Uh, Tesla is Worth How Much Now?

Why Tesla's size makes absolutely no sense but betting against it would be crazy

*This is not a deep dive on the company but rather visually showing you just how ridiculous Tesla’s business is in comparison to other automakers*

Quick Note

I love Tesla. I love everything that they’re doing to the point where I even have Tesla merch (t-shirt and a mug). Hell, Tesla TSLA 0.00%↑ was the first stock I ever bought back in January of 2014 for $172 a share (~$30 a share now post splits) which I sold not too long later because of me being a college kid needed money for food.

I also am an Elon fanboy and respect this guy so much for risking it all in order to build things with the premise of changing the traditional way of life for many.

Even as Tesla stock has minted millionaires and billionaires, this company’s valuation makes zero, let me repeat that, zero sense.

Here’s why in five, easy to understanding charts.

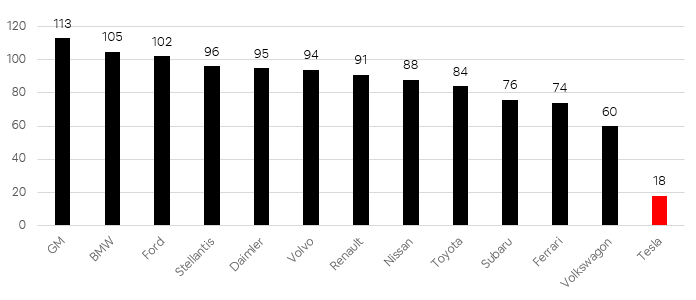

1️⃣ Total vehicles produced

In 2020, Tesla was able to produce 510,000 vehicles across all the models that it offers (Model X, S, Y, and 3). Though this might seem like a lot, other American automakers such as Ford and GM produced ~4.2 million and ~6.8 million respectively.

This equates to about 8.2x and 13.4x the amount that Tesla produced within the same given year.

Tesla only produced 1.07% of the total 47.7 million cars out of all the aforementioned companies you see above.

2️⃣ It is the youngest car company, comparatively

Tesla made headlines back in 2003 when Elon decided to throw a massive amount of his wealth after his Paypal sale into a new electric vehicle company. However, though this was in a new class of its own, these days Tesla now competes with a lot of legacy automakers looking to try and monetize the future of EVs for themselves.

Though Tesla was able to gain notoriety and fame from breaking with traditional combustion engine cars, a lot of the other competitors that he’s now having to face have been in the business for quite a while, some even more than 5x longer than it has been around.

They have been able to successfully work out supply chains, massive economic recessions (some depressions), wars, etc. Tesla has worked through its own problems, even potential bankruptcy, though don’t expect it to know everything just yet.

3️⃣ Its market cap is the biggest

With the COVID stock run-up and announcements that Tesla will be holding Bitcoin, investors all over have poured money into Tesla with the hopes that it will continue to skyrocket to the moon. Elon is Tesla, and Tesla is Elon. If you were to look at the market caps (equity values) of all the publicly traded car companies that I have shown you thus far, Tesla makes up more than 53% of the total 2 trillion (trillion with a “t”) market value.

Even the top five companies that aren’t Tesla, make up 32.9% of the market value (Toyota, Volkswagon, GM, Ford, and Daimler).

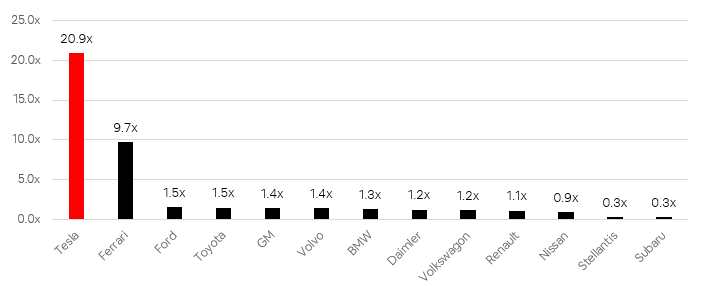

4️⃣ Valuation using forward EV/Sales

Valuation plays a key part in what convinces you to buy a stock. Perhaps it’s too low and you think a re-rating of the multiple will lift it up or perhaps it’s too high and you choose to pass or possibly short.

In Tesla’s case, it doesn’t even make sense.

Using an EV to sales multiple generally provides you will the lowest (without going negative) multiple for valuation as the denominator is a much bigger number, thus showing a more contracted multiple. In Tesla’s case, despite only selling 510,000 cars last year, the company is trading for a mind-boggling 20.9x forward EV/Sales multiple.

Investors are pricing in a lot of future upside at these levels more so than the future prospects of other legacy players launching their own EVs.

It really doesn’t get better using the next metric either.

5️⃣ Valuation using forward EV/EBITDA

If you thought that metric was bad, its forward EV/EBITDA multiple is even worse.

Trading for a cool 99.6x forward EBITDA, you too can become an owner of Tesla stock.

Final thoughts

There actually isn’t any metric at face value that warrants Tesla being this high despite thousands of loyal investors swearing on their mother’s life that it’s only going to keep going up.

I personally want to short the stock because fundamentally it makes no sense but you’d have to be either crazy or an idiot to do so. With that, I leave it alone and will watch from the sidelines.

There are others that don’t feel the same way, publicly. Michael Burry, the famous investment manager that shorted the housing market back in 2006 has Tesla on its shit list.

He’s been very vocal on the absurd valuation of the stock, even having taken a short position via puts at the beginning of this year.

Maybe he just hates Elon? Maybe just Tesla? Or both? Either way, Tesla makes no sense but bravo to everyone that risked holding it all these years and continues holding it at these levels.

Until next time,

Paul Cerro | Cedar Grove Capital