It's not a paid ad but just wanted to let everyone know that if you’re wondering what I use to get my information for my research, it’s largely Koyfin. I use it daily and rely heavily on it to get the necessary information for my reports. If you’re interested in checking it out (highly recommend it), you can get 20% off your plan if you use my code here.

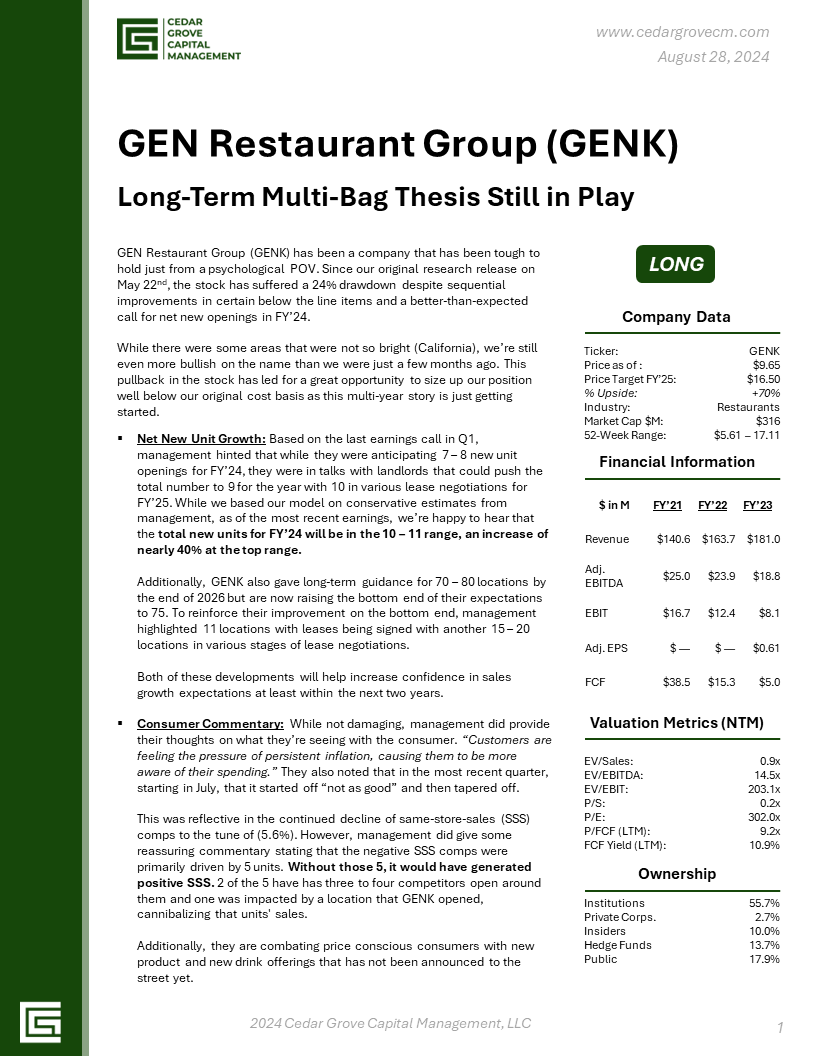

At the end of last month, GEN Restaurant Group (GENK) shared their Q2’24 earnings and we were quite happy with the financials and management commentary. For those of you who aren’t aware, we shared our initiating coverage on the name and highlighted our long position at the end of May.

You can see the research via the link below.

Despite a 24% drawdown since then, Q2 earnings have highlighted stronger unit growth figures, better adjusted restaurant-level EBITDA margins, and higher conviction in LT unit target figures.

We remain bullish on the name and have included a teaser of the report below and a full report for download at the end of the email for paid investors. As always, feel free to message me with any questions.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.