Earnings Update: Red Cat Holdings (RCAT) And The Impending U.S. Army SRR Contract

If they win, the upside is still over 100% at these levels.

It's not a paid ad but I just wanted to let everyone know that if you’re wondering what I use to get my information for my research, it’s largely Koyfin. I use it daily and rely heavily on it to get the necessary information for my reports. If you’re interested in checking it out (I highly recommend it), you can get 20% off your plan if you use my code here.

As a reminder, if you’re a student, you also get an annual subscription for $52/yr if you use your school email. Just click through with this link. I also share updates via Substack chat for topics that don’t warrant an email. Join it to make sure you don’t miss out on one.

If you remember, I initially shared an event-driven trade with you all on July 23rd and gave a performance update on August 16th. Both can be found below which includes the model math and breakdown.

But aside from the previous two updates, their earnings release on Monday, September 23rd was one that everyone was waiting on, including myself. Long story short, the SRR contract announcement that this trade was based on has still not been released.

Talk about a gut punch. Since the market closed on Monday, the stock is down 25% to settle at $2.36. However, Jeff made it known that the Army has technically already decided on a winner.

“In late August, at the Pathfinder Conference in Huntsville, Alabama, the Army mentioned during its speech that SRR had a clear winner. We are hoping to have an update from the Army for this call, but that is not the case.”

While the above means they’re still technically in the race, jumbled financial results and a dilutive warrant offering + share buyout of FlightWave I believe really added fuel to the fire for investors hoping for an SRR decision.

Below, I’ll go over my thoughts on the earnings results, what this means for a standalone company sans an SRR contract win and what I personally think is the status of the SRR contract.

To answer two quick questions I’m sure you have.

Yes, I’m still in it.

No, I haven’t sold. In fact, I bought a little more.

So now, let’s begin.

First things first, let me go over my thoughts on what I think is going on with SRR which I have to caveat is highly speculative and is not based on anything other than what I’m interpreting from the financials and Jeffrey’s commentary on the call.

My immediate takeaway is that if you did hear that you lost a ~$450 million contract but weren’t supposed to tell anyone (potentially NDA reasons), your voice/tone would not be as calm or optimistic as Jeff’s was on that call.

The reason why I think this is because, at various times during that call, Jeff mentioned things that I don’t think one would say if he either a) lost the contract, b) won but can’t say, or c) truly don’t know yet but is optimistic.

Examples below.

“A common question from investors is whether we can meet the demand of an SRR contract or other large-scale contracts. The answer now is a resounding yes.

If we get news in the next couple of weeks, we will update our guidance for calendar 2025.

We think it could happen anywhere from early October or maybe they wait to the big Army show they have every year at AUSA. We're very confident. But when we -- until we get official notice, we have no idea.”

Again, this is just speculation but if you’ve heard Jeff on past earnings calls, he usually doesn’t sound this optimistic. While not a solid reasoning, I don’t want to downplay it either.

The other qualitative fact is that as of August 15th, web archives show that there were 21 job openings on the Red Cat website with the oldest being from July 29th to the most recent being July 31st.

As of yesterday, there are only 11 job openings on their website. This could mean either 1 of 2 things.

They hired the people in anticipation of a ramp-up in employment needs from new contract wins.

They didn’t win and pulled the listings.

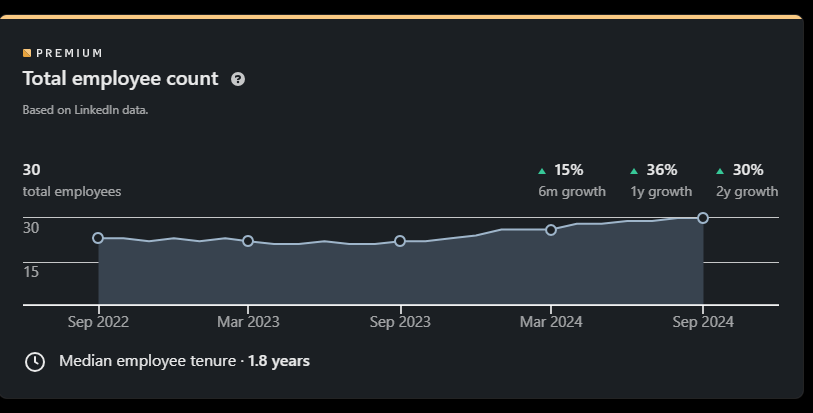

If you go to LinkedIn Premium, they’ve only had 1 new person added with links to the company page (showing employment) in the last month (from 29 to 30).

I will say though that on LinkedIn, there are only 30 people listed and the people that are listed aren’t lower-level employees that those job openings would account for. You can see for yourself here, it’s only senior people who have a LinkedIn who bother to update it. That’s why I think this research isn’t a good indicator but wanted to share it with you all anyway to possibly calm down your mind.

To reinforce that, on their most recent 10-K, they said they had 89 FT employees as of June 30, 2024.

The quantitative reason why I think RCAT is in a good spot to win is why would the company take on bridge financing of an $8 million promissory note and issue the option for additional warrants if it wasn’t shoring up its balance sheet in anticipation of large production ramp-ups to new contracts.

I think the reasoning lies in their mass production switch from Teal 2 drones to the newer SRR-submitted Teal 3 which won’t be gaining product realization until it clears through the large $13 million backlog that it’s developed. Something that the company is aiming to get mostly completed by the end of the year.

Additionally, even working through the backlog, you have to remember how these contracts work in the first place. Once they get down-selected, it’s not always an immediate win and thus, payment. Jeff explains that below.

“Once you get down-selected, you typically negotiate for 2 to 3 months. We've signed probably the last 3 years in December. By the time we have a closed deal, we're heading -- and we start getting our first checks in January. So -- and if you look at all the continuing resolutions, they always get in the way.”

So my hunch is that in order to get them into the new year where they’ll start to get paid by the U.S. government, they took on a promissory note to get them there. If they had $7 million in cash at the end of July, using their recent cash burn of $2.3 million would imply that they only have a little more than three quarters left assuming no additional burn or degradation in operations.

That means if using their old FY end (announced they’ll change to quarterly), that means they’d have enough to last until about the end of April but by then you lose considerable leverage for terms if you wait too long. This is why I think he did it now so while the SRR contract is still in play and they have a backlog, the terms weren’t as bad as they could be.

The other big point I want to make that just came out yesterday was a rumor that Skydio lost the contract.

Bob Sakaki, who is one of the more knowledgeable people in the drone industry, shared an update that he’s heard Skydio is raising money despite not being selected for SRR.

Granted this is just speculation and “not winning” could also just mean that they haven’t heard yet either. Whatever it may be, it’s something to note but I don’t want anyone getting too caught up in this because I am not.

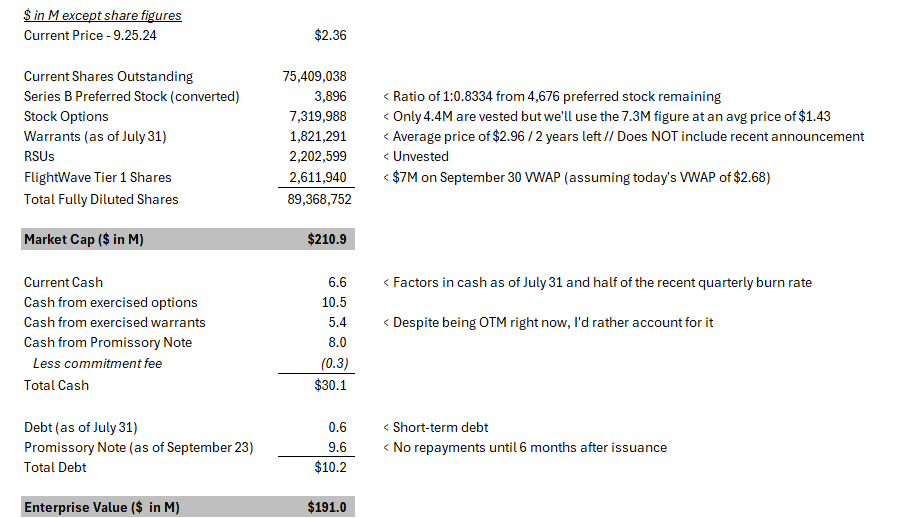

While this was largely the reason why the stock dropped over the last couple of days, we can’t leave out the newly updated capital structure that was completed just hours before the press release. That, I believe, is another reason why the stock dropped.

Similar to how I highlighted the math in my previous two reports, I’ll do the same below. As a reminder, the first image you see will be from the August update. The material change here will be moving from an April FY end to a calendar year-end.

However, when you factor in the newly updated promissory note and fully diluted shares with new revenue assumptions, the math changes a bit.

Right off the bat, I based scenarios off of FY’26E which would technically be 3 quarters of CY’25 and 1 quarter of CY’26. However, since the company is moving to a CY basis from FY basis, I’ve updated my numbers up a it.

Note: All the rationale still stays the same except for the standalone multiple which I dropped from 3.5x forward sales to 3.0x. The balance sheet figures, share counts, and revenue projections have changed.

I still think a no-win contract will command a 3.5x forward P/S multiple considering the company is posting figures of over 150% between the current FY and new CY but will leave at 3.0x to be conservative. For the record, it was trading between 2.0x and 3.0x for most of this year but that was prior to FlightWave (which makes up ~50% of the current backlog) and the family of systems as opposed to just Teal 2.

Fully diluted shares reflect all the new changes that have occurred + the updated cap structure which I left out last update because I didn’t think it would be so pertinent for a September decision. The enterprise value with FDS breakdown is below.

I know not all warrants will be exercised nor options bought, etc. I still want to account for everything to make sure that I’m not missing any scenario where someone could just come in and cash in to sell out.

The below is the updated scenarios based on standalone, T2 win (partially valued), and T2 win (fully valued with discount).

The real game changer here was the increased guidance with the new FlightWave systems. The guidance they gave doesn’t reflect any NATO or SRR contracts so that should give you some margin of safety in your estimates. Jeff also seems optimistic about imminent initial order wins which will then be added to guidance.

“We've been doing tests with certain ministries of defense for some almost 16 months now. We are -- we have a couple that are getting real close. We think we're pretty darn close to getting what we call the initial order. It's typically 100 or 200 systems to get the training started before they do a very significant buy. And that's -- you're always waiting for that first order.

It's kind of like what happened with us in Border Patrol, they give us an order for 50 before they give us a large order, and we became the drone for the Border Patrol.”

Aside from their guidance, if you figure estimates based on my previous numbers, I was still somewhat close to what they guided for but under slightly.

This is an interesting trade and while it’s incredibly frustrating that we still don’t have an answer for the contract, I think hearing Jeff speak to it made me feel personally a little better though that doesn’t technically surmount to anything tangible.

With such a pullback in the stock already, the “floor” should things work out based on what management has stated shouldn’t be too much lower. Of course, once news breaks it will most likely crater well below $2 before finally settling.

As I mentioned before, I’m still in this trade, I have increased my position by 33% on a share basis but when it comes to a total allocation of my portfolio, it’s still under 4%.

Any questions about the raise, the dilution from FlightWave, or anything else, comment below and I’ll be happy to answer. That way it’ll benefit everyone.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm