IPO Notes: EV Maker FLY-E Group Going Public

A profitable IPO that I might actually consider buying

While I was reading around from my list of authors, I came across an IPO that caught my eye because it was founded right here in Queens, NY. The company is called FLY-E Group (holding company) which specializes in designing, installing, and selling smart electric motorcycles.

They’re basically the ones that sell all those e-bikes and e-motorcycles to delivery drivers in urban cities for gig work and mopeds for those who just want a moped.

Immediately, this caught my attention because I see these guys driving around 24/7 weaving in and out of traffic to make sure I get my $20 burrito delivered on time. If you’re in the NYC area, look for the bikes with the wings logo on them and you’ll know exactly what I’m talking about.

Before I dive into this S-1 though, you need to understand that FLY-E Group (“FLYE”) is an emerging growth company and thus does not need to adhere to the stricter SEC IPO rules that non-emerging growth companies need to.

This means that they

Only need to have 2 full years of audited financials.

Exempt from auditor attestation requirement on effectiveness of internal controls for financial reporting.

Reduced disclosure obligations regarding executive compensation.

Exemptions from the requirements of holding a non-binding advisory stockholder vote on executive compensation and any golden parachute payments.

Until the company reaches $1.235 billion in annual revenue or issued more than $1 billion of non-convertible debt in the past three years, we’re running on limited information and should treat such information as such.

How small is small though when it comes to this company being considered emerging growth? Well, the company (founded in 2018) generated just under $22 million in sales but is profitable (shocking for an IPO).

It’s tiny. I know a lot of the other managers that subscribe to my notebook run enough money to just frankly buy this thing out so when it comes to my other readers that might be looking for a different kind of IPO exposure, this is one you might be interested in.

I’ll first go over the company based on its S-1 and then the reasons why I might actually want to own this name.

**Mind you, this is the first pass at their S-1 and this post is meant to be more of an introduction to the company to highlight the interest I have in it before the fully baked document gets released.**

With that, let’s get into it.

Who is FLY-E?

When it comes to understanding companies, the less complex the better. This is why I like investing in consumer and retail names because I get them, I can relate to them, and their products/services are (mostly) tangible.

FLY-E was built to sell electric motorcycles, bikes, and mopeds and coincidentally, they ended up in the hands of a lot of food delivery drivers.

What’s interesting about these bikes is that they’re assembled in the various leased spaces here in NY. Additionally, most of the components to make these bikes come from China and the United States and not just solely overseas. The component shift has had its ebbs and flows but currently, as of September 2023, 55% of the components come from China while 45% are from the U.S. This is in contrast to 80% coming from China in their FY’22.

Out of the three aforementioned product categories, they offer:

21 e-motorcycle products

34 e-bike products

12 e-scooter products

With prices ranging from a few hundred dollars to thousands of dollars depending on what you get. All these products are sold and serviced across 39 retail stores across 6 states (NY, TX, DC, CA, FL, and NJ) with 1 location in Canada.

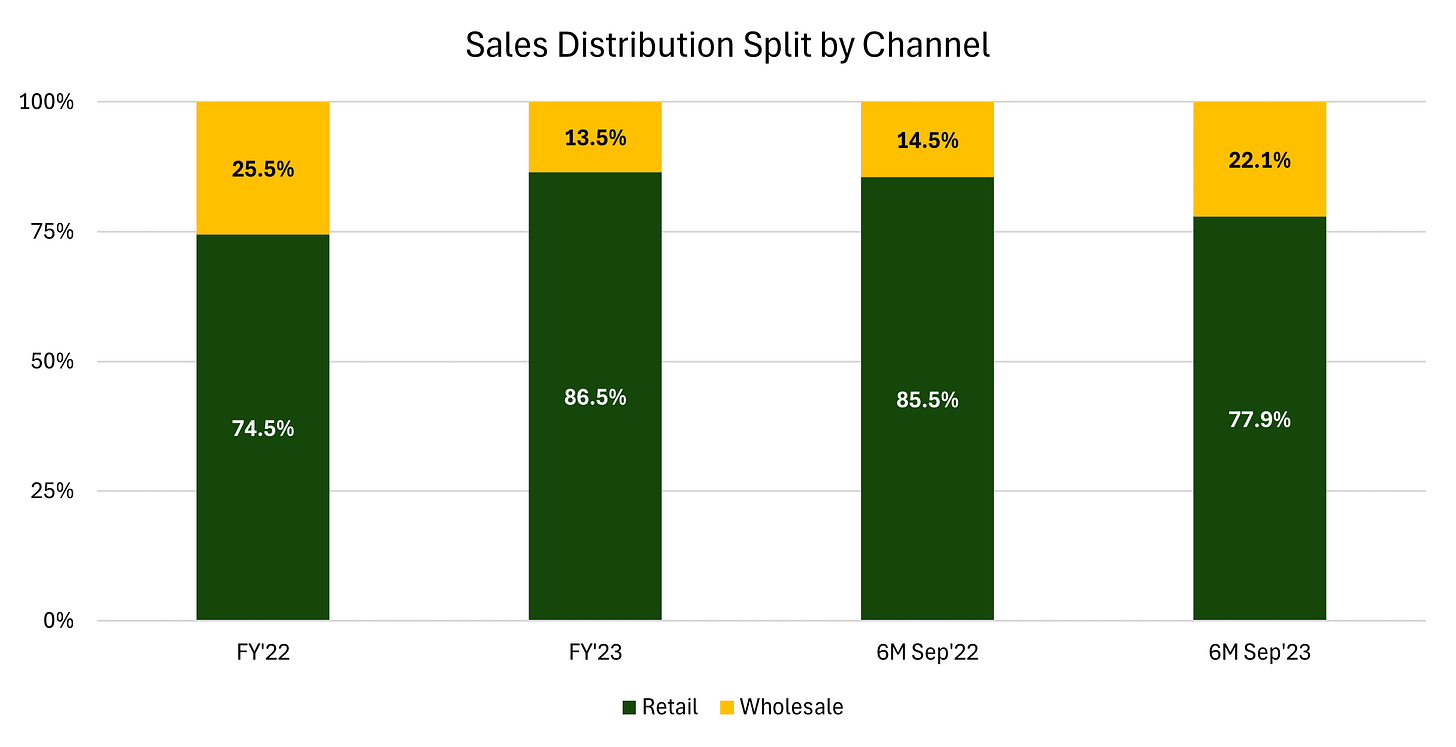

Even though the company operates 39 owned locations, there are still dealers that buy wholesale as an added distribution channel. You can see the split below on how that’s been allocated historically.

While there aren’t many ratings online for the products (Reddit wasn’t much help) I went ahead and took at every store listed online through their website to get a pulse check on what customers have rated them. Mind you, I don’t think they’ve updated the list fully because some stores pop up on Google Maps but not on the website.

Overall, general sentiment at the store level is pretty positive with many having reviews left over the last few weeks and months. There’s only one BBB complaint that seems to have come from an angry customer in 2022 but filed in 2023.

So with a business that assembles and sells transportation products in urban cities, how have their financials been?

Last fiscal year, which ends in March, the company made nearly $22 million in revenue with an operating margin of 10.6%. Not an adjusted operating margin mind you.

That jump represents a 26.7% YoY growth rate and 700 bps of margin expansion. However, looking at a more recent timeframe, the first 6 months of FY’24 showed a 38.6% YoY growth in revenues with a 100 bps margin decline. Still, it's not bad for a company selling bikes and parts.

I will caveat that a lot of this growth did not necessarily come from volume, but rather price increases.

The large jump in 2023 revenue was due to the average sales price (ASP) increasing by $297 to $941, or 46.1% from $644 in 2022. However, sales volume slightly decreased by 1,118 units, from 12,381 units in 2022 to 11,263 units in 2023.

Not the best trend but if we look at the most recent six reported months ending Sep’23, EV volume increased by 3,162 to 9,636, or 56.9%, from 6,474 in the prior period with only increasing ASP by $50.

This leads me to believe that FY’24 volumes will easily surpass FY’23 as Q3 seasonality of winter makes people order delivery more instead of physically going out.

While the recent developments in total volume might still be growing overall, management calls out that demand is exceeding their capacity to build the EVs at their current facilities.

Because of this, they are looking for a larger assembly facility to increase capacity. This is the right problem to have when you’re selling products + maintenance parts.

Vendor Relationships

When looking at their component exposure, I will have to admit there are inherent risks with their suppliers though I’m not sure how immediate the risks are. As I mentioned in the beginning, roughly 55% of the company’s components come from China.

Pretty important if you want to weigh out potential future tariffs with China but I’m not suggesting that this is something I’m worrying about at the moment. However, the company does buy a significant amount of its products from key vendors, and over time, they have shifted dramatically.

*Anhui supplied 70% of accessories and components in FY’22.

As you can see, there have been shifts with who FLYE gets their components from with Fly Wing E-Bike becoming their most recent top vendor. While I haven’t been able to look up how these vendors’ relationships are in general, FLYE is essentially buying from a “private label” brand suggesting that they are looking to also sell components to other companies as well. While this isn’t confirmed, I can’t see any other reason why they’d be buying from “Fly Wing E-Bike Inc.” unless that was a future plan.

Given the shift in these relationships, it appears that management is on top of optimizing supply chains and QC as time has progressed.

Skin in the Game

This is actually one of my favorite sections to talk about because I know a lot of investors out there are looking for high insider ownership to align for long-term thinking for a company.

For most IPOs that you and I have looked at, the captain at the helm still has an ownership stake in the company before going public. This is more a function of dilution over the years in the name of growing an unprofitable company until it reaches enough scale to become profitable.

This is traditional startup fundraising in the next big thing which yields a high valuation (possibly) with the owner typically left with a single-digit or low double-digit ownership stake.

However, with FLYE, the owner and current CEO, Zhou Ou (Andy) has a real vested interest in the company with a 35% ownership stake, and the rest is split between just 5 other people. There are no institutions, funds, or anything else with an equity stake in FLYE.

To give you a taste of what I mean when it comes to sweat equity, since its founding in 2018, Andy and his other partners have funded this endeavor through their own personal loans to the company and traditional loans/lines of credit from banks.

From Apr’21 to Sep’23, Andy advanced the company $4,198,865 which was unsecured, had no interest, and no maturity date, and the balance remaining is now $183,866. Talk about commitment.

He’s not the only one though. Xi Lin and Rui Feng advanced a total of $194,940, under the same terms, and have since paid off everything owed to them.

I can list them all out but each one of the names above in some capacity advanced the company's money, time, or services in order to make this endeavor a success.

The reason why I like this so much is because rarely do we see founders/owners put in so much in an effort to get a business going.

Andy also doesn’t even command a high salary at all. In 2022, he had a salary of $49,250 with no stock awards. Mind you this is a salary while living in Queens, NY where the median HHI is ~$80k.1 In 2023, they did increase his salary to $100,000 and in the filing marked it as

“Receiving compensation at the level of a store manager.”

Which is true because even on his LinkedIn his title is quite literally “Manager at FLY E-Bike”. 2

Balance Sheet

Turning to the balance sheet, it’s not in bad shape at all to be completely frank.

The company, in order to fuel growth, borrowed money to size up its war chest, buy inventory and what appears to be retiring some outstanding loan payables.

The current status of the loan payables is shown below.

The other thing that I want to point out too is that even though the lease obligations seem astronomically high, 94.7% of all the current and non-current lease obligations are right-of-use (ROU) assets with maturities spread out.

Given that the company is profitable, I don’t see their balance sheet being much of a concern at the moment.

Call Options (Growth)

Because FLY-E makes its money by selling its bikes and the accessories and upkeep components, there isn’t much of a recurring revenue aspect to this business. Yes, you could argue that the maintenance from the bikes by their owners can have them keep coming in, similar to how consumers buy a car and get it serviced over its life.

Right now, the company is building out an app which is a management service mobile software for the EVs. In their own words,

“Once development is completed, the app is expected to include functions such as GPS, navigation, battery and tire pressure management, online shopping, and anti-theft features.”

I’m not riding high on this plan but there’s no mention of any R&D spend going into this thing so I can’t imagine that they’re all-in on this one. I mark this more as a nice to have but will by no means have a significant impact on growth.

The other call option is what the company calls “Fly E-Bike Care.” It’s basically insurance.

“We plan to launch our value-added Fly E-Bike Care program in the near future, which will function as an insurance policy to provide customers with continuous maintenance services beyond the warranty period mentioned above. This program will be designed to offer a wider range of coverage than the manufacturer and battery warranties, including accidental damages caused by customers. Additionally, we intend to add a “Fly E-Bike Care” feature to our app, which will send maintenance reminders to users based on their driving behavior and mileage.”

At the scale they’re at, I’d be cautious of what a separate side insurance business would do for the company considering these things are getting damaged, stolen, and manhandled all the time.

It might be as simple as something like Apple Care where depending on the product, you pay the upfront fee, have an extended warranty, and will still need to cough up some money for a replacement or fix.

Without knowing the full details, I’ve also labeled this as a nice to have.

Deal Dynamics

While the S-1 isn’t inclusive of proposed shares being offered and at what price, the company is looking to raise $17 million in their IPO which has yet to establish a date.

Uses of proceeds are highlighted below:

For the purchase of inventory and production costs of our vehicles

For the expansion of our retail stores

For our technology, research, and development efforts

Remainder for working capital

With the current sales and profitability, and being an emerging growth company, applying a 3-4x sales multiple means this could command a $100 to $130 million market cap after raising.

Why I’m Interested

This is just a really interesting opportunity. I personally see these bikes everywhere when it comes to food delivery and have many photos on my phone while I’ve conducted this research.

It’s small enough that getting in early could really pan out as it grows and expands. I’ve gone ahead and just listed the reasons below why I might consider it.

High insider ownership with no signs of overexuberance

Growing topline aggressively but still remaining profitable

An incredible amount of whitespace in other urban cities and countries (particularly Latin America)

Decently high reviews for retail locations with an active response rate for any negative comments that come into the review system

Focus on delivering various options at a great value

Possibility of future product/service offerings (battery charging/swapping)

These are just a few of the reasons why I’m interested but until we get a more updated S-1, I’m running with the above, which certainly has my attention.

I hope you enjoyed today’s post. If you have any comments, please shoot them below and consider subscribing to get updated thoughts on this opportunity and many others I’ve written about.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm