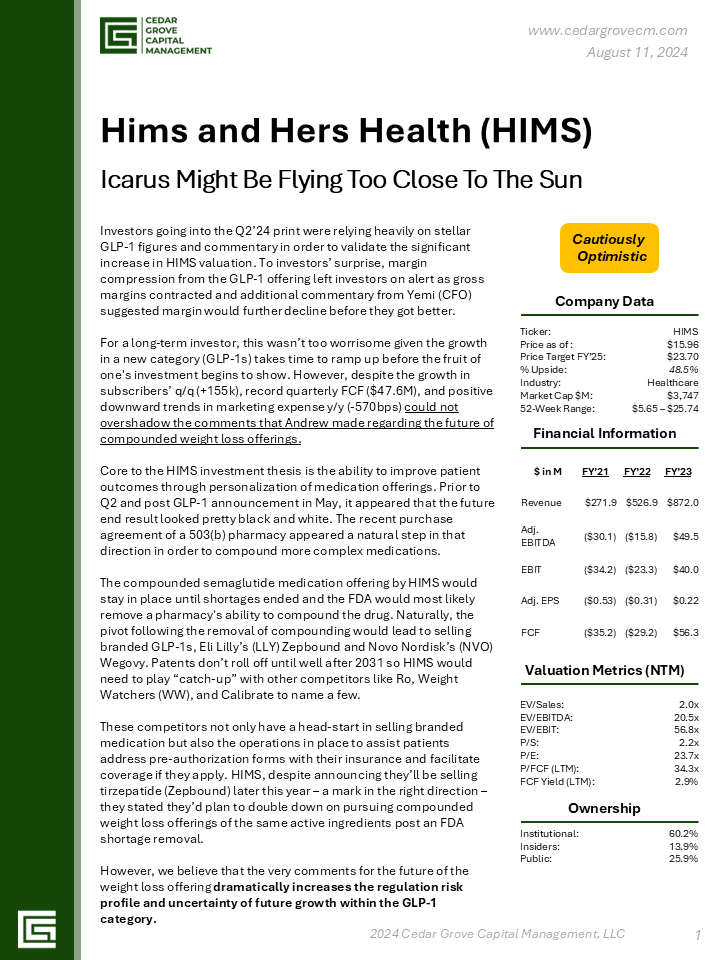

The recent earnings release from HIMS last Monday left many investors puzzled by the price action both before and after the earnings call. The days after were no help as the stock continued to drop, briefly breaking through $15 on Thursday.

I think a lot of assumptions as to “why” the stock dropped ranged from being an overreaction to a good print to run for the door. Considering my background working for the competition years ago, and recent coverage on the name, I believe I know what the market is “pricing in” and what many investors are left scratching their head.

Based on these findings, I think the future of HIMS had a justified re-evaluation after that call which I’ve gone ahead and included in the PDF below for all paid investors. The picture below is a teaser of the 12-page report for those who aren’t paying investors yet.

If you would like to look at my past work, you can access it via the Table of Contents. I would ask if you do like the update, please like the post and share it with your friends or fellow investors.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm