Hydrofarm: Picks and Shovels

Why Hydrofarm (HYFM) is a great investment for helping fuel the growth of indoor vertical farming

Summary

Hydrofarm has a long runway for revenue growth as more states legalize cannabis for both medical and recreational use + the added benefit of more traditional vertical farms coming online in the next few years

Their bountiful amount of proprietary brands will give the company increased pricing power and margin expansion

The company has sufficient cash in the bank post IPO/secondary offering to make more accretive acquisitions as they continue to grow

This company is so easy to understand that it’s not sexy at all, but boy does this unsexy company have a bright future ahead.

In a nutshell, what Hydrofarm is doing isn’t complicated at all and to the average investor, doesn’t seem like it’s worth putting their dollars into. However, agtech/hydroponics are gaining steam, along with cannabis legalization and I believe that this company is the right investment to make in the space as a “pick and shovel” play.

Let’s dive in!

Business Overview

Hydrofarm HYFM 0.00%↑ is a leading independent distributor and manufacturer of controlled environment agriculture (“CEA”, principally hydroponics) equipment and supplies, including a broad portfolio of their own innovative and proprietarily branded products. They operate in the U.S. and Canada and are one of the leading competitors by market share in these markets in an otherwise highly fragmented industry.

They reach commercial farmers and consumers through a broad and diversified network of over 2,000 wholesale customer accounts, who they connect with primarily through their proprietary eCommerce marketplace. Also, over 80% of their net sales are through specialty hydroponic retailers.

Some of their market-leading CEA products are found below.

Financial and Stock Performance

Stock Performance

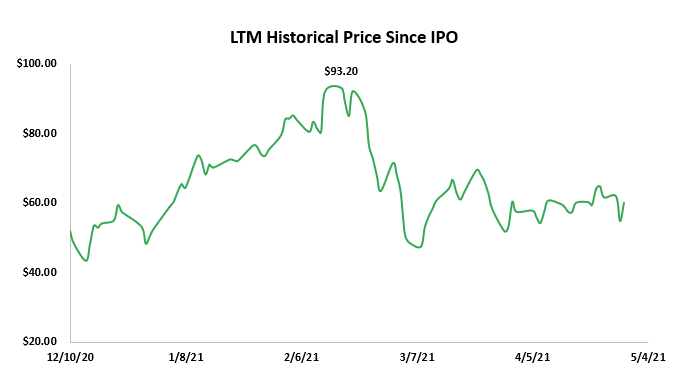

Having priced their IPO at $20 a share back in December, the stock opened at $46 a share, trading 130% above their priced amount. Post their IPO date, Jim Cramer was asked on Mad Money during the lightning round if he thought this company was worth buying when it dipped to $44 a share. He said no. He thought it was still too hot, and recommended Grow Generation GRWG 0.00%↑, a stock he’s been pitching for some time and has indeed made people a lot of money. However, this stock quickly shot to the stratosphere at ~$93 a share in mid-February when just about everything reached euphoric levels before crashing down like the rest of them.

Though the stock is off of its highs, that in no way means that it is not on track to retrace and then some. After a recent pullback of roughly 15% due to a secondary offering announcement and an acquisition, the stock quickly rebounded and is looking quite promising for a long-term hold. Hey, you’d still be up ~30% if you bought at IPO open ($46) and just held. More on valuation later.

Financial Performance

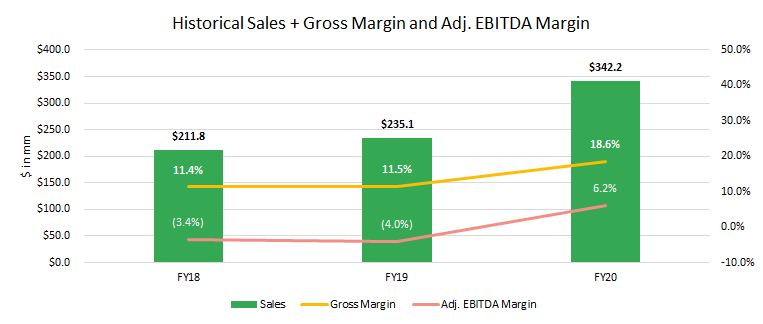

The company has seen significant growth over the last few years with overall margins improving at a rapid pace. Over the last two years, sales have grown +11.0%, and +45.5%, respectively. Gross profit margins have expanded by 702bps and on an adjusted EBITDA level, have finally become positive, posting a 6.2% margin in the most recent fiscal year.

What is also encouraging is that this company is not one that is still hemorrhaging money in the name of growth. With margin expansion quickly improving, the bottom line is not left in the dust. Net income margin has improved to -2.9% in 2020 compared to -17.1% in 2019 and with management’s goal of continuing to improve margin, I would not be surprised if Hydrofarm achieves positive net income for fiscal 2021.

Forward guidance:

“We are off to a strong start in 2021 with net sales growth year-to-date roughly on par with levels realized during our recently ended fourth quarter of 2020. Based in part on this strong start, we are currently estimating 20% to 25% organic net sales growth in fiscal 2021. We expect outsized growth in the first half to moderate in the second half of 2021 as we begin to lap particularly strong comparable periods in the third and fourth quarter. We also expect this growth will be dominantly driven by volume in conjunction with broader demand themes in the CEA industry; though we do anticipate that commodity cost inflation may result in some price increases across the industry during the year.” - John Lindeman, CFO

Organic net sales growth between 20% and 25% with stronger growth in the first half and moderating growth in the second half.

Adjusted EBITDA estimated at $28.0 million to $31.0 million representing further margin expansion to approximately 6.8% to 7.2%.

Why this stock? Why now?

So being the thematic investor that I am, I was very interested last year when I really caught wind of vertical farming and its massive potential for the future. With this in mind, I first pitched a micro-cap company called Agrify (AFGY), which operates in the indoor vertical farming space, and recently reiterated a buy rating on the stock post-earnings. However, unlike Hydrofarm, they are much smaller and specialize in selling physical growing systems and the software that goes along with it to provide the user valuable and necessary insights to efficiently grow their crops.

Hydrofarm is the other end of this thematic play. Supplying the picks and shovels.

What do I mean by this? Well, the saying was coined during the California gold rush where so many went out west to prospect for riches. Large infrastructure was needed to mine, wash, and sift the gold, not to mention, dynamite to blow up rocks. However, when it came to investing in this gold rush, people found that it was more lucrative to supply the “picks and shovels” to these miners so that they in turn could make money with less risk and what seemed to be an endless supply of miners.

So when I say Hydrofarm is the picks and shovels play, I mean that they are the ones that sell the small goods that are necessary in order to build these farms without actually having to sell them the entire, costly, slower growth, farming unit.

Market Potential

The Expanding Controlled Environment Agriculture Market

CEA is an increasingly significant and fast-growing component of the expansive global commercial agriculture and consumer gardening sectors. According to the USDA and National Gardening Survey, the agriculture, food, and related industries sector produced more than $1 trillion worth of goods in the U.S. alone in 2017, and U.S. households spent a record of approximately $48 billion at retail stores on gardening and growing supplies and equipment.

According to industry publications, the global CEA industry totaled approximately $65 billion in 2019 and is expected to grow at a CAGR of 16% from 2019 to 2023. The rapid growth of CEA crop output will subsequently drive growth in the wholesale CEA equipment and supplies industry. The global wholesale CEA equipment and supplies industry totaled approximately $8 billion in 2019 and is expected to grow at a CAGR of 12.8% from 2019 to 2025.

Significant Growth in the Cannabis Industry

According to industry publications, the U.S. cannabis market is projected to reach approximately $31.1 billion by 2024, up from approximately $12.2 billion in 2019, representing a 21% CAGR. In Canada, the cannabis market is projected to reach approximately $6.2 billion by 2024, up from approximately $1.7 billion in 2019, representing a 30% CAGR.

This significant growth in the U.S. cannabis market is expected due to

State initiatives for new adult-use and/or medical-use programs in additional U.S. states

Expanded access for patients or consumers in existing state medical or adult-use cannabis programs

Increased consumption driven by greater product diversity and choice, reduced stigma, and real and perceived health benefits in states with existing adult-use or medical use programs.

Little Customer/Supplier Exposure

I like the company’s customer base because of how wide and diverse it is. For a relatively small company, there aren’t a few players that could easily deteriorate their sales growth should they decide to go somewhere else. They currently reach over 2,000 wholesale customer accounts according to their recent 10-k filing. This is more of a defensive aspect of the company rather than a growth catalyst but still, I feel that it’s very important.

What’s also great is that they source their products from over 400 suppliers so there is a smaller chance of supply chain issues happening as a result. No single supplier makes up more than 10% of the company’s total purchases in 2020 which is great considering the chip shortage right now in the tech industry.

Product Differentiation

Currently, the company has over 6,000 SKUs sold under leading proprietary, exclusive/preferred brands or non-exclusive/distributed brands. The company estimates that approximately two-thirds of its net sales relate to recurring consumable products, including growing media, nutrients, and supplies that require regular replenishment. Their top 20 customers buy over 3,000 SKUs in aggregate.

Recurring revenue? Music to my ears!

The remaining portion sold revolves around more durable hydroponic equipment that sells under exclusive/preferred brand relationships providing for attractive margins and a significant competitive advantage.

We maintain an extensive portfolio of products which includes 26 internally developed, proprietary brands across approximately 900 SKUs with 24 patents and 60 registered trademarks as well as over 40 exclusive/preferred brands across approximately 900 SKUs.

With a significant amount of their products coming from proprietary brands, this will allow them to continue commanding a higher premium on the price of their products which will trickle down into expanding overall margins.

Acceleration of CEA Adoption

Both the commercial agriculture and cannabis industries are increasingly adopting more advanced agricultural technologies in order to enhance the productivity and efficiency of operations. The benefits of CEA include:

Greater product safety, quality and consistency

More reliable, climate-agnostic year-round crop supply from multiple, faster harvests per year as opposed to a single, large harvests with outdoor cultivation

Lower risk of crop loss from pests (and subsequently lower need for pesticides) and plant disease

Lower required water and pesticide use compared to conventional farming, offering incremental benefits in the form of reduced chemical runoff and lower labor requirements

Potentially lower operating expenses from resource-saving technologies such as high-efficiency LED lights, precision nutrient and water systems and automation

CEA implementation continues to increase globally, driven by the factors listed above as well as growth in fruit and vegetable farming, consumer gardening and the continued adoption of vertical farming. Vertical farming, a subsector of CEA, has gained popularity mainly due to its unique advantage of maximizing yield by growing crops in layers.

Future Acquisitions

Given the nature of this fragmented industry, there will be plenty of consolidation in the coming years as key players start to take shape. Recently, Hydrofarm announced an acquisition of a nutrient maker called HEAVY 16. This deal will be accretive and I’ve included a snippet from the press release below.

Hydrofarm expects HEAVY 16 to generate approximately $23 million in net sales across the full calendar year 2021, representing significant growth from the prior year. HEAVY 16’s profit margin profile will be accretive to Hydrofarm and as a result, the Company expects the acquisition will enhance the Company’s adjusted EBITDA margin for the 2021 fiscal year.

Incorporating more high margin businesses and products to their already massive portfolio will allow the company to offer better production differentiation to their customer base and help boost overall margins.

I would not be surprised if they continue to acquire smaller companies every year or so.

Valuation Support

Valuing Hydrofarm is difficult. On the one end, you could look for pure-play competitors in the space, though uyo’ll notice from the chart below, there aren’t that many available, and half are smaller than the company. You could through in retailers in the home and garden space such as Home Depot (HD), Lowe’s (LOW), or even Tractor Supply Co (TSCO), however, those are very mature companies and don’t quite have the same +20% y/y growth profile as HYFM has.

The company currently trades at a 5.3x Fwd EV/sales multiple based on 20% growth from 2020 figures. I believe that post their stellar 2020 earnings report, and further market penetration within the cannabis space, the stock should be trading closer to 6.3x forward sales, or roughly $76 a share. For reference, the average PT based on analysts’ estimates stands at $77/share. I gave the company one turn on its forward multiple, compared to 5.3x, based on comparing it a little more to the cannabis industry, which is trading at 12x+ fwd EV/sales.

Is this perfect? Absolutely not, but I believe it’s a start into an industry that can see immense near-term growth in the cannabis industry and long-term growth in the overall agtech space.

Conclusion

Hydrofarm has a lot going for them. From industry tailwinds propelled by cannabis and overall agricultural farming shifts to rapid revenue growth and margin expansion. Management has executed its goals for margin expansion effectively and I believe they will continue to do so going forward with the intent of achieving profitability in 2021 on a net income basis.

Forward EV/sales multiple of 6.3x is not a crazy assumption their growth profile and how their business is one that has an incredible amount of runway into the future.

If you’re looking to have exposure in the near term to the cannabis industry through ancillary companies, Hydrofarm looks like a winner. Why be the one building the farm when you can just sell them everything they need.

*The current stock price at the time of this article: $64.42.