The Honest Co. (HNST), is Honestly Overvalued

Why Jessica Alba's eco-friendly consumer brand is not worth its current valuation

Summary

The company’s significant sales growth of +27.6% during COVID is a one-off and will not continue at this rate going forward

Small addressable markets don’t seem too appetizing given the Goliaths currently owning the CPG space at scale

Serious risk factors associated with their retail distribution and supplier agreements could leave the company exposed to revenue deterioration

The company is riddled with lawsuits and issues regarding the integrity of its eco-friendly and natural products

DCF assumptions more in line with other CPG players point to a lower valuation than where it’s currently trading

Business Overview

Company founder Jessica Alba was inspired by the 2008 birth of her first child, Honor, and her own history of childhood illnesses to create a company that provided an alternative to the prevalent baby products with ingredients such as petrochemicals and synthetic fragrances. She was compelled to become serious about this venture when one of her mother's baby laundry recommendations caused her to have a welt outbreak and founded the firm in 2011.

She serves as the company’s chief creative officer and board chair, though is playing a more backseat role post the IPO while collecting a $600k a year salary.

The Honest Company HNST 0.00%↑ sells hypoallergenic, eco-friendly cosmetics, baby goods, cleaning solutions, and other consumer products both directly to the public via the Web and through major retailers.

They sell their products under three business units; Diapers and Wipes, Skin and Personal Care, and Household and Wellness. They also have two main distribution channels; e-commerce DTC and retail (Costco COST 0.00%↑, Target TGT 0.00%↑, Amazon AMZN 0.00%↑, etc.).

Financial Performance

The below commentary is taken directly from their S-1.

From 2018 to 2020, we grew revenue by a 12% compound annual growth rate, or CAGR, from $237.9 million to $300.5 million, with only a slight decline in 2019 as we offset declines from Non-Core Products;

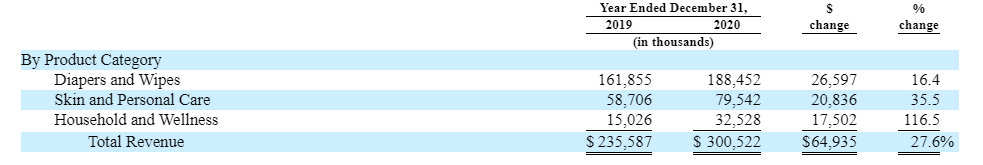

We achieved 27.6% year-over-year revenue growth in 2020, recording year-over-year revenue growth rates of 16.4%, 35.5%, and 116.5% in our Diapers and Wipes, Skin and Personal Care and Household and Wellness categories, respectively;

We also increased gross margin by 1,080 basis points from 25.1% in 2018 to 35.9% in 2020, by driving growth in higher-margin products and channels, leveraging our strategic relationships with retailers, gaining leverage on fixed costs in fulfillment, as well as executing on accretive product innovation; and

In 2020, we reported a net loss of $14.5 million and adjusted EBITDA of $11.2 million, or 4% of revenue.

This Company Has Plenty of Speed Traps

Don’t get me wrong, I’m personally a fan of a company with a strong mission to provide sustainable and chemical-free ingredients to the masses. It’s honorable and frankly, noble, though I don’t think The Honest Company is the one to disrupt the industry in a meaningful way to command this valuation.

The company has plenty of areas that I’m uneasy about and, in my opinion, lead it to be worth a lot less than it currently is.

Let’s start off with their recent pandemic success.

COVID success helpful, but shortlived

Let’s be honest (ha!), anyone who remotely sold, broadly speaking, household/cleaning products in 2020 really benefited from the pandemic. The Honest Company was one of these benefactors of this pandemic.

During the pandemic, household and wellness grew the fastest with an over +116% increase from the prior year. As a proportion of sales, diapers and wipes commanded 68.7%, skin and personal care at 24.9%, and household wellness at 6.4% during 2019. In 2020, it shifted to 62.7%, 26.5% and 10.8%, respectively.

This shift in product category is a direct reflection of the pandemic and commentary taken from their S-1 below supports this theory.

The revenue increase from Household and Wellness was primarily driven by sales from the sanitization and disinfecting products that we introduced in 2020, in particular through the Retail channel…..For example, we created and brought to market a new Stay Safe cleaning collection, a complete set of cleaning, sanitizing and disinfecting solutions, in less than six months after the onset of COVID-19. In 2020, 22% of our revenue was generated from stock keeping units, or SKUs, introduced in 2020.

Over a fifth of their 2020 sales came from new products that were introduced that year and the biggest uptick on a percentage basis came from their disinfecting products. As more people continue to get vaccinated, less disinfectant will be needed and sales growth should return to a more normal level. This has been a hot topic for other CPG companies such as P&G, J&J, and others about being able to maintain growth in their consumer categories post a pandemic reopening.

As far as their gross profit is concerned, a callout from their S-1 is included below that sheds light on just how much easier it was to sell their household and wellness products.

Gross profit also benefited from lower promotional discounting in 2020, in particular in the Household and Wellness category.

With the category being in such high demand last year, not as many discounts were needed to move inventory, and thus the company benefited by capturing more margin on their product via this product category.

Small, but growing, addressable markets

I am also skeptical that the company can able to make continued meaningful penetration within their respective categories considering the company currently operates in a niche sub-category.

In 2019, we estimate that the clean and natural U.S. Diapers and Wipes, Skin and Personal Care and Household and Wellness markets generated approximately $1 billion, $12 billion and $4 billion in retail sales, respectively, and that they will grow at a compound annual growth rate, or CAGR, of 16%, 10% and 4% from 2019 to 2025, respectively.

They even peg themselves at having less than 5% market share in these combined markets though they caveat this with “room to grow.” Yes, in theory, when you don’t own all of something you can make the case that you can move in to capture incremental share, though this is easier said than done.

Given changing consumer trends and a highly competitive market with legacy players and newcomers like Grove Collaborative, I do not believe that The Honest Company will be able to make further market penetration in a meaningful way.

Without the face and brand of Jessica Alba, it may have never even gotten to this point, which took 10 years…and still hasn’t turned a profit…

Heavily dependent on retail partners and suppliers

Retail is becoming a much bigger part of digitally native first companies but putting your eggs in just a few baskets that make up 45% of your total revenue is a risky model.

As of right now, The Honest Company sells its products in Costco, Target, and Amazon, representing sales of 23%, 22%, and 8% respectively.

Even the company labels this a risk when it comes to their overall sales.

The loss of Target, Amazon, Costco, or any other large partner, the reduction of purchasing levels, or the cancellation of any business from Target, Amazon, Costco, or any other large partner for an extended length of time could negatively impact our sales and ability to achieve or maintain profitability.

Though it is always great that companies can include different retailers as part of a revenue-generating channel, having just a few names command almost half your sales is dangerous in my opinion. Should trouble befall the company again as it has in the past, they could pull the plug without notice since there are no termination provisions for Costco and Target, though there is a 60-day notice for Amazon.

The company also relies heavily on a few key suppliers for their products and admits as part of their risks that any interruption or sudden termination of supply agreements would severely hamper their ability to grow and achieve profitability.

In my opinion, it’s just too risky to not be well-diversified in these areas, though they have mentioned they are working on diversification amongst suppliers and hope to add new retailers in the future.

Shelf space becoming harder for them to secure

To piggyback off of the retail story from above, if you’ve dabbled in the retail space, then you know that shelf space is super important. Retailers give brands prime shelf real estate to the companies and products that they believe will be able to sell a lot easier and faster.

The Honest Company labels this as a risk in their S-1.

…we may be unable to secure adequate shelf space in new markets, or any shelf space at all, until we develop relationships with the retailers that operate in such markets. Consequently, growth opportunities through our Retail channel may be limited and our revenue, business, financial condition, results of operations and prospects could be adversely affected if we are unable to successfully establish relationships with other retailers in new or current markets...

…We also face severe competition to display our products on store shelves and obtain optimal presence on those shelves. Due to the intense competition for limited shelf space, retailers are in a position to negotiate favorable terms of sale, including price discounts, allowances and product return policies. To the extent we elect to increase discounts or allowances in an effort to secure shelf space, our operating results could be adversely affected…

This greatly correlates with their dependence on these few retailers for distribution and also the shelf space that they decide to give them which leaves them at risk for negative sales exposure.

Negative sentiment about their products

Throughout the life of The Honest Company since its founding, they have had lawsuits, product recalls, and negative reviews.

Right now, if you were to go to the consumer affairs website, they have a 3.3 out of 5 rating. The Better Business Bureau (BBB) has have over 40 complaints made with the most recent one being filed on March 9, 2021.

However, they have improved their Amazon average star rating from 3.9 to 4.4 between January of 2018 and March of 2021, though I would be cautious of Amazon ratings since buying your rating runs rampant there.

The risk of any potential product issues can lead to further damage to the overall brand and a loss of sales.

Valuation can’t support the current trajectory of the business

The Honest Company has been around for about a decade, yet has not become profitable on a net income basis and only recently became profitable on an adjusted EBITDA basis.

At its current enterprise value of ~$1.7b (this factors in cash raised from IPO), current EV/Sales is 5.6x and EV/EBITDA stands at 149.5x. I don’t know about you, but paying almost 150x for a consumer sustainability product company with meager growth is just bonkers.

So how did this company get priced at $15.50 a share and then open on the public markets at around $23? This is beyond me but I wanted to create a DCF in order to figure out what it’s currently worth. To gauge how the company’s margins compare to other big players, I’ve included a chart below to better visualize how they’re doing.

Callouts that I want to make in the above chart is that the competitors that I’m comparing HNST to are legacy players and have been around for a VERY long time, many have other divisions that could boost EBIT and EBITDA margins, and because they're more mature, they do not have as high sales growth figures anymore. However, I wanted to see how much The Honest Company could scale their EBIT margin to considering how underperforming they are.

I based my assumptions on a sales CAGR of 15% through 2025E, achieving a 12% operating margin (half the rate of its peers) by 2025E and a generous EV/EBITDA multiple of 15x. I chose this sales CAGR (happy middle between total and core CAGR since 2018 - see financial performance) and exit multiple because let’s be honest, the company sells diapers and sanitation wipes not some futuristic tech.

Given these assumptions and all else equal, this led me to a current implied share price of $11.28. This represents a downside from Friday’s close of -41%. I’ve provided a sensitivity table below that flexes the exit multiple and growth rate for you to better visualize.

For the share price to equate to what it recently opened at, you’re looking at a CAGR well over 23% and a multiple of over 20x, this is based on my margin assumptions, however.

Even at an IPO pricing of $15.50, that’s still an aggressive take on where I currently think it’s valued.

Conclusion

This company is little more than an “okay” run consumer sustainability products company with a celebrity face as its promoter (Jessica Alba), and cannot command the premium it currently does. Compared to its peers, The Honest Company is growing fast, but not much faster. Given its current multiple, it’s trading more like a tech stock than it is a consumer brand and I would’ve even given it the benefit of the doubt should it be a disruptor in the CPG space, but then again, it’s not.

The company is doing great things and they have greatly improved their overall business since its founding, but that doesn’t give it a get-out-of-jail-free card to trade much higher than its other CPG peers.

All in all, I like the business but I do not like the stock. Because of this, I have recommended a SHORT position for this company until it can come down much more than it currently has since IPOing last Wednesday.

*The current stock price at the time of this article: $19.42