GLP-1s: Effective But With A Catch

Why the hype for GLP-1s isn't as easy as you think

“There is no silver bullet. There are always options and the options have consequences.”

Foreword: This is actually my first notebook post on something related to healthcare. It revolves around the hot market for GLP-1s and what I think of them when it comes to the consumer.

I’ll be touching base on different areas regarding this topic from the science to the benefits and issues that come with them. If you’re only interested in certain parts, I would just recommend skipping to that section and read what you want to.

Weight loss is a hard journey for many Americans. It’s easy to put it on but an uphill battle to take it off. Depending on the numbers and source, either one-third of dieters return to their old weight, or as many as 65% do.

America’s food rules and regulations make it incredibly easy for companies to make food products loaded with different types of sugar, preservatives, bad oils, etc in the name of improving shelf life and reducing costs.

Unfortunately, Americans pay at the waistline and the obesity epidemic has exploded over the years. For instance, in 2000, no U.S. state had an obesity rate (defined as having a BMI of 30 or greater) of 35%.

By 2010, 27 states had met that mark.

By 2019, every single U.S. state had an obesity rate higher than 35% except two: Colorado and Hawaii (and the District of Columbia). Ten states were over 45%, and Mississippi, the state with the highest obesity rate, nearly hit 50%.

Using current trends in overweight and obesity from each state, researchers projected into the future and found that by 2030, one in two adults in the U.S. will be considered obese, and one in four will be considered severely obese, with a BMI of 40 or higher.

In 29 states, obesity rates will climb to over 50%.1

The situation has continued to spiral out of control and it seems that government policy will not help the situation.

But why do I bring this up? Well, weight loss comes in many forms, and depending on who you speak to, they will swear on one way versus another. Keto diets, all carb, no carb, no fat, just exercise, etc etc.

Americans spend $70 billion a year losing pounds, including on gyms, apps that count calories and track exercise, and often-grisly diet meals and shakes.

While many of these diets or regimes work, they don’t work for everyone but one thing that every single overweight individual would agree on is if there was a single way to lose weight, a sliver bullet if you must, then they’d take it.

However, silver bullets don’t exist, and the one’s that come off as one doesn’t come without a silver lining.

Enter GLP-1s.

What Are GLP-1s?

GLP-1s, or Glucagon-like-peptide-1, are drugs that are used to treat conditions such as type 2 diabetes and obesity.

They have been shown to improve cardiovascular risks, reduce weight, and lower blood pressure and cholesterol. Which is why they help treat obesity and not just those with diabetes.

Hell, even Elon Musk uses it.

How Do GLP-1s Work?

You have a naturally occurring hormone called glucagon-like peptide-1 (GLP-1) produced in your gut. The GLP-1 hormones are stimulated by food intake, primarily carbohydrates from your diet. The GLP-1 hormones bind to and act on specific GLP-1 receptors in various tissues, including the pancreas.2

After binding, the GLP-1 hormone can stimulate the pancreas to produce insulin. Insulin, in turn, helps your body cells take up the sugar in the blood to ultimately lower the blood sugar level.

GLP-1 drugs work by mimicking the GLP-1 hormone in your body. When you take a GLP-1 medicine, it works in three main ways:

Stimulates the release of insulin by the pancreas after eating.

Inhibits the release of another hormone called glucagon. Glucagon stimulates the liver to release sugars that have been stored in the bloodstream.

Slows the absorption of glucose into the blood by reducing the speed at which the stomach empties after eating, thus making you feel more satisfied or extending the sensation of feeling full after a meal.

These effects combine to keep your blood sugars down and support the other benefits of taking a GLP-1 drug.

Because the GLP-1s curb your desire to eat, the effects of weight loss can be dramatic over the first few months.

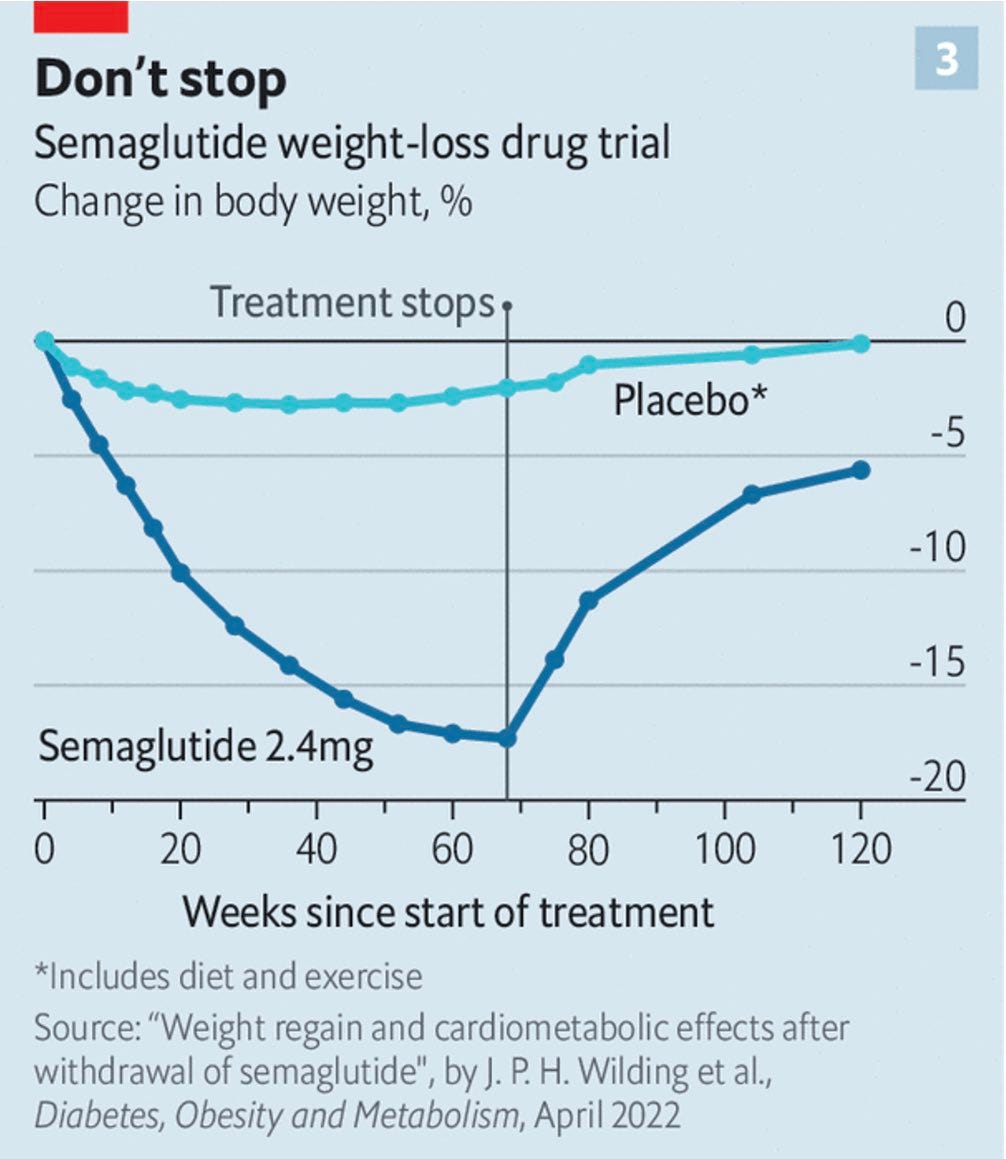

Going off of the trial results for Semaglutide (above), the estimated mean change in body weight from baseline to week 104 was –16.7% with Semaglutide and –0.6% for placebo (ETD –16.0 percentage points).3

However, it’s important to note that the 104 weeks is in fact two years so for those hoping for a quick in and out, that’s not the case.

Types of GLP-1 drugs

There are a few types of GLP-1 drugs. Below is a breakdown of the currently available forms of administration and examples.

Oral GLP-1 drug

Most GLP-1 drugs are injectables; however, semaglutide is an available oral option. Semaglutide is administered orally once a week.

Short-acting injectable GLP-1 drugs

GLP-1 drugs dosed once or twice a day are short-acting and are administered via a subcutaneous injection. Short-acting GLP-1 drugs include:

Exenatide (twice a day)

Liraglutide (daily)

Lixisenatide (daily)

Long-acting injectable GLP-1 drugs

Long-acting subcutaneous injections of GLP-1 drugs are administered once a week. Examples of GLP-1 long-acting medicines are:

Dulaglutide (once a week)

Exenatide extended-release (once a week)

Tirzepatide (once a week)

Semaglutide (once a week)

The Market Opportunity

Because of the efficacy of the aforementioned drugs and the opportunity that it presents with helping those with diabetes or weight loss, you have to imagine the TAM for drugs like this.

The GLP-1 market was valued at ~$22.4 billion in 2022 but is anticipated to grow at a 9.6% CAGR from 2023 to 2032.

If we’re putting hard numbers here to the market size that aren’t completely crazy, figure this.

In 2021, the IDF (International Diabetes Federation) estimated that there were 537 million adults living with diabetes. That figure is estimated to grow to 643 million by 2030 and then 783 million by 2045.4

For obesity, the World Health Organization (WHO) estimated that there were 1 billion people who were classified as obese of whom 650 million were adults, 340 million were adolescents, and 39 million were children.

That’s a shit ton of people and the number is only going up.

While all those people technically fit under the umbrella, the cost and access is an issue which I’ll touch upon in the next section.

The Problems With GLP-1s

Adverse effects

Just like almost every prescription drug out there, they are not absent of side effects.

Common side effects of GLP-1 drugs are nausea, vomiting, and diarrhea. You may also experience dizziness, mildly increased heart rate, infections, headaches, and upset stomach.

It’s also important to note that GLP-1 drugs increase satiety; if you continue to eat while feeling full, it may lead to a wave of temporary, mild nausea. If you experience nausea, your healthcare provider should slowly increase your dosage.

Since the majority of GLP-1 drugs are subcutaneous injections (i.e. needle), there may be injection-site itchiness and redness could occur. However, this class of medications has a low risk of hypoglycemia or low blood sugar.

Price and access

Let’s move to price because I don’t think many people realize just how expensive this drug is.

If you go to GoodRx and search for Wegovy and Ozempic, these are the results you get.

Mind you that the Wegovy price is for a 1 month supply. So even with coupons, you’re looking at cash pay options well over $10k - $15k a year depending on which one you get.

But what about insurance?

Well, that’s the thing. Not all insurances are the same which means not all coverage is the same.

Some commercial insurance plants cover GLP-1 medications after a deductible is met but some insurers will only cover certain GLP-1 medications and not others.

Cost is obviously one of the biggest concerns and a recent survey from 180 benefits executives representing health plans, employers, and unions found that these drugs are a major concern.

“We know that they are safe, and that they’re safe for long-term use. They are going to be in very high demand because there are a very large group of people who would benefit from them. The problem is that they cost too much and widespread coverage would indeed be very high. What we really need is to lower the unit cost for the drugs.”

- Jeff Levin-Scherz, M.D., the population health leader for health and benefits in North America at Willis Towers Watson

Cost isn’t the only concern, however. Questions have always been raised about off-label use of medications and paying for lifestyle drugs, which health plans do not generally cover.

Despite a boom in the demand for the drugs, insurers often require prior authorization before paying for the drug. This means that you have to basically get a green light from your insurer which is a lengthy endeavor riddled with paperwork and doctors visits.

Additionally, weight loss has often been considered a “cosmetic” category, but this is starting to change as doctors increasingly view obesity as a medical condition that requires treatment.

This is why insurers are trying to prioritize those with diabetes for coverage rather than those that are looking to just lose weight since the cost to payers is so high.

Patients who do get an insurance plan to cover Wegovy, Ozempic or Mounjaro may find they face a big out-of-pocket charge. An analysis by KFF, a health-research nonprofit, found the average patient charge for a month of treatment on Ozempic or one of its sister drugs was $66 in 2021, but doctors say they sometimes see plans forcing patients to pay a percentage of the drugs’ cost, known as coinsurance, which can be hundreds of dollars.

For patients who can’t afford the fee, or aren’t able to get their insurer to pay at all, the drug companies sometimes offer help, though it’s typically limited. For patients whose insurance plans cover Wegovy, Novo Nordisk provides assistance that can reduce their out-of-pocket costs to as little as zero per 28-day supply, with a maximum benefit of $225.

For patients who don’t have insurance coverage for Wegovy, Novo Nordisk provides a discount of $500 off the full retail price. The $500 discount is good for up to 12 refills of a 28-day supply.

Lilly provides a savings card for commercially insured patients taking Mounjaro for Type 2 diabetes. If Mounjaro is covered, Lilly can reduce a patient’s out-of-pocket costs to as little as $25 per prescription.

But if a patient’s insurance plan doesn’t cover Mounjaro, Lilly has capped its assistance at $500 a month. That means the patient is responsible for the rest, which can exceed $500.

People who secure insurance payment for a weight-loss prescription should also remember it’s just the start of a continuing process. After several months on the drug, plans may require patients to hit a milestone before getting further refills.

Often, patients must lose at least 5% of their pretreatment body weight. If they haven’t, their next prescription might not be covered, potentially halting treatment.

You can’t stop taking it

This might be a good thing if you’re thinking about investment but just like all changes in one’s life, the habit of continuing what works is imperative. This is exactly the case for GLP-1s and I’ve voiced this concern on Twitter.

GLP-1s work, but that doesn’t mean that you can stop taking them once you’ve reached your desired weight. Because people stop feeling full and their food cravings return when they stop using the drugs, weight gain quickly returns.

However, this could also be double-edged because if patients lose enough weight, the insurer might decide they no longer qualify for treatment with the drug, raising the risk they will regain the pounds.

This is basically why the stickiness amongst its user base is high but those who either can’t afford it down the road or have their pre-authorization pulled will quickly see years of progress mean revert.

Mark this one down as a double-edged sword with more emphasis on it being sticky than patient churn.

Players and competition

When it comes to competition, there are a number of public and private players in the space. Typically, private companies (mostly startups) offer GLP-1s in addition to weight loss services. These are your Calibrates, Ro, Measured, NextMed, Found, etc.

Just google it and you get slammed with sponsored ads.

However, for public companies, you’re mainly looking at the manufacturers which are dominated by 5 names.

AstraZeneca AZN 0.00%↑

Sanofi SNY 0.00%↑

Eli Lilly LLY 0.00%↑

Pfizer PFE 0.00%↑

Novo Nordisk NVO 0.00%↑

Another stand out is actually Weight Watchers WW 0.00%↑. They announced that they were entering the space back in March by offering Ozempic and the stock took off 79% in a day before retracing.

Since then, the company has rebounded once more and is up over 100% YTD though this can be for other reasons and not solely on their new weight loss announcement.

Concluding Thoughts

I’ve done an extensive amount of research on GLP-1s and they really do sound promising and the data supports its efficacy.

The issue that I have with it is that just because it works, it doesn’t mean that people can get access to it. This isn’t like Epi-pens where people NEED to get it and will pay what they need to or risk dying. This is very much an “I’d like to lose weight or manage my diabetes better” than life or death.

This is why I think the hype around the drugs is warranted but overdone. The current reach along with all the issues I mentioned above (plus shortages) seems like an aggressive pull forward.

Either way, it would make for a very interesting long depending on who you’re trying to back. Diabetes drugs, weight loss drugs, or the people that sell them along with a service.

Food for thought. Or lack thereof.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech