If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.

At the end of September, F45 Training (FXLV) received an unsolicited proposal from one of its investors, Kennedy Lewis Investment Management LP (KLIM), to acquire the company in a $385 million take-private offer at $4.00 a share.

For those of you that don’t know, F45 Training is the fitness studio brand that had a big investment from actor Mark Wahlberg back in 2019.

It is also the company that we held a position in at the beginning of the year which we closed in favor of Xponential Fitness (XPOF). Thankfully we made the right decision.

In this post, I’m going to be talking about this deal and if I think there’s an arbitrage trade to be done here.

Deal Context

KLIM is the third largest shareholder in the company, owning about 14.6% of shares after a late August purchase of more than 3.5 million shares of the brand.

KLIM is owned by Darren Richman, who sits on the F45 board, and David K. Chene.

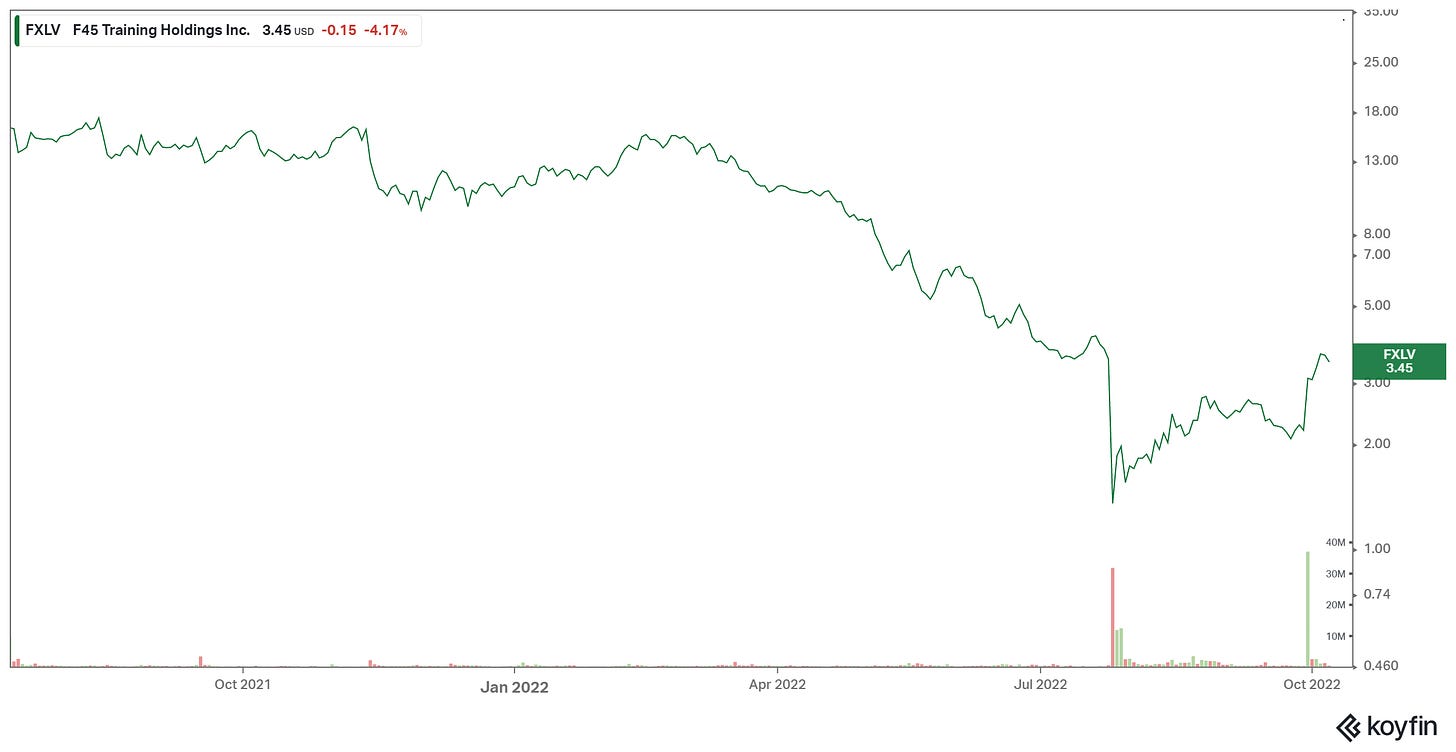

F45 Training went public in July 2021 at a price of $16 per share and was valued at $1.4 billion.

Its stock has never risen higher than $16.44 per share and fell to as low as $.78 per share at one time. After Darren Richman — of KLIM — made the bid public on September 30, the stock rose to $3.09 per share from $2.19 the day prior.

The filing states that KLIM believes returning to private status would allow the company to

“be in a stronger position to maximize its resources and realize strategic value that enhances its operations and supports its stakeholders.”

What that actually means I don’t know but it might imply that the noise from a declining stock price is hurting morale and taking space in the minds of management that can be optimized elsewhere.

Members of the F45 Training board of directors, which includes actor and producer Mark Wahlberg, will evaluate the proposal with its advisors to determine the best course of action for the company and its stockholders.

The proposal calls for the board to establish an independent committee to review the proposal, to solicit and evaluate other proposals and to negotiate terms of the proposal.

Will Deal Happen?

Given that shares closed at $3.45 on Friday, 10/7, the market is basing a ~70% chance of the deal being completed, however, I’m skeptical of the deal happening but I think there’s a way to come out on top.

Valuation a Far Cry

While the offer price is relatively good based on the 52-week low, you need to put things into perspective. Back in 2019, Mark Wahlberg took a stake in the company (via SPV MWIG) at a $450 million valuation. At the take-private price now, KLIM buying the ~85% it doesn’t own, would put the valuation at the same level it was three years ago.

But while the valuation has come down from its peak, that doesn’t mean that the company hasn’t grown since then.

However, its losses are mounting and it’s collectively lost $60 million in FCF over the last twelve months. This is one of many reasons the company’s stock price has collapsed.

But even before the proposal was submitted, it’s not like the company wasn’t taking steps to stem the bleeding. In July, the company announced it would lay off 110 people in the corporate office, comprising 45% of its corporate workforce.

The layoffs would cost the company $10 million to $12 million in severance and related costs, but it would save $15 million to $20 million per quarter in SG&A expenses, which is approximately 40% to 50% less than SG&A expenses during the first quarter 2022.

This announcement caused F45’s stock to fall 61.5% to close at $1.35 per share on July 27.

While this cost savings initiative won’t allow FXLV to be breakeven EBITDA, it will help with the bleeding. If management and the BoD feel like they can get it done on their own, taking the deal might cut them off too soon to see the fruit of their labor.

Equity Capital Markets

While not game-changing, it is a factor to consider, especially when FXLV was supposed to go public via a SPAC. Going private would cut off its access to equity capital markets and its ability to fundraise if needed.

Given that the company only has ~$8.5 million in cash and burned over $15 million in the most recent quarter, the odds of them needing money are looking pretty high.

While the company could still raise through the debt markets, rising rates, and suboptimal operations, it could get expensive real fast.

Cutting off 50% of its channels for additional funding while they are trying to sort things out would most likely not be the best idea.

Board of Directors

Here’s where the tide may be in favor of a take private. While the CEO and one of the founders, Adam Gilchrist, was outed earlier in the summer, he still is a member of the board. While still being a large shareholder (>20%), there are other directors that could be in favor of a take private.

For instance, out of the current board of 11, Mark Walhberg and through his SPV own two seats, KLIM owns one, and other BoDs could be swayed for this as well. Unlike other take privates where the acquirer could scrap management and redo the board, KLIM in the proposal stated,

The Proposal states that it is conditioned on other large stockholders of the Issuer agreeing to roll their existing equity in connection with the proposed Transaction...

Meaning that they are not looking to take control but rather partner with others that also believe the company would be better off being private instead of public right now.

This could help with the odds that the company should be in private hands should many of the current equity holders (excluding institutional owners) believe they can re-IPO in a few years once operations become better again. Given much of F45’s recent marketing has Mark Walhberg’s face and likeness, I find it hard to believe that he would entertain being completely bought out and not rather just have his equity rolled over despite his massive selling earlier this year for a liquidity event.

Trade Structure

So when it comes to the deal, the way I’m thinking about it isn’t quite a lucrative one right now but can provide for some returns based on whether the deal happening or not.

The structure I’m thinking of is going equity long and PUT option short. To remind you, the below scenario does not account for

Implied volatility → which will lead to increased returns should the deal fall apart

Time

With that said, let’s have a look.

Since the deal was announced at the end of September, I would imagine that the BoD would not need too much time to decide if they want to be private or not. Could it be until the third week of October? Sure, but let’s be cautious and say by November 18th (~1.5 months from the announcement) they will have their decision.

To make the best use of risk/reward pricing here, I’m looking at 11.18.22, $2.50 PUTs, that last traded at $.10 a contract (above).

I’m using simple numbers here but the ratio I’m portraying is long shares via blocks of 100 and long via PUT contracts in sets of 3.

LONG Math

If we expect the deal to close, the equity will get us $25 in earnings ($55 long return less $30 of worthless PUT contracts).

Should this deal close on November 18, we can expect mid-single-digit returns but an excellent IRR. This obviously is maximized more if you cut down on the PUT contracts but that leaves you more exposed should the deal not be completed.

SHORT Math

If we expect the deal to fall apart, I’m considering a 50% cut to the share price for two reasons.

Given how much the stock rallied on the news, it only makes sense that the stock would retrace back to those lows (~$2.19) however,

With the market being more volatile since the announcement, I believe further downside is warranted which brings me to $1.73 share price.

The breakeven PUT contract price is $2.40 ($2.50 strike less $.10 per option contract) which means that should the share price crater to ~$1.75, the spread is ~$.70 a contract (not including implied volatility).

The loss on the equity would be ~$172.50 while the net gain on the option contracts would be $210. This leaves us with a greater net return and IRR than if the deal closes because you’d be making back the premium you paid on the PUT contracts.

Closing Thoughts

Either way, you could in theory make money on either way this deal does/doesn’t happen but my biggest question mark is what KLIM expects to do once the take private occurs.

Since we don’t know exactly what they have in mind, we can’t say with any level of confidence that the company in private hands would fair better than in public ones. This goes with my comments on the access to equity capital markets I mentioned earlier.

Because of this, I can’t place any additional weight as I could on our Microsoft (MSFT) / Activision (ATVI) trade we published earlier in the year.

This FXLV take private will be an interesting one once the committee makes their decision but given that there isn’t much premium left, you really have to ask yourself, is the juice worth the squeeze?

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Share this post