When Misunderstandings Create Opportunities

Why we decided to buy OneSpaWorld (OSW) with just a few hours of research

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or “the fund”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Students can get access to our research at a reduced rate by clicking here. If you’re interested in using Koyfin (I highly recommend it), you can get 20% off your plan using my link here.

Interested in becoming an LP? Click here to fill out the contact form.

Many investors aim to find the next multi-bagger opportunity, which usually leads them to areas with high growth, sex appeal, or left-for-dead companies banking on a turnaround (arguably meme stocks).

Rarely have we found opportunities where the underlying business is so simple and impressive yet wildly underfollowed and completely misunderstood by the market.

This “misunderstanding” amongst investors allowed us to start and scale a position faster than we ever have, and all it took was just a few hours of research to make that call.

Today’s post is going to be about how we concluded that this was an excellent investment for us to take based on the “perceived risk”, and highlight why, as an investor, capitalizing on a **true** market misunderstanding can lead to not just outsized returns, but also better risk-adjusted ones.

The investment we’re talking about is OneSpaWorld (OSW), a wellness spa/center operator that predominantly conducts business on cruise lines while also having select on-land locations. You know, massages, hot stones, facial treatments, botox, etc.

Seems simple (because it is), but boring (because it is), and that’s where the money was made. To first understand the misunderstanding, we need to understand the context.

Let’s begin.

Market Risk

Right off the bat, consumer discretionary names were getting hurt after inauguration day due to the unforeseen impacts of Trump’s tariffs, and the Liberation Day announcement didn’t help the situation at all.

The “R” word (recession) was consistently being floated around before April 2nd and especially in the days after as Trump increased China’s tariffs to an eyewatering 145% at its peak.

However, leading up to Liberation Day, OSW was already down 15% on the year and in our opinion, it theoretically made sense. It’s no secret that when recessions hit, or are about to hit, there’s typically an order for how consumer spending gets affected.

Housing slows down and consumers pull back on bigger spend → lower durable goods orders (big purchases).

Down the grapevine, more “discretionary” spending gets pulled back with travel being one of them → airlines, hotels, etc.

Again, given that OSW relies on traveling guests on cruise lines to partake in their wellness centers, it’s not so farfetched to assume why investors wrote OSW off as collateral damage for the “post-tariff travel trade.”

But investors got it wrong for two reasons.

Yes, travel takes a hit during recessions, but not ALL travel and not in unison.

OSW has a very unique business which takes a lot of the risk off of investors compared to other sectors, just by the nature of their business model.

The first was an easy one for us to quickly address and get comfortable with. Who gets hurt in the travel industry during recessions, and what better example than to look at the more recent recession in our lifetimes, the GFC?

We looked at the airline, hotel, and cruise line industries to see just how bad things got at the height of the GFC (below).

Airline Industry

First, when you think about travel, you automatically assume that the airlines will get hit, because, otherwise, you’re resorting to a car, which already was a cheaper means of transportation anyways.

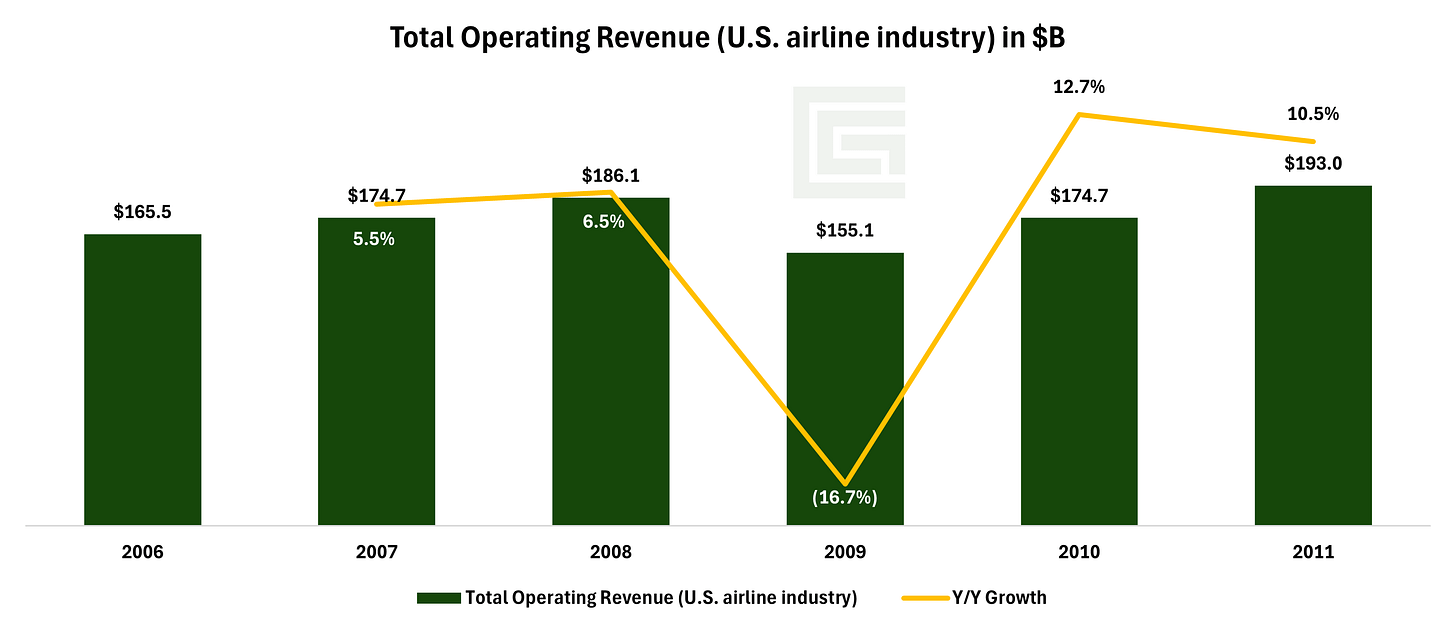

Overall, the revenues of the U.S. airline industry didn’t face a downturn until 2009, which was the height of the GFC, which tracks with how you would expect things to go given the circumstances.

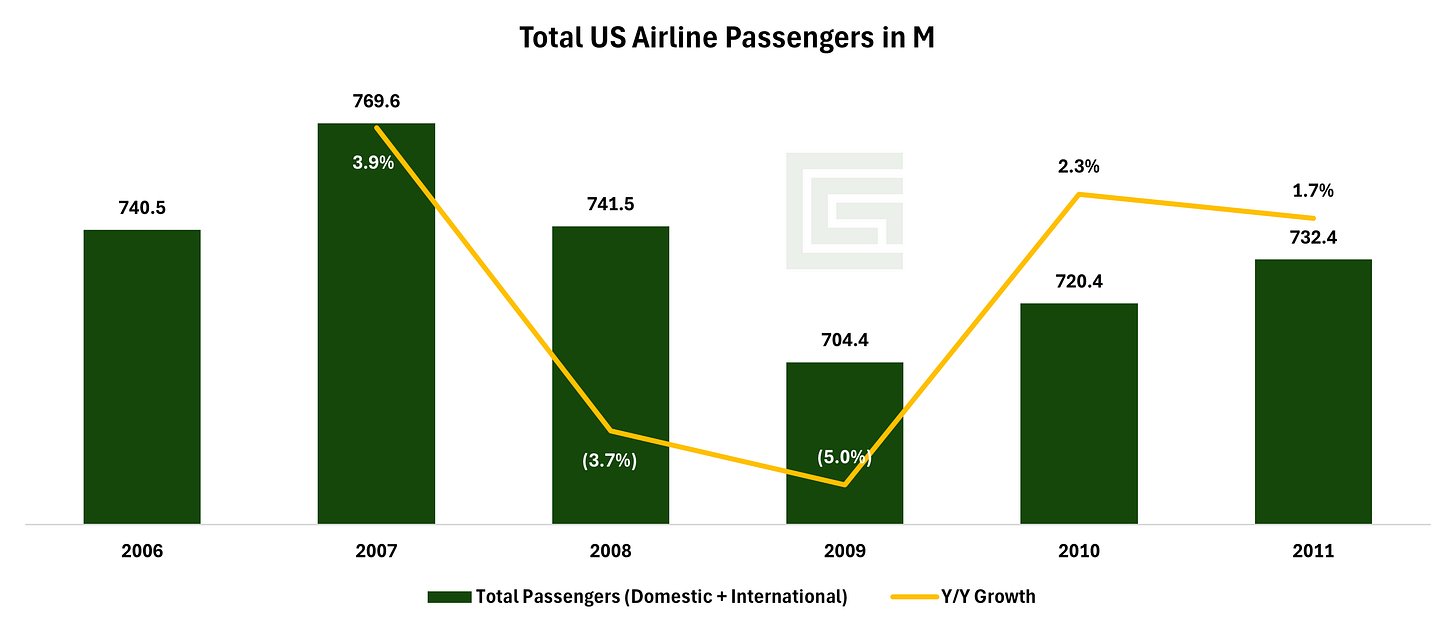

To match up revenue with total passengers taking flights, overall passengers started to dip in 2008 at the outset of the GFC. We will caveat that while total passengers were down in 2008, revenue was up partially due to oil jumping from ~$50/barrel in Jan’07 to ~$145/barrel in Jul’08 at the peak, which is reflected in overall gross revenue.

Takeaway: Airlines began to see a drop in revenue began in 2008 but didn’t see a drop in annual passengers until 2009. Big picture, airlines did take a hit amongst travelers during the GFC.

Hotel Industry

If we pivot to the hotel industry, which is the other component of travel among U.S. travelers, it shows a similar story.

Just like the airline industry, the hotel industry saw revenue decline in 2009 but started to see its occupancy rate start to dip as early as 2007 and accelerate into 2008 and bottom in 2009.

Takeaway: Just like the airline industry, the hotel industry also saw a decline in both overall revenue AND the amount of “guests” staying in their hotels.

Cruise Industry

Now, to the main industry that we cared about the most, cruises. We’ve had difficulty gauging the revenue generated during this timeframe because back then, the vast majority of cruise lines were private, but we were able to get revenue for the two biggest cruise lines public during the time; Carnival Cruise Lines (CCL) and Royal Caribbean Cruise Lines (RCL).

Just like the airline and hotel industries, revenue decreased in 2009 at a meaningful amount, BUT, unlike those industries, the passenger statistics are different.

When we looked at total passengers carried for these cruise lines, CCL (the biggest) did not see a decline in the number of passengers on their ships before, during, and after the GFC. RCL saw a very slight decline in 2009 before rebounding sharply in 2010.

Takeaway: This is where industries start to split because while all saw their revenue decline, they did not all see the amount of guests/passengers decline, and THAT is key to our next point when it comes to the business specific risk.

Business Specific - OSW

As we said earlier, it really only took us a few hours to know that this was more likely than not to be a good investment. The quickest we’ve ever done research and felt comfortable enough to throw a full-size position into it in such a short amount of time.

We already addressed the elephant in the room with how the broader traveling market reacted in one of the worst recessions in the last 30 years. This ‘lookback’ was deliberately done to possibly foreshadow what could happen if Trump’s tariffs stuck around and threw us into a recession. This was the assumption we were working off of at the time.

For the cruise line industry, it was not nearly as bad as other areas, and MORE people set sail on them when unemployment was peaking at 10% and foreclosures were happening all the time. This is a benefit to cruises because, unlike other industries, it attracts value-oriented travelers looking to combine destination with pleasure/relaxation. Hence, all-inclusive getaways.

But how does this translate into OSW being a good investment when everything was going to up in smoke after Liberation Day?

OSW’s business is unique in that it IS tied to the cruise industry, but NOT tied to how the cruise industry conducts its business.

What we mean by this is that all OSW needs to be successful is the ability to get access to passengers. Once this happens, then the rest is up to them.

This is a BACKEND problem (onboard), not a front-end (come take a cruise). Where industries like airlines, hotels, and cruises might offer discounts and promotions to get people in the door, OSW doesn’t have exposure to this.

They are not tied to the activities used to get people in the door.

That means that their revenue is derived AFTER the passenger steps on the ship, so it doesn’t have the general broad-based traveling recession exposure as you might think, since, as we saw above, passenger volumes generally went up for cruises, not down.

That’s misunderstanding #1 that OSW is not tied to. Cruise lines will always discount tickets closer to departure to leave with a full ship, but it doesn’t affect OSW.

To highlight what we mean, take a look at the next two charts for CCL for passenger stats. Aside from the first quarter in ‘09, they still saw net y/y growth in total passengers carried.

Like we mentioned, OSW makes its money once passengers are on the ship. We see that the ship, even during the GFC, was leaving at above 100% occupancy as it had in the quarters leading up to the bottom of ‘09. ✅

Once on the ship, then comes the “onboard revenue,” which is what matters to all the vendors who operate on the ship.

While revenue did decline, onboard revenue, which is what makes the “trip” memorable for sea-faring passengers, dropped less than the revenue that was generated from passenger ticket sales.

However, this “onboard” revenue is a mix of all discretionary spending on the ship once a passenger is on, so don’t assume it’s exclusive to one area. Pulling a quote from Q2’09 earnings call

“Net on-board yields in all major categories of bar, casino, shore ex, shops, photo and spa were down in the second quarter versus the prior year.” - David Bernstein, CFO

While not a perfect hedge, this at least showed us that people were still spending modestly once they got onboard, which hit everyone, not just wellness. Call this a “yellow” flag. 🟡

This is key because we’ve already limited downside risk in two major areas.

Cruises actually see a net benefit due to their value-oriented seeking passengers during downturns.

Onboard vendors don’t have to worry about discounting to get passengers; that’s the job of the cruise line.

So what else made this business interesting to us? Plenty.

OSW’s business is to operate these wellness/spa centers on the ships on behalf of the cruise line. This business relationship means that if a cruise line wants to have one of these centers onboard, the cruise line is responsible for the build-out, maintenance, and refurbishment, which means that OSW remains asset-light because they aren’t the ones outlaying the capex needed for these builds.

And this relationship means that they have a revenue split of ~50/50 to make this arrangement worthwhile.

OSW also has very favorable tax treatment because of how the business is set up and how its sales are derived. For instance, because most of their revenue is derived in international waters, this allows them to get no-tax or low-tax treatment due to the jurisdictions they operate in. This is also in tandem with OSW being set up as a Bahamian International Business Company (IBC), so their effective tax rate is ~5/6%.

And just look at their financials at the time.

Revenue growing, adj. EBITDA margin expanding, FCF growing, cash balance healthy, and net leverage coming down significantly since the depths of COVID.

So, to recap, the thesis for OSW was

Exposure to broader travel industry, but in an industry that saw itself grow in the last major recession.

Not tied to the heavy promotional discounting needed to get passengers on the ship (front-end vs backend).

Asset light model since the cruise lines pay for all the upfront and ongoing capex (risk off).

Growing topline with expanding margins as the global cruise industry continues up and to the right.

Net leverage decreasing with favorable tax treatment.

All of this looked really good to us, and we messaged everyone on Substack at the time (March 31) about the position, and the company was trading at 14.9x NTM EV/EBITDA — avg. 16.8x — and was down ~15% on the year.

Over the next few days, as Liberation Day tariffs came out, the stock only got cheaper. NTM EV/EBITDA contracted further to 13.6x, and that brought YTD performance to -25% (~$15/share) with the market panic selling a misunderstood asset.

It’s easy to say now that nearly anything bought during this time was a smart move because “TACO”, but we sized up significantly during this time — and none since — with full expectations that the Liberation Day tariffs would not come off and the likelihood of a recession was high.

We bought it with the probability of a recession occurring and the market punishing it without understanding its true exposure to the travel industry, which is now up >28%.

You could also ask, “why not just buy the cruise line?” → multiple reasons.

Our long positions are small-cap and below, so buying the cruise line would be out of our mandate (OSW was ~$1.7B MC at the time).

We didn’t want to have exposure to the companies that had ties to the physical asset and need to worry about ship leases + new builds and a sizable debt load.

Plus, even though cruise lines grew topline and got passengers onboard, they did not make much money (bottom line) and their stocks cratered (below).

The whole point of this play was the risk-adjusted return potential. Again, very healthy balance sheet, asset-light, and a steady grower with a growing industry (outside COVID).

Though the stock has rebounded significantly since the depths of Liberation Day, we’re merely outlining our thinking for those who might want to use our logic from this example elsewhere.

At 18.6x NTM EV/EBITDA, we can attest that there probably isn’t much juice left in this one to get really excited about, but should it perhaps backtrack a bit on any macro-related news, it could be interesting again for those who missed our initial message.

As always, we appreciate your support of our work. If you have any questions, please make sure to message or comment below. If you think others would benefit from the research/commentary we release, we would greatly appreciate your sharing.

Don’t forget, if you are interested in becoming an LP, click here to fill out the contact form.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm