REAL: Q1'25 Earnings Shows Oversold +35% Reversal in 3 Weeks

Why the recent earnings selloff leaves us confused, but unfazed.

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or “the fund”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Students can get access to our research at a reduced rate by clicking here. If you’re interested in using Koyfin (I highly recommend it), you can get 20% off your plan using my link here.

Interested in becoming an LP? Click here to fill out the contact form.

Key Highlights

Q1’25 Sales saw an 11.3% jump y/y, followed by a significant improvement in Direct Revenue (+60.9% y/y) and Consignment Revenue (7.3% y/y).

Gross margin saw a modest uptick from 74.6% to 75.0%, with Direct Revenue seeing a healthy jump from 3.3% to 25.5% y/y.

Active buyers were up 6.8% y/y (1.3% q/q) while AOV was up a modest 4.8% y/y.

The company once again achieved positive adjusted EBITDA of ~$4.1 million (2.6% of sales), though it had negative OFCF of ~$28 million.

Management reiterated FY guidance of $645 - $660 million in sales with $20 - $30 million in adjusted EBITDA.

Currently, management does not see any issues with the business when it comes to tariffs and, in fact, sees itself as a beneficiary (what we called out a month ago).

The stock sold off ~30% on Friday despite many positives from the earnings report, which we feel was grossly unwarranted.

Below, we’ll go over their earnings from our perspective and what we think was a massive overselling day for the stock. This led us to add more to our position on Friday.

Disclaimer: We are long The RealReal (REAL) at the time of this post.

Earnings Notes

If you need a recap, we shared our long note for The RealReal (REAL) on April 17th, which was less than 30 days ago. You can find a link to that post here.

When we published that report, our main takeaways were that

It was punished during the tariff news despite having ZERO tariff exposure.

Would be a beneficiary of tariffs and isolated from lower-quality goods margin compression.

Experiencing massive tailwinds in the second-hand luxury market (growing twice as fast as traditional luxury).

Inflecting positively on adjusted EBITDA and FCF with a debt refinancing that pushed out its obligations.

Since that report, the stock rallied to a high of $7.61/share before it reported earnings on Friday, which saw all of its recent gains, and then some, evaporate overnight.

However, this move to us seemed very dramatic and uncalled for, given that management continued to execute well on its margin expansion efforts, as well as reiterating guidance for the year despite market turmoil.

Looking below, management did not touch guidance at all for the year, which they initially gave as part of their Q4’24 earnings release.

Given that the stock already experienced a 54% drawdown from the peak, you’d think the Friday sell-off already baked in the guidance given last quarter but perhaps the market wasn’t expecting a softer Q2 which puts emphasis on 2H’25.

However, we do think that confidence, or lack thereof, from the market, could explain at least its partial move. First and foremost, the company did (slightly) beat sales estimates (~$159.8 million) and came in line with EPS (-$0.08).

So earnings estimates weren’t the direct reason but sentiment is still sentiment.

We think the selloff stemmed from what Q1 results hinted at going forward, which again, seems a bit much.

Direct Revenue Segment

If you remember from our original report, the company was experiencing tough times coming out of COVID due to their split between consignment sales (high margin) and direct sales (low margin - i.e., holding direct inventory). This was a function of the market at the time in order to unlock supply, which pressured margins.

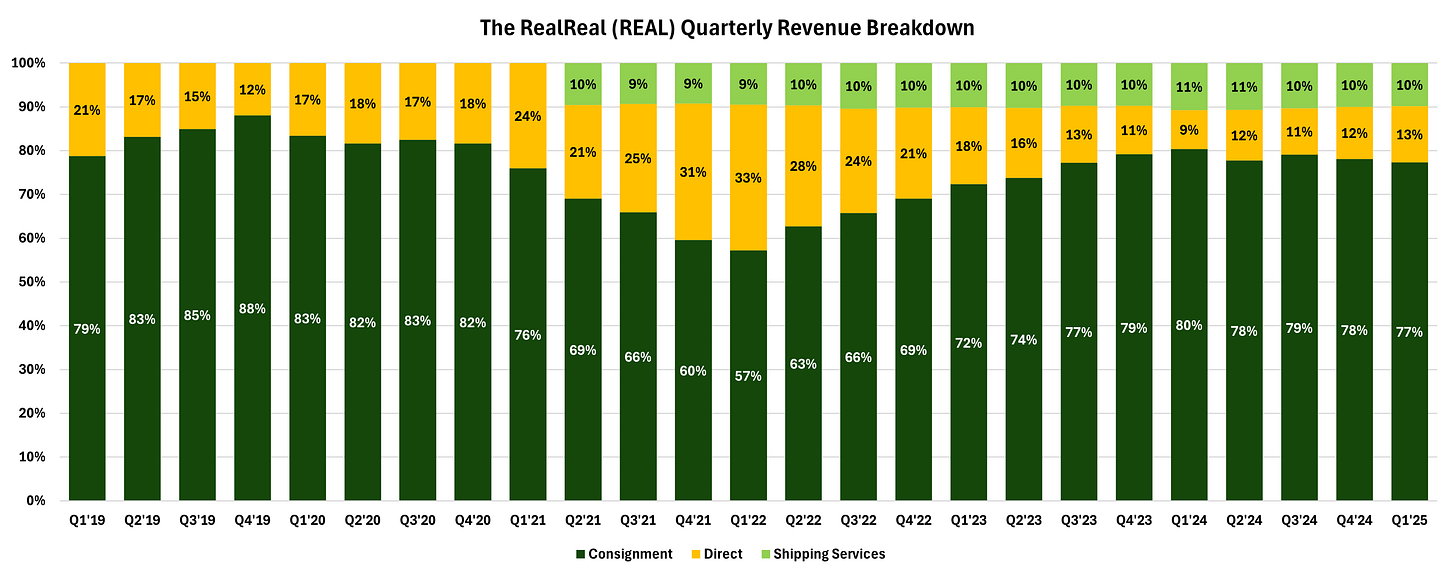

Looking at the recent quarter, it would appear as if direct revenue was staging a comeback as a % of total sales (13% in Q1’25 vs 9% in Q1’24).

But we need to highlight that there have been dramatic improvements to this business segment since just a few quarters ago.

With operational improvements via their “out-of-policy” returns for direct revenue (i.e., items that REAL has taken back from customers), coupled with their recently launched Get-Paid-Now offering (where consignors just sell their inventory as a lower price to REAL), direct revenue margins have increased to 25.5% this past quarter, up 23,200 bps from 3.3% in Q1’24.

So what once was a foot-dragging, low-margin business, REAL has been able to make headway in that segment by dramatically improving gross margins to record highs. We will caveat that management does see direct revenue being anywhere from 10 - 15% of total sales going forward and will just scale naturally as the company grows.

**For reference on Get-Paid-Now margins vs consignment, Ajay (CFO) gave an example using a handbag.

“For a bag between $1,500 to $5,000, somebody choosing that alternative [Get-Paid-Now] would effectively be getting paid about 55% of the expected retail price, a consignor I would make closer to 70%.

So think about it as a 15-point differential between the two offerings. With that inherent structure, it will yield better margins on a like-for-like basis. It is still -- by no means is it the biggest part of direct. The biggest part of direct really still continues to be our out-of-policy returns.”

So, even while the margins are dramatically better with this new option, management also made note that the average selling price (ASP) of a Get-Paid-Now item is 10x higher than the average ASP on the platform.

This is because Get-Paid-Now is only offered to categories like watches, handbags, and fine jewelry, which are more selective and track along “hot” trends that will move.

What also led us to think that direct revenue could play a part was that a lot of the analyst questions on the call were centered around that business segment. Questions around

Will it become a larger portion of sales?

Will the margins get better, or is there a range you expect it to stay within?

Will the Get-Paid-Now offering become a bigger portion?

Questions like that which is why we think that direct revenue might have scared investors a bit, given the PTSD they had from the past. It’s not a surprise to us, but we do discount that direct sales revenue is the sole culprit here.

Debt Levels

While we pointed out the leverage profile in the original report, we did highlight the refinancing of the near-term notes in exchange for longer dated maturities. This effeectively pushed out their repayment obligations to at least 2028 which gave them some breathing room.

While not a big cause for concern, we do point out that the 2025 notes are due in June (next month) which will see a cash outflow of ~$27 million.

So while it is manageable for repayment, we do see REAL’s cash balance drop by 17.3% on a total cash basis or 19.1% on a non-restricted cash basis.

Much attention will be placed on FCF going forward which management has said will be back-half weighted.

Quarterly Operating Cash Flow Reversal

We do believe that the negative operating FCF (OFCF) change of -$28 million (vs +$28 million in Q4’24), at face value, looked rather alarming. But while they did report a negative Q/Q change, much did have to deal with the change in NWC

“Operating cash flow for the first quarter was negative $28 million. Due to the timing of incentive payments and working capital seasonality, we expect operating cash flow and free cash flow to be back half weighted.” - Ajay, CFO

Looking at the numbers, it does seem that REAL had accelerated AR/AP payments while also one-off changes due to the extinguishment of debt (-$37 million) and change in value of warrant liability (-$42 million), which we admit, will continue to be a volatile source/use of cash.

Pulling a section from a BTIG note,

“…unsually high negative free cash flow was impacted by higher than usual working capital usage, exacerbated by the strength of the 2024 holiday season as consignor sales made in Q4 were paid in Q1. There were also higher bonus payouts for management, which qualifies as a reflection of REAL’s healthy financial performance.”

So we do consider this to be a partial reason to the sell-off. But, despite these ‘negatives’, we did still find some of the results/commentary to be rather positive.

The Positives

Scaling Athena

As we mentioned in our previous note, REAL has been implementing AI to use image recognition to authenticate items and pre-populate their key attributes for listing on its website.

Management was aiming to have at least half of its items flow through Athena by the end of the year, and as of the end of Q1, more than 10% of items are already flowing through Athena.

Results have shown that its helped cut processing times by an estimated 20%. It’s currently only being used on Ready-to-Wear (RTW) but is looking to expand into shoes and handbags later in the year.

Athena should be able to help with margins by increasing sell-through and getting better pricing on items.

Unlocking Supply

As we’ve mentioned before, this model only works if you can consistently unlock supply to sell. If supply dries up, then it won’t matter how many buyers you have. What we appreciate is just how much emphasis management is putting on being able to secure new forms of supply.

One of those areas is still it’s investment and improvement in their retail arm. Retail is currently being able to acheive a few things.

Secure overall net new consignors to the business.

Management highlighted that retail locations contributed to 1/4th of all new consignors during the quarter.

Gathering not just more supply, but higher priced supply.

With consignors being able to walk in and talk to experts, REAL is able to secure higher-end items without having them needing to always wait a few weeks to secure an appointment.

Aside from retail, REAL also mentioned their new ‘Real Partners Program.’ This program unlocks additional supply by partnering with stylists and closet organizers who help clients turnover their wardrobe.

Given the nature of this profession, closets are constantly being turned over and for every item that these stylists help consign and sell, they receive a fee for doing so.

We’re liking what we’re seeing and as we mentioned at the opening of our first note, we weren’t going to get the timing right out the gate due to tariff/market uncertainty. Given the clawback by Trump and the numbers that REAL put up, we’re more confident now in the R/R profile than we were just a mere month ago.

What Our Valuation Shows

Given the further upside for REAL through increased margin expansion from operational improvements and general growth from natural tailwinds, we still think the longterm return is there for patient investors.

Take a look at our model output below.