The Dog Goes, WOOF! WOOF!

How Petco is positioned for a major comeback in the pet space with the stock seeing significant upside.

Summary

The continuation of building a highly defensive ecosystem as a one-stop-shop experience for all your pet needs will lead to increased long-term value per customer

Leveraging the power of their retail network to offer same-day delivery and improve margins and AOV through buy online and pick up in-store (BOPUS)

An aggressive push into e-commerce to catch up to competitors like Chewy and membership programs like Pupbox, Vital Care, and Petco Insurance will continue to drive top-line revenue

Business Overview

Petco Health and Wellness Company, Inc. WOOF 0.00%↑ operates in the pet health and wellness business. It is involved in the retailing of pet consumables, supplies, and companion animals and services.

The company also offers various services, such as outpatient veterinary care services through Vetco clinics; tele-veterinarian services; pet health insurance; grooming; and in-store and online training.

Petco also offers pet consumables, supplies, and services through its petco.com, petcoach.co, petinsurancequotes.com, and pupbox.com websites.

As of January 13, 2021, it operated 1,500 pet care centers in the United States, Mexico, and Puerto Rico, which also includes a network of more than 100 in-store veterinary hospitals.

Q4’20 and FY 2020 Earnings Recap

Petco had a great first earnings release since being a public company and Ronald Coughlin (CEO) was pleased with the results and provided some great commentary on the overall company.

“We exited 2020 with momentum, delivering fourth quarter revenue growth of 16%, above our expectations, a 17% comparable store sales or comp sales, 90% plus digital growth, almost 1 million new customers into the franchise and 13% adjusted EBITDA growth.”

- Ronald Coughlin, CEO

Adjusted EPS of 17 cents was up 103% from last year and ahead of the FactSet consensus for 13 cents. Sales totaled $1.338 billion, up from $1.149 billion last year and ahead of the FactSet consensus for $1.309 billion. Petco went public in January.

"Our category continues to grow powered by the millions of incremental new pets in households, which is creating an annuity for years to come" - Ron Coughlin, CEO

Petco reduced its total debt by 49% to $1.7 billion using the proceeds from the IPO. For fiscal 2021, Petco is guiding for revenue of $5.25 billion to $5.35 billion and adjusted EPS of 63 cents to 66 cents. The FactSet consensus is for revenue of $5.237 billion and EPS of 60 cents.

Business Performance

Petco has done an amazing job creating an all-inclusive, multichannel ecosystem for humanity’s various pets. This same multichannel ecosystem, which ranges from basic pet food and supplies all the way to grooming, training, and veterinary care has created a “stickiness” amongst its millions of customers.

Incorporating a one-stop-shop for all your pet needs through its retail footprint while growing its online presence, which admitted was lacking, and expanding its pet care businesses is setting Petco up for future success. This multichannel ecosystem drives incremental spend for the average customer by up to 6.4x.

“…customers who engage with us across two or more channels spend on average 2.8x as much as our single-channel customers spend, and those who engage with us across three or more channels and all four channels spend on average 4.4x to 6.4x as much, respectively.”

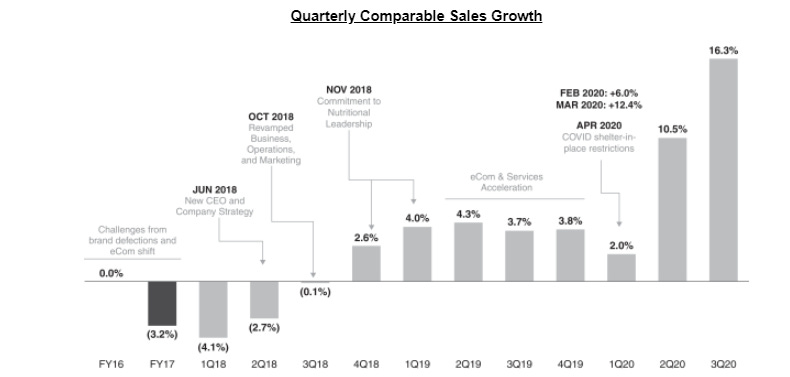

The company’s SSS has increased dramatically as a result of COVID, reporting an increase in SSS during Q4’20 of 17%, up from 3.8% a year ago and 16.3% q-o-q.

Despite an improvement in SSS, top-line growth has not moved much over the last 5 years and the most recent uptick in 2020 was a direct result of COVID and millions of Americans adopting pets in masse.

However, what is reassuring is that digital sales grew over 90% and acquired approximately 1 million new customers in the fourth quarter of 2020.

Growth Catalysts

Pet Industry Trends Support Long-term Tailwinds

Americans have become a nation of pet owners instead of parents. According to one survey, 80% of pet owners care for their pets like kids, 79% believe pets should eat the same food as people and 50% clothe their pets.

Nearly 65 million American households have dogs. Only 35 million have children. There are about 4 million babies and 6 million puppies born in the U.S. every year.

Household penetration rates for pet ownership in the United States from 1988 to 2019 can be found below.

Americans also spend $3.6 billion on their dogs every year. Babies R Us goes bust, while Petco expands.

The spend per pet has increased 4% annually for years, as pet owners increasingly embrace their pets as part of their family.

Even in Petco’s S-1, management highlighted how big the market opportunity is and the growth rate attached to its market size.

“The U.S. pet care industry is a large, attractive growth market experiencing a significant acceleration in response to multiple secular consumer themes. In 2020, the industry is estimated to serve more than 72 million households with pets, representing a total addressable market of $97 billion. Due to its non-discretionary nature, the market has demonstrated a long-term track record of consistent growth and resilience throughout economic cycles. From 2020 to 2024, the industry is expected to grow at a 7% CAGR, driven by steady, predictable growth in the underlying pet population coupled with strong tailwinds associated with pet humanization and COVID-19.”

The continued adoption of pets into American homes, 3.3million added in 2020 alone, will continue to be a strong tailwind directly affecting Petco’s top and bottom lines.

Leveraging Their Retail Network

In today’s environment, speed to delivery, product optionality, price competitiveness, and convenience are key to winning over a customer that seems to be more and more expensive to acquire. That’s why Amazon has spent billions of dollars building out its logistics infrastructure to get products to customers within hours these days.

As for Petco, they fulfill 80% of their online orders through their more than 1500 pet-care centers, which operate as traditional pet stores and fulfillment centers.

“Two, three years ago people were saying, ‘Are [the retail locations] albatrosses?’" ….“They’re absolutely sources of competitive advantage in our digital play today.”

- Ron Coughlin, CEO

So how does Petco’s retail network give it a competitive advantage? Simple.

Buy Online, Pick-Up In-Store (BOPUS)

Instead of having to bear the burden of shipping costs that eat into overall margins, they can still grow their e-commerce business by offering buy online and pick up in-store. They’ve been marketing this option with either a value prop of being able to get your goods quicker and at your convenience or with an incentive of 10% coupons that frequently come out (strictly for this service). I personally have received them NS definitely taken advantage considering one store is just a few blocks away.

For example, if you’re talking about a simple $20 bag of food, with 10% off the customer wins by saving the $2 and time but so does Petco by not having to pay significantly more for shipping-related costs. Thus, this has a net positive effect on operating margins at scale.

I almost want to make a connection here to Blockbuster when they launched their DTC movie rental business to compete with Netflix. They made it so convenient for customers once they rented movies to then physically go to the store to return the movie and easily pick up another one. A super high convenience factor, especially when over 70% of Americans buy their pet food and supplies in-store already.

I can easily see why customers would continue to opt-in for this service, especially if they’re under the $35 threshold for my next reason.

Same-Day Delivery

The retailer struck a nationwide partnership with DoorDash in December that allowed it to start offering same-day delivery, which was an instant hit with online shoppers.

Orders placed before 2 p.m. local time will be delivered the same day, and orders beyond that time will be delivered the following day. Customers can also earn Pals rewards with same-day delivery purchases, giving them access to all the health and wellness offerings available at Petco.

According to their CEO, same-day delivery is now 30% of all their orders.

This speed surpasses one of their main competitors, Chewy, who offers super fast 1-3 day free shipping on $49 or more. A snippet from the Q4 earnings transcript supports this thesis.

“At the onset of the pandemic, we launched curbside pickup. And over the holiday period, we launched same-day delivery and offering that our digital pure-play competitors just cannot offer. We believe this will further enhance our customer retention with almost 40% of early adopters saying they prefer same-day delivery.” - Ron Coughlin, CEO

Digital Offerings, Services & Product Differentiation

Petco Mobile App

What also helps drive retention and stickiness for Petco is the use and integration of their Petco mobile app. Customers can use it to order their products, book appointments, and pick up in-store (see above).

Over 25% of grooming appointments (another part of their ecosystem build) are booked online or in their app.

“…by the end of the fourth quarter, our mobile app has been downloaded 3 million plus times and is driving merchandise sales and incremental services bookings. Our own brands and exclusive merchandise deepen our competitive moats and power our growth. Our team has demonstrated the ability to build brands and products that resonate with customers. In both Q4 and full year 2020, our own brands grow double-digit growth and are rapidly approaching 30% penetration, further fortifying our differentiation from our competitors.”

- Ron Coughlin, CEO

Further use and adoption of the app will keep customers plugged into their multi-channel ecosystem.

Veterinary Hospitals, Grooming and Training Services

Veterinary care is super important for young pets and in general, something I had to learn the hard way with my dog when I moved from the suburbs to New York City. Improving access to pet care will be a huge moneymaker for Petco as they look to open 60 - 70 new hospitals every year with the goal to get over 900+ locations going, according to their S-1.

“Notably, our hospitals completing the third year of operations are ahead of model, generating over $1 million in revenue and over $200,000 in four-wall EBITDA in year 3.”

Vetco, which is their mobile vaccination clinic business, services over 800 pet care centers weekly and are seeing strong customer demand.

The below, also taken from their S-1, address the TAM of the pet services market and how fast it’s expected to grow over the coming years.

“The pet services category represents a $35 billion market consisting of the $27 billion veterinary services and $8 billion non-medical services categories in 2020. According to Packaged Facts and company internal estimates, veterinary services and non-medical services are forecasted to grow at a CAGR of 9% and 14%, respectively, from 2020 to 2024.”

“Rising focus on pet health is also driving increased adoption of pet insurance, especially in developed markets, where the rates of insured pets are as high as 25%. In the United States, the North American Pet Health Insurance Association reported that only 2% of pets are estimated to be covered by insurance, which implies potential for significant growth.”

Grooming is a large addressable market in the United States, representing approximately $3 billion in 2020, according to Packaged Facts. Petco served over 2 million pets across approximately 1,350 of their pet care centers during Fiscal 2019.

The introduction of their “Spa Club” grooming loyalty program has helped drive 14% improvement in customer retention rate between the fourth quarter of Fiscal 2018 and the fourth quarter of Fiscal 2019

Their training business served over 180,000 pets across approximately 1,470 pet care centers during Fiscal 2019. Because training is generally conducted at an early stage in a pet’s life, this offering is a strategic customer acquisition tool to engender long-term loyalty with new pet parents. According to their S-1, in Fiscal 2019, on average, their training customers spent 3.3x more with them than their non-training customers.

Can you see what I mean when I say creating this ecosystem is what will drive future growth for Petco? This only gets helped by another growing change of habit with what we decide to put in our pet’s mouth.

Humanization of Pet Food

As the trend has continued with pet owners treating their pets as children or “fur babies”, so does the thought of feeding them high-quality food. Gone are the days when you would just buy simple kibble or wet food based on price. Now, consumers are not only more health-conscious for themselves but also their pets. According to a Statista survey, a majority of consumers surveyed strongly agree with paying more for healthier pet food.

The fresh food category is roughly valued at $650 million today, going up to $2 billion by 2024. A great market opportunity for Petco as they continue to launch their Just Food For Dogs distribution, while also recently launching their premium-priced human-grade, Honest Kitchen. Additional commentary straight from their most recent transcript below.

“Overall, our own brands and brands exclusive to Petco and specific markets represent over half our portfolio, not only enhancing our gross margin, but also creating competitive insulation.” - Ron Coughlin, CEO

Valuation

Picking peers for Petco was slightly tough. I wanted to pick some internet companies since Petco is pushing heavy into e-commerce and digital while also selecting peers that operate within the retail space that also have a digital presence. This led me to pick the following peer set below, Etsy, Target, Chewy, At Home, and Wayfair. The table is updated as of March 31, 2021.

With a market cap of ~$5b, Petco is comparably smaller than its most direct public peer (Chewy) which stands at around $35b. Using our comps table above and applying a 45.0x Forward P/E multiple on $0.66 EPS for 2021, that leaves you with a price of $29.71 a share. A 34% upside from a closing price of $22.16 as of March 31, 2021.

Not bad if you ask me, though I think that is more on the conservative side, and if growth can continue like this in a post-pandemic world, the stock can easily hit high $30’s a share.

Conclusion

Petco is playing catchup in the digital space, but the black swan event of a global pandemic really expedited their push into e-commerce in a meaningful way while eventually being able to leverage their stores once things started opening up.

Management has the right idea of creating an enclosed ecosystem for all of your pet needs and the growth of each respective category will prove beneficial for overall company growth. What they really need to do is continue executing this plan and put fuel to fire to grow more quickly than they have in the past.

I would love to see what new services the company can incorporate next, perhaps new dog walking/sitting services, daycare (huge moneymaker), or something along those lines.

I look forward to seeing where the stock goes next.

*The current stock price at the time of this article: $22.04.