M&A Arb Update: FXLV Going Private

Update on our trade notes from the FXLV/KLIM take private

If you like today’s post, please like and share. I run a combination of a free and paid newsletter that highlights my notes, thoughts, opinions, and trade ideas.

You can do so by subscribing via the link below and selecting which part you would like to be a part of.

TL;DR

The take-private of FXLV did not happen and most likely will not happen

Either management hate the price, or they didn’t want to work with KLIM as an owner

FXLV opted to close a new debt facility to have fund operations

Fitness is not in trouble, FXLV is just terrible at managing a fitness franchise

A Revisit of FXLV Take Private Trade

On October 10th, 2022, I released our thoughts on the F45 Fitness FXLV 0.00%↑ take private by Kennedy Lewis Investment Management. I outlined how I was skeptical about the deal going through but how setting up the trade could produce returns.

To see my original thoughts, click the link below.

Not more than two days later, the PUT position of the trade was up 80% while the equity leg was down a modest ~3.5%.

But what happened with this deal? Well, a few things for sure happened but why that happened is what’s interesting.

“It’s Complicated”

The original deal was supposed to be KLIM, with an already significant stake in FXLV, buying out the rest of the company in a take-private for a significant premium. However, I believed that the deal wasn’t going to go through because management didn’t want to come to terms with just how much the value of the company had cratered and admit defeat by taking the buyout.

So what did they do instead? On February 15h, FXLV announced that it just raised a $90 million debt facility that was actually led by KLIM! FXLV said that the fund would be used for, among other things, general corporate purposes and a partial paydown of the company’s existing senior secured revolving credit facility with JPM.

However, what’s hilarious is the statement that came from Darren Richman, the Co-founder of KLIM.

“We’re pleased to deepen our partnership with F45, an innovator with a differentiated brand that is uniquely positioned to capitalize on the growing trend of consumers prioritizing health and fitness in their daily lives. As long-time investors in F45, we have a deep understanding of, and continued confidence in, the business and the opportunity ahead for F45 as a disruptor in the fitness space.”

I read this as the company didn’t want to be taken private at that price or if they did, they didn’t want KLIM to be the owner of them.

So the only real alternative was to raise money another way to keep the lights on and this is what they decided on. The added aspect of this debt facility was that upon its completion, three board members resigned and were replaced by new independent board members.

Marky Mark was still there along with the other remaining board members. While investors initially saw the news as a positive, the price quickly reflected the little confidence that management could navigate all the macro issues at hand.

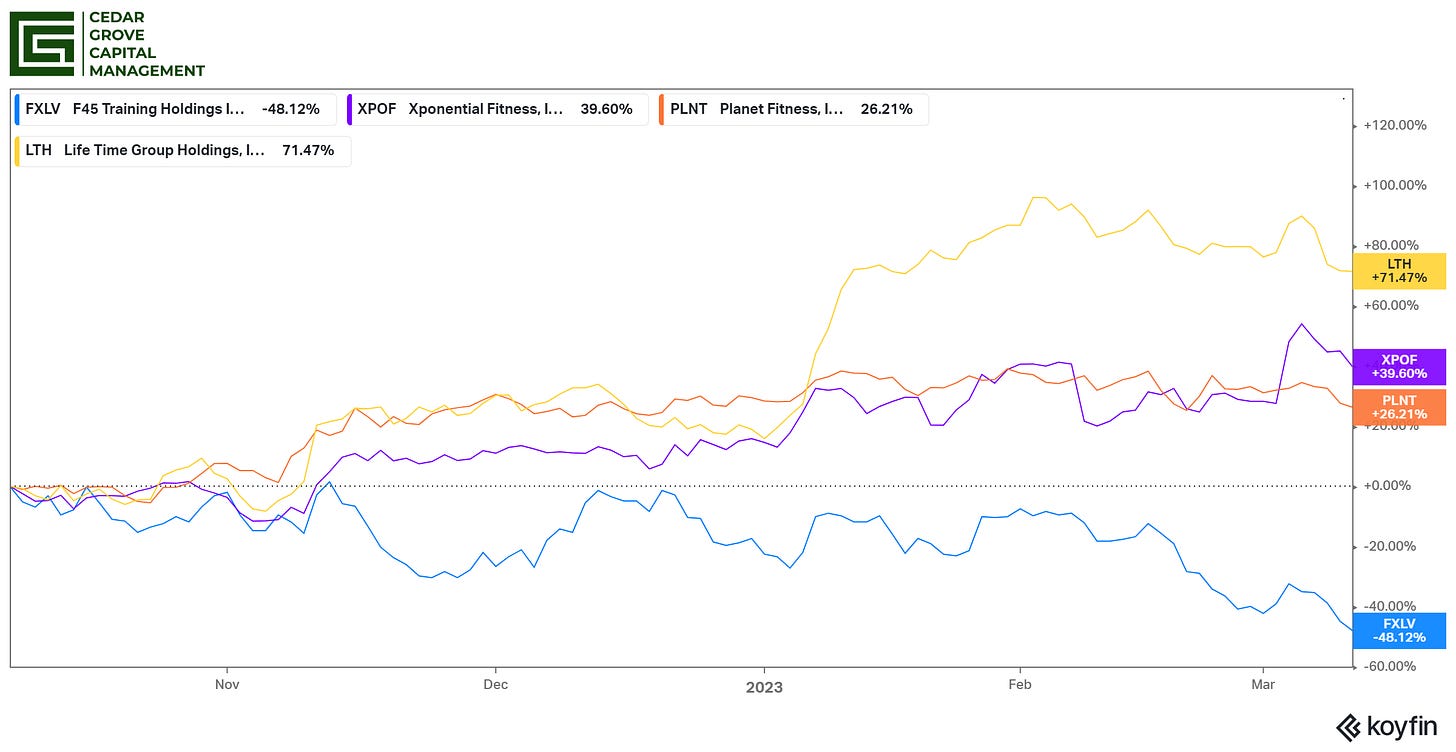

What I don’t want people to think is that fitness is in trouble. This is F45 being in trouble, not the fitness industry. To prove this, take a look at other public fitness companies (not PTON 0.00%↑) and how they've performed over the same time.

Bottom Line

FXLV management is pretty much in survivor mode. It’s dealing with plenty of lawsuits from other celebrities and investors.

Even franchisees are fed up with the lack of support from the parent company despite members of the brand like the type of classes that are taught in a convenient 45 minutes.

This one is a dud, and I wouldn’t touch it at all unless it drops even further and I purchase it as purely a speculative take-private opportunity above what happened with KLIM.

Anyways, thanks for stopping by. For those of you that don’t know, I do run another newsletter for our private side of the business through

. This newsletter is all about SMB topics in case you're interested. See the example below.Lastly, if you’re interested in joining our premium community, you can enjoy a free trial below.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech