If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.

At the end of September, the Bureau of Economic Analysis released U.S. data on income and spending for August for Q2’22.

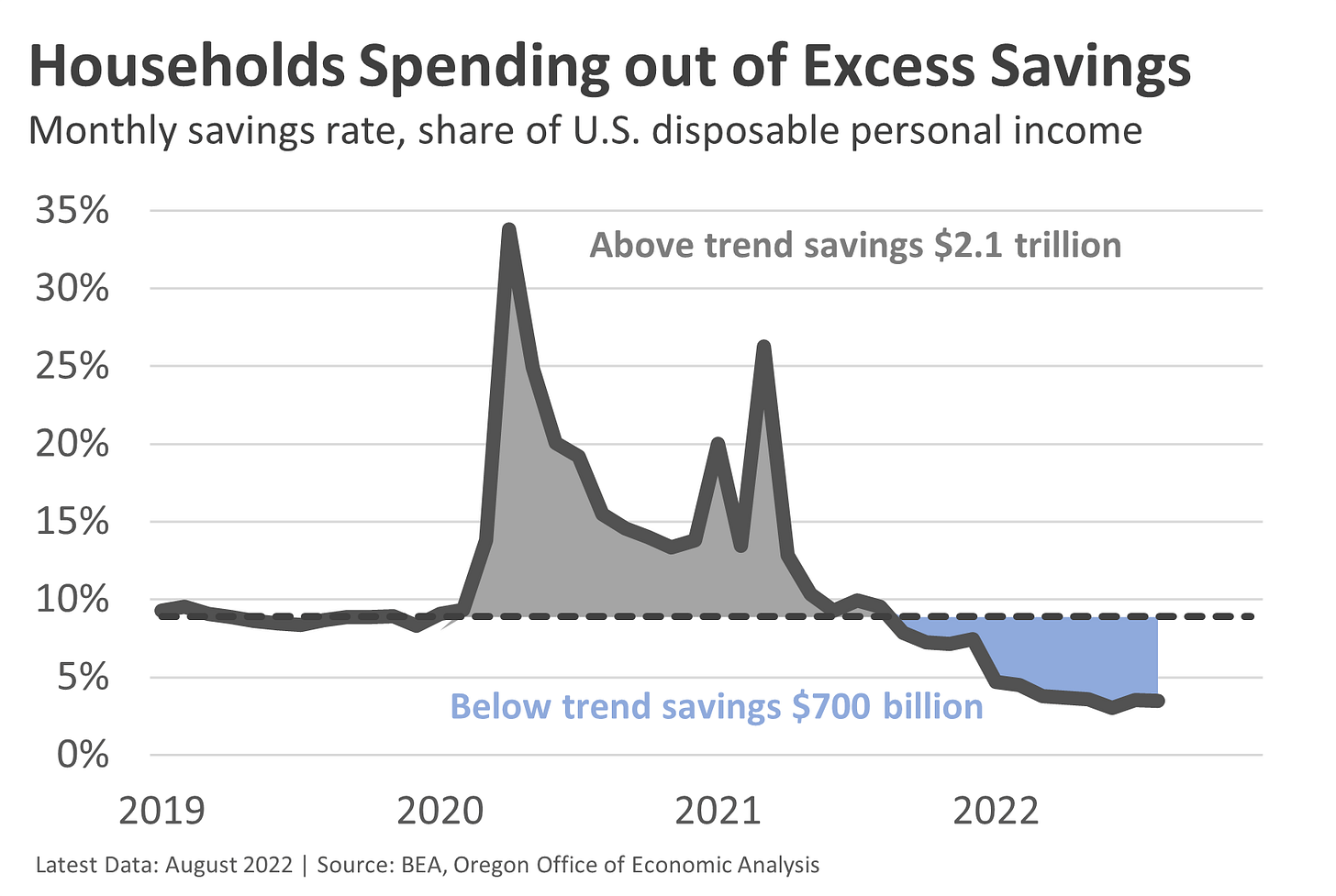

U.S. incomes were revised down slightly and spending up moderately. The net result of lower incomes and higher spending is less savings. The implication here is that the estimates of “excess savings” for households is both smaller and being drawn down faster than previously thought.

“Excess savings” is defined as above-trend savings that happened early in the pandemic.

The current version of the data shows that the stock of excess savings has been drawn down by about a third, whereas the previous version indicated it was more like a tenth.

With excess savings being drawn down at a rapid rate, we’ll see how quickly consumer spending will hold up, which only grew 0.4% in August.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Share

Disclaimer

All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. Cedar Grove Capital may buy, sell, or otherwise change the form or substance of any of its investments. Cedar Grove Capital disclaims any obligation to notify the market of any such changes.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Cedar Grove Capital. The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of Cedar Grove Capital which are subject to change and which Cedar Grove Capital does not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the fund/partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.