Cannabis: Rome Wasn't Built in a Day

Why the U.S. cannabis market will richly reward investors who show patience

Foreword

Everyone is looking for the next big thing and is typically impatient when it comes to getting a sizeable return. I believe that the cannabis and vertical farming industries will deliver stellar returns, but only for those that have the strength to be patient.

I’ve already written a primer on the vertical farming space (Vertical Farming: Don't Sleep on this Opportunity) and a piece on why cannabis stock valuations are suppressed (Why Your Cannabis Stocks Aren't Higher).

What I haven’t written about thus far is a detailed breakdown of the U.S. cannabis market and why it’s waiting for the green light to launch higher. I should know, I was a previous investment banker that covered the space starting back in 2018.

This primer will be that explanation and if you feel others would benefit from it, I ask that you share it with them so they too can potentially make some money.

What I’ll cover:

The U.S. Cannabis Market

How Consumer Views Have Changed

Current Market Landscape

Legalization: What’s Present and What’s Coming

The Market Opportunity

Key Takeaway

1️⃣ The U.S. cannabis market

The cannabis market is divided into two parts: medical and recreational.

The medical side requires a state-issued certification card in order to purchase and consume cannabis products with THC (tetrahydrocannabinol) from a licensed dispensary. Whereas in states where recreational (adult-use) is legalized, those of age can purchase without a physician’s input.

However, now that times are changing, more states have started to become open to legalizing recreational use in order to gain from the massive tax windfall that could accompany it.

Every year, analysts predict what the cannabis industry is worth. And every year that number exceeds expectations.

With 10 newly legalized states slated to begin selling cannabis in 2021 or 2022, the legal market is projected to pull in $42 billion by 2026.

In a new study conducted by New Frontier Data, the report finds that 141 million Americans—or 43% of the adult population—reside in 18 adult-use states, "representing a diverse and widely distributed consumer base for retailers to segment and target." And by 2025, 42% of the total annual U.S. cannabis demand is projected to be met by legal purchases in regulated marketplaces.

This is a 24% jump from 2020. New Frontier Data cites a surge in legal market spending as well as the conversion of existing illicit market consumer spending to legal regulated sources as reasons for the estimated increase in consumer demand.

Another interesting finding: By 2025, 5.4 million Americans—or 2.4% of U.S. adults—will be registered patients in medical cannabis states.

As more states legalize and cannabis consumption increases, investor confidence is also growing. The study found that in May 2021, fundraising in the legal cannabis market more than tripled, amassing $6 billion.

On the opposite side, however, the black market is still alive and thriving. For the pandemic-ruled 2020, illicit national cannabis demand and consumption were estimated to be over $65bn.

Roughly a third of the $65bn illicit market figure is comprised of states that have not, and do not appear to have plans to legalize any form of cannabis before 2025.

Don’t count medical cannabis out just yet

Election day 2020 was big for medical marijuana: Mississippi voted to legalize medical, and South Dakota passed legislation for both medical and recreational use.

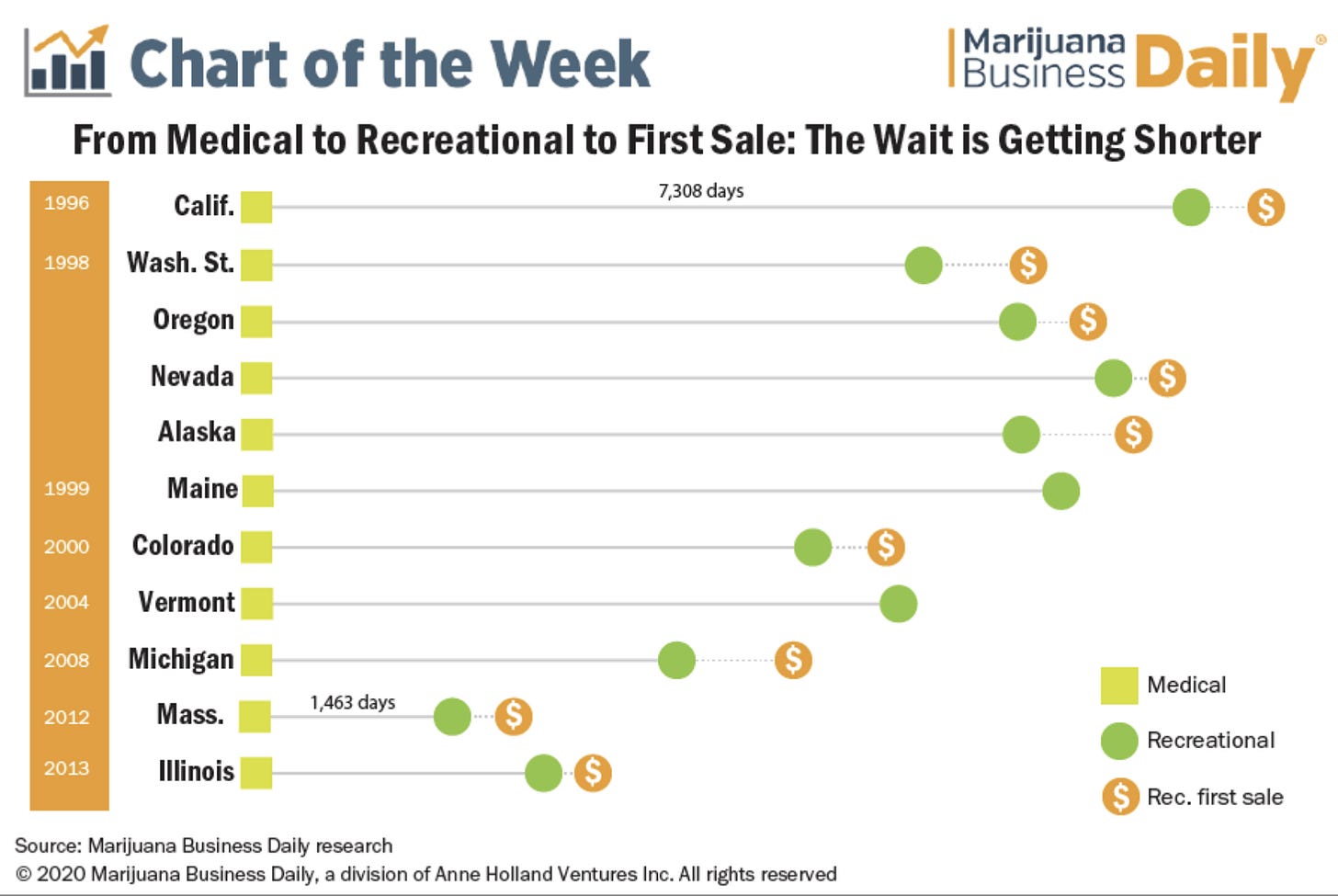

As the industry matures, we’re seeing significantly less time from when medical weed is first legalized to the first recreational sale.

According to Marijuana Business Daily, California took 7,308 days from medical to recreational to the first sale. Massachusetts, just 1,463 days.

This trend should only continue and perhaps we'll see the average time go down as adoption rates go up.

2️⃣ Consumers have a change of heart

As I mentioned previously, the growth of the market is not being done without the help of the American people. With that, views of the drug have changed.

According to a Gallup poll, support for legal marijuana is at an all-time high of 68%. Among 18- to 29-year-olds, that support rises to 79%. In 2018, 66% of Americans supported legalization.

The first time Gallup took the same poll in 1969, just 12% of Americans held the same view.

Currently, 48% of Republicans and 83% of Democrats are in favor, showing that state-level recreational legalization in Republican-dominated states still has a way to go. Between 2018 and 2020, Republican support for legalization decreased (from 53% to 48%), while Democrat support jumped (from 71% to 83%).

That said, several traditionally red states have entered the cannabis market with gusto, including Oklahoma.

3️⃣ Current market landscape

Even after I’ve hit you with a bunch of numbers and stats, when you think about cannabis, what do you immediately think of?

I’m betting that many of you just think about the actual plant and how you would buy it in nugget form to smoke or perhaps make edibles.

While this might be true, that’s not all I want you to think about.

I want you to view the industry in its three categories:

Producers, growers, cultivators, and retailers

Ancillary businesses to support the actual growing of said cannabis plant

Technology companies to support (i.e. payment solutions, banking, marketing, etc.)

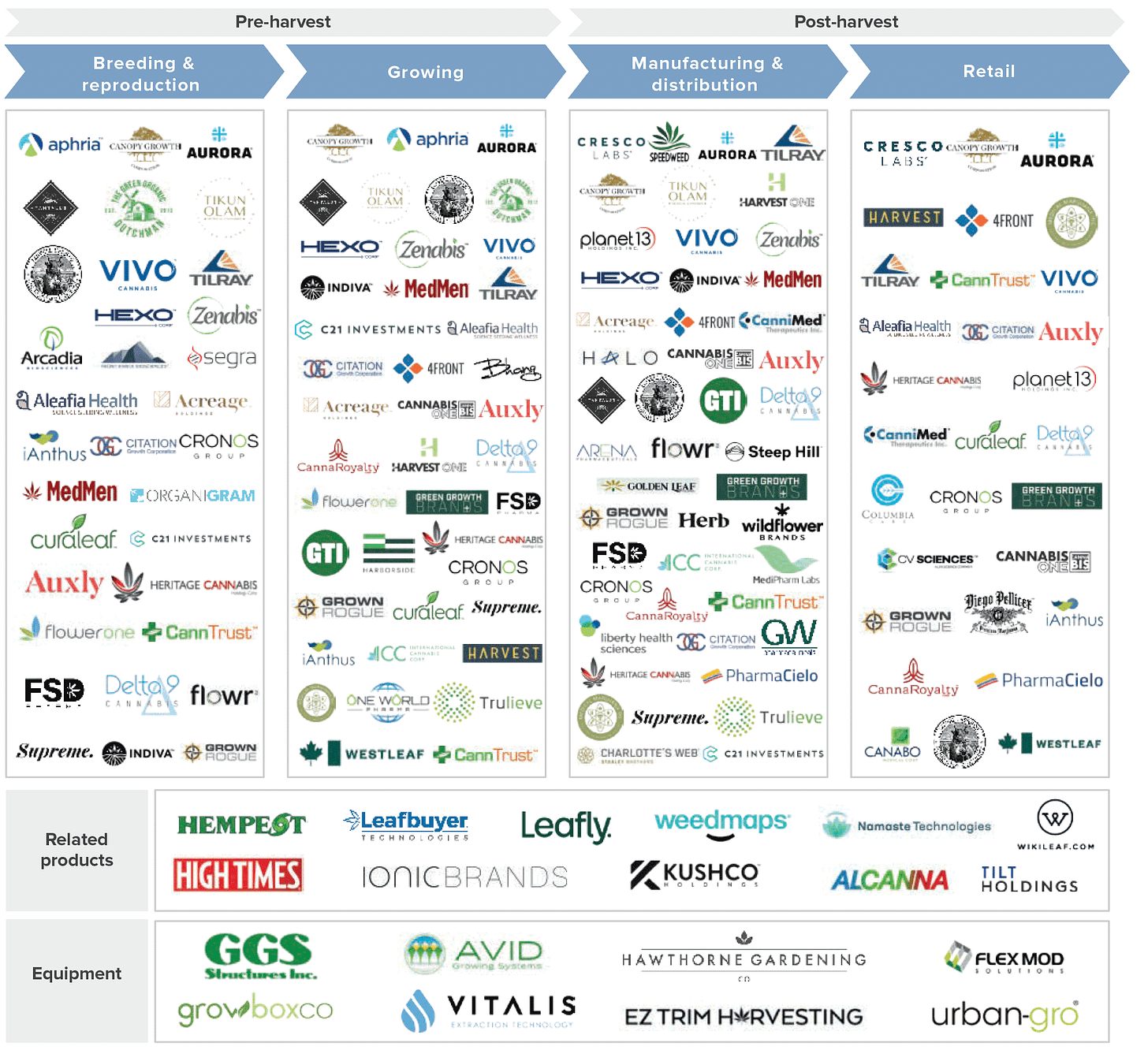

Though I split them out above, I want to combine them both in the infographic below.

As you can see, there are plenty of companies (both U.S.- and Canada-based) that cover categories one and two.

Some of these names you might have heard of and others maybe not. The point of this visual is twofold: to show you just how fragmented the market is, but also to show you who operates in one or many categories.

What I love about this is that you can either invest in the companies that have direct exposure to growing and selling cannabis (Green Thumb Industries, Acreage, Tilray, etc.) or you can invest in the companies that supply the equipment needed for them to grow (Hawthrone Gardening, Urban-Gro, Hydrofarm, Agrify, etc.)

This sweet spot grants you access to the plant whether the company you're investing in touches it directly or indirectly. I’ve written multiple articles in the past if you’d like to go back and read them at your leisure.

Many of these companies are worth exploring, and I can imagine many being acquired through M&A in order to capture more licenses for dispensaries and command better pricing power from economies of scale.

Because of a complex regulatory landscape and numerous marketing restrictions, the cannabis industry is currently running into several obstacles. However, the industry’s most potent driving force continues to overcome these growing pains: made-to-measure technology that makes commercial enterprise possible.

Unlike traditional retailers, the cannabis industry is subject to a complex collection of state-by-state mandates and a never-ending shift of local laws. U.S. cannabis retailers cannot just sell. They must verify the buyer’s identity and medical card where applicable, calculate local taxes, track every individual purchase, and send to regulatory bodies to validate and enforce possession limits. Being compliant is only half the battle—albeit a necessary one.

The industry has started to see the value in technology related to most aspects of the business, from inventory management and point-of-sale and delivery, to CRM and marketing automation. However, the operative word is started. The legal cannabis industry is still immature, and sales and marketing technology remains a relatively new concept. Luckily, canna-tech capabilities and adoption are growing quickly—and maturing the industry along with it.

4️⃣ Legalization

Current status

Since 2012, 18 states and Washington, D.C., have legalized marijuana for adults over the age of 21. And 37 states have legalized medical marijuana—meaning that a majority of Americans have access to cannabis, whether medically or recreationally.

Three states—New Mexico, Virginia, and South Dakota—passed legalization in recent months, and the laws took effect in late June and early July.

What’s on the table

Recently, however, Senate Majority Leader Chuck Schumer wanted to introduce a bill at the federal level to decriminalize cannabis. The Cannabis Administration and Opportunity Act would remove marijuana from the Controlled Substances Act and introduce regulations to tax cannabis products.

The proposal would expunge federal records of nonviolent cannabis offenders and allow people serving time in federal prison for nonviolent marijuana crimes to petition a court for resentencing.

The outlook for the final passage is still uncertain. Schumer and co-sponsors, including Sen. Cory Booker, D-N.J., have not yet formally introduced their draft bill, and Congress is currently consumed by a debate to pass trillions of dollars in spending on infrastructure and social programs.

It’s also unclear whether President Joe Biden will sign the bill. While Biden has endorsed decriminalizing the drug, he has not backed full legalization.

5️⃣ The market opportunity

This is where the real fun starts. Why cannabis is going to make a lot of people who hold the right stocks rich.

There are a few reasons why this industry is ripe to move higher, much higher.

Government regulations don’t just affect the businesses themselves, but also who can own it

Because there’s a limitation on who can own cannabis-related equities right now, liquidity in relation to volatility is an issue

Margins are currently being compressed by the laws that live around controlled substances, and once federal legalization happens, margin expansion will quickly follow

Re-ratings will occur when moves from the OTC market to traditional exchanges (NYSE and NASDAQ) take place, allowing for multiple expansion as well

I won’t dive too much into points 1 and 2 because they are covered in depth in my article Why Your Cannabis Stocks Aren't Higher, so I suggest you read that instead of me regurgitating everything.

Government regulations

Because the government has set laws on cannabis being a controlled substance, this prohibits many institutional investors from owning the stock.

That means that big mutual funds, hedge funds, various portfolio managers, and more cannot own the stock because legally they aren’t allowed to.

This in turn leaves hundreds of millions, if not billions, of dollars on the sidelines that could otherwise be invested in cannabis stocks.

Lack of liquidity → increased volatility

To my previous point, since big money can’t enter the cannabis market, that leaves a lot of cannabis-related equities very volatile.

I go more into detail about this in the article I highlighted above, but I wanted to carry over my graph example to explain.

At the time I wrote that article, the prices and liquidity were what’s listed above. What’s an interesting callout is that Tilray (TLRY) and Green Thumb Industries (GTBIF) are both cannabis companies, one Canada-based and the other U.S.-based.

Their market caps are very similar, though Tilray deals with ~39x more dollar transactions than Green Thumb Industries. Because the liquidity on a daily basis is so little, huge price swings can occur for absolutely no reason.

Once federal legalization occurs, expect large amounts of funds to enter the market and provide much more trading volume which helps promote sensible price movements.

Compressed margins

MJBiz data revealed that in 2016, 18% of dispensaries reported they were very profitable; 41 percent had a modest profit; 29% broke even, 11% had some losses, and 1% had larger losses.

For cannabis businesses, Section 280E of the internal revenue code forbids cannabis businesses from deducting ordinary business expenses from gross income. This results in lower overall profits as businesses can’t take deductions that the IRS affords to most other companies.

Rule 280E

Rule 280E excludes tax write-offs for labor, rent, utilities, insurance, professional fees, etc. Harborside, the Oakland, California dispensary co-founded by industry legend Steve DeAngelo, has been fighting 280E’s cannabis exemptions since 2009.

Unfortunately, in 2018 Harborside lost its case in U.S. Tax Court and is appealing the decision. However, until the federal government legalizes cannabis, most tax professionals and cannabis attorneys do not envision the IRS (or federal courts) ruling in dispensary owners’ favor.

To give you an example of just how much Rule 280E affects cannabis businesses’ bottom line, take a look at the chart below and see the difference.

General operational expenses

Additionally, many companies don’t have access to traditional banking and mostly have to solely deal in cash or high-cost POS systems. The need for pricey cash management, security (literal people with guns), and high marketing costs (since they aren’t as efficient as traditional companies) really take a toll on margins.

Once laws get relaxed or lifted for many different parts of the business, you’ll start to see massive expenses either being removed entirely or dramatically reduced, inevitably trickling down to the bottom line.

Valuation re-ratings

Besides the fact of the first two points (government regulation and lack of liquidity), many U.S.-based cannabis companies have to resort to trading over-the-counter (OTC). These are those tickers that have five characters instead of four. Ex. Green Thumb Industries (GTBIF) vs. Tilray (TLRY).

Because these companies are forced to trade OTC, since legally they cannot tap into the mainstream exchanges, they don’t trade well (lack of liquidity) and thus have depressed multiples compared to their Canadian peers.

I’ve provided a visual reference for you below, though this is not apples to apples since there are indeed different business fundamentals between all of them.

There are two important callouts from the chart above:

The biggest U.S. cannabis players are making more (sales) than the biggest Canadian ones

U.S. cannabis company sales growth rates are larger in comparison to the Canadian ones

One caveat to what I just mentioned is that though cannabis is federally legal in Canada, the business model on how these companies operate are fundamentally different and that’s why it’s not completely apples to apples.

With that being said, the Canadian players listed above all trade on major U.S. exchanges, and thus have access to more of the markets than the other U.S. cannabis players.

Once federal legalization happens, or an amendment to the SAFE Banking Act of 2021, U.S. companies will be able to list their stocks on major exchanges and a re-rating will occur from investors looking to cash in.

6️⃣ Key takeaway

The U.S. cannabis industry is still very much in its infancy, but it is still growing at incredible speeds despite the regulatory hurdles that come along with operating in the space.

Price entry into these names will be key for starting a position. But I will admit, you will have to stomach the intense volatility that comes with owning these names.

I would know, I own some of them and nothing beats seeing your stock go up and down by +/- 30% every month for absolutely no reason. However, if you are a long-term investor, the waiting game is going to play out well for you.